Ever try to buy a few shares of Under Armour and end up staring at your screen like it's a math problem you didn't study for? You type in the name, and suddenly you're staring at two different options: UA and UAA.

It's confusing. Honestly, it's enough to make most casual investors just close the app and go buy a pair of Curry 12s instead. But there is a very specific, slightly dramatic reason for the split. Understanding the under armour stock market symbol situation isn't just about knowing which buttons to click; it’s a peek into how a massive brand tries to keep its founder in the driver's seat while still taking public money.

The Tale of Two Tickers: UAA vs. UA

Basically, if you want the "standard" version of the stock that most people talk about, you're looking for UAA. This represents the Class A Common Stock.

Then there's UA, which represents the Class C shares.

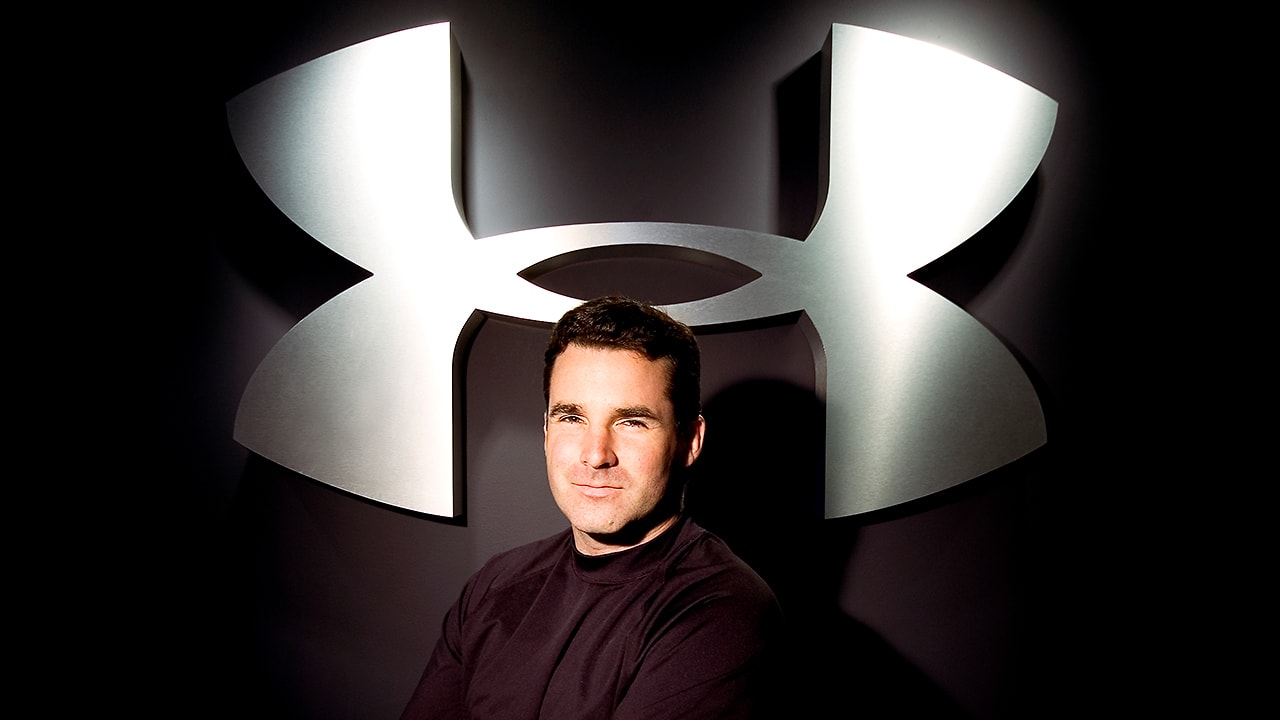

Why the mess? Back in 2016, the company pulled a move that several tech giants—think Google or Meta—have used. They created a new class of shares to ensure that Kevin Plank, the guy who started the whole thing in his grandmother's basement, wouldn't lose control of the company.

What’s the actual difference?

The main thing is voting rights.

👉 See also: SCHG Stock Price Today: Why Most Investors Are Missing the Real Growth Story

- UAA (Class A): You get one vote per share. If there’s a big corporate decision, you get a (very tiny) say.

- UA (Class C): You get zero votes. You own the stock, you get the price action, but you’re essentially a silent partner.

- Class B (The Secret Tier): These aren't traded publicly. Kevin Plank owns these. They carry ten votes per share. This is why, no matter how many Class A shares the public buys, Plank usually still calls the shots.

Interestingly, for a long time, the symbols were actually reversed or formatted differently (like UA.C). In late 2016, they swapped them to the current UAA and UA labels to try and clear things up. Did it work? Sorta. Most people still get them mixed up.

Why the Stock is Currently a Battleground

If you’ve looked at the under armour stock market symbol on your watchlist lately, you’ve probably noticed things are... volatile. As of early 2026, Under Armour is actually one of the most shorted stocks in the consumer discretionary sector.

Recent data from December showed short interest as high as 34.96%. That is a massive number. It means a huge chunk of the market is literally betting on the company to fail.

Why the pessimism? The company has been in a "restructuring" phase for what feels like forever. They’ve had a revolving door of CEOs. Patrik Frisk tried his hand, then Stephanie Linnartz (from Marriott) took over to try and fix the digital side. Then, in a "prodigal son" moment in April 2024, Kevin Plank returned to the CEO role.

The Numbers Nobody Likes to Hear

Under Armour's fiscal 2026 outlook isn't exactly a victory lap. Revenue is expected to drop by 4% to 5%. In North America—their home turf—they are seeing high-single-digit declines.

- Tariff Troubles: New trade policies and tariffs have been a nightmare for their margins.

- Footwear Fatigue: While they dominate in "sweat-wicking" shirts, they've struggled to make their sneakers as "must-have" as Nike or Hoka.

- Restructuring Costs: They are burning millions—somewhere between $140 million and $160 million—just to "fix" the business.

Despite the gloom, the stock recently saw a weird 32% spike in a single month. This happens sometimes when a stock is so heavily shorted; a little bit of good news causes a "short squeeze" where people betting against it have to buy back in, driving the price up even more.

Is UAA or UA a Better Buy?

Generally, UAA and UA trade in lockstep. They have a correlation of about 97%. If one goes up 5%, the other usually follows.

However, UA (Class C) often trades at a slight discount—maybe a few cents or a couple of percent cheaper—because it lacks those voting rights. If you’re a long-term investor who doesn’t care about voting on board members (which, let's be real, most of us don't), the "cheaper" UA shares might technically give you more bang for your buck in terms of raw ownership.

But liquidity matters. UAA usually has higher trading volume. This means it's easier to buy and sell large amounts without moving the price too much.

What Most People Get Wrong

People think because the stock price is low—hovering around $5 or $6 lately—that it's "cheap."

✨ Don't miss: Why East End Studios Sunnyside Is Actually a Huge Deal for Queens

Wall Street experts like those at Simply Wall St or Investing.com are quick to point out that "cheap" is relative. While some analysts have a fair value target around $5.87, others using Discounted Cash Flow (DCF) models think the "real" value might be closer to $4.43.

Basically, the market is currently split between people who think Kevin Plank can pull off a miracle comeback and people who think the brand is losing its cool factor to newcomers like On Running or Lululemon.

Actionable Insights for Your Portfolio

If you're looking at that under armour stock market symbol and wondering whether to pull the trigger, here is the reality of the situation in 2026:

- Watch the Margins, Not Just Sales: The company is currently battling a 200+ basis point drop in gross margin. Until they get supply chain costs under control, the stock will struggle to sustain a rally.

- Choose Your Ticker Wisely: If you want to trade options or need high liquidity, stick with UAA. If you’re just tucking it away for five years and want a slightly lower entry price, look at UA.

- Check the Short Interest: Since the stock is so heavily shorted, it’s going to be "bouncy." Expect big swings on small news. Don't put money in here that you can't afford to see drop 10% in a single afternoon.

- The "Plank" Factor: Betting on Under Armour right now is a bet on Kevin Plank. He’s back in the driver’s seat. If you believe in his vision for a "reconstituted" brand, the current lows might look like a bargain in hindsight. If you think the brand’s best days were in 2015, stay away.

The next few earnings reports will be the real test. Watch for updates on North American sales; if that number stops shrinking, it might finally be the signal that the turnaround is actually happening.