If you’ve ever tried to take out a massive business loan or lease a piece of heavy machinery, you probably bumped into a three-letter acronym that sounds like something out of a tax manual: UCC. It stands for the Uniform Commercial Code. But what people often scramble to find when a deal is on the line is the UCC statement request form. It sounds bureaucratic. Honestly, it is. But if you don't understand how to use this specific piece of paperwork, you might find yourself accidentally buying equipment that someone else technically still owns, or worse, getting rejected for a line of credit because of a "ghost" lien from a decade ago.

A UCC statement request form is basically the official way you ask a Secretary of State's office to hand over the records of who has a legal claim on someone’s property. Think of it like a background check, but for stuff instead of people.

Understanding the UCC-1 and Why the Request Form Exists

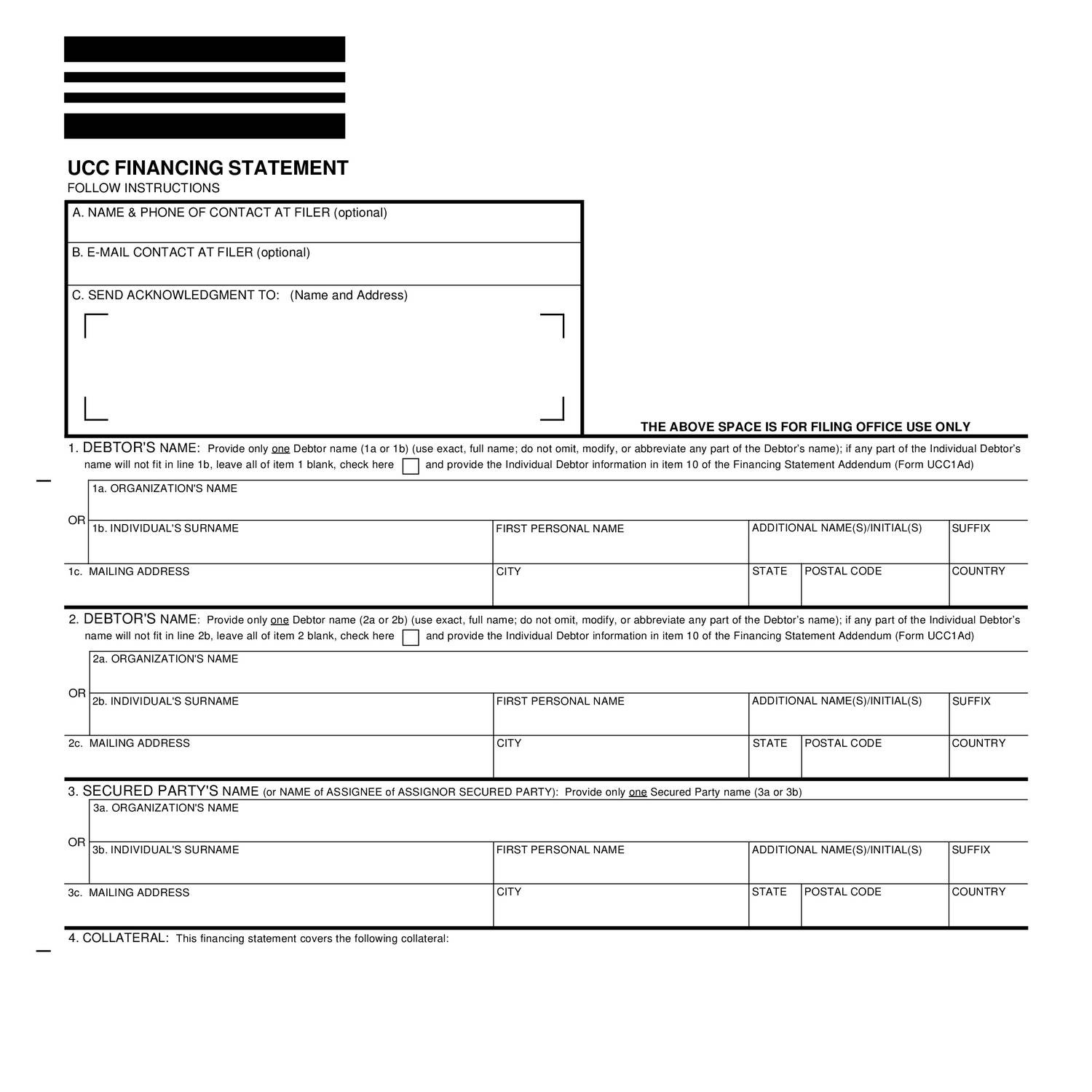

Before you can understand the request form, you have to know what it’s looking for. When a bank lends a business money, they don't just take the business owner's word for it. They file a UCC-1 Financing Statement. This is a public "keep off" sign. It tells the rest of the world, "Hey, we have a lien on this printing press" or "We have a claim on all the inventory in this warehouse."

✨ Don't miss: Gas Tax in Each State: What Most People Get Wrong

So, why do you need a request form? Because those filings are public records. If you are a lender, you use the UCC statement request form (often officially called a UCC11) to pull a certified search report. You need to see if any other lenders got there first.

Lenders aren't the only ones using them. Smart business buyers use them too. Imagine buying a used delivery fleet only to find out later that a bank in another state has a lien on every single truck. That is a nightmare you want to avoid. You use the request form to pull the "Information Request" that proves the title is clear.

The UCC11: The Most Common Version of the Form

Most states follow a standardized format, but they love their specific nuances. Generally, the UCC statement request form is known as the UCC11 Information Request.

When you fill this out, you aren't just asking for "anything you have on John Doe." You have to be precise. You provide the exact legal name of the debtor. If you get one letter wrong, the search might come back clean even if there’s a massive lien under a slightly different name. That’s the scary part.

The form usually asks for:

- The name and address of the person or business you are searching.

- Whether you want a "Certified" search (which is legally admissible in court).

- If you want copies of the actual filings or just a summary list.

- A specific timeframe, though most people just want everything currently active.

State fees vary wildly. In some places, it’s a flat twenty bucks. In others, they charge you per page of the results. It gets expensive fast if a business has a long history of debt.

Why You Can't Just "Google It"

You might think, "It’s 2026, why can’t I just search a database?" You can. Most Secretaries of State have online portals. But a casual online search isn't the same thing as a formal UCC statement request form submission.

An official request provides a snapshot in time that is legally recognized. If a lender is doing "due diligence," they want that official seal. They want to know that if a dispute goes to court, they have a document from the state showing no prior liens existed on that specific Tuesday at 10:00 AM.

Also, state databases are notoriously finicky. Some use "Standard Search Logic" (SSL) which is incredibly rigid. If the business is "Smith & Sons" but you search "Smith and Sons," a basic search might miss it. A formal request form forces the state's filing office to run the search according to their specific legal protocols.

Real World Example: The "Second-Hand Forklift" Disaster

Let’s look at a real scenario. A small construction company in Ohio, let's call them BuildRight, wanted to buy three used forklifts from a liquidating competitor. The price was great. BuildRight checked the physical titles, but in many states, heavy equipment doesn't have a title like a car does.

The buyer didn't file a UCC statement request form. They just handed over a check for $45,000.

Six months later, a regional bank showed up to repossess the forklifts. Turns out, the liquidating competitor had used those forklifts as collateral for a massive revolving line of credit. Because the bank had filed a UCC-1 years prior, their claim was "perfected." It didn't matter that BuildRight paid cash. The bank's claim stayed with the equipment. If BuildRight had spent $30 and ten minutes on a UCC-11 request, they would have seen the lien and walked away.

Common Mistakes When Filing the Request

People mess this up all the time. It's frustratingly easy to do.

The biggest mistake is the Debtor Name. In the world of the Uniform Commercial Code, the name on the driver's license (for individuals) or the exact name on the Articles of Incorporation (for businesses) is the only name that matters. Don't use trade names or "Doing Business As" (DBA) names on the request form unless you want to search those specifically as extras.

🔗 Read more: Thinking about 1.7 billion won: What that money actually buys you in 2026

Another gaffe? Checking the wrong boxes for copies. If you just get the "search report," you get a list of filing numbers. But that doesn't tell you what the collateral is. You usually need to check the box for "copies" so you can actually read the descriptions. One lien might cover "all assets," while another might only cover a specific piece of equipment with a serial number. You need the details.

How the Process Varies by State

While the UCC is supposed to be "uniform," every state has its own little flavor of bureaucracy.

- Delaware: They are the kings of this because so many companies are incorporated there. Their systems are fast but they use authorized searchers (third-party agents) for a lot of the heavy lifting.

- California: Their SOS office is massive. You can do a lot online, but for certified copies, you’re still often looking at a formal form process.

- Texas: Very straightforward, but they have specific rules about searching by "organizational number" rather than just the name.

How to Get the Form

Usually, you just go to the Secretary of State website for the state where the business is registered. Look for a section labeled "Business Services" or "UCC Filings."

You'll find a PDF or an online portal version of the UCC11. If you're dealing with a complex merger or a multi-million dollar loan, most people don't do this themselves. They hire a service company like CT Corporation or CSC. These companies live and breathe the UCC statement request form. They charge a fee, but they ensure the search is exhaustive across multiple states.

Why This Matters Right Now

In an economy where businesses are leaning more on equipment financing and alternative lending, the UCC filing system is busier than ever. With interest rates fluctuating, more companies are refinancing. Every time a refinance happens, a new UCC search is triggered.

💡 You might also like: How to get tax exemption: The parts the IRS doesn't exactly put in bold print

If you are a business owner, you should actually run a UCC statement request form on yourself once in a while.

Why? Because mistakes happen. Sometimes a bank forgets to file a "Termination Statement" (UCC-3) after you’ve paid off a loan. That old lien sits there, making you look more indebted than you actually are. It can tank your creditworthiness or prevent you from getting a new loan. Finding a "zombie lien" through a simple request form allows you to contact the old lender and demand they clear the record.

Actionable Steps for Using a UCC Statement Request Form

If you’re ready to pull a report, don’t just wing it. Follow these specific steps to make sure you don't miss a lien that could ruin your deal.

- Verify the Exact Legal Name: Get a copy of the Articles of Incorporation or the debtor's state-issued ID. Do not guess. Even a missing "Inc." or a misplaced comma can invalidate the search results in some jurisdictions.

- Determine the Proper Jurisdiction: Usually, you file the request in the state where the debtor is "located." For a registered organization (like an LLC or Corp), that’s the state of incorporation. For an individual, it's their primary residence.

- Decide on Search Scope: Decide if you need a "Standard" search or if you need to look for lapsed filings. Generally, a standard search only shows active liens (those filed within the last five years). If you suspect a long-term legal battle or an old, unreleased lien, you might need to dig deeper.

- Choose Certified vs. Uncertified: If you are just curious, an uncertified search is fine. If you are a lawyer or a lender closing a deal, always go for the Certified UCC Search. This is the version that holds up in a courtroom.

- Check for "All Assets" Clauses: When you get the results back, don't just look at the names. Look at the "Collateral" section. If it says "All assets now owned or hereafter acquired," that lender basically owns a piece of everything that business touches.

- Follow Up on Terminations: If you see a filing that you know should be closed, look for a corresponding UCC-3 filing. If it’s not there, the lien is still technically active. You’ll need to contact the "Secured Party" (the lender) listed on the form to get it cleared.

By treating the UCC statement request form as a vital piece of business intelligence rather than just another government form, you protect your investments and keep your credit profile clean. It’s the simplest way to ensure that when you buy something, it’s actually yours to keep.