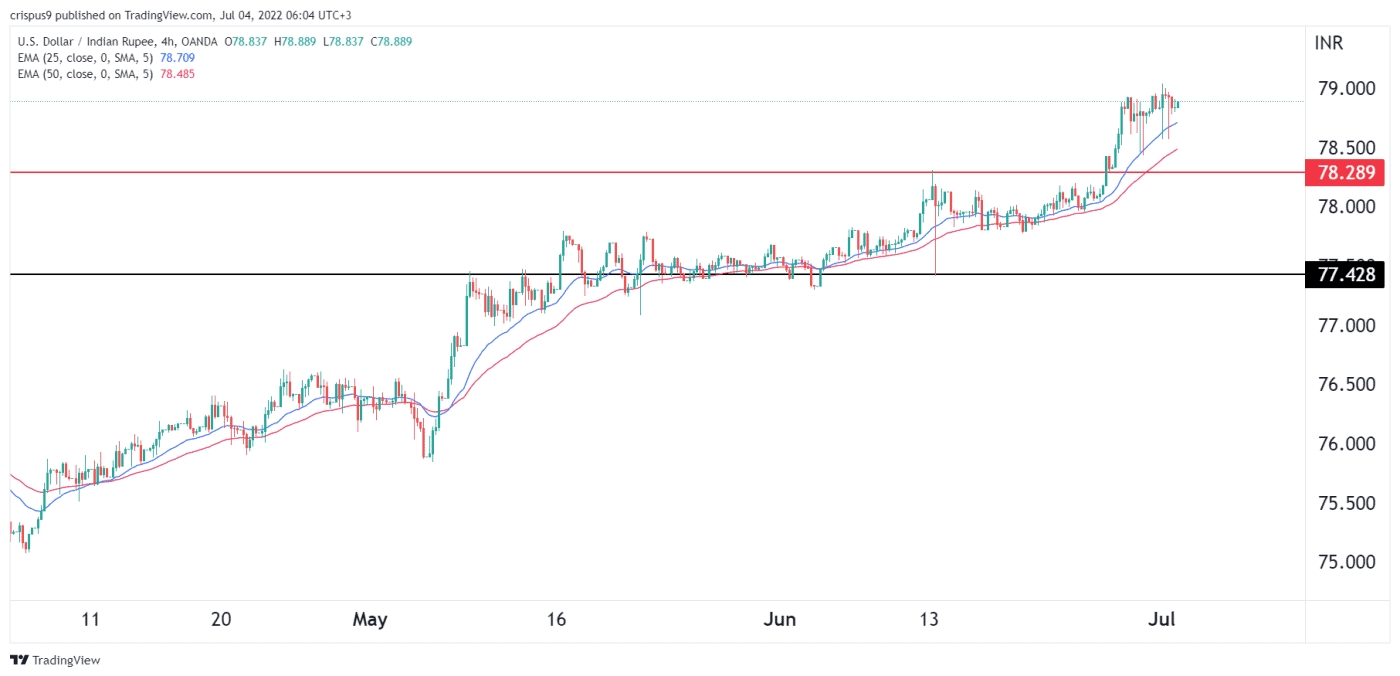

Everything felt stable for a while, didn't it? If you were watching the charts in early 2024, the Rupee seemed stuck in a loop around the 83 mark. Then the world changed. High interest rates in the US, shifting trade policies under the new Trump administration, and a sudden scramble for oil have turned the USD to INR prediction 2025 into a high-stakes guessing game for everyone from import-export business owners to families sending money back home.

Honestly, the "official" numbers rarely tell the whole story. While some big banks are painting a rosy picture of a 6.6% GDP growth for India, the currency market is shouting something else entirely. As of early 2026, looking back at the 2025 data, we saw the Rupee take a massive hit, eventually sliding past the 90 mark in December.

It wasn't a slow walk. It was a sprint.

The Reality of USD to INR Prediction 2025: A Year of Volatility

The biggest mistake people make is thinking the exchange rate is just about India's economy. It's not. It's a tug-of-war. On one side, you have the Reserve Bank of India (RBI) sitting on a massive pile of cash—roughly $687 billion by late 2025—trying to keep things steady. On the other side, you have "Trumponomics" and a Federal Reserve that kept everyone guessing.

In 2025, the US dollar didn't just stay strong; it got aggressive. While the Fed did eventually cut rates by 75 basis points throughout the year, it wasn't enough to stop the greenback's dominance. Why? Because the market was terrified of new trade tariffs. When the US talks about a 50% tariff on exports, investors don't wait around to see what happens. They pull their money out of emerging markets like India and park it in US Treasuries.

👉 See also: Why 601 California Street San Francisco Still Anchors the Financial District

That's exactly what happened. Foreign Institutional Investors (FIIs) dumped over $18 billion in 2025 alone. You can't have that much money leaving the country without the Rupee feeling the pain.

Why the 88 Handle Was the Tipping Point

For most of the summer in 2025, the Rupee hovered near 87. It felt like a psychological floor. But by October, that floor gave way.

- Trade Deficits: The gap between what India buys and what it sells hit $25 billion in December.

- Oil Prices: India imports nearly 89% of its crude. When the Rupee weakens, every barrel gets more expensive, which creates a nasty cycle of "imported inflation."

- The Trump Factor: Speculation about trade wars kept the Bloomberg Dollar Spot Index up by 5% late in the year.

Most analysts at firms like ICRA and MUFG were busy adjusting their targets every other month. One minute they were predicting a range of 87 to 89, and the next, we were staring at an intraday low of 91.14. It was chaos.

What Kept the Rupee From Crashing Completely?

If it weren't for the RBI, we might have seen 95. Seriously. The central bank didn't just watch from the sidelines; they spent more than $40 billion in the second half of 2025 alone to keep the currency from spiraling. They also tightened the rules on "speculative" trading. Basically, they told traders: "If you don't have a real business reason to buy dollars, stay out of the market."

The "Silent" Strength: Services and Electronics

There is a silver lining that most people ignore. While the merchandise trade (physical goods) looked like a disaster, the "invisible" earnings—things like software exports and remittances—actually grew by nearly 20%.

India is also becoming a global hub for electronics. Thanks to the Production-Linked Incentive (PLI) schemes, smartphone exports (think iPhones and Samsungs) surged by 40%. This is the only thing that kept the Current Account Deficit from ballooning out of control. It's a weird paradox: the currency is weak, but the industrial base is getting stronger.

🔗 Read more: Good Luck Booking That Stage You Speak Of: The Reality of Event Keynotes

Practical Steps: How to Handle the 90+ Exchange Rate

If you're waiting for the Rupee to return to 82, you're going to be waiting a long time. The "new normal" is here, and it's likely going to stay in the 89-91 range for the foreseeable future.

For NRIs and Remitters:

Don't try to time the absolute peak. If the rate hits 90.50 or higher, it's generally a good time to send money. The risk of the RBI stepping in and cooling the market is high whenever it nears an all-time low.

For Business Owners (Importers):

If you haven't hedged your currency exposure, you're essentially gambling. The RBI has made it clear they won't "defend" a specific level—they only care about preventing "extreme volatility." This means a slow, painful slide to 92 is totally possible, and they might not do anything to stop it.

For Investors:

Look at sectors that love a weak Rupee. IT services (TCS, Infosys) and Pharmaceuticals (Sun Pharma) are the classic plays. However, be careful with Pharma—they are currently the biggest targets for US trade tariffs, which could wipe out any gains they get from a favorable exchange rate.

👉 See also: How Much is Considered Wealthy: Why $2.3 Million is the New Magic Number

The Bottom Line

The USD to INR prediction 2025 taught us that geopolitical noise matters more than domestic data. India's GDP is "robust," sure, but the Dollar is the king of the mountain. Until the US Fed makes a decisive move toward 3% interest rates—which likely won't happen until late 2026—the Rupee will remain under pressure.

Keep a close eye on the US Treasury 10-year yields. If those start dropping below 3.5%, the Rupee might finally catch a break. Until then, expect more turbulence and plan your finances around a "90-is-the-new-85" reality.