You've probably been there. You open your brokerage app, type in "Under Armour," and suddenly you're staring at two different options. One says UAA. The other says UA. They both look like the same company because, well, they are. But the prices are different, and the letters are just similar enough to be annoying.

Honestly, the under armour stock name situation is one of the most confusing setups in the retail investing world. It's not just a quirk of the New York Stock Exchange; it’s a deliberate move by the company’s founder to keep the steering wheel firmly in his hands. If you’re trying to figure out which one to buy—or why there are two in the first place—you aren't alone. Most people get this wrong, thinking one is "preferred" or that the "UA" ticker is the main one because it's the brand name. It's actually the opposite.

The Tale of Two Tickers: UAA vs. UA

Back in the day, everything was simple. There was just one under armour stock name and it was UA. Then, around 2016, the company decided to pull a "Google." They split the stock into different classes.

📖 Related: John Mars: The Richest Person You’ve Probably Never Heard Of

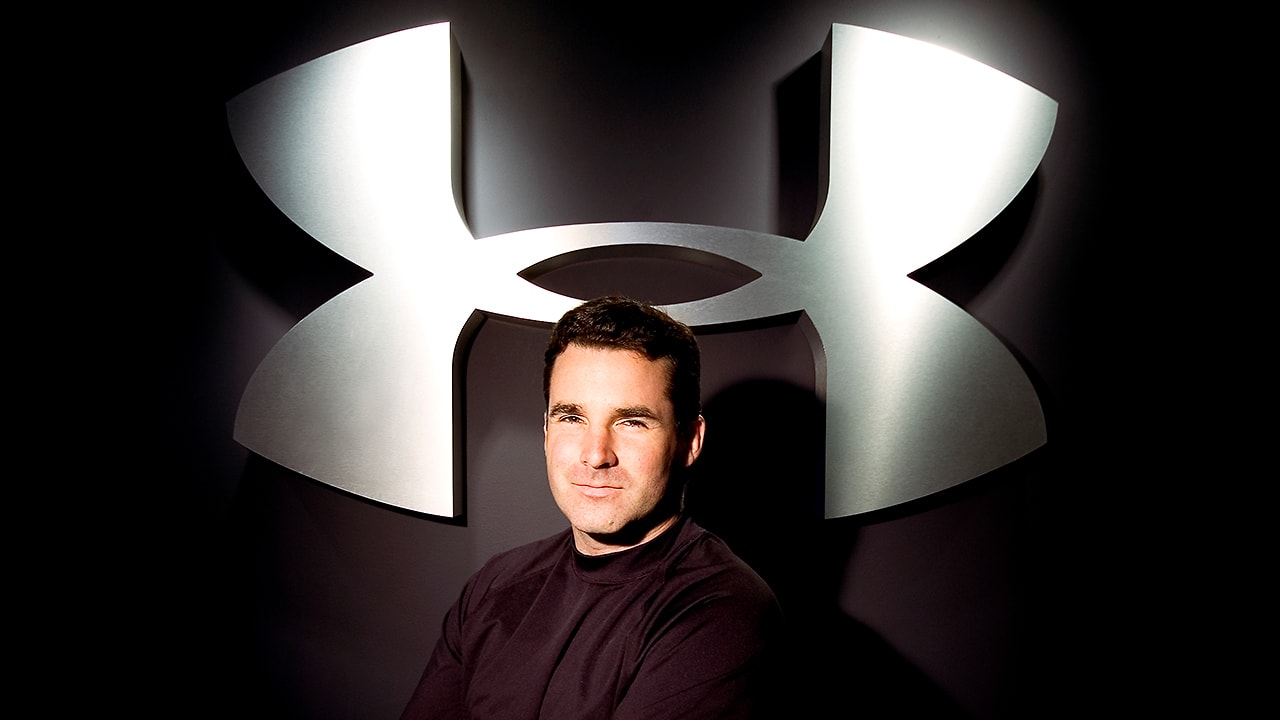

The goal? Founder Kevin Plank wanted to make sure he could issue more shares to employees or use them for acquisitions without losing his majority voting power. To do this, they created Class C shares. These shares have absolutely no voting rights. If the company holds a meeting to decide something big, Class C shareholders don't get a say.

Class A (UAA)

This is the "primary" ticker now. It represents Class A Common Stock. When you buy UAA, you get one vote per share. If you look at the trading volume, this is usually where most of the action happens. As of early 2026, UAA is trading around $5.78. It's the one institutional investors and big funds usually gravitate toward.

Class C (UA)

This is the "non-voting" stock. It used to trade under the symbol UA-C, but they eventually shortened it to just UA. This creates a ton of confusion because people see "UA" and assume it's the "Alpha" stock. It isn't. It’s the Class C stock. Interestingly, UA often trades at a slight discount to UAA. On any given day in 2026, you might see UA trading for about $5.69, roughly ten cents cheaper than its voting sibling.

Why the Price Gap Exists

You might wonder why anyone would pay more for UAA if Kevin Plank owns all the Class B shares anyway.

That’s the kicker. There is a "Class B" that you can't even buy. These shares have 10 votes each and are held by Plank and his family entities. Because he has those Class B shares, he effectively controls over 60% of the voting power. So, whether you own UAA (1 vote) or UA (0 votes), you basically have no power to change the company's direction.

💡 You might also like: Richest Companies in the World: What Most People Get Wrong

Yet, UAA still trades higher. Why?

- Liquidity: More people trade UAA. It's easier to buy and sell in large chunks.

- Index Inclusion: Many ETFs and mutual funds are required to hold the voting Class A shares.

- Psychology: Investors generally dislike "limited" versions of things, even if the "benefit" (voting) is currently useless.

It's sorta like buying a car with a sunroof you can't open vs. one without a sunroof at all. Even if you never planned on opening it, the one with the sunroof just feels like it's worth more.

Under Armour’s Identity Crisis in 2026

The under armour stock name has been through a lot lately. If you've been following the news, the company is in the middle of a massive "brand comeback" led by Kevin Plank himself, who returned as CEO in 2024.

The 2025-2026 fiscal years have been... let's call them "transformational." That's corporate-speak for "we’re closing stores and cutting costs because things got messy." They’ve been trimming the fat, reducing their product styles (SKUs) by 25%, and even separating the Stephen Curry brand to give it more room to breathe.

The Financial Reality

Right now, the stock is a speculative play. Revenue has been dipping—down about 5% recently—because they’re trying to stop discounting their clothes so much. They want to be a premium brand again.

Investors like Fairfax Financial have noticed. In early 2026, Fairfax (led by Prem Watsa, often called the "Canadian Warren Buffett") disclosed a massive 22.2% stake in the company. When a value-focused giant like that moves in, people start paying attention to the under armour stock name again. It signals that someone with very deep pockets thinks the brand is undervalued.

What You Actually Need to Do

If you're looking at the under armour stock name for your portfolio, you have a choice to make. Do you go for UAA or UA?

If you are a long-term "buy and hold" investor and you want to save a few cents on the dollar, UA (the non-voting shares) is often the better deal. You’re getting the same claim on the company’s earnings and assets for a cheaper price. Since Plank controls the votes anyway, your lack of a vote doesn't really matter.

However, if you're a day trader or someone who moves in and out of positions quickly, stick with UAA. The higher volume means you won't get stuck in a "wide spread" where you lose money just trying to sell the stock.

Actionable Steps for Investors

- Check the Spread: Before buying UA, make sure the discount is actually significant. If UAA and UA are only a penny apart, just buy UAA.

- Watch the Debt: Under Armour has about $600 million in senior notes due in June 2026. Keep an eye on how they handle that repayment.

- Monitor the Turnaround: The "New Under Armour" is focusing on full-price sales. If you see their gross margins (currently around 47-48%) start to climb, the strategy is working.

- Institutional Moves: Keep tabs on Fairfax Financial's filings. If they continue to buy, it’s a vote of confidence. If they start trimming, be careful.

Don't let the dual-ticker system scare you off. It's just a structural quirk of a company trying to find its footing in a market dominated by Nike and Lululemon. Just remember: UAA for liquidity, UA for the discount.

Strategic Move: Before putting a single dollar into either ticker, look at the quarterly "Direct-to-Consumer" (DTC) revenue. If eCommerce continues to drop because they are cutting promotions, that’s actually a good sign for brand health in the long run, even if the total revenue number looks ugly for a few months. Focus on the margin, not just the top line.