Gold isn't just a shiny metal sitting in a vault. It’s a geopolitical sledgehammer. When people search for top gold producing countries, they usually expect a static list that stays the same year after year. That’s a mistake. The rankings are actually incredibly volatile, influenced by everything from local labor strikes in Johannesburg to massive tech upgrades in the Siberian tundra. Honestly, if you aren't looking at the specific tonnage shifts from the last eighteen months, you're looking at old news.

China is still the king. It’s been that way since 2007. But the gap is closing, and it’s closing fast.

The China Dominance and Why It’s Complicated

China produced somewhere around 370 metric tons of gold recently. They’ve held the top spot for over a decade, which is wild when you think about how much the global economy has changed in that time. But here’s the kicker: China doesn't export its gold. Not really. Most of what they dig out of the ground stays right there, feeding their own central bank reserves or their massive jewelry market.

You’ve got to understand the scale. We’re talking about provinces like Shandong and Henan basically carrying the national output on their backs. However, there’s a catch. Environmental regulations in China are getting stricter. The government is shutting down smaller, "dirty" mines that don't meet new green standards. This means their production has actually dipped a bit from its all-time highs. It’s a strange paradox where the world's biggest producer is actually tightening its own belt.

Australia and the Massive Pipeline

Australia is basically breathing down China's neck. They sit in the number two spot, pulling in roughly 310 to 320 tons annually. If you’ve ever flown over Western Australia, you know why. It’s a moonscape of open-pit mines. The Boddington mine and the legendary Super Pit in Kalgoorlie are absolute behemoths.

What makes Australia different? Innovation.

They are pioneers in autonomous mining. We're talking about massive haul trucks moving millions of tons of earth without a human behind the wheel. It’s tech-heavy. Because labor is expensive in the Outback, they’ve had to automate to stay competitive. Experts like those at the Department of Mines, Industry Regulation and Safety (DMIRS) in WA point out that while the ore grades (the amount of gold per ton of rock) are technically dropping, the sheer volume of dirt they can move keeps them at the top.

Russia: The Wildcard in the North

Then we have Russia. This is where it gets murky. Officially, Russia produces about 310 tons, putting them neck-and-neck with Australia. But since the geopolitical shifts of 2022 and 2023, the data is harder to verify with 100% certainty. The Polyus-owned Olimpiada mine in the Krasnoyarsk region is one of the largest gold deposits on the planet. It’s massive.

The Russian strategy is simple: keep digging. With Western sanctions, gold has become a vital "sanction-proof" asset for the Kremlin. They are investing heavily in the Far East and the Arctic. However, getting equipment is becoming a nightmare for them. They used to rely on Caterpillar and Komatsu parts. Now? They’re scrambling for domestic or Chinese alternatives. It’s a friction point that might slow their growth, even if the gold is physically there.

The Surprising Rise of Canada

Canada is sneaky. You don't often think of it as a mining superpower in the same breath as Russia or China, but it’s currently holding the number four spot. Production has surged to over 200 tons.

Why the jump?

- New projects in Nunavut and British Columbia.

- The "Golden Triangle" in BC is seeing a literal renaissance.

- High-grade discoveries that make extraction cheaper.

Companies like Agnico Eagle and Barrick Gold are pouring billions into the Canadian Shield. It’s stable. Investors love Canada because, unlike some other regions, the government isn't going to nationalize your mine overnight. That stability is worth its weight in... well, you get it.

The Tragedy of South Africa’s Decline

If you looked at a list of top gold producing countries in 1970, South Africa would have been the only name that mattered. They produced over 1,000 tons back then. It was insane.

Today? They barely crack 100 tons.

It’s a slow-motion collapse. The mines in South Africa are the deepest in the world—some go four kilometers underground. It’s hot. It’s dangerous. It’s expensive. When you have to spend millions just on refrigeration so your miners don't die of heatstroke, the math stops working. Add in the frequent power grid failures (load shedding) from Eskom, and you see why the industry is suffocating. It’s a cautionary tale: having the gold in the ground doesn't matter if you can't afford to get it out.

The Rest of the Contenders

The middle of the pack is a revolving door. The United States stays consistent at around 170 tons, mostly from Nevada. In fact, if Nevada were its own country, it would still be a top 10 global producer. The Carlin Trend is a geological freak of nature that just keeps giving.

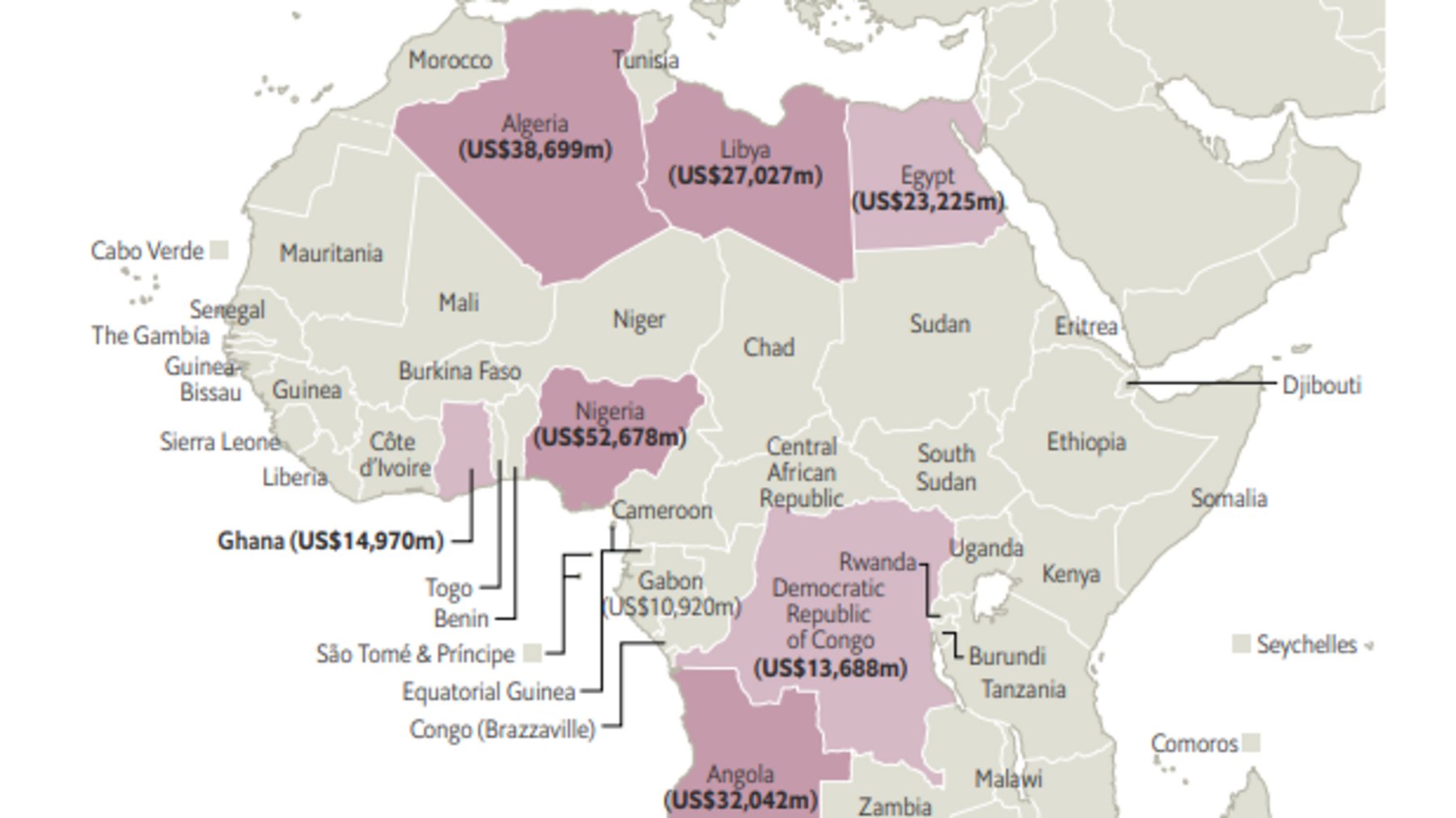

Ghana has recently overtaken South Africa as the king of African gold. They are hitting around 120-130 tons. It’s a huge win for West Africa, though they struggle with "galamsey"—illegal small-scale mining that causes massive environmental damage and complicates official production numbers.

Uzbekistan and Peru also hover around the 100-ton mark. Peru used to be much higher, but social unrest and protests against mining companies have stalled several multi-billion dollar projects. It’s a reminder that mining is as much about "social license" as it is about geology.

🔗 Read more: Wall Street Journal Dumbest Trade War: What Most People Get Wrong

Modern Realities: All-In Sustaining Costs (AISC)

You can't talk about gold production without talking about the cost. It’s not just about how much you find; it’s about how much it costs to find it.

Most major miners are looking at an AISC of $1,200 to $1,400 per ounce. When gold is trading at $2,000+, everyone is happy. But if the price dips, the "top producers" list changes instantly. High-cost mines in South Africa or deep-level operations in South America shut down first. The countries that stay on top are the ones with the lowest "cost to lift."

Why This Matters for the Average Investor

So, what’s the takeaway? If you’re watching the gold market, don't just watch the price ticker on CNBC. Watch the mining permits in Ontario. Watch the power grid stability in Johannesburg. Watch the autonomous trucking regulations in Perth.

The "Top 10" list is a lagging indicator. By the time the annual reports come out, the ground has already shifted.

- Monitor the "Big Three": China, Australia, and Russia control the lion's share. Any disruption in one of these three will spike global prices.

- Focus on Jurisdiction: Canada and the US are "safe" production zones. High-yield but high-risk zones like Mali or Burkina Faso can see production vanish overnight due to coups or instability.

- Watch Central Bank Buying: Countries like China and India are buying gold as fast as they can mine it. This creates a supply squeeze that isn't always reflected in the "production" numbers alone.

If you're looking to gain exposure to these markets, the best move is often looking at the major miners operating in these top-tier countries. Diversification across jurisdictions is the only way to sleep at night.

To track this in real-time, your next step is to pull the quarterly production reports from the World Gold Council. They provide the most granular breakdown of mine-level data that eventually rolls up into these national rankings. It’s the difference between guessing and knowing.