Money is weird. One day you’re buying a cheap gadget from Shenzhen, and the next, your procurement costs have spiked by 8%. If you’ve been watching the USD to CNY exchange rate lately, you know it’s less of a steady climb and more of a jagged, unpredictable heart rate monitor. People talk about "the rate" like it’s a single number, but honestly, it’s a battlefield where central banks, massive hedge funds, and geopolitical tension all collide.

It’s personal for some of us. Maybe you're a small business owner importing electronics, or perhaps you're an expat living in Shanghai watching your dollar-denominated savings fluctuate. Whatever the case, understanding the relationship between the US dollar and the Chinese yuan (renminbi) requires looking past the ticker symbols.

The Two Faces of the Yuan

Here is something that trips up almost everyone: there isn't just one Chinese yuan.

👉 See also: 250 CAD to USD: Why Your Bank Is Probably Overcharging You

Basically, you have the CNY and the CNH. The CNY is the "onshore" yuan. It’s traded within mainland China and is heavily controlled by the People’s Bank of China (PBOC). Then you have the CNH, the "offshore" version traded in places like Hong Kong, London, and New York. Because the CNH is more susceptible to the whims of the global market, it often acts like a canary in the coal mine. When the CNH starts dipping, you can bet the USD to CNY exchange rate is about to feel the heat.

The PBOC sets a daily "fix." Every morning, they establish a midpoint. The market is then allowed to trade the yuan within a 2% band of that fix. If the dollar gets too strong, or the yuan too weak, the PBOC steps in. They’ve got a massive toolkit—reserve requirement ratios, "window guidance" to banks, and even direct intervention—to make sure things don't get out of hand.

Why the Dollar Keeps Pushing Back

The Federal Reserve is the main character in this story.

When the Fed keeps interest rates high to fight inflation in the States, the US dollar becomes a vacuum for global capital. Investors want that sweet, sweet yield. If you can get 5% on a US Treasury bond, why would you risk your money in a volatile emerging market? This "carry trade" creates massive demand for dollars, which naturally pushes the USD to CNY exchange rate higher, meaning you need more yuan to buy a single buck.

Lately, we’ve seen a divergence. While the US was hiking rates to cool a hot economy, China’s central bank was doing the opposite. They’ve been cutting rates to jumpstart a sluggish post-pandemic recovery and a cooling property market. It’s a classic tug-of-war. High rates in the West versus low rates in the East. Guess who usually wins that fight in the short term? The dollar.

👉 See also: Why 1209 Orange Street Wilmington DE 19801 is the Most Famous Building You Have Never Seen

Trade Wars and Semiconductor Tensions

Politics is the invisible hand here. You can’t talk about the USD to CNY exchange rate without talking about Washington and Beijing.

Tariffs aren't just taxes; they are currency movers. If the US imposes a 25% tariff on Chinese EVs or semiconductors, it effectively makes those products more expensive for Americans. To compensate and keep their goods competitive, China might allow the yuan to weaken slightly. A weaker yuan makes Chinese exports cheaper for the rest of the world, acting as a natural buffer against trade barriers.

However, there’s a limit. If the yuan drops too far, it triggers capital flight. Wealthy Chinese citizens and companies start panicking and try to move their money into gold or foreign real estate. This is exactly what the PBOC tries to prevent. It’s a delicate balancing act—keeping exports competitive without scaring everyone into selling their currency.

The "De-Dollarization" Myth vs. Reality

You’ve probably seen the headlines. "The Dollar is Dying!" or "BRICS is launching a new currency!"

Let’s be real for a second. The US dollar is still involved in nearly 90% of all global foreign exchange transactions. While China is pushing for more trade to be settled in yuan—especially with Russia and Saudi Arabia—the USD to CNY exchange rate remains the most important metric for global trade. Most of the world's debt is still denominated in dollars. Most commodities, like oil, are still priced in dollars.

💡 You might also like: S\&P 500 up or down today: Why the Index is Treading Water While the "Rotation Trade" Heats Up

That doesn't mean things aren't changing. They are. Just slowly. Central banks are diversifying their reserves, buying more gold and fewer Treasuries. But for the average person looking at a conversion chart on their phone, the dollar is still king. For now.

Surprising Factors You Might Have Missed

- Tourism: When Chinese tourists travel to the US, they sell yuan to buy dollars. When that flow stops (like it did during the zero-COVID years), it actually impacts the liquidity of the currency.

- Property Market: China's real estate sector represents a huge chunk of its GDP. When giants like Evergrande or Country Garden face trouble, it lowers investor confidence, putting downward pressure on the yuan.

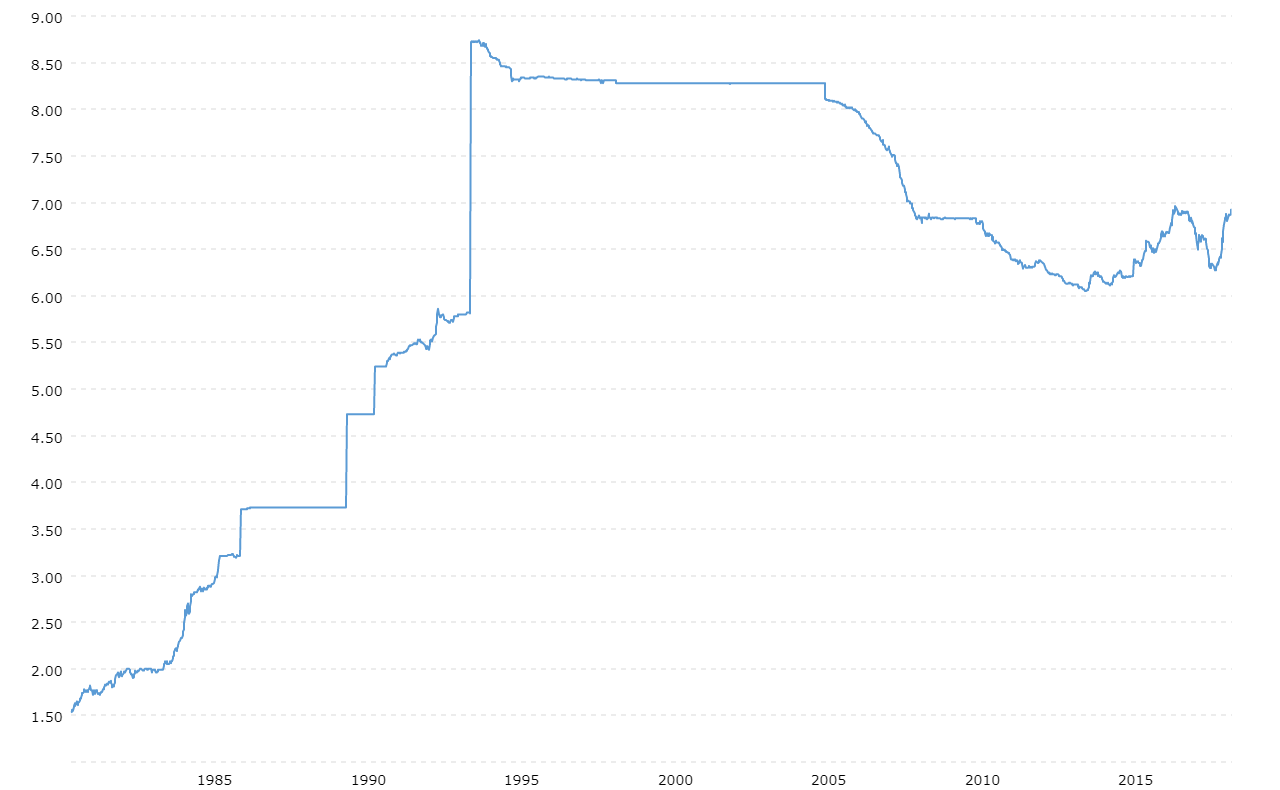

- The "Double-Seven" Psychological Barrier: For years, the level of 7.00 was seen as a "line in the sand." When the USD to CNY exchange rate crosses 7, it’s a huge psychological blow. Traders go into a frenzy.

The Cost of a Strong Dollar

A strong dollar sounds great if you’re an American tourist in Beijing. You feel rich. Your coffee costs "nothing."

But for a global manufacturer, it’s a nightmare. If you’re a US company manufacturing components in China, a strong dollar means your local costs in China (labor, rent, electricity) are technically cheaper. Great! But if you’re a Chinese company buying American software or machinery, your costs just skyrocketed.

This is why the USD to CNY exchange rate is such a massive deal for corporate earnings. A swing of just a few pips can mean the difference between a profitable quarter and a massive loss. Companies use "hedging"—complex financial instruments like forwards and options—to lock in rates months in advance. They aren't gambling; they're just trying to survive the volatility.

Managing Your Exposure

If you're dealing with currency exchange, you've got to be proactive.

Don't just look at the "spot rate" on Google. That’s not the price you’re going to get. Banks take a spread. If the middle-market rate is 7.20, your bank might charge you 7.35 to buy or give you 7.05 to sell. They’ve got to make their cut.

Keep an eye on the "Data Calendar." The first Friday of every month is the US Non-Farm Payrolls report. It’s a monster for the markets. If US jobs data comes in stronger than expected, the dollar usually rips higher. Conversely, watch the Chinese CPI (Consumer Price Index) data. If China shows signs of deflation, it usually means the yuan is going to stay weak as the PBOC tries to stimulate the economy.

Actionable Steps for Navigating the Rate

- Monitor the PBOC Fix: Every day at 9:15 AM Beijing time, the central bank signals its intent. If the fix is consistently stronger than what the market expects, the government is trying to support the yuan. That’s a signal that a "floor" might be near.

- Use Multi-Currency Accounts: Platforms like Wise or Revolut (and even some traditional business banks) allow you to hold both USD and CNY. When the USD to CNY exchange rate is in your favor, convert some and hold it. Don't wait until the day you need to pay a bill to exchange money.

- Watch the 10-Year Treasury Yield: This is the North Star for the dollar. If the yield on the US 10-year note is climbing, it puts immense pressure on the yuan. If yields start to drop, the yuan finally gets some breathing room.

- Factor in "Slippage": If you are budgeting for an import or a trip, always add a 3% buffer to your calculations. Currencies move fast. What looks like a good deal today could be a 5% loss by the time the wire transfer clears.

The relationship between these two giants is the most important financial story in the world. It’s about more than just numbers on a screen; it’s about the shift in global power, the cost of living, and the future of trade. Stay sharp, watch the headlines, and never assume a "stable" rate is a permanent one.

To stay ahead of these shifts, regularly review your international payment providers and compare their spreads against the mid-market rate to ensure you aren't losing 2-4% on every transaction. Check the economic calendars for both the US Federal Reserve meetings and China's National Bureau of Statistics releases to anticipate volatility before it hits your balance sheet.