Honestly, if you try to talk about the national debt at a dinner party, people usually start looking for the exit. It sounds like math homework. But when you look at us deficit growth by president, it’s not actually about dry spreadsheets. It's about a decades-long game of "pass the bill" that has left the United States with a $38 trillion tab as of early 2026.

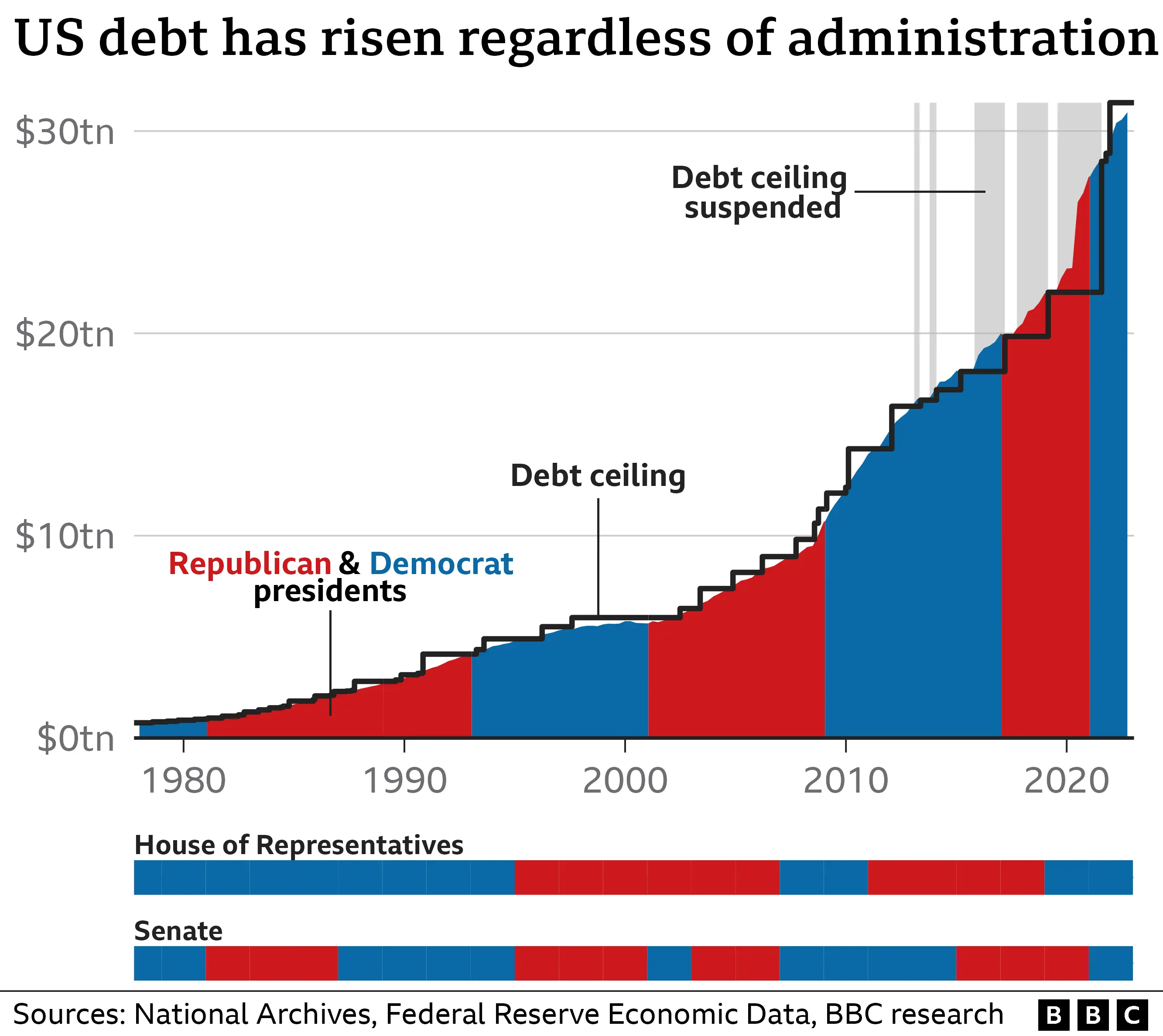

Most of us have this idea that one party is the "spender" and the other is the "saver." If you look at the raw data from the Treasury, that's kinda not how it works at all.

The Shocking Reality of Who Spent What

Let’s get one thing straight: the deficit and the debt are different. Think of the deficit as how much you overspend your paycheck this month. The debt is the total balance on your credit card from years of doing that.

When we look at us deficit growth by president, the numbers are staggering. In 2025, the federal government ran a deficit of $1.78 trillion. That's actually a "good" year compared to the chaos of the early 2020s. For context, under Donald Trump’s first term, the deficit spiked to $3.1 trillion in 2020. People blame COVID-19 for that, and they’re mostly right. The CARES Act was a massive $2.2 trillion injection. But even before the pandemic, the deficit was already climbing toward $1 trillion thanks to the 2017 Tax Cuts and Jobs Act.

Then you’ve got the Biden years. Biden's administration saw the deficit hit $2.77 trillion in 2021 as the American Rescue Plan rolled out. It dropped significantly in 2022 to around $1.38 trillion, but it’s been creeping back up ever since. By the end of 2024, the national debt had jumped by over $8 trillion during his tenure.

👉 See also: Do I Have to Pay? Does the State of Washington Have State Income Tax?

Why the Numbers Are So Messy

You can't just look at a president and say "their fault." It’s basically a team effort between the White House and Congress.

Take Barack Obama. He inherited the 2008 financial crisis. His first year saw a $1.4 trillion deficit. By the time he left in 2017, he’d cut the annual deficit down to about $665 billion. That’s a 53% decrease in the yearly overspending, even though the total debt grew by trillions because we were still in the red every single year.

Compare that to George W. Bush. He started with a surplus. Yes, a surplus. Bill Clinton actually left office with the government making more than it spent. Bush then had two wars and a major tax cut. By the time he left, the annual deficit was $1.4 trillion. That’s a percentage increase that makes your head spin—over 1,200% growth in the deficit from his first budget to his last.

The 2026 Landscape: Tariffs and Interest

We’re sitting in January 2026, and the conversation has shifted. The big story right now is how interest and tariffs are changing the math. For the first time in history, the US is spending more on interest payments for our debt than we are on the entire defense budget.

The current administration has leaned heavily into tariffs. In the first quarter of fiscal year 2026, customs duties brought in $90 billion. That’s a massive jump from the $21 billion collected in the same period for 2025. It’s helping. The deficit for the start of 2026 is actually about 15% lower than it was last year. But there’s a catch.

Inflation is still lingering above the 2% target. Economists from the Congressional Budget Office (CBO) are pointing at those same tariffs as a reason why. It’s a trade-off. You get more revenue to pay down the deficit, but the prices at the store stay high.

Breaking Down the Presidential Impact

It’s tempting to just rank them, but context matters. Here is a rough look at how the annual deficit changed from the first budget to the last budget of recent presidents:

- George W. Bush: Inherited a surplus, left with a $1.41 trillion deficit.

- Barack Obama: Inherited a $1.41 trillion deficit, left with a $665 billion deficit.

- Donald Trump (First Term): Inherited a $665 billion deficit, left with a $2.77 trillion deficit (COVID-impacted).

- Joe Biden: Inherited a $2.77 trillion deficit, left with roughly a $1.8 trillion deficit.

Basically, every president since Reagan has seen the total national debt grow. The only difference is the speed at which they added to it. Reagan himself tripled the debt. It was a whole "starve the beast" philosophy that didn't actually result in less spending, just less revenue.

What This Means for Your Wallet

If you're wondering why you should care about us deficit growth by president, it’s because it eventually hits your bank account. When the government runs a massive deficit, it has to borrow money. To attract lenders, it might have to keep interest rates higher.

Higher rates for the government mean higher rates for your mortgage. It means higher rates for your car loan. It also means that in the future, the government might have to choose between cutting Social Security or raising your taxes just to pay the interest on the money it already spent.

Honestly, it’s a bit of a trap. No president wants to be the one to cut popular programs, and no one wants to be the one to raise taxes. So, they keep borrowing.

Actionable Insights for the Future

You can't control the federal budget, but you can protect yourself from the fallout of us deficit growth by president. Here’s what the experts are actually doing:

- Watch the Interest Rates: Since the government is competing for loans, expect "higher for longer" to be a reality. If you have high-interest debt, pay it off now before the next fiscal crunch.

- Diversify for Inflation: If the deficit stays high, the dollar can lose value. Having some of your savings in assets like real estate, gold, or even a diversified stock portfolio can act as a hedge.

- Audit Your Future Benefits: Don’t assume Social Security will look exactly the same in 20 years. If the deficit isn't reigned in, "means-testing" (where they give less to people with other savings) is a real possibility. Build your own "personal deficit" plan by over-saving in your 401k or IRA.

- Vote on Policy, Not Just Vibes: When you hear "tax cuts," ask how they'll pay for the spending. When you hear "new spending," ask where the revenue is coming from.

The deficit isn't just a number on a screen in DC. It’s the weight on the economy we’re all carrying. Understanding that both parties have contributed to this $38 trillion mountain is the first step in actually demanding a fix.

Next Steps to Secure Your Finances:

- Review your fixed-rate vs. variable-rate debt. With interest costs dominating the federal budget, variable rates are a major risk.

- Evaluate your portfolio's inflation protection. Ensure you have assets that historically perform well when the government is overleveraged.

- Stay informed on the 2026 appropriations bills. The January 30th deadline for government funding will tell us a lot about whether the current deficit-reduction trend through tariffs will hold.