Money makes people act weird. When we talk about the S&P 500, specifically through the lens of the Vanguard S&P 500 ETF, everyone gets hyper-focused on one specific number. They want the "magic" figure. Well, let's just get it out of the way immediately. The voo average return last 10 years is approximately 12.8% to 13.2% annually, depending on exactly which month you stop the clock.

That is massive. Honestly, it's better than almost anyone expected back in 2016 or 2017.

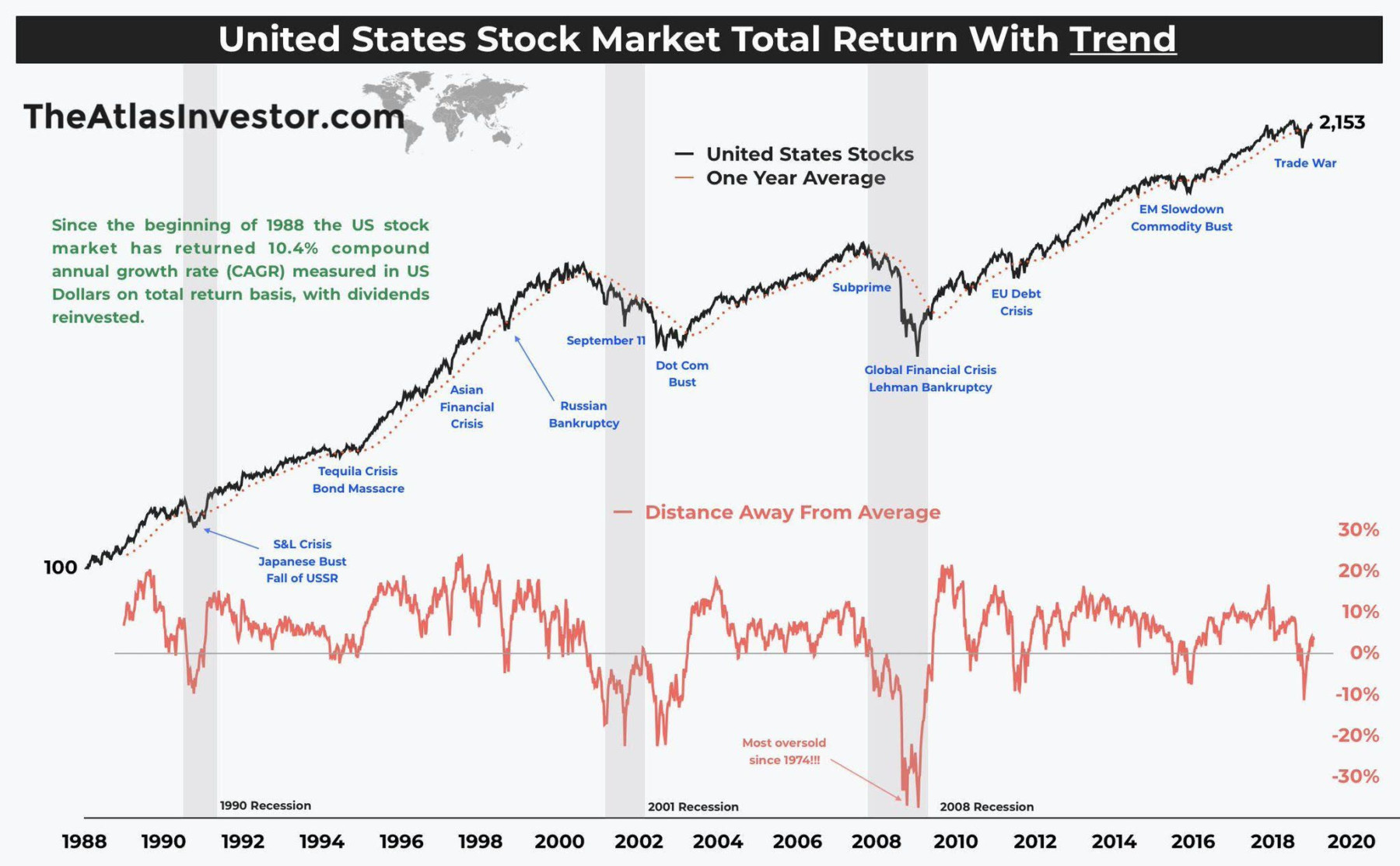

But here’s the thing. If you think you’re just going to click "buy" and see a smooth 13% climb every year until 2035, you're in for a very rude awakening. Averages are liars. They smooth out the gut-punching drops that make most people sell at the worst possible time.

The Reality Behind the 13% Annual Return

The stock market doesn't do "average." In the last decade, we've seen years where the market was up 30% and years where it felt like the sky was falling. The voo average return last 10 years looks like a beautiful, straight line on a long-term chart, but zoom in and it’s a jagged mess of anxiety.

Think back to 2022. The S&P 500 dropped about 18%. If you had $100,000 in VOO, you woke up one day and $18,000 of it was just... gone. Most people can't handle that. They see the "average" and think it’s a guarantee, but the cost of entry for that 13% gain is the willingness to watch your net worth crater every few years without panicking.

Why has VOO been such a monster? Tech. It’s basically that simple.

The weight of companies like Apple, Microsoft, Amazon, and Nvidia in the S&P 500 has grown significantly. Because VOO is market-cap weighted, the bigger a company gets, the more it drives your returns. We’ve lived through a decade where software literally ate the world. If you owned VOO, you were essentially betting on Silicon Valley’s dominance. It paid off.

🔗 Read more: Wait, Is the 401k Tax Break Ends Narrative Actually True? What’s Really Changing

Dividends: The Silent Partner

People forget the dividends. They focus on the share price, which is cool, but VOO pays out a dividend quarterly. When we talk about that 13% "total return," we are assuming you took every cent of those dividends and immediately bought more VOO.

If you spent that cash on coffee and rent? Your return was lower.

The current yield hovers around 1.3%. It’s not much, but over a decade, the compounding effect of reinvesting those payouts is what turns a good portfolio into a retirement-funding beast.

What Actually Happened Each Year?

Let's look at the actual path. It wasn't a steady climb.

In 2014, things were relatively calm. Then 2015 happened and the market basically went nowhere—a "flat" year that bored everyone to tears. Then 2017 came along with a nearly 22% gain, making everyone feel like a genius. But then 2018 hit, and the market actually ended the year in the red.

You see the pattern?

- 2019: A massive 31% surge.

- 2020: The COVID crash, followed by a logic-defying 18% recovery.

- 2021: Another 28% gain fueled by stimulus and low interest rates.

- 2022: The reality check. A nearly 20% drop as inflation roared back.

- 2023/2024: The AI-led resurgence that pushed us back to all-time highs.

If you just looked at the voo average return last 10 years, you’d miss the drama. You’d miss the fact that in March 2020, the world felt like it was ending. The people who actually "earned" that 13% average are the ones who did absolutely nothing while the news told them to run for the hills.

Why VOO Is Different From a "Normal" Fund

Vanguard’s whole vibe is being cheap. Jack Bogle, the founder of Vanguard, basically revolutionized investing by saying, "Stop trying to find the best stocks and just buy the whole bucket."

VOO has an expense ratio of 0.03%.

That sounds like nothing, and that’s the point. If you invest $10,000, Vanguard takes $3 a year to manage it. Compare that to a "wealth manager" who might charge you 1% ($100). Over 10 years, that fee difference is the difference between a nice vacation and staying home. When you look at the voo average return last 10 years, you’re seeing a number that is almost pure profit because the fees aren't eating the gains.

Most active fund managers—the guys in expensive suits in Manhattan—actually underperform VOO over long periods. It's embarrassing, really. They charge more to give you less.

The Concentration Risk Nobody Talks About

We need to be honest about the risks here. The S&P 500 is more "top-heavy" now than it has been in decades.

The "Magnificent Seven" (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, Tesla) make up a huge chunk of the index. If tech takes a massive, permanent hit—say, due to massive regulation or a shift away from AI hype—VOO will suffer more than it would have in the 90s when the index was more diversified across oil, retail, and manufacturing.

You aren't just buying "the economy." You're buying a very specific slice of the largest winners in the economy.

Looking Forward: Can 13% Last?

Probably not.

Most analysts, including the folks at Vanguard themselves, are projecting lower returns for the next decade. Why? Because valuations are high. When you buy VOO today, you are paying a premium for those future earnings.

Historically, the S&P 500 averages closer to 10% over very long periods (30-50 years). The last decade has been an anomaly of low interest rates and unprecedented tech growth. If we revert to the mean, the next ten years might look more like 7% or 8%.

Does that mean you shouldn't buy it? No. It just means you shouldn't build your retirement math on the assumption that the last decade's gold rush is the new permanent reality.

Actionable Steps for Investors

If you're looking at the voo average return last 10 years and wondering how to move forward, stop overthinking it.

Check your timeline. If you need the money in two years for a house down payment, VOO is a gamble. A 10-year average doesn't protect you from a 20% drop next Tuesday. If your timeline is 20 years? The "when" doesn't matter nearly as much as the "how much."

Automate the pain away. Set up a recurring buy. Investing $500 every month regardless of whether the market is up or down is called dollar-cost averaging. It’s the only way to make sure you don't "wait for a dip" that never comes, or buy everything at the very top.

Reinvest those dividends. Ensure your brokerage account is set to "DRIP" (Dividend Reinvestment Plan). If you’re taking the cash, you’re missing out on the compounding power that makes the 10-year return so impressive in the first place.

Ignore the "Financial Porn." The 24-hour news cycle needs you to be scared so you'll watch their segments. They will tell you every week why the market is about to crash. Maybe they'll be right once, but they've been wrong for most of the last ten years.

The most successful VOO investors are usually the ones who forget their login passwords. They let the 500 biggest companies in America do the work while they go live their lives. The 13% return wasn't a gift; it was a reward for the people who stayed chill when everyone else was screaming.

Next Steps for Your Portfolio

- Verify your expense ratios: Ensure you are in VOO (0.03%) and not a legacy mutual fund with a similar name charging 0.50% or more.

- Calculate your "Personal Inflation": If the market returns 13% but your lifestyle costs rise by 10%, you aren't actually getting ahead. Focus on the gap between what you earn and what you spend.

- Audit your tech exposure: If you work in tech and own VOO, your entire life is tied to one sector. Consider if you need a little more international or small-cap exposure to balance the scales.