Money is weird right now. If you've been watching the tipo de cambio de dolar a peso mexicano lately, you know it feels like a rollercoaster that someone forgot to maintain. One day we're talking about a "Super Peso" that makes everyone in Mexico City feel like a king, and the next, a sudden spike in volatility has everyone clutching their wallets.

It’s personal.

Whether you’re sending a wire transfer back home to Michoacán, paying a remote developer in Guadalajara, or just trying to figure out if that vacation to Tulum is going to bankrupt you, the exchange rate is the heartbeat of the North American economy. But honestly? Most of the "expert" advice you see on TV is basically just educated guessing.

💡 You might also like: 600 British Pounds to USD Explained: Why Your Exchange Rate Might Be Lying to You

The reality of the tipo de cambio de dolar a peso mexicano is a complex mix of high-interest rates, geopolitical drama, and the sheer gravity of the U.S. economy.

The Real Reason the Peso Isn't What It Used to Be

We have to talk about the carry trade. It sounds boring. It's not.

Basically, investors borrow money in places where interest rates are dirt cheap—think Japan for a long time—and they dump that money into Mexico because Banco de México (Banxico) has kept interest rates sky-high. When you can get an 11% return on Mexican government bonds (CETES) versus a fraction of that elsewhere, the peso becomes a magnet for global cash. This massive inflow of "hot money" is what fueled the peso's strength for the last couple of years.

But here is the catch. Hot money leaves as fast as it arrives.

When the Bank of Japan finally started nudging rates up in 2024, it sent shockwaves through the tipo de cambio de dolar a peso mexicano. Investors panicked. They started unwinding their positions. Suddenly, the peso wasn't the invincible currency everyone thought it was. It's a reminder that Mexico's currency is often used as a proxy for all emerging markets. When the world gets nervous, the peso usually feels the sting first.

Why the U.S. Election Always Breaks the Rhythm

You can't talk about the dollar-to-peso relationship without talking about Washington. Every four years, the rhetoric shifts.

Tariffs. Border security. The USMCA review.

The market hates uncertainty. If a candidate starts talking about 200% tariffs on Mexican-made cars, the peso takes a hit instantly. It doesn't even matter if the policy actually happens; the fear of it is enough to move the needle. We saw this clearly during the 2016 cycle and again leading into 2024. The peso acts like a political thermometer.

Breaking Down the "Nearshoring" Myth vs. Reality

Everyone keeps shouting "nearshoring" from the rooftops. The idea is simple: companies are moving factories from China to Mexico to be closer to the U.S. market. This should, in theory, create a constant demand for pesos as companies buy land, pay workers, and build infrastructure.

It's happening, but it’s slower than the headlines suggest.

Look at Tesla’s Gigafactory in Nuevo León. It was the poster child for nearshoring, but then delays hit. Water shortages, electricity grid issues, and political back-and-forth have slowed the "gold rush." While the tipo de cambio de dolar a peso mexicano benefits from the promise of nearshoring, the actual dollar inflows from FDI (Foreign Direct Investment) haven't always matched the hype.

The Remittance Powerhouse

Don't ignore the families.

Remittances are the backbone of the Mexican economy. We're talking about $60 billion a year. When the peso is strong, those dollars don't go as far. Imagine you're a mother in Oaxaca receiving $300 a month. When the rate is 20:1, you have 6,000 pesos. When it drops to 17:1, you’re down to 5,100 pesos. That’s a massive loss in purchasing power for the people who need it most.

Ironically, a "strong" peso can be a nightmare for the poorest households in Mexico.

✨ Don't miss: Harrison County Ohio Auditor: What Most People Get Wrong

How to Actually Track the Tipo de Cambio de Dolar a Peso Mexicano

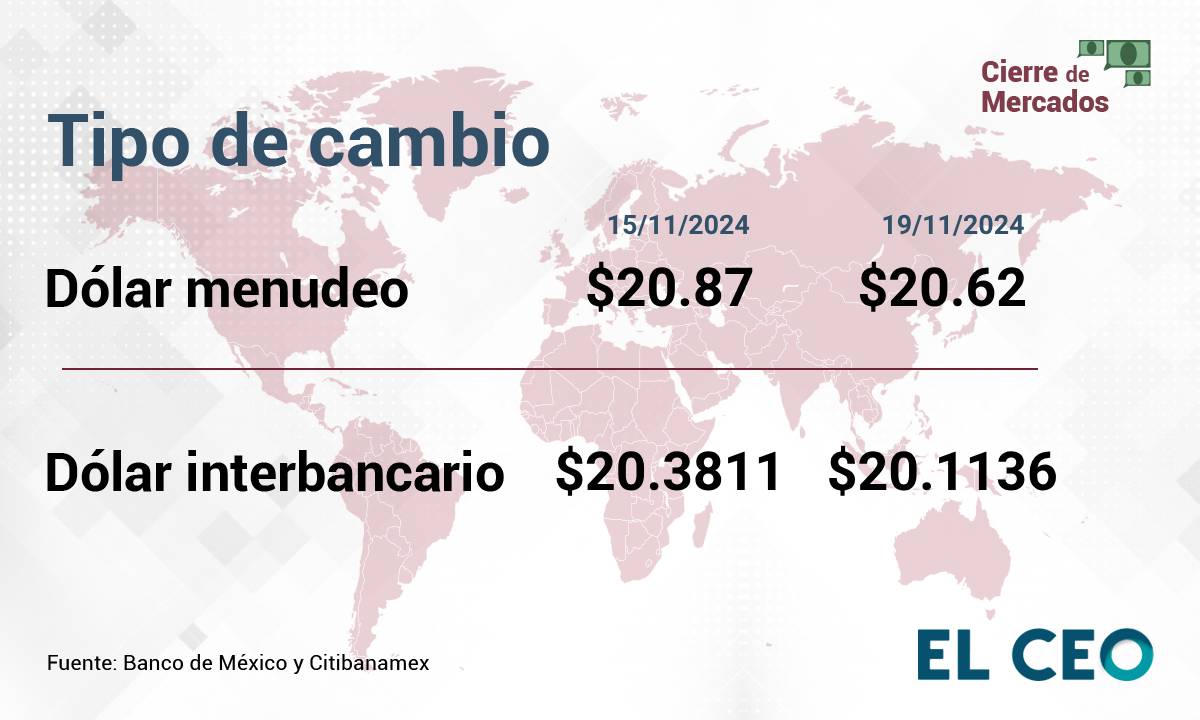

If you're looking at the Google ticker, you're only seeing half the story. That's the mid-market rate. You will almost never get that rate unless you're a bank trading millions.

- The Interbank Rate: This is the "wholesale" price.

- The Retail Rate: What you get at CiBanco, BBVA, or a kiosk at the airport.

- The Spread: The hidden fee where companies make their money.

If you’re moving money, you need to look at the spread. A 3% spread on a $10,000 transfer is $300 gone. Poof. Gone. Use platforms that show you the mid-market rate and charge a transparent fee instead of "zero commission" places that just give you a terrible exchange rate.

Banxico’s Tightrope Walk

The Mexican Central Bank is in a tough spot. If they cut interest rates too fast to help the domestic economy, the peso might crash as investors flee for higher returns elsewhere. If they keep rates too high, they stifle Mexican businesses that need cheap credit to grow.

Current governor Victoria Rodríguez Ceja has been relatively cautious. The market watches her every word. One "dovish" comment about cutting rates can send the tipo de cambio de dolar a peso mexicano up by 20 or 30 centavos in minutes.

Psychological Levels Matter

In trading, humans are predictable. We love round numbers.

The 18.00 and 20.00 levels are huge psychological barriers. When the peso broke below 17.00, people lost their minds. It felt like a new era. But once it climbs back over 19.00, people start hoarding dollars again. It’s a self-fulfilling prophecy. Panic leads to more buying, which leads to more devaluing.

Honestly, the best thing you can do is stop trying to time the "bottom." Unless you are a professional day trader, you will probably lose. If you need to exchange money, do it in stages.

Actionable Steps for Managing Your Money

Don't just watch the numbers change on your screen. Take control of the volatility.

1. Use Limit Orders. If you use a business FX platform, don't just "buy now." Set a target rate. If you think the peso will hit 19.50, set an order for that. The market moves while you sleep.

2. Diversify Your Cash. If you live in Mexico but earn in dollars, keep a healthy chunk in USD. It’s your hedge against a sudden peso devaluation. Conversely, if you're a Mexican business exporting to the U.S., consider forward contracts to lock in a rate for next month's invoices.

3. Watch the WTI Crude Oil Price. Mexico is no longer just an "oil economy," but the peso still often moves in tandem with oil prices. When oil drops, the peso often feels heavy.

4. Check the Calendar. Banxico meetings and U.S. Fed announcements are the "danger zones." Avoid making big transfers 24 hours before or after these meetings unless you're prepared for a 2% swing in either direction.

The tipo de cambio de dolar a peso mexicano is never going to be "stable" in the way the Euro or the Pound might feel. It’s a high-yield, high-volatility currency that reflects the chaotic, beautiful, and complicated relationship between two of the most integrated economies on earth. Watch the trends, ignore the 24-hour news cycle panic, and always look at the spread before you click "send."