You’re staring at your phone, refreshing the banking app, wondering where that transfer went. It’s Monday. You sent the money Friday. Then you realize—it’s some random Monday in October or February. Everything is frozen. This is the reality of united states bank holidays, those quiet days on the calendar that still have the power to grind the world’s largest economy to a screeching halt. It’s honestly a bit weird how much a few designated days off can mess with your digital life in 2026.

We live in an era of instant gratification, yet the Federal Reserve still takes a breather. When they do, the plumbing of the financial system stops. You can't just ignore these dates. If you’re running a business or just trying to pay rent, knowing the rhythm of these breaks is basically survival.

What Are These United States Bank Holidays Anyway?

Technically, there’s a difference between a "public holiday" and a bank holiday, though we use them interchangeably. The Federal Reserve follows the schedule set by Congress for federal employees. If the Fed is closed, the ACH (Automated Clearing House) and wire transfers aren't moving. Most retail banks like Chase, Bank of America, and Wells Fargo follow this lead. They close their physical branches. They stop processing "manually reviewed" transactions.

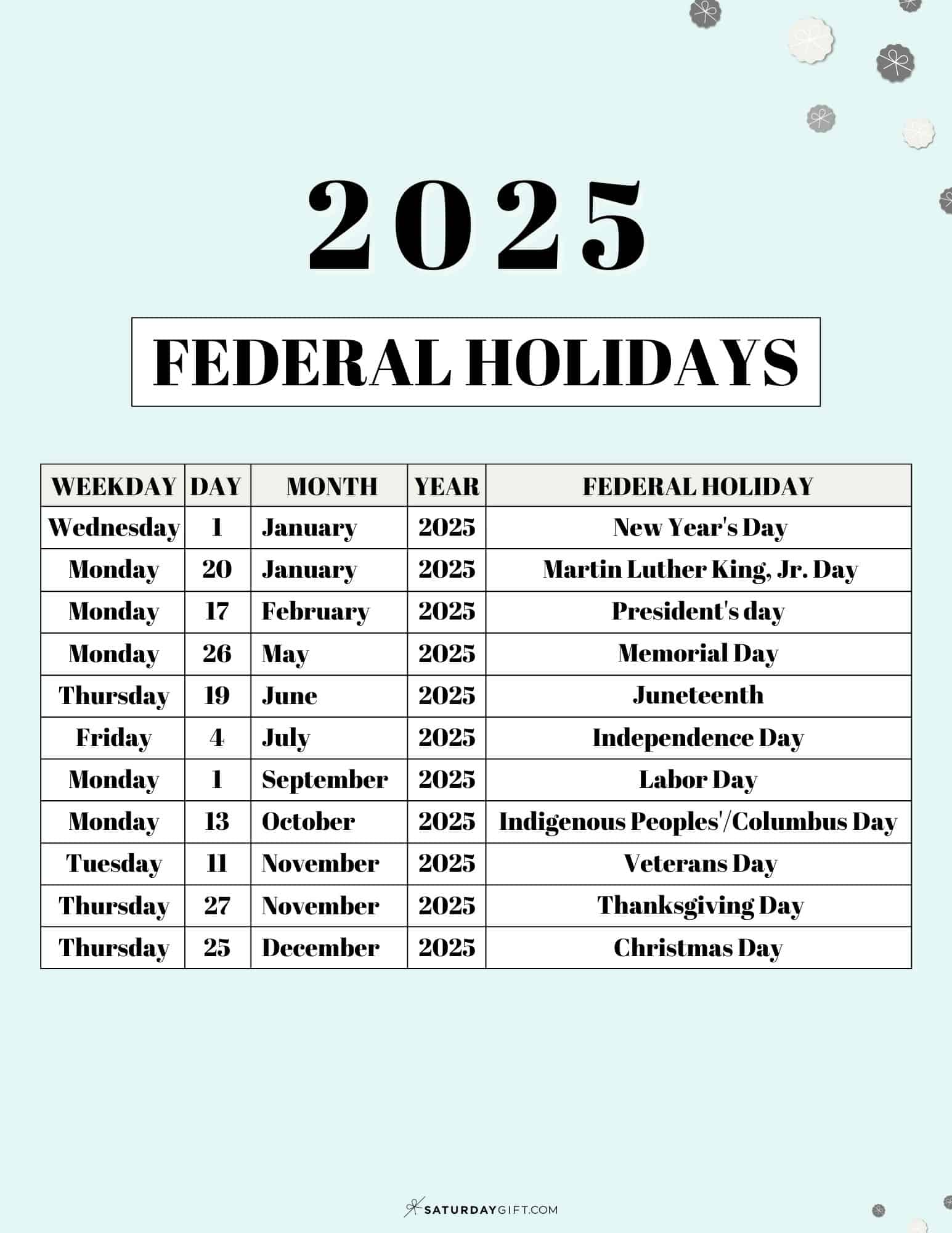

The list is fairly standard, but the dates jump around. We’ve got New Year’s Day, Martin Luther King Jr. Day, Washington’s Birthday (which most of us call Presidents' Day), Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Columbus Day (increasingly recognized as Indigenous Peoples' Day), Veterans Day, Thanksgiving, and Christmas.

It gets tricky when a holiday falls on a weekend. If the 4th of July is a Saturday, banks usually close the Friday before. If it's a Sunday, they take the Monday off. This "observed" rule is where most people get tripped up and end up with a late fee they didn't see coming.

The Juneteenth Shift and Modern Banking

Adding Juneteenth to the official list of united states bank holidays in 2021 was a massive deal. It was the first new federal holiday since MLK Day was signed into law by Reagan in 1983. For a lot of people, it was a surprise. Suddenly, mid-June payments were lagging. It serves as a reminder that this list isn't set in stone. It reflects the culture.

But why does a physical branch being closed affect your app?

Essentially, banking in the U.S. still relies on a "batch" system. Your bank doesn't necessarily send your $50 Venmo cash-out to the Fed the second you tap the button. They bundle thousands of transactions together. These bundles are processed through the Federal Reserve’s systems. If those systems are dark for a holiday, your bundle just sits in a digital waiting room. It’s old-school. It’s frustrating. But until "Real-Time Payments" (RTP) become the universal standard across every tiny credit union and massive bank, this is our life.

📖 Related: Finding Your Rite Aid on York Road: What You Need to Know Right Now

Why the "Long Weekend" is a Financial Trap

You've probably noticed that most united states bank holidays are strategically placed on Mondays. This was thanks to the Uniform Monday Holiday Act of 1968. Congress basically decided that three-day weekends were better for the economy because people travel and spend money.

The downside? The "Friday Trap."

If you initiate a transfer on a Friday afternoon before a Monday holiday, that money might not "land" until Tuesday or Wednesday. That is five days of your cash sitting in limbo. In financial terms, this is called "float." Banks love it because they technically hold the money longer, but for a small business owner waiting to make payroll, it’s a nightmare. Honestly, it’s the kind of thing that makes you want to keep a stack of twenties under the mattress.

Beyond the Big Names: Local and State Variations

Here is what most people get wrong: they think every bank follows the federal list perfectly. It's mostly true, but not always.

👉 See also: Where Did Elon Musk Make His Money: What Most People Get Wrong

Take Good Friday. It isn't a federal holiday. The Fed is open. However, in states like Connecticut, Delaware, or Tennessee, it’s a state holiday. You might find your local branch closed even though your online transfers are zipping through the Fed just fine. Then there is the "Mardi Gras" factor in Louisiana or "Patriots' Day" in Massachusetts. If you’re doing business across state lines, you can’t assume everyone is on the clock just because it’s a Tuesday in April.

Real-World Impact: What Happens to Your Paycheck?

If your payday falls on one of the united states bank holidays, your employer has to make a choice. Most "good" employers will trigger the direct deposit so it hits your account on Friday if the holiday is a Monday. But they aren't legally required to do that by federal law in many cases—it depends on the employment contract and state labor laws.

I’ve seen cases where people expected their check on Monday (the holiday), and it didn't show up until Tuesday. If your car payment was set to auto-draft on Monday, you might get hit with an NSF fee because your bank tried to take money that wasn't there yet. It’s a domino effect.

- Pro tip: Always check your payroll calendar in December for the upcoming year.

- The 2:00 PM Rule: Many banks have a "cutoff time." If you miss that window on the day before a holiday, you’re basically adding an extra 24 hours to your wait time.

- Zelle and Venmo: These often feel "instant," but moving that money from the app to your actual bank account still gets snagged by the holiday schedule.

The Future: Is the Bank Holiday Becoming Obsolete?

We are seeing a slow shift. With the launch of FedNow in 2023, the U.S. is finally moving toward a 24/7/365 processing environment. In theory, the "holiday lag" should eventually die. But we aren't there yet.

💡 You might also like: Finding the Navy Federal Lexington Park Maryland Branch: What You Need to Know Before Heading to Pax River

Think of the U.S. banking system like a giant cruise ship. It takes a long time to turn. Thousands of smaller banks have to update their core software to handle 24/7 processing. Until then, the united states bank holidays remain the gatekeepers of your liquidity. They are the leftovers of a paper-check world that we haven't quite outgrown.

Strategic Steps for Managing Your Cash

Don't let a Monday off ruin your credit score. It’s easy to get complacent when everything is "automated," but automation is only as smart as the calendar it's programmed with.

First, go into your banking app and look at your scheduled transfers for the next six months. If any fall on a Monday, move them to the preceding Friday. It is always better for the bill to be paid two days early than one day late.

Second, if you’re a freelancer or business owner, send your invoices earlier in the month of November and December. The cluster of holidays—Veterans Day, Thanksgiving, Christmas—creates a "dead zone" for accounts receivable. People go on vacation, banks close, and suddenly a 30-day payment cycle turns into 45 days.

Lastly, keep a "buffer" in your primary checking account specifically for holiday friction. A few hundred bucks can be the difference between a smooth long weekend and a Tuesday morning spent arguing with a customer service bot about an overdraft fee.

The banks might be taking the day off, but your bills certainly aren't. Stay ahead of the schedule, and you’ll never have to wonder where your money went on a random Monday in October.