Money moves fast. Honestly, if you’re looking at the USD to FRW exchange rate right now, you’re probably seeing a number that looks significantly different than it did even six months ago. The Rwandan Franc has been on a wild ride. It’s not just a line on a graph; it affects everything from the price of a Primus beer in Kigali to the cost of importing construction materials for the new projects popping up in Bugesera.

Most people just check Google and see a number. Maybe it’s 1,350 or 1,400. But that’s rarely the price you actually get when you walk into a forex bureau or use a banking app. There is a massive gap between the official rate and what’s happening on the street.

Why the US Dollar to FRW Rate is Shifting So Fast

Economics is messy. In Rwanda, the National Bank of Rwanda (BNR) tries to keep things stable, but they can't fight global gravity. The US Dollar has been a powerhouse lately. When the Federal Reserve in the United States keeps interest rates high, investors flock to the dollar like it’s a life raft in a storm. This leaves smaller currencies, like the Rwandan Franc, struggling to keep up.

It’s basically a supply and demand problem.

Rwanda imports a lot more than it exports. Think about it. Fuel, cars, specialized electronics—most of that is bought in dollars. When Rwandan businesses need to buy these things, they have to trade their Francs for Dollars. If everyone is hunting for dollars and there aren't enough to go around, the price of the dollar goes up. It’s simple, but it’s painful for the average person.

The Role of Foreign Direct Investment

You've probably noticed the cranes. Kigali is a construction site. All that investment—from the Basketball Africa League to the new BioNTech vaccine factory—brings in foreign currency. That helps. Without those inflows, the USD to FRW rate would likely be much worse. However, even with the "Kigali Miracle" narrative, the pressure of a rising global dollar is a heavy weight to carry.

Inflation also plays a huge role here. If prices for food and transport are rising locally, the purchasing power of the Franc drops. People naturally start looking for "hard" currency to protect their savings. It’s a bit of a cycle.

✨ Don't miss: Sovereign Funds by Country: What Most People Get Wrong

The "Street Rate" vs. The Official Rate

Let's get real for a second. If you look at the BNR website, you’ll see one rate. If you walk into a small exchange office near the Kigali City Tower, you’ll see another. This spread is where most people get burned.

Banks usually have the worst rates for individuals. They take a big "spread"—the difference between the buying and selling price. Forex bureaus are usually more competitive, but they are also more sensitive to daily shortages. If a big shipment of goods just arrived at the border, every trader in the city is suddenly desperate for dollars, and the rate you get at the window will spike instantly.

Why the Gap Exists

- Liquidity issues: Sometimes there just aren't enough physical dollar bills in the country.

- Transaction fees: Banks have overhead. A lot of it. They pass that on to you.

- Speculation: If people think the Franc will drop further tomorrow, they hold onto their dollars today.

It’s frustrating. You see a rate online and think you’re getting a deal, only to find out the "actual" rate is 2% or 3% higher once fees are baked in.

Real World Impact: From Coffee to Construction

Rwanda’s economy is deeply tied to the US Dollar to FRW exchange because of its export profile. Take coffee and tea. These are Rwanda's pride and joy. They are sold on international markets in—you guessed it—US Dollars.

When the dollar is strong, exporters technically get more Francs for their goods. That sounds great, right? On paper, yes. But the cost of the fertilizer, the fuel for the trucks, and the machinery parts has also gone up because those are imported in dollars. Often, the gains from the exchange rate are swallowed whole by the rising costs of production.

Small Businesses are Feeling the Squeeze

I talked to a shop owner in Gisozi who sells imported home fixtures. He told me he used to update his price tags once a year. Now? He’s doing it every month. He can't afford not to. If he sells a sink today for 50,000 FRW, by the time he needs to restock, those 50,000 FRW might not buy enough dollars to get the same sink back from the supplier.

This is the "hidden" tax of currency depreciation. It’s not just a number on a screen; it’s the reason your grocery bill feels heavier every time you hit the till at Simba Supermarket.

🔗 Read more: Bechdel Jewelers Inwood WV: What Most People Get Wrong About This Local Staple

How to Get the Best Rate Without Getting Ripped Off

Look, if you’re moving money, you need a strategy. Don't just walk into the first bank you see.

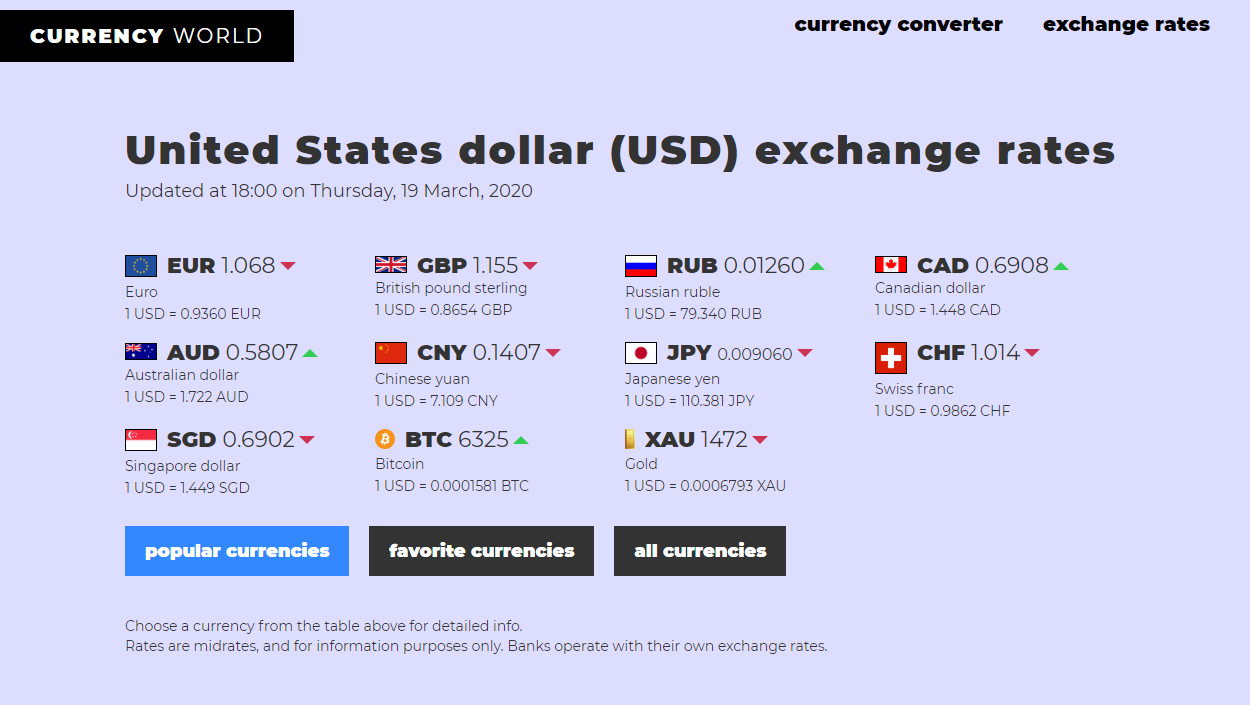

First, use a mid-market rate tracker. Websites like XE or OANDA give you the "real" rate—the one banks use to trade with each other. You won’t get this rate, but it’s your North Star. If the mid-market rate is 1,380 and someone is offering you 1,300, they are taking you for a ride.

Digital Transfer Services are Winning

Old-school wire transfers are dying for a reason. They are slow and expensive. Services like WorldRemit, Western Union, or even local fintech solutions are often better because they have lower overhead.

If you are a business owner, talk to your bank about a "forward contract." This is basically an agreement to buy dollars at a set price in the future. It’s a way to gamble against volatility. If the Franc crashes, you’re protected. If the Franc gets stronger, you might lose out a bit, but at least you had certainty. In business, certainty is often more valuable than a few extra points on a trade.

Surprising Facts About the Rwandan Franc

Did you know the Franc wasn't always the currency? Back in the day, during the colonial era, the German East African Rupie was the standard. Then came the Belgian Congo Franc. The Rwandan Franc as we know it didn't really stand on its own until 1964.

💡 You might also like: Why 300 E Washington St is the Most Important Corner in Syracuse Right Now

Another weird detail: Rwanda is one of the few places where the physical condition of your US Dollar bills actually matters. If you have a $100 bill that is torn, dirty, or—heaven forbid—printed before 2013, many places will either refuse it or give you a terrible USD to FRW rate. They want the "blue" notes. The crisp ones. It’s not just being picky; it’s about the difficulty of clearing those older notes through international banking systems.

The Regional Context

Rwanda is part of the East African Community (EAC). There’s been talk for years about a single currency, similar to the Euro. Imagine an "East African Shilling" that works in Kigali, Nairobi, and Dar es Salaam.

It’s a beautiful dream. But it’s stuck in the mud.

Why? Because every country has different debt levels and inflation rates. If Rwanda joined a single currency with a country that has massive inflation, the Franc’s relative stability would be ruined. For now, the USD to FRW remains the most important pair for anyone doing business in the land of a thousand hills.

What Most People Get Wrong About Currency Devaluation

There’s a common myth that a "weak" currency is always a sign of a failing economy. That’s just not true.

Sometimes, a government wants a slightly weaker currency. It makes their exports cheaper for the rest of the world. If the Rwandan Franc drops, a bag of Rwandan specialty coffee becomes cheaper for a cafe in New York. That boosts sales.

The problem is the speed of the drop. If it happens too fast, the local economy can't adjust. People lose their savings. Businesses can't plan. That’s the tightrope the BNR has to walk every single day.

Actionable Steps for Managing Your Money

If you’re dealing with USD to FRW transactions, stop winging it.

- Monitor the BNR daily updates. They publish official rates that give you a baseline of where the government wants the market to be.

- Keep "Blue" Dollars. If you hold physical cash, ensure they are post-2013 Series $100 bills. You will lose 5-10% of your value instantly if you try to exchange old or small denominations ($1, $5, $10) at many bureaus.

- Use Peer-to-Peer when possible. If you know someone who needs Francs and you have Dollars, you can both agree on the mid-market rate and skip the bank fees entirely. Just make sure you trust the person.

- Diversify your holdings. Don’t keep all your liquid cash in Francs if you have large upcoming expenses in Dollars. If you have a big import coming up in six months, start buying small amounts of dollars now to "average out" your cost.

The reality of the USD to FRW exchange is that it's a reflection of Rwanda's place in the global market. It’s a story of growth, growing pains, and the relentless strength of the American dollar. Stay informed, watch the spreads, and never accept the first rate you're offered without checking the math.