You’ve spent decades cramming money into your 401(k) or IRA. You’ve watched the markets swing, maybe panicked a little in 2022, and cheered when things bounced back. But eventually, Uncle Sam wants his cut. That’s where the uniform lifetime table 2024 enters the chat. It’s not just a boring grid of numbers. It’s the regulator of your retirement cash flow. If you misread it, you’re looking at a massive tax headache.

Honestly, the IRS doesn't make this easy. Most people think they can just "set it and forget it" once they hit 73. Wrong. The numbers change every single year because your life expectancy—at least according to the government—shrinks as you get older.

Why the uniform lifetime table 2024 is different now

Back in the day, the age for Required Minimum Distributions (RMDs) was a crisp 70½. Then the SECURE Act bumped it to 72. Now, thanks to SECURE 2.0, most folks are looking at 73. If you were born between 1951 and 1959, 73 is your magic number. If you were born in 1960 or later, you get to wait until 75.

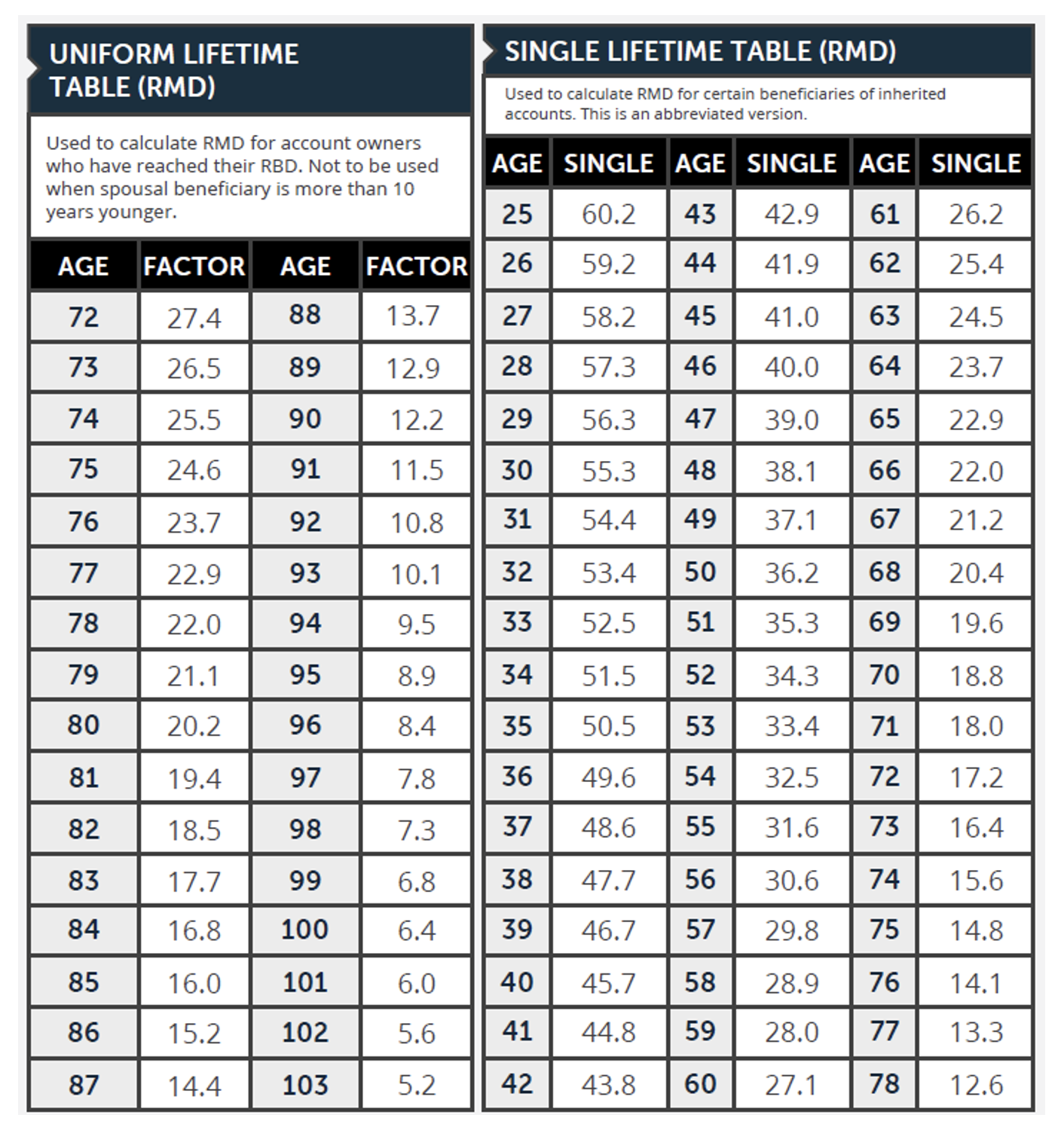

The uniform lifetime table 2024 is the specific tool used by almost every IRA owner and 401(k) participant to figure out how much they have to take out. It assumes you have a beneficiary who is exactly 10 years younger than you. Even if your spouse is 20 years younger or you’ve left the money to a charity, you generally still use this specific table.

✨ Don't miss: Check New Jersey Unemployment Status: Why Your Claim Is Still Pending

It’s about life expectancy factors. For example, if you are 75 in 2024, your "distribution period" is 24.6. You take your account balance from December 31 of the previous year and divide it by that 24.6. That’s your RMD. Simple? Kinda. But the math gets wonky fast if you have multiple accounts.

The 2022 overhaul that still matters today

We actually got "new" tables in 2022. The IRS finally realized people are living longer than they did in the 90s. They updated the mortality assumptions, which was a huge win for retirees. Longer life expectancy in the eyes of the IRS means a larger divisor. A larger divisor means a smaller required withdrawal.

Smaller withdrawals mean less taxable income.

Before this change, you were forced to drain your accounts faster. Now, the uniform lifetime table 2024 lets that money sit and grow (hopefully) for a bit longer. If you’re using a calculator or a spreadsheet you built in 2020, delete it. It’s wrong. You’re likely over-withdrawing and paying more in taxes than you legally have to.

When you DON'T use this table

There is a big trap here. You don’t use the Uniform Lifetime Table if your spouse is more than 10 years younger than you and is the sole beneficiary of your IRA. In that specific case, you use the Joint Life and Last Survivor Expectancy Table.

Why? Because a much younger spouse significantly extends the statistical life of that money. Using the standard uniform lifetime table 2024 would force you to take out too much. Always check the age gap. If your spouse is 11 years younger, stop what you're doing and switch tables. It could save you thousands in immediate tax liability.

Calculating the actual damage

Let’s look at a real-world scenario. Say you have $500,000 in a traditional IRA. You turned 73 in 2023, so 2024 is your second year of distributions.

- Find your age on the December 31, 2024: 74.

- Look up the factor on the uniform lifetime table 2024: 25.5.

- Take your account balance from Dec 31, 2023: $500,000.

- $500,000 / 25.5 = $19,607.84.

That $19,607.84 is your RMD. You have to take it out by December 31, 2024. If you don’t? The penalty used to be a staggering 50%. SECURE 2.0 dropped it to 25%, and if you fix the mistake quickly, it can go down to 10%. Still, 10% of $19k is nearly two grand literally thrown in the trash. Don't do that.

The "First Year" quirk

If you turned 73 in 2024, you actually have until April 1, 2025, to take your first distribution. This sounds like a great deal. It’s a trap for many. If you wait until April 2025 to take your 2024 RMD, you still have to take your 2025 RMD by December 31, 2025.

That’s two RMDs in one tax year.

📖 Related: When Was the American Dollar Created: The Messy Truth About Our Money

For many people, that double-dip of income pushes them into a much higher tax bracket. It can also trigger higher Medicare Part B premiums (IRMAA). Usually, it’s smarter to just take the first one by the end of the calendar year.

Strategic moves: The QCD

If you don't need the money from the uniform lifetime table 2024 to live on, look into Qualified Charitable Distributions (QCDs). You can send up to $105,000 (for 2024) directly from your IRA to a 501(c)(3) charity.

This counts toward your RMD but doesn't show up as taxable income.

It’s basically the most efficient way to give to charity. If you take the RMD as cash and then donate it, you might not even get a tax break if you don't itemize. The QCD skips the middleman and keeps your Adjusted Gross Income (AGI) low. This is huge for keeping those Medicare costs down.

Common misconceptions about RMDs

People think they can take their RMD from their Roth IRA. Nope. Roth IRAs don't have RMDs during the owner's lifetime. (Roth 401(k)s used to, but SECURE 2.0 fixed that starting in 2024).

Another one: "I can just move the money to my brokerage account." You can, but that counts as a distribution. You have to pay the taxes first. You can't just "transfer" the shares in-kind to satisfy the RMD without the IRS seeing it as a taxable event.

✨ Don't miss: High Net Worth Insurance: Why Your Standard Policy is Probably Leaving You Exposed

Actionable steps for your 2024 strategy

First, gather every single 1099 and year-end statement from 2023. You need those year-end balances.

Second, verify your age. I know that sounds silly, but the IRS cares about how old you turn in the calendar year, not how old you are the day you take the money.

Third, check your beneficiaries. If you’ve gone through a divorce or a death in the family, your beneficiary designations might be outdated. This doesn't just affect who gets the money—it can affect which table you're legally allowed to use.

Fourth, calculate the RMD for each separate IRA you own. You can aggregate the total and take it from just one IRA, but you cannot aggregate 401(k) RMDs. Those must be taken from each specific 401(k) plan.

Finally, automate it. Most custodians like Vanguard, Fidelity, or Charles Schwab have an "automatic RMD" feature. They’ll do the math using the uniform lifetime table 2024 for you and send you the cash. Use it. It’s the best way to avoid that 25% penalty.

If you're still working at 73 and you don't own more than 5% of the company, you might be able to delay RMDs for your current employer's 401(k). But your old IRAs? Those are still fair game. Always check the "still-working" exception rules with your HR department. It's one of the few ways to legally dodge the table for a few more years.