Investing is often painted as a choice between the safe giants or the wild west of startups. You’ve probably heard people say that if you own the S&P 500, you "own the market." Honestly? That is only 80% true. The missing piece is where things get interesting—and that is exactly where the Vanguard Institutional Extended Market Index Trust lives.

Basically, this trust is the "everything else" of the American stock market. It doesn't touch Apple, Microsoft, or Amazon. Instead, it scoops up the thousands of mid-sized and small companies that the S&P 500 ignores. It’s designed to track the S&P Completion Index. Think of it as the bench players who eventually become the superstars.

The Misfit of the Investing World

The Vanguard Institutional Extended Market Index Trust is technically a Collective Investment Trust (CIT). You won't find it on a standard Robinhood or E*TRADE ticker search. It’s a "velvet rope" institutional product, usually tucked away inside 401(k) plans or pension funds.

Because it’s a CIT and not a mutual fund, it has way less overhead. We are talking about an expense ratio that often sits around 0.05% or even 0.02% depending on the specific unit class your employer negotiated.

Most people mistake this for a "Small-Cap Fund." It isn't. Not really. It is a "Completion Fund." If you take the S&P 500 (the big guys) and add the Vanguard Institutional Extended Market Index Trust (the mid and small guys), you finally own the 100% total U.S. stock market. Without it, you are essentially ignoring about 3,000+ companies.

👉 See also: Understanding a 6/7 Wire Rope: Why This Specific Lay Matters

Why Mid-Caps Are the Secret Sauce

We spend so much time talking about Nvidia or Tesla that we forget the "middle class" of the stock market. The extended market is heavy on names you recognize but don't obsess over. Names like Snowflake, Marvell Technology, and CrowdStrike have all lived in this space.

Mid-caps are the "Goldilocks" of stocks. They are bigger and more stable than a tiny biotech startup, but they still have the "room to run" that a $3 trillion company like Apple lacks. In the Vanguard Institutional Extended Market Index Trust, these mid-sized companies make up a huge chunk of the weight.

The Profitability Problem

Here is something most experts won't tell you: the S&P 500 has a "quality" filter. To get into the 500, a company usually has to be profitable. The Extended Market? It doesn't care.

If a company is public and traded on the NYSE or NASDAQ but isn't in the S&P 500, it’s probably in here. That means you are buying a lot of "growth" companies that are still burning cash. When money is cheap and interest rates are low, this fund flies. When rates spike? It feels the burn more than the big guys do.

Performance Realities in 2025 and 2026

If you look at the numbers for the start of 2026, the Vanguard Institutional Extended Market Index Trust (and its mutual fund sibling, VIEIX) has been on a bit of a roller coaster.

- 2023: A massive 25.41% return as tech rebounded.

- 2024: Solid gains of about 16.91%.

- 2025: A more modest 11.42% return.

As of mid-January 2026, the price has stabilized around $165.98. It’s important to realize that this trust is significantly more volatile than a standard Large-Cap fund. You’ll see 2% swings in a single day like it's nothing.

Sector Breakdown (The Heavy Hitters)

You aren't just buying "small" stocks; you are buying specific industries. As of the latest filings, the trust is heavily tilted toward:

- Information Technology (~18-23%): Software and semiconductors.

- Industrials (~18%): Manufacturing and transport.

- Financials (~15-16%): Regional banks and insurance.

- Health Care (~12%): Biotech and medical devices.

Notice something? It’s much more balanced than the S&P 500, which is becoming a "Tech and Friends" club. The Vanguard Institutional Extended Market Index Trust gives you real exposure to the "physical" economy—factories, banks, and labs.

The "Completion" Strategy: How to Use It

Most institutional advisors recommend a 4-to-1 ratio. For every $4 you have in an S&P 500 fund (like VIIIX), you put $1 into the Vanguard Institutional Extended Market Index Trust.

This "completes" your portfolio.

If you just hold the S&P 500, you are 100% dependent on the "Magnificent Seven." If tech takes a dive, you go down with the ship. By adding the extended market, you’re diversifying into the companies that will eventually replace the laggards in the S&P 500. It’s like owning the farm system for a Major League Baseball team.

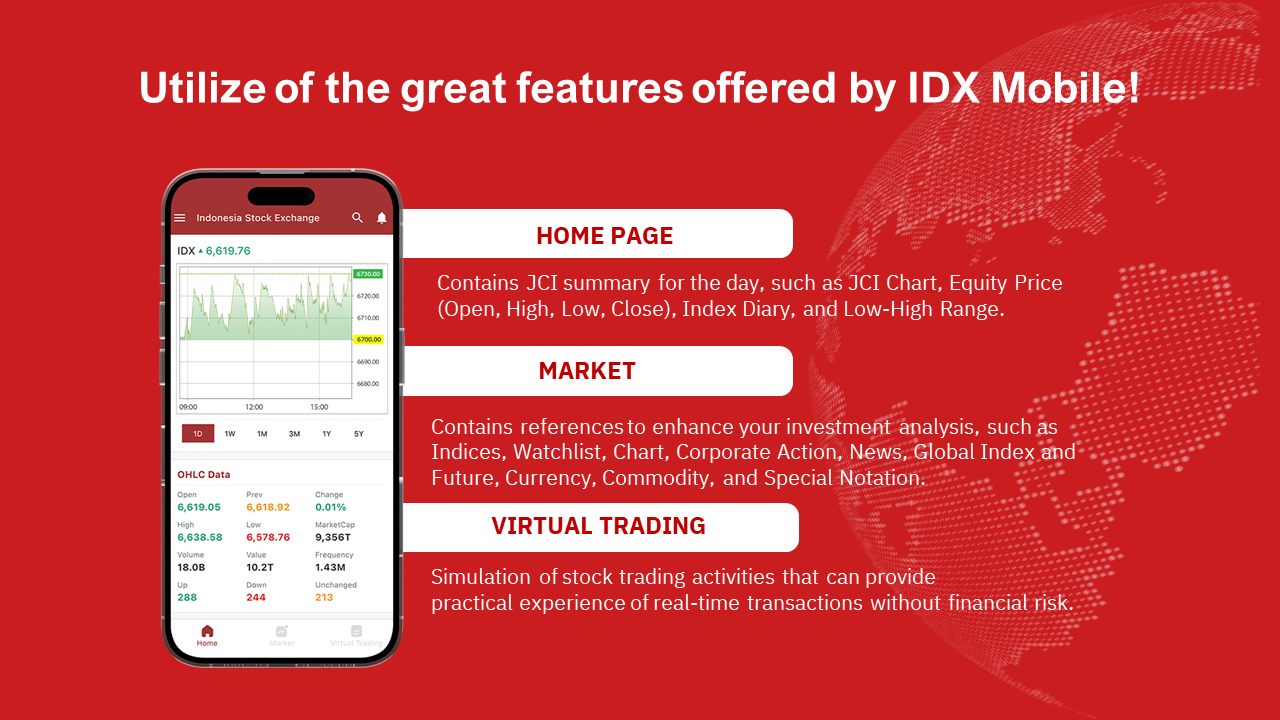

[Image showing the overlap between Total Market, S&P 500, and Extended Market]

Common Misconceptions

People think "Institutional" means it’s safer. Nope. It just means it's cheaper to own because of the way the trust is structured for large groups.

💡 You might also like: Why the be back in 5 minutes sign is a Small Business Trap (And How to Fix It)

Another big one: "It's the same as the Russell 2000." Actually, no. The Russell 2000 tracks 2,000 small companies. The Vanguard Institutional Extended Market Index Trust tracks over 3,000 companies, including many mid-caps that are too big for the Russell but not quite "S&P 500" material.

Actionable Steps for Your Portfolio

If you see the Vanguard Institutional Extended Market Index Trust (or a similar name like "Ext Mkt Idx Tr") in your 401(k) options, here is how to handle it:

- Check the Expense Ratio: If it’s under 0.05%, it is likely the cheapest way you will ever find to own small and mid-cap stocks.

- Don't Go Overboard: Keep this to 15% to 25% of your total U.S. stock allocation. Any more, and you are "tilting" toward smaller stocks, which can be painful during market downturns.

- Rebalance Annually: Small caps often have "breakout" years. If this fund grows to be 40% of your account, sell some and move it back into large-caps to lock in gains.

- Verify the Manager: While Vanguard's Equity Index Group has managed this for decades, ensure your specific plan hasn't swapped to a different provider like BlackRock or Fidelity, as the underlying index (and risk) might slightly differ.

The Vanguard Institutional Extended Market Index Trust is a tool for the patient investor. It won't make you a millionaire overnight, but it ensures you aren't leaving the most dynamic 20% of the American economy behind.