If you’re walking down Samora Machel Avenue in Harare right now, you’ll see something kind of wild. People are carrying around phones, tapping for digital payments, and occasionally clutching the newish gold-backed ZiG notes. But honestly? The real power still sits in the crisp, sometimes slightly grimy, US dollar bill.

It’s 2026. We were supposed to be well on our way to a "mono-currency" system by now. President Mnangagwa has been pretty vocal about wanting the Zimbabwe Gold (ZiG) to be the only legal tender, even hinting that the 2030 deadline might be moved up. Yet, if you try to buy a used car or pay for a high-end safari in Victoria Falls, everyone looks for the greenback.

The Great Tug-of-War

Zimbabwe's relationship with the US dollar is complicated. It’s like that ex you can't quite quit because they’re the only one who actually shows up when you need them. The Reserve Bank of Zimbabwe (RBZ) has been trying to stabilize the ZiG—which was introduced back in April 2024—and they've had some success. Governor John Mushayavanhu recently pointed out that foreign currency earnings hit a massive $16.2 billion in 2025. That’s a lot of "hard" money flowing into a country that is technically trying to move away from it.

Why the attachment?

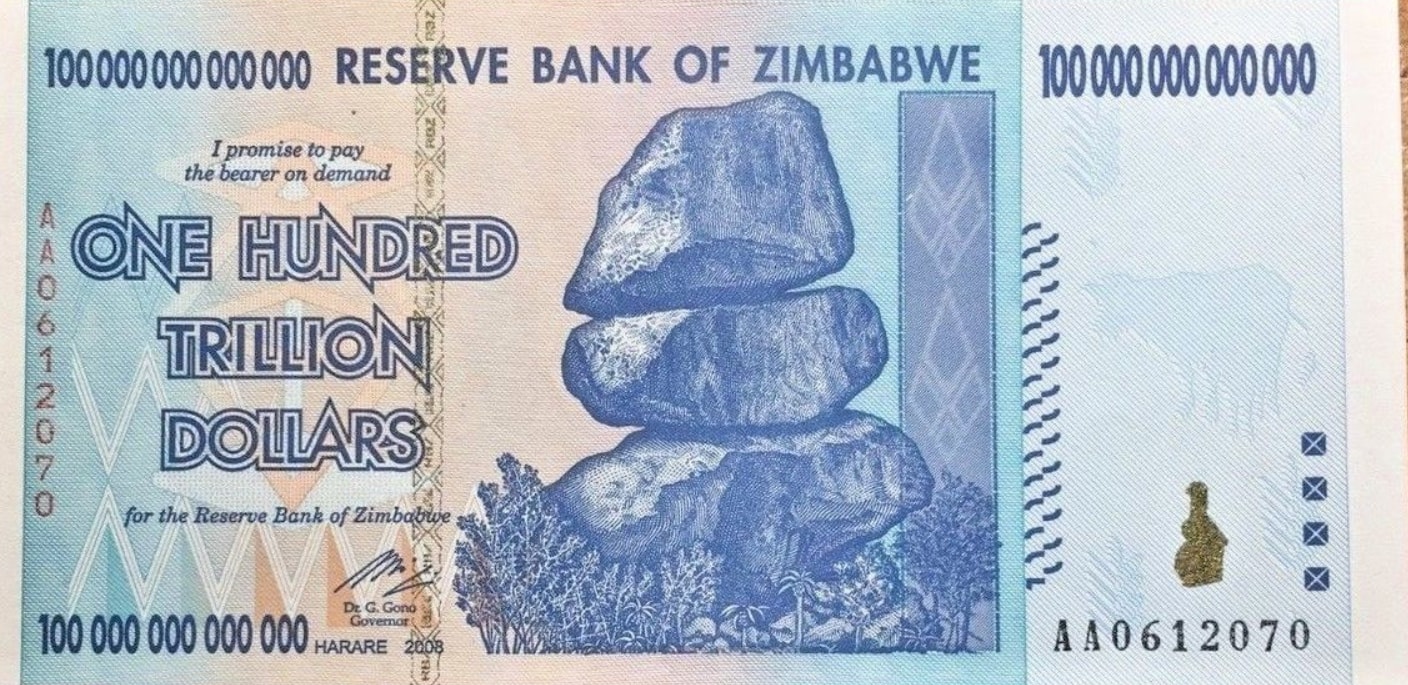

Confidence isn't built in a day. Or a year. Or even a decade, apparently. After the hyperinflation nightmares of 2008 and the more recent stumbles of the RTGS dollar, people have long memories. The US dollar represents a "store of value" that doesn't evaporate overnight. While the official inflation rate has finally slowed down to around 15% to 18% as of early 2026, the psychological safety net of the USD is still very much a thing.

Using US Dollars in Zimbabwe Today

If you're visiting, you've gotta know how the street works.

Most formal shops—think supermarkets like OK or Spar—will display prices in ZiG but allow you to pay in USD. They use the official interbank rate, which is hovering around 25.72 ZiG per 1 USD as of mid-January 2026. But head over to the informal "tuckshops" or the open-air markets, and the math changes. These guys live and breathe the parallel market.

- Cash is literally king. Don't expect your international Visa or Mastercard to work everywhere. It’ll work at the Meikles Hotel, sure. At a roadside biltong stand? Forget it.

- Small denominations are gold. If you try to pay for a $2 soda with a $50 bill, you’re going to get a very stressed look from the teller. They don't have change. You'll likely end up getting your "change" in the form of a chocolate bar, a pack of tissues, or if you're lucky, some ZiG coins.

- Condition matters. This is a weird one. In the States, a torn dollar is still a dollar. In Zimbabwe, a bill with a tiny ink mark or a small tear is often rejected. Keep your bills pristine.

The 2030 Deadline and the ZiG Factor

The government’s strategic plan for 2026–2030 is all about "de-dollarization." They want you to use the ZiG. They’re increasing the amount of taxes that must be paid in the local currency to force demand. They're also cracking down on businesses that refuse to accept ZiG.

But here’s the kicker: the economy is roughly 70% to 80% informal.

When the majority of the population is trading outside the banking system, government mandates have a hard time sticking. The RBZ is currently working on building up gold and foreign currency reserves to back every ZiG in circulation, which is a smart move. They’re trying to prove that this time, the money is "real."

What You Need to Know for 2026

If you're doing business or traveling here, the dual-currency system is your reality. You’ve basically got two parallel worlds running at once. One world is the official, gold-backed digital and paper ZiG economy used for government fees, utilities, and formal retail. The other is the USD-dominated world of fuel, rentals, and imported goods.

Honestly, it’s a bit of a headache. You’re constantly doing mental math.

💡 You might also like: Why the Angry Guy Stock Image Is Actually Everywhere (And Why It Works)

One thing that has improved is the availability of foreign currency through formal channels for locals. The "willing-buyer, willing-seller" market has narrowed the gap between the official and street rates significantly compared to the chaos of 2023. It’s not perfect, but it’s less of a wild west than it used to be.

Practical Steps for Managing Money

If you're landing in Harare or Bulawayo this week, do these things:

- Bring USD Cash: Don't rely on ATMs. Most ATMs still have low withdrawal limits or might not dispense USD to international cards at all.

- Declare your cash: If you're carrying more than $2,000 in, declare it at the border. If you don't, you can't legally take more than $2,000 back out.

- Download a conversion app: The rates fluctuate. Even with the current "stability," it helps to know the daily interbank rate so you don't get fleeced.

- Accept the "Mixed Change": You will likely spend USD and receive change in ZiG. It's fine. Just use that ZiG for smaller purchases like parking or groceries.

The US dollar isn't going anywhere soon. While the government is pushing hard for a ZiG-only future by 2030, the street has its own set of rules. For now, the greenback remains the most trusted piece of paper in the country.