Honestly, whenever the government starts talking about "sending money back," there's a lot of noise. You've probably heard the rumors or seen the headlines about the Virginia rebate check 2025, and if you’re like most people in the Commonwealth, you’re wondering where your money is. Or if you even get any.

It's actually pretty simple, but the details matter. Governor Glenn Youngkin announced this fall that the state is handing out roughly $978 million. That’s a massive chunk of change. It comes from a $10 billion surplus. Basically, Virginia's coffers are full, and the law says some of that has to go back to the people who paid it in the first place.

But here is the thing. Not everyone gets a check. It isn't a "stimulus" in the way we saw a few years ago. It’s a tax rebate. That distinction is the difference between a $400 deposit and getting nothing at all.

💡 You might also like: A Diagram of How Mercantilism Worked: Why It’s Not Just Old History

Who Actually Gets the Virginia Rebate Check 2025?

To get the cash, you must have had a tax liability for the 2024 tax year. This is the part that trips people up.

Tax liability isn't just about whether you got a refund when you filed your taxes last spring. It’s about the total amount of tax you owed before you even looked at your withholdings or credits. If your total tax was zero—maybe because your income was below a certain level or your deductions wiped it out—you aren't getting a rebate.

The amounts are capped.

- Individual filers: Up to $200.

- Married couples (filing jointly): Up to $400.

I say "up to" because you can't get back more than you actually owed. If your total tax liability was only $150, your rebate will be $150. You won't get the full $200 just because you’re a single filer.

The Deadline You Can't Miss

You have to file your 2024 Virginia state tax return by November 3, 2025. If you haven't done that yet, stop reading and go do it. If you miss that date, the money stays with the state. No exceptions.

Most people who filed before July 1 should have seen their money arrive by the end of October 2025. If you filed later, the state processes them in the order they were received. It takes time.

How the Money Arrives

The Virginia Department of Taxation isn't reinventing the wheel here. They use what they already know about you.

If you received a tax refund via direct deposit this year, that’s how the rebate will show up. Look for "VA DEPT TAXATION VATXREBATE" on your bank statement. It’s a bit of a mouthful, but that’s the golden ticket.

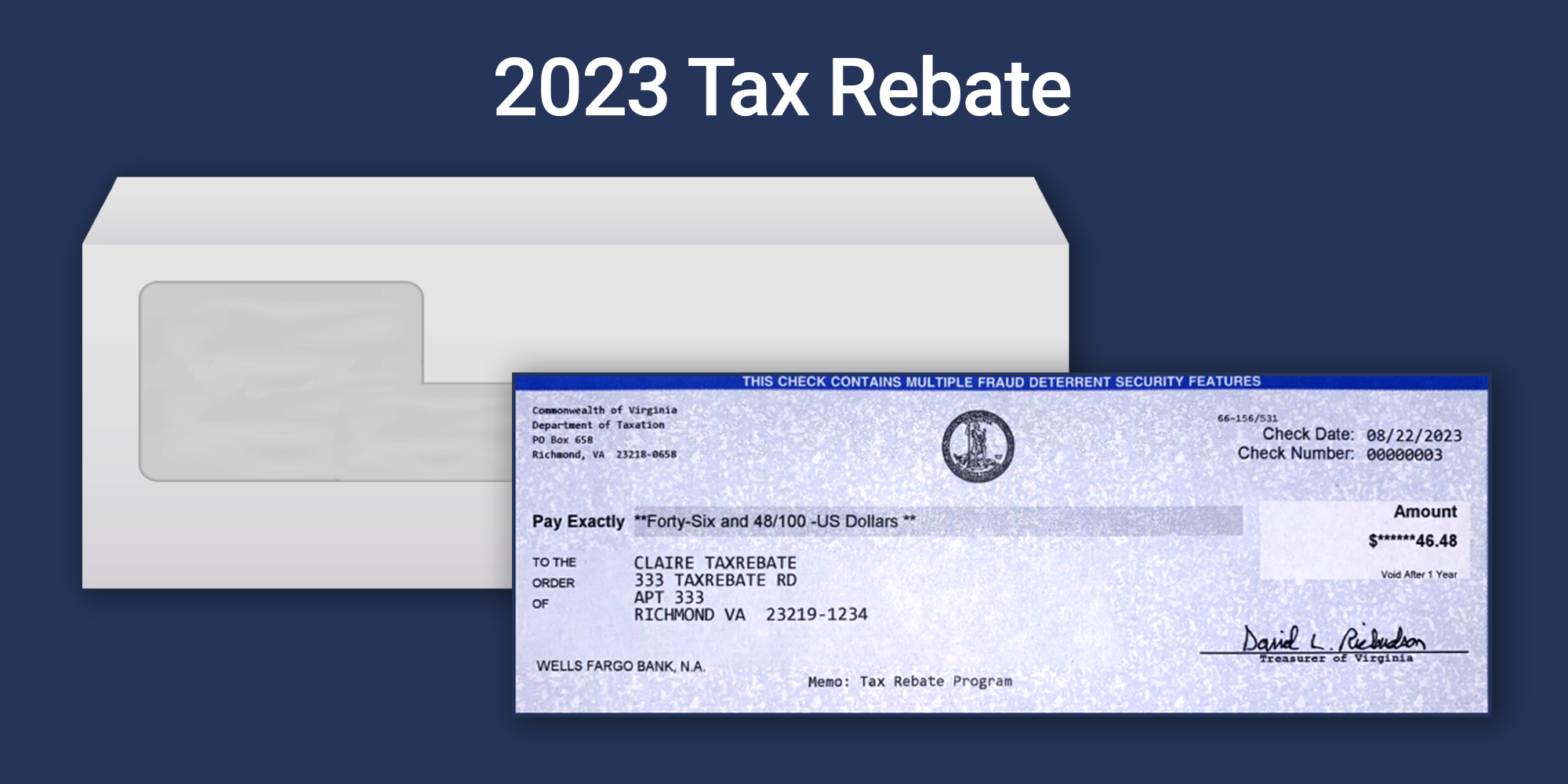

Everyone else gets a paper check.

Wait.

There is a catch.

If you owe money to the state—think back taxes, overdue child support, or even certain court fines—the Commonwealth is going to take their cut first. They call it a "debt setoff." If your rebate is $400 but you owe $300 in old parking tickets or state fees, you’re only getting $100. If you owe more than the rebate, you’ll just get a letter explaining where the money went.

Why This is Happening Now

Governor Youngkin has been pushing for tax relief since he took office. He keeps saying, "It's your money, not the government's."

The state's economy has been surprisingly resilient. With $140 billion in business investment commitments over the last few years, the tax revenue has outpaced the budget. This Virginia rebate check 2025 is the latest in a series of similar moves. In fact, since 2022, Virginia has returned billions to taxpayers through these one-time payments and by bumping up the standard deduction.

Speaking of deductions, 2025 brings more changes than just the rebate. The standard deduction is rising to $8,750 for individuals and $17,500 for joint filers. That’s a significant jump from the old levels of $8,000 and $16,000.

📖 Related: The Energy Development Corporation Logo and What It Really Says About Geothermal Power

Common Scenarios and Confusion

I've seen people get frustrated because their neighbor got $400 and they only got $200. Usually, it's just filing status. But sometimes it's because of the Earned Income Tax Credit (EITC).

Virginia boosted the refundable portion of the EITC to 20% of the federal credit this year. That’s great news for lower-income families. However, if that credit (along with others) reduced your "tax liability" to a very low number, your rebate check might be smaller than you expected.

Also, don't get scammed.

The Department of Taxation will never text you asking for your bank info to "release" your rebate. They won't call you out of the blue demanding a fee to process it. If you're unsure, go directly to the official tax.virginia.gov website and use their lookup tool. It’s the only way to know for sure what’s happening with your specific account.

What You Should Do Next

If you are still waiting on your Virginia rebate check 2025, here is your checklist:

💡 You might also like: ASEA Brown Boveri Share Price: What the Experts Aren't Telling You

- Check your 2024 tax return: Look at the line for "Total Tax." If that number is $0, you likely aren't eligible.

- Verify your filing date: Ensure you submitted your return before the November 3, 2025, cutoff.

- Search your bank history: Use the keyword "VATXREBATE" in your banking app. Sometimes these deposits slip past people's notifications.

- Watch the mail: If you didn't do direct deposit, keep an eye out for a plain envelope from the "Commonwealth of Virginia, Department of Taxation."

- Address your debts: If you know you have an outstanding balance with a state agency, don't expect the full amount.

This rebate is a nice little win for Virginia households, but it isn't a permanent fix for inflation or rising costs. It's a one-time "thank you" for a budget surplus. Make sure you claim what's yours before the window closes.