You’re digging through a pile of mail or scrolling through a cluttered "Tax Documents" folder in your inbox, and you're looking for one specific thing. A tax break. If you own a home, that 1098 is basically a golden ticket. But honestly, most of these IRS forms look identical at a glance. They’re all white rectangles with black grids and tiny, soul-crushing font sizes. So, what does a 1098 form look like when you actually find it?

It’s smaller than you think.

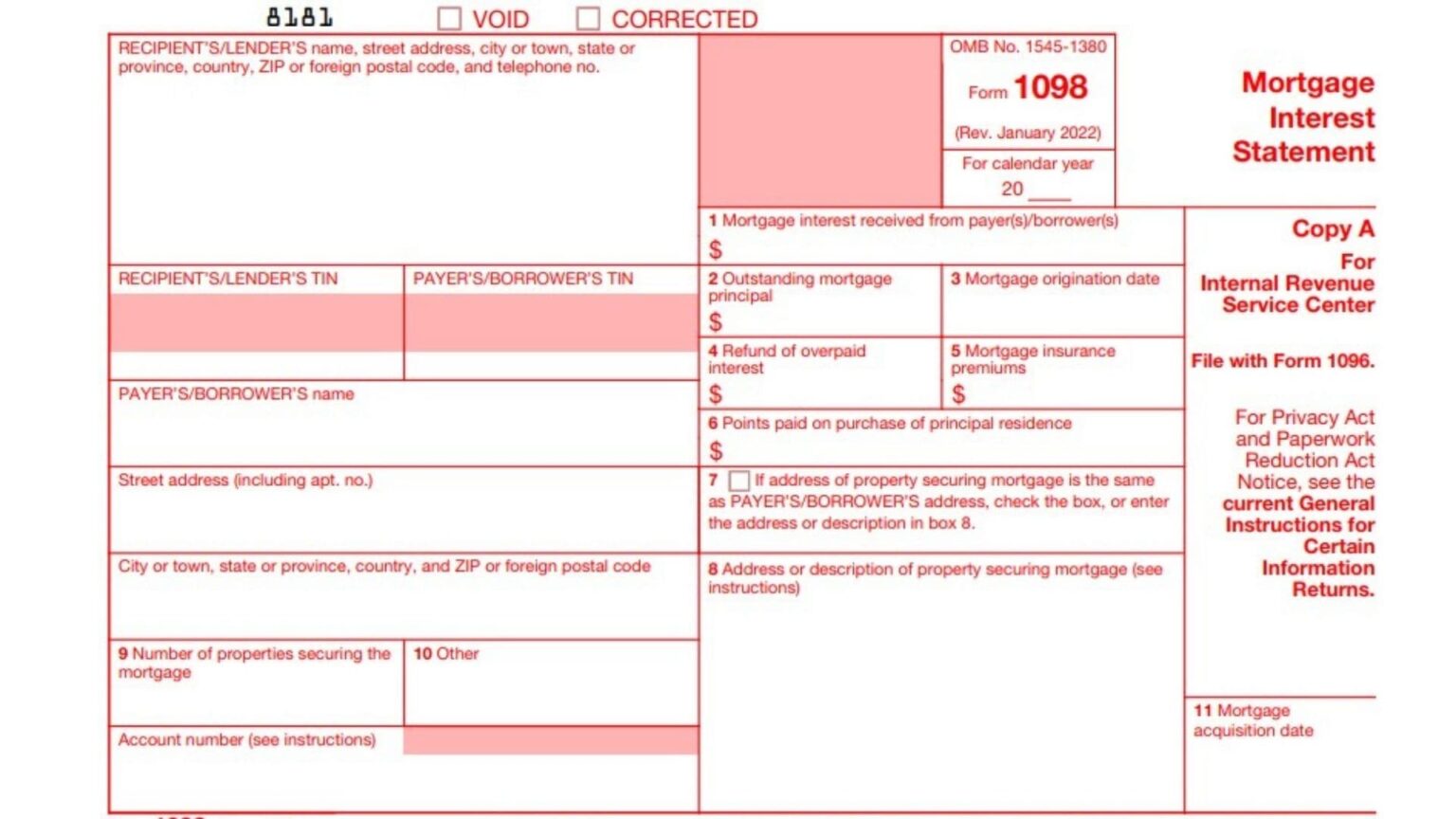

Usually, the official IRS version—the one they call Copy B—is a half-sheet of paper. If your bank mailed it, it might be integrated into a full 8.5 x 11 page with a perforated edge, or it could be a digital PDF that looks surprisingly sparse. Don't expect a flashy "Tax Savings Here!" header. It’s titled "Mortgage Interest Statement" in a very dry, functional font at the top.

The Anatomy of the Grid

The layout is a bit like a game of Battleship, but with your money. On the left side, you’ll see several large boxes for addresses. The top one is for the "Lender," which is just a fancy way of saying your bank or mortgage servicer. Below that is your information—the "Payer."

📖 Related: Jamie Dimon and the JPMorgan Chase CEO succession: Why everyone is obsessing over the timeline

It’s the right side where the magic (or the math) happens.

The most important part of the 1098 is Box 1. This is where your mortgage interest received from payers is listed. For most homeowners, this is the biggest deduction they’ll see all year. If you paid $12,500 in interest over the last twelve months, that number will be sitting there in Box 1, plain as day.

Why the 1098-T and 1098-E Keep Confusing People

Here is the thing. The IRS didn't stop at one 1098. They made a whole family of them.

If you’re a student or you’re paying off those relentless student loans, you might be looking for a 1098-T or a 1098-E. They look almost exactly the same as the mortgage version. Same grid. Same font. Same "I'm a serious government document" vibe.

The 1098-T is for tuition. Your college sends this to show how much you paid for classes. The 1098-E is for student loan interest. If you’re searching your files and you see a form that says "1098" but the numbers look way too small to be a mortgage, check the letter suffix. It matters. A mortgage 1098 is strictly for real estate debt.

Those Little Boxes You Usually Ignore

Most people glance at Box 1 and call it a day. But if you look closer at what a 1098 form looks like, there are other details that can save you—or sink you—during an audit.

- Box 2: This shows the outstanding principal on your mortgage as of January 1st. It’s a snapshot of how much you still owe the bank.

- Box 3: This is the mortgage origination date. It’s the "birthday" of your loan.

- Box 4: This one is empty for most people, but it’s for "Refund of overpaid interest." If your bank messed up and gave you money back, the IRS wants to know.

- Box 5: Mortgage insurance premiums (PMI). This is a big one because the tax deductibility of PMI tends to expire and get renewed by Congress at the last minute almost every year.

Did you buy a house recently? Then you need to look at Box 6. That’s where "Points" paid on the purchase of a principal residence live. If you paid points to lower your interest rate, that's often deductible right away, and it shows up right there.

Digital vs. Paper: The Visual Disconnect

If you’ve gone paperless, your 1098 won't have those red-ink lines you sometimes see on the official IRS "Copy A." The version you download from your bank portal is usually a black-and-white PDF.

Sometimes banks get "creative" and include the 1098 as part of your final December or January billing statement. It might not even be a separate document. You have to look for a section titled "Tax Information" or "Year-End Summary." If you see a table with "Form 1098" printed in the corner, that’s your guy.

The "Copy" Confusion

When you finally see what a 1098 form looks like, you’ll notice labels on the side or bottom: Copy A, Copy B, or Copy C.

👉 See also: Nigeria Naira to US Dollar Black Market: Why the Gap Is Finally Shrinking

Copy A is red. It’s for the IRS. You’ll almost never see this one unless you’re an accountant or a glutton for punishment. Copy B is for you, the payer. It’s the one you use to fill out your Schedule A on your 1040. Copy C is for the lender’s records. If you’re looking at a screen or a printout, you’re almost certainly looking at Copy B.

Real-World Example: The Refinance Trap

Let's say you refinanced your home in June. In this scenario, you won't be looking for one 1098. You’ll be looking for two.

You'll get one from your old lender for the interest paid from January to June. Then, you'll get another from your new lender for July through December. I’ve seen so many people miss out on thousands in deductions because they only grabbed the 1098 from their current bank and forgot about the one they "broke up" with halfway through the year.

Both forms will look identical. They will both say 1098. But the "Lender" box at the top left will have different names. Make sure you have the full set before you start filing.

What if the Form Looks Wrong?

It happens. Banks make mistakes.

If the Social Security number in the "Payer’s TIN" box is off by one digit, or if the interest in Box 1 doesn't match your own records, don't just "fix it" on your tax return. The IRS computers are programmed to match what the bank reported with what you report. If they don't match, you get a letter. And nobody likes those letters.

🔗 Read more: PAG Stock Price Today: Why This Giant Is Moving and What It Means for Your Portfolio

You have to call the lender and ask for a "Corrected 1098." A corrected form looks exactly like the original, except there will be a small "X" in a box at the very top labeled "CORRECTED."

How to Use This Information Right Now

Now that you know exactly what a 1098 form looks like and where the traps are, it's time to actually do something with it.

- Check your "Mailed" pile: Look for a windowed envelope from your mortgage company. It’s often disguised as a bill or "Important Account Information."

- Log in to your portal: If you don't see it in the mail, go to your mortgage lender’s website. Look under "Statements," "Taxes," or "Documents." It was likely available for download by January 31st.

- Cross-reference with your Closing Disclosure: If you bought a home this year, your 1098 might not show the points or interest you paid at the closing table. You may need to look at your settlement statement (the ALTA or CD) to find extra deductions the 1098 missed.

- Confirm the TIN: Ensure your Social Security number is correct on the form so the IRS links the deduction to your account.

- Separate your 1098s: If you have a 1098-E (student loans) and a 1098 (mortgage), put them in separate folders. They go on different lines of your tax return—one is an adjustment to income, the other is an itemized deduction.

Gathering these forms early is the only way to avoid the frantic April 14th scramble. If you see that 1098 header, keep it safe; it's the most valuable piece of paper in your filing cabinet.