Money in West Africa is doing something weird right now. If you've looked at the USD to Guinean franc rate lately, you might have noticed a slow, grinding climb that doesn't quite match the headlines about Guinea's "economic miracle." As of mid-January 2026, the rate is hovering around 8,765 GNF for a single US dollar.

It’s a massive number. It feels heavy.

But looking at the exchange rate alone is like trying to understand a book by only reading the page numbers. There is a specific kind of tension in Conakry today. On one hand, you have the Simandou iron ore project—a literal mountain of wealth that experts say will double Guinea's GDP. On the other, you have regular people in the markets of Madina struggling because that mineral wealth hasn't exactly made the franc stronger in their pockets yet.

Honestly, the "official" rate and the "street" reality are often two different animals.

The Simandou Effect and Your Money

Everyone in the mining world is obsessed with Simandou. By the end of 2026, it’s projected to pump out 100 million tonnes of iron ore every year. That is a staggering amount of foreign currency—mostly US dollars—flowing into a relatively small economy.

Usually, when a country starts exporting that much, its currency gets a "steroid shot." More demand for the local currency should, in theory, make the Guinean franc (GNF) appreciate. But we aren't seeing that yet.

Why?

Because the central bank (BCRG) is playing a very careful game. If the franc gets too strong, too fast, it kills off every other industry in the country. Imagine trying to export pineapples or coffee if your currency suddenly doubles in value. You’d be priced out of the market instantly. To prevent this, the government is launching a Sovereign Wealth Fund in the second quarter of 2026 with an initial $1 billion endowment. They want to soak up those extra dollars and park them in long-term investments rather than letting them flood the local streets and cause a "Dutch Disease" scenario.

💡 You might also like: US Dollar to MUR Rupees: Why Everyone Is Getting the Rate Wrong

A Quick Look at the Numbers (January 2026)

- Current Rate: ~8,765 GNF per 1 USD.

- One-Year Trend: Up about 3.3% from 8,479 GNF in early 2024.

- Central Bank Key Rate: Sitting at a steep 10.25%.

- Inflation: Still stubborn, roughly in the double digits depending on who you ask.

Why the USD to Guinean Franc Rate Stays Volatile

You've probably noticed that the franc doesn't move like the Euro or the Yen. It’s what the IMF calls a "crawl-like arrangement." Basically, the Central Bank of the Republic of Guinea (BCRG) keeps the currency on a leash. They intervene. They hold auctions. They try to keep the movements predictable because Guinea's economy is almost entirely dependent on mining exports—90% of it, actually.

There's also a literal cash problem.

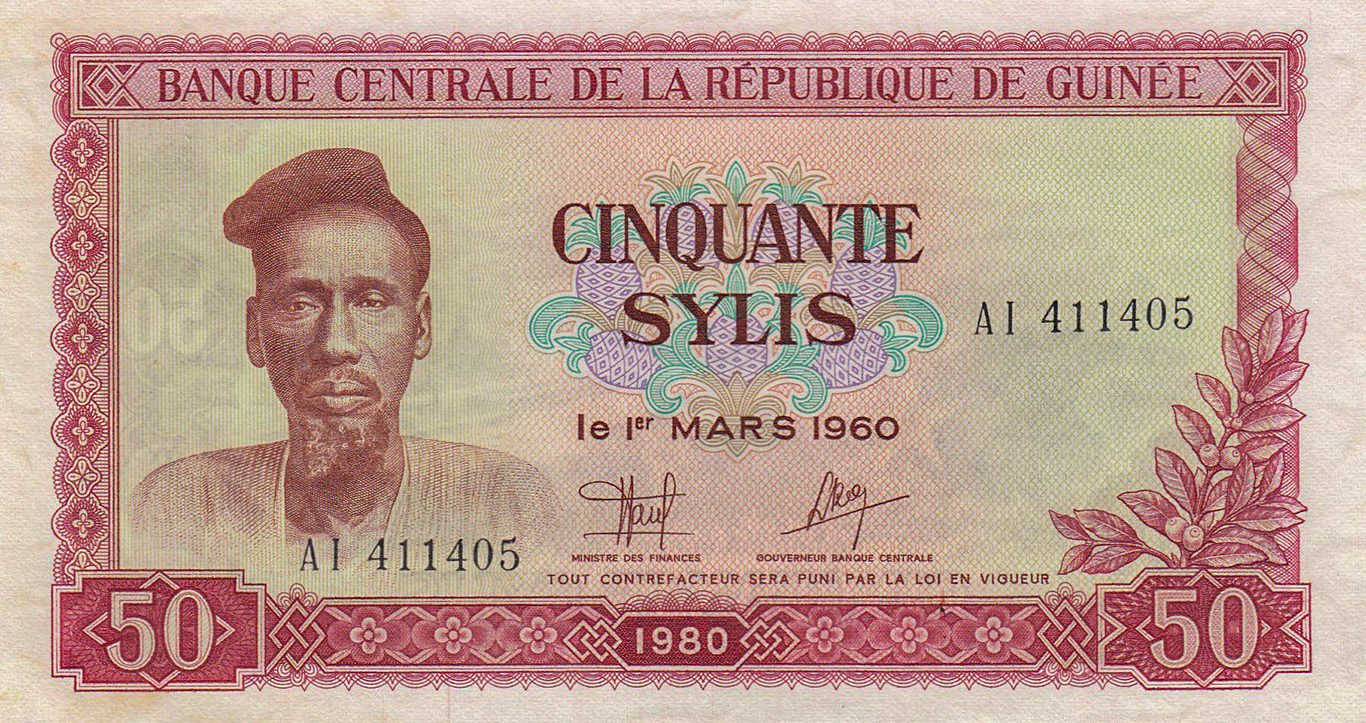

In late 2025 and moving into early 2026, there’s been a persistent shortage of physical banknotes. It’s a paradox. You have billions of dollars in mining contracts being signed, but if you walk into a bank in Conakry to withdraw physical GNF, you might be told to come back tomorrow. The BCRG has even ordered emergency shipments of new bills just to keep liquidity moving.

This creates a "risk premium" on the USD to Guinean franc rate. If people don't trust they can get their money out of the bank, they start hoarding dollars. And when everyone wants dollars, the price of the dollar goes up.

What Travelers and Expats Usually Miss

If you are heading to Guinea for work—maybe on one of the bauxite sites near Boké—don't just trust the XE.com or Google rates. Those are "mid-market" rates. They are the "theoretical" price.

When you actually try to swap your greenbacks for francs at a bureau de change or, more likely, with a licensed trader, you’ll see a spread. Usually, you’re looking at a 1% to 2% difference between the buying and selling price.

Survival Tips for Handling GNF:

- Newer is better. Seriously. If you have US $100 bills printed before 2013, many exchange spots will either reject them or give you a lower rate. They want the "blue" notes.

- Cash is king, but digital is coming. While the street runs on paper, the government is pushing a massive "Digital Push" to get people using mobile money like Orange Money. It’s safer and often cheaper than carrying a brick of GNF in your backpack.

- The Friday Slump. Sometimes exchange rates get "sticky" over the weekend when the central bank is closed. If you can wait until Tuesday or Wednesday to change large amounts, you might get a slightly tighter spread.

The 2026 Outlook: Will the Franc Recover?

The International Monetary Fund (IMF) thinks Simandou could add 3.4% to Guinea's GDP annually for the next decade. That is huge. But the USD to Guinean franc rate is also battling a high interest rate of 10.25%. High rates usually support a currency, but only if investors feel the country is stable.

Guinea is currently under a transition government. Political "surprises" can cause the franc to dip overnight, regardless of how much iron ore is in the ground.

Most analysts expect the rate to stay in the 8,700 to 8,900 range for the rest of 2026. The central bank has enough reserves to prevent a total collapse, but they don't have enough "firepower" to force the franc back down to 8,000.

Actionable Steps for Managing Your Exchange Risks

If you are a business owner or an expat living in Guinea, sitting on a pile of GNF is a gamble. Here is how to handle it:

👉 See also: Dunn Givnish Funeral Home Langhorne: What Families Actually Need to Know

- Hedge with Assets: If you have extra GNF, don't leave it in a standard savings account. Local inflation will eat it faster than you can count it. Look into short-term government bonds or even physical assets if you're staying long-term.

- Use Multi-Currency Accounts: Several pan-African banks like Ecobank or UBA allow you to hold USD and GNF separately. Keep your "rainy day" fund in USD and only convert to GNF for your immediate 30-day expenses.

- Monitor the Simandou Milestones: Watch the news for the "First Ore" shipment. When that happens—expected late this year—there will be a psychological boost for the franc. That might be the best window to convert dollars into GNF if you have upcoming local projects.

- Verify Street Rates: Always cross-reference the official BCRG rate with the rates offered at the major hotels or the airport. If the gap is wider than 3%, something is up with local liquidity, and you might want to wait a day.

The Guinean economy is a sleeping giant that is finally waking up. The exchange rate is the heartbeat of that process. It's messy, it's complicated, and it's definitely not just a number on a screen.