If you’ve spent any time looking at a US national debt chart lately, you probably felt a little bit of vertigo. It’s basically a vertical line now. People love to share these graphs on social media to freak everyone out, and honestly, the scale is hard to wrap your head around. We are talking about over $34 trillion. That’s a number with twelve zeros. It’s essentially a mountain of IOUs that has been growing for decades, but the speed at which it’s climbing today is what has economists—and regular people trying to buy groceries—genuinely worried.

The debt isn't just a big scary number on a screen.

It’s a reflection of every war, every stimulus check, every tax cut, and every infrastructure project the government couldn't pay for with cash on hand. When you look at the long-term trend, you see these massive spikes that correlate with historical crises. The Civil War. World War II. The 2008 financial crash. And then, of course, the absolute explosion during the COVID-19 pandemic. But unlike the post-WWII era where the debt-to-GDP ratio actually started to shrink, we aren't seeing that "cool down" period this time. We are just staying hot.

Why the US national debt chart looks like a mountain range

If you zoom out to a 100-year view, the US national debt chart tells a story of survival and, some would say, fiscal recklessness. For most of the early 20th century, the debt was relatively flat. Then came 1945. To win World War II, the U.S. borrowed more than the entire size of its economy. Debt-to-GDP hit 106%. But here is the kicker: in the 1950s and 60s, the economy grew so fast that we essentially "outgrew" the debt. The line on the chart started to slant downward.

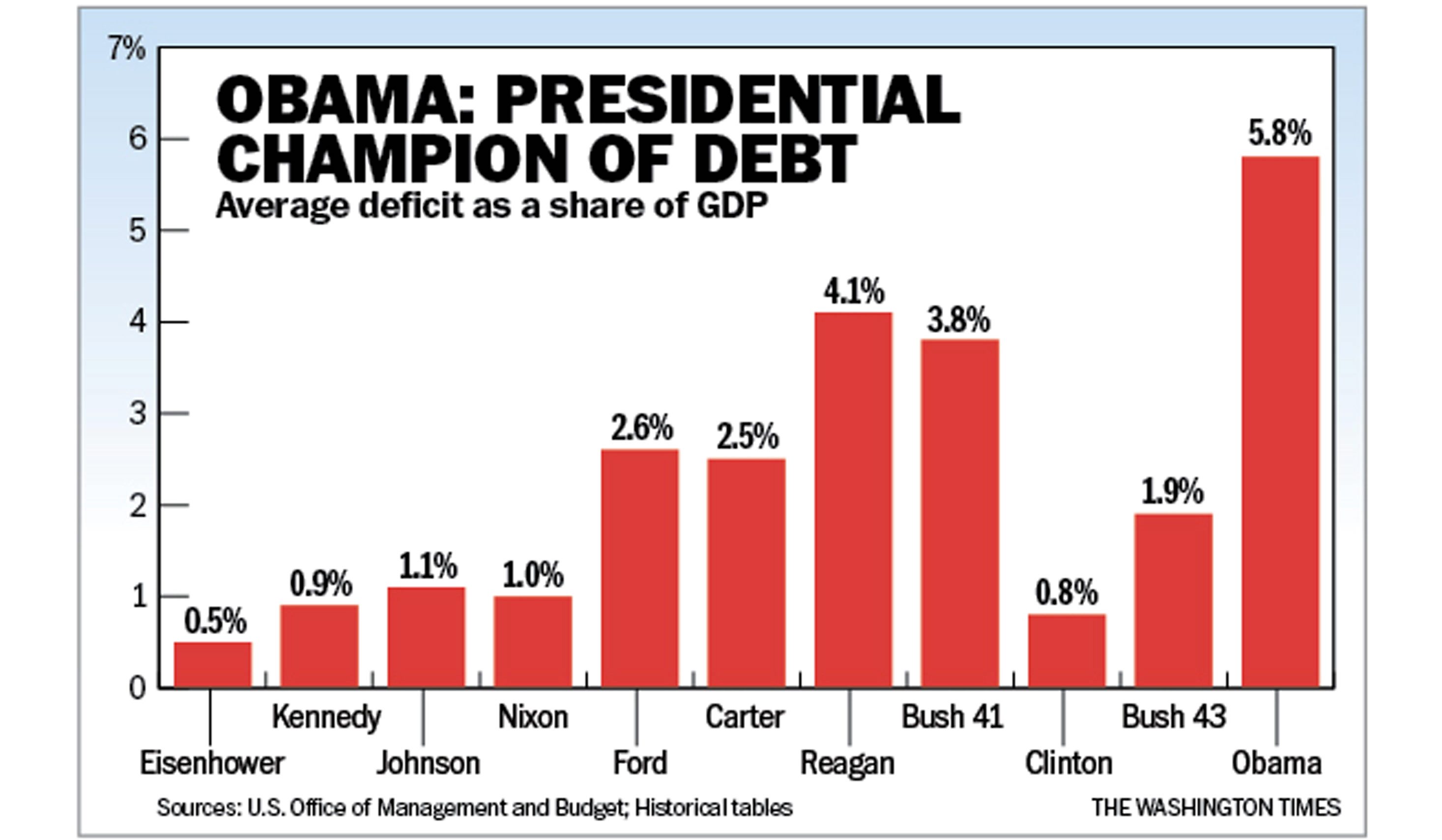

Things changed in the 1980s. Supply-side economics and increased military spending under Reagan started the upward climb again. Then the 2000s hit. You had the "War on Terror," which cost trillions, followed by the Great Recession. By the time we hit 2020, the fiscal floor just fell out.

The Congressional Budget Office (CBO) is pretty blunt about this. They release these long-term projections that look even worse than the current charts. They estimate that by 2054, the debt held by the public could reach 166% of GDP. That’s uncharted territory for the United States. It's like a household that owes 1.5 times what they earn in a year, every year, forever.

The Interest Trap is the Real Boss Fight

The most dangerous part of the US national debt chart isn't the total principal. It's the interest. For a long time, interest rates were near zero. Borrowing was "cheap." The government could pile up trillions in debt and the monthly "payment" stayed manageable.

That era is over.

When the Federal Reserve hiked rates to fight inflation in 2022 and 2023, the cost of servicing our national debt skyrocketed. We are now spending more on interest payments than we do on the entire defense budget. Let that sink in for a second. More money goes to paying back interest to bondholders—many of whom are foreign countries or large institutions—than we spend on our actual military.

Who actually owns this debt?

A common misconception when people see a US national debt chart is that China owns all of us. That’s just not true. It's a myth that won't die. In reality, the biggest owner of U.S. debt is... well, the U.S.

- The Social Security Trust Fund: The government borrows from itself. It takes the surplus from Social Security and replaces it with "special-issue" securities.

- The Federal Reserve: They buy Treasury bonds to manage the money supply.

- Individual Investors: Maybe you have a Treasury bond in your 401(k)? You own a slice of that debt.

- Foreign Governments: Japan and China are the top foreign holders, but they only own a fraction of the total.

It's a giant, interconnected web. If the U.S. were to default—which has never happened—it wouldn't just be a "government" problem. It would tank the retirement accounts of millions of Americans and likely freeze global credit markets. This is why the "Debt Ceiling" debates in Congress get so heated. It’s high-stakes poker where the chips are the global economy.

✨ Don't miss: Why the Amazon Volume Cut Is Hurting UPS Stock (and What Happens Next)

Is there a "Breaking Point"?

Economists like Kenneth Rogoff and Carmen Reinhart have famously argued that once debt-to-GDP hits 90%, it starts to significantly slow down economic growth. The logic is simple: the more money the government has to spend on interest, the less it has for things that actually grow the economy, like research, education, and bridges.

However, "Modern Monetary Theory" (MMT) fans argue differently. They suggest that since the U.S. prints its own currency, it can’t technically "go broke." They think the only real limit is inflation. If the government spends too much and prices start rising too fast (sound familiar?), then they have to pull back.

But looking at the US national debt chart, you have to wonder how much further the rubber band can stretch before it snaps. We are currently in a cycle where we borrow money to pay the interest on the money we already borrowed.

How this affects your daily life

You might think, "I don't care about a chart in Washington, I'm just trying to pay my rent." But the national debt acts like a silent tax. When the government borrows heavily, it competes with private borrowers for capital. This can push up interest rates for everyone. That means your mortgage, your car loan, and your credit card balance all get more expensive because the government is hogging the "loan" market.

Then there is the inflation angle. If the Fed has to "monetize" the debt—basically printing money to buy those Treasury bonds—it devalues every dollar in your pocket. Your savings account stays the same, but the eggs and gas you buy cost more.

Real-world scenarios: The 2026 Outlook

As we move through 2026, the fiscal situation is hitting a crossroads. The Tax Cuts and Jobs Act (TCJA) provisions are facing expirations or renewals. If Congress extends them without cutting spending, the US national debt chart will likely see another sharp tick upward. On the flip side, letting them expire is essentially a tax hike on a lot of households.

There are no easy exits.

To fix the chart, you basically have three options:

- Raise Taxes: Politically unpopular and can slow down business.

- Cut Spending: This means looking at Social Security, Medicare, or Defense—the "third rails" of politics.

- Grow the Economy: If the GDP grows faster than the debt, the ratio improves. But with an aging population, 5% growth isn't exactly easy to come by.

Actionable Steps for the Skeptical Investor

Since you can't control what happens in the Treasury Department, you have to protect your own "personal debt chart." The national fiscal situation suggests that volatility is the new normal.

First, diversify your currency exposure. If you are worried about the dollar's long-term value due to debt levels, consider assets that aren't tied strictly to the USD. This could be international stocks or even "hard assets" like gold or real estate.

Second, watch the bond market. The yield on the 10-year Treasury is basically the world's "fear gauge." When it spikes, it's a sign that investors are demanding more interest to compensate for the risk of lending to the government. This is usually a signal to tighten your own belt and avoid high-interest variable debt.

🔗 Read more: Larry Fink Letter 2025: What Most People Get Wrong

Third, don't panic-sell based on headlines. People have been predicting a "debt collapse" since the 1970s. The U.S. dollar is still the world's reserve currency, and there is currently no viable alternative that offers the same liquidity. The "collapse" might be a slow erosion rather than a sudden cliff.

The US national debt chart is a sobering reminder that there is no such thing as a free lunch. Every dollar spent today that wasn't earned is a dollar plus interest that someone—likely your kids or grandkids—will have to account for. Keeping an eye on these trends isn't just for policy wonks anymore; it's a fundamental part of understanding where the global economy is headed and how to keep your own head above water.

To get a clearer picture of your own financial resilience in this environment, start by calculating your personal debt-to-income ratio. If your personal "chart" looks like the national one, it's time to prioritize high-interest debt payoff before the broader economic pressures make it even more expensive. You can also track the daily changes in the public debt through the TreasuryDirect website to see exactly how the "mountain" is growing in real-time. Knowing the numbers is the first step to not being blindsided by them.