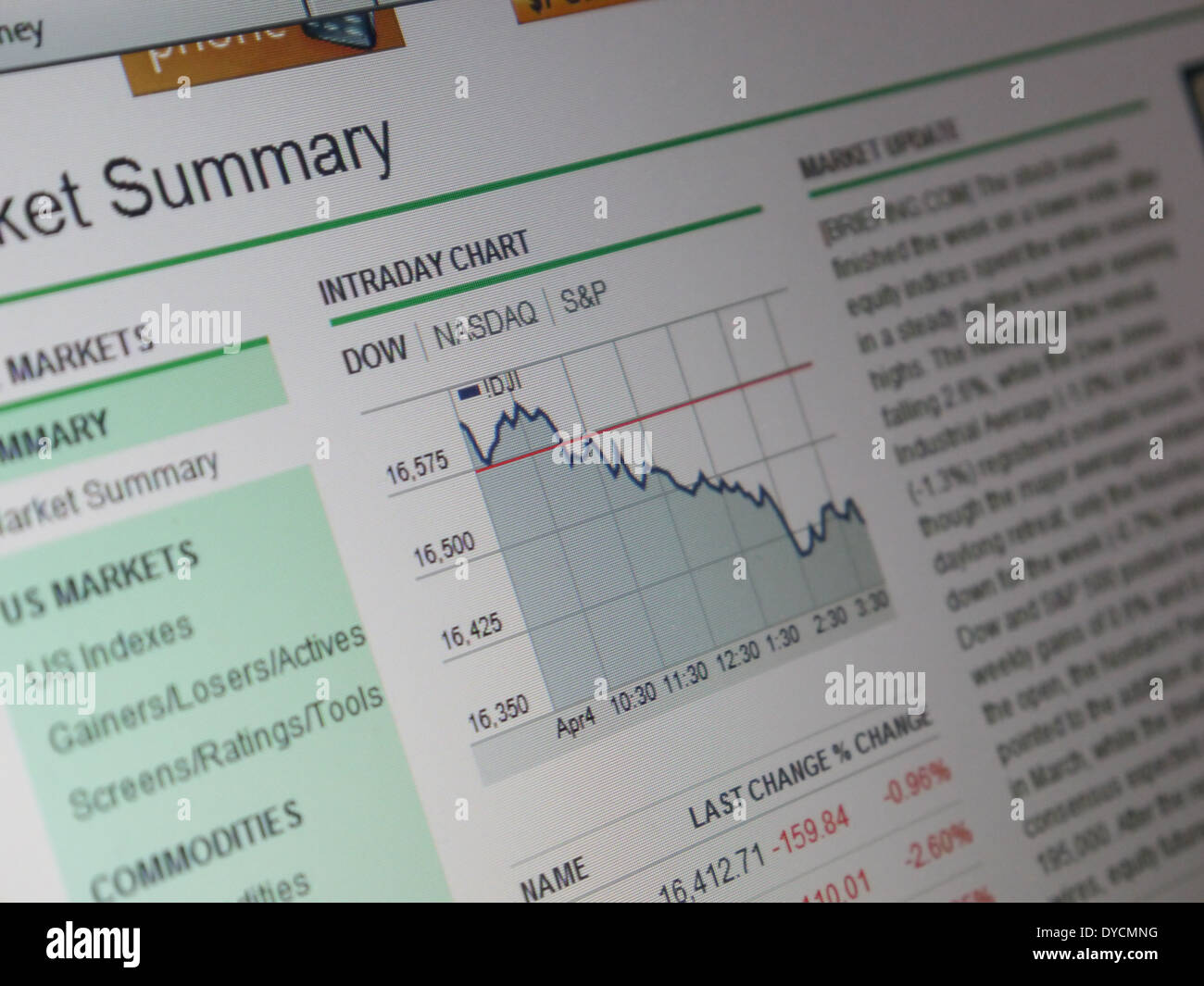

You’ve seen it on the news. A jagged red or green line flickering across the screen while a breathless anchor talks about "points" and "basis points." Looking at a stock market graph dow for the first time—or even the hundredth—can feel like trying to read a heart monitor for an extremely caffeinated giant. It’s chaotic. It’s twitchy. Honestly, it’s often a bit misleading if you don't know what you're staring at.

The Dow Jones Industrial Average (DJIA) isn't the whole market. Not even close. It’s just 30 massive, blue-chip companies like Apple, Microsoft, and Coca-Cola. But because it’s the oldest "barometer" we have, everyone watches it. When people ask "how's the market doing?" they usually check that specific graph first.

Why the Price-Weighted Mess Matters

Most indexes, like the S&P 500, are market-cap weighted. That means bigger companies have a bigger say. The Dow is different and, frankly, kind of weird. It’s price-weighted. This means a company with a higher stock price per share has a larger influence on the stock market graph dow than a company with a lower share price, even if the "smaller" share price company is actually a bigger business.

Think about that for a second. If Goldman Sachs moves $5, it impacts the graph way more than if Intel moves $5, simply because Goldman's nominal stock price is higher. It’s an old-school way of doing things that dates back to Charles Dow in 1896. He literally just added up the stock prices and divided by the number of companies.

Today, they use something called the "Dow Divisor." It’s a mathematical constant that accounts for stock splits, dividends, and other corporate shifts. Without it, the graph would fall off a cliff every time a company like Walmart did a 3-for-1 split. The divisor ensures the line stays continuous.

Reading the Trends Without Losing Your Mind

If you look at a one-day graph, you’re seeing noise. Pure, unadulterated static. High-frequency trading algorithms are fighting each other over fractions of a penny. However, when you zoom out to the five-year or ten-year stock market graph dow, a different story emerges. You see the 2008 financial crisis—a massive, terrifying crater. You see the COVID-19 flash crash of 2020, which looked like a vertical drop followed by a rocket ship recovery.

Long-term investors don't care about the daily wiggles. They care about the "Moving Average."

📖 Related: Barstool Sports Net Worth: What Most People Get Wrong

If you see a smooth line running through the jagged teeth of the graph, that’s likely the 200-day moving average. It’s a great way to see if the market is actually trending up or just having a good week. If the current price is significantly above that smooth line, some analysts might say the market is "overextended." If it’s below, people start whispering the "R" word: Recession.

Support, Resistance, and Psychological Barriers

Charts aren't just math; they're a map of human emotion. Greed and fear are baked into every pixel.

Have you noticed how the stock market graph dow seems to struggle when it hits "round numbers"? Like 30,000 or 40,000? Traders call these psychological resistance levels. Humans like round numbers. We set sell orders at 40,000, not 39,942. When the graph hits that ceiling, it often bounces back down because a wave of sell orders gets triggered all at once.

Conversely, "support" is the floor. It’s the price point where buyers feel like a stock is a bargain. They step in, start buying, and the graph stops falling. If the Dow breaks "through the floor," it can lead to a panic. It’s like a physical barrier breaking. Everyone rushes for the exits.

The Problem With Ignoring Dividends

Here is the secret most people miss: the standard stock market graph dow you see on Google or Yahoo Finance is a "price return" index. It doesn't show dividends.

If you bought the Dow 20 years ago and just watched the price, you’d be happy. But if you reinvested the dividends those 30 companies paid out, you’d be wealthy. There is something called the "Dow Jones Industrial Average Total Return Index." It looks much, much better than the standard graph. It accounts for all that cash being funneled back into more shares.

📖 Related: ANZ National Bank NZ: Why the Merger Still Matters Years Later

When you're evaluating your own performance against the Dow, make sure you aren't comparing your total portfolio (with dividends) to a price-only graph. It’s apples and oranges. You'll either feel like a genius or a failure based on a data error.

Real World Impact: Why Your 401k Cares

Even if you don't own "The Dow," you probably do. Most target-date funds and pension plans are heavily weighted toward these 30 companies. They are the "bedrock" of the American economy. When the stock market graph dow shows a sustained downward trend, it’s usually a signal that big institutional investors—the guys managing billions—are worried about consumer spending.

UnitedHealth Group, Salesforce, Amgen. These aren't flashy startups. They are the plumbing of the global economy. If the plumbing is leaking, everyone gets wet.

Avoid the "Zoom In" Trap

Day traders live in the 1-minute and 5-minute charts. For a regular person, this is financial poison. It triggers a dopamine loop that makes you want to "do something." Usually, "doing something" involves selling at the bottom because you're scared or buying at the top because you have FOMO (Fear Of Missing Out).

The most successful investors I know barely look at the daily graph. They check the monthly or quarterly candles. A "candle" is just a way of showing the high, low, open, and close of a period in one little vertical bar.

💡 You might also like: Dollar US to Krona Sweden Explained: Why Your Money Goes Further in 2026

If the candle is green, the close was higher than the open. Red? The opposite. A long "wick" on the bottom of a red candle suggests that while the price dropped significantly, buyers stepped in and pushed it back up before the period ended. That's a sign of strength, even if the day was technically "down."

Actionable Steps for Navigating the Volatility

Instead of just staring at the screen and feeling anxious, use the data to your advantage.

- Check the RSI: The Relative Strength Index is a tool often found below the main graph. If it’s over 70, the Dow might be "overbought" (too expensive). Under 30? It might be "oversold" (a potential bargain).

- Ignore the "Points": When the news says "The Dow dropped 500 points!", it sounds like the end of the world. But if the Dow is at 40,000, 500 points is only a 1.25% drop. That’s a normal Tuesday. Always look at the percentage, not the point total.

- Diversify Beyond the 30: Remember that the Dow ignores huge sectors of the economy. It doesn't really capture the small-cap explosion or the international markets. Use the stock market graph dow as a pulse check, not a full physical exam.

- Set Realistic Timeframes: If you need your money in two years, the current graph matters a lot. If you need it in twenty, the current graph is basically a weather report from a city you aren't visiting for a decade.

Stop checking the price every hour. The "Dow" is a collection of businesses, not a video game score. If the businesses are still making money, providing services, and innovating, the graph will eventually point toward the top right corner of your screen. History has shown us that through wars, pandemics, and depressions, the line eventually finds its way back up. Patience is the only "indicator" that has a 100% success rate over a long enough timeline.

Next Steps for You:

- Compare the Indexes: Open a charting tool and overlay the Dow Jones with the S&P 500 and the Nasdaq. You’ll notice the Dow is often less volatile because it lacks the "hyper-growth" tech stocks that swing wildly.

- Identify the Top Weights: Look up the current "Dow Divisor" and the top five highest-priced stocks in the index. This will show you exactly who is driving the bus the next time the graph takes a sharp turn.

- Audit Your Dividends: Check if your brokerage account is set to "DRIP" (Dividend Reinvestment Plan). This ensures you’re capturing the "Total Return" mentioned earlier rather than just the price movement.