Honestly, walking into a supermarket lately feels like a bit of a psychological experiment. You see the headlines saying things are "cooling down," but then you look at the price of a block of cheddar and wonder if the economists are living on a different planet.

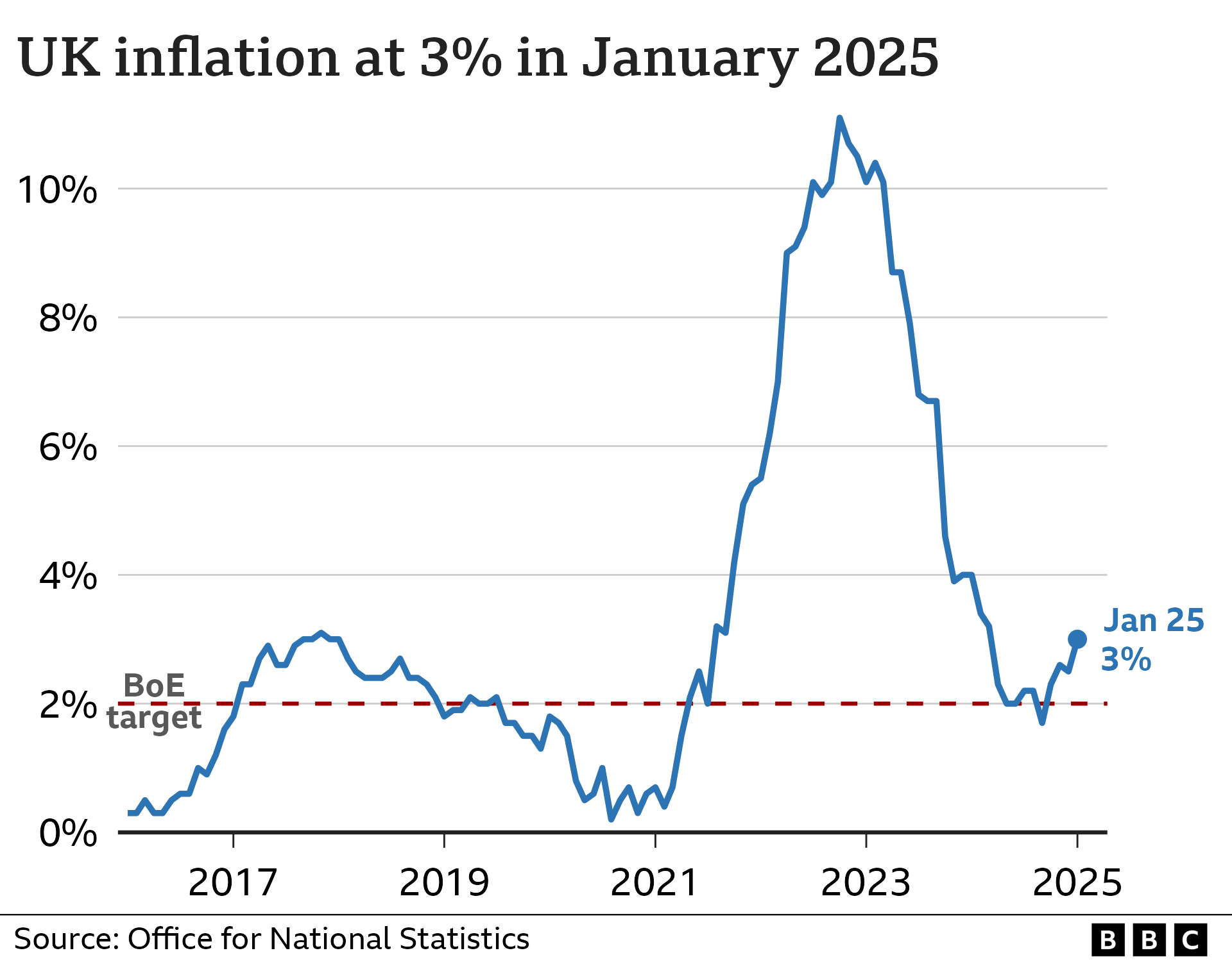

As of January 2026, the UK inflation rate current figure sits at 3.2%. That’s the official Consumer Prices Index (CPI) number from the most recent Office for National Statistics (ONS) data. It’s a massive drop from those terrifying double-digit peaks we saw back in 2022, but let's be real—prices aren't actually falling. They’re just climbing more slowly.

✨ Don't miss: Converting 1 rupee to yen: Why the Math Usually Breaks Your Brain

Why that 3.2% feels like a lie

Most people hear "inflation is down" and expect their weekly shop to get cheaper. It doesn't.

Inflation is a measure of the rate of change. If inflation is 3.2%, it means something that cost £100 last year now costs £103.20. The "down" part just means it isn't costing £110. You've still lost purchasing power; you're just losing it at a slightly more manageable pace.

The "Squeezed Middle" of the Basket

While energy prices have stabilized significantly compared to the 2023 crisis, other areas are still sticky. Services inflation—basically the cost of anything involving a human being doing a job, like a haircut, a meal out, or a plumber—is still hovering around 4.4%.

Why? Because wages have had to go up.

When businesses pay their staff more to keep up with the cost of living, they often pass those costs right back to you. It's a bit of a dog-chasing-its-tail situation. Economists call this "persistence." I call it the reason a pint of lager in London now feels like a down payment on a house.

The Bank of England’s Next Move

The folks over at Threadneedle Street have a single, obsessive goal: get that number down to 2%.

They've been using the bluntest tool in the shed to do it—interest rates. Right now, the base rate stands at 3.75%, following a series of cautious cuts toward the end of 2025.

Andrew Bailey and the Monetary Policy Committee (MPC) are in a tight spot. If they cut rates too fast, they risk reigniting the inflation fire. People start borrowing and spending again, demand outstrips supply, and we’re back to square one. If they keep rates too high for too long, they might accidentally choke the economy into a recession.

Goldman Sachs analysts are currently betting on three more 25-basis-point cuts throughout 2026, potentially bringing the terminal rate down to 3%. But that’s a "maybe." The Bank is notoriously data-dependent. If the next ONS report shows a surprise spike, those cuts will vanish faster than a supermarket discount.

What’s actually driving the UK inflation rate current?

It’s not just one thing. It's a messy cocktail of global and local factors.

- Food Prices: We’ve seen a slight relief here. Bread and cereal prices actually dipped slightly last month, which is the first time we’ve seen that kind of "deflation" in specific categories for a while. However, olive oil and eggs are still way higher than their 2020 averages.

- The Energy Cap: The Ofgem price cap is the big one to watch. We’re expecting a roughly 5% drop in the cap come April 2026, which could shave about 0.3 percentage points off the headline inflation rate.

- The Rental Trap: This is the "hidden" inflation. The CPI often doesn't capture the sheer brutality of the rental market. Private rents in some UK cities have seen double-digit growth, far outstripping the headline 3.2% figure. If you're a renter, your personal inflation rate is likely much higher than the national average.

The 2026 Forecast: Are we nearly there yet?

The consensus among major banks like KPMG and the Office for Budget Responsibility (OBR) is that we’ll hit that "holy grail" of 2% by the spring or summer of 2026.

But there are "black swan" risks.

Geopolitical tensions in the Middle East still threaten oil prices. If shipping routes get blocked or energy supplies get throttled, that 3.2% could easily bounce back up to 4% or 5% before we know it.

Actionable Insights for Your Wallet

Knowing the UK inflation rate current is 3.2% is fine for a pub quiz, but what do you actually do with it?

Review your "lazy" subscriptions.

Inflation thrives on inertia. When companies raise prices by 5%, most people just let the direct debit run. Take an hour this Sunday to cull anything you haven't used in 30 days.

Fix your mortgage strategy.

If you're on a tracker, the expected rate cuts in 2026 are good news. If you're coming off a fixed rate soon, don't panic-lock into a 5-year deal at current rates without talking to a broker. The market is betting on rates being lower in 12 months than they are today.

Hedge with high-interest savings.

With the base rate at 3.75%, you can still find savings accounts offering 4% or more. Since inflation is at 3.2%, your money is actually growing in real terms for the first time in years. This is a rare window—don't let your cash sit in a 0.5% high-street current account.

Negotiate your "Services."

Broadband and mobile providers love the "CPI + 3.9%" yearly price hike. Since the current CPI is lower than last year, their justification for massive hikes is weaker. Call them. Threaten to leave. Usually, they'll find a "loyalty discount" they forgot to mention.

👉 See also: PPL Building in Allentown PA: Why This Art Deco Giant is More Than Just an Office

The 2026 economy is looking "lower and slower." It's calmer than the chaos of the last three years, but it requires a more tactical approach to personal finance. Keep an eye on the next ONS release on February 18—that’s the data point that will determine if the Bank of England stays the course or pivots again.

Next Steps for You:

Check your latest energy bill against the current Ofgem cap and use a comparison tool to see if moving to a fixed-rate tariff now makes sense before the April price change. Additionally, move any emergency fund cash into an account yielding at least 4% to ensure you are beating the 3.2% inflation mark.