You'd think the richest investor in history would have a shelf full of bestsellers with his name on the cover. He doesn't. Honestly, if you walk into a Barnes & Noble looking for warren buffett authored books, you’re going to be disappointed by the search results. You’ll see hundreds of titles about him. You’ll see "The Buffett Way" or "The Tao of Warren Buffett."

But did the man himself actually sit down and write a book from scratch?

Kinda. But also, not really.

The truth is that Warren Buffett has never written a traditional narrative book. He hasn't penned a "How to Get Rich" memoir or a step-by-step investing manual. Instead, his "books" are actually collections of his annual letters to Berkshire Hathaway shareholders, curated and organized by other people. It’s a weird distinction, but for someone trying to learn his specific philosophy, it’s the only thing that matters.

The One Warren Buffett Authored Book You Actually Need

If you want the closest thing to a definitive text, you’re looking for The Essays of Warren Buffett: Lessons for Corporate America.

This is the holy grail. It’s the one book Buffett himself often signs for fans. But here’s the kicker: he didn’t technically "write" the book as a book. It was edited and arranged by Lawrence Cunningham.

Cunningham basically took decades of Buffett’s annual letters—which are famous for being hilarious, blunt, and packed with wisdom—and reorganized them by topic. Instead of reading them chronologically, you can read everything Buffett thinks about "Corporate Governance" in one chapter and "Investing" in another.

Why does this matter? Because Buffett’s writing style is incredibly conversational. He explains complex insurance float or deferred taxes like he’s talking to you over a steak dinner in Omaha.

📖 Related: Mashup Ireland AB Stockholm: Why This Agency Actually Matters for Nordic Brands

Why the Letters are Better Than a Biography

Most people start with The Snowball by Alice Schroeder. It’s a great biography. It’s massive. But it’s Alice’s voice, not Warren’s.

When you read warren buffett authored books—specifically the collected letters—you get the primary source. You see how his mind evolved. You see him admit to massive mistakes, like the Dexter Shoe disaster, in real-time. There is no filter.

There are a few variations of these collections out there:

- Berkshire Hathaway Letters to Shareholders: These are often huge, raw volumes containing every letter from 1965 to the present. It’s a lot to digest.

- The Essays of Warren Buffett: (The Cunningham version) This is the curated, readable version.

- Back to School: This is a lesser-known title that is essentially a transcript of a Q&A session Buffett did with business students. It’s raw, it’s punchy, and it’s arguably the most "honest" Buffett you’ll find.

The Myth of the Secret Manual

You’ll see a lot of books on Amazon with "Warren Buffett" in big letters and a smaller name like Mary Buffett or David Clark underneath.

Don't get it twisted. These are not warren buffett authored books.

Mary Buffett was once his daughter-in-law, and while her books (like Buffettology) are popular, they are interpretations of his methods. They aren't his words. There is a huge difference between someone explaining what they think Buffett does and reading the man himself explain why he bought a specific railroad in 2009.

Buffett is famously protective of his "brand." He doesn't do endorsements. He doesn't write forwards for most people. So, if the book wasn't published by Berkshire Hathaway or curated by Cunningham, it’s probably an outside perspective.

The "Must-Reads" That He Didn't Write

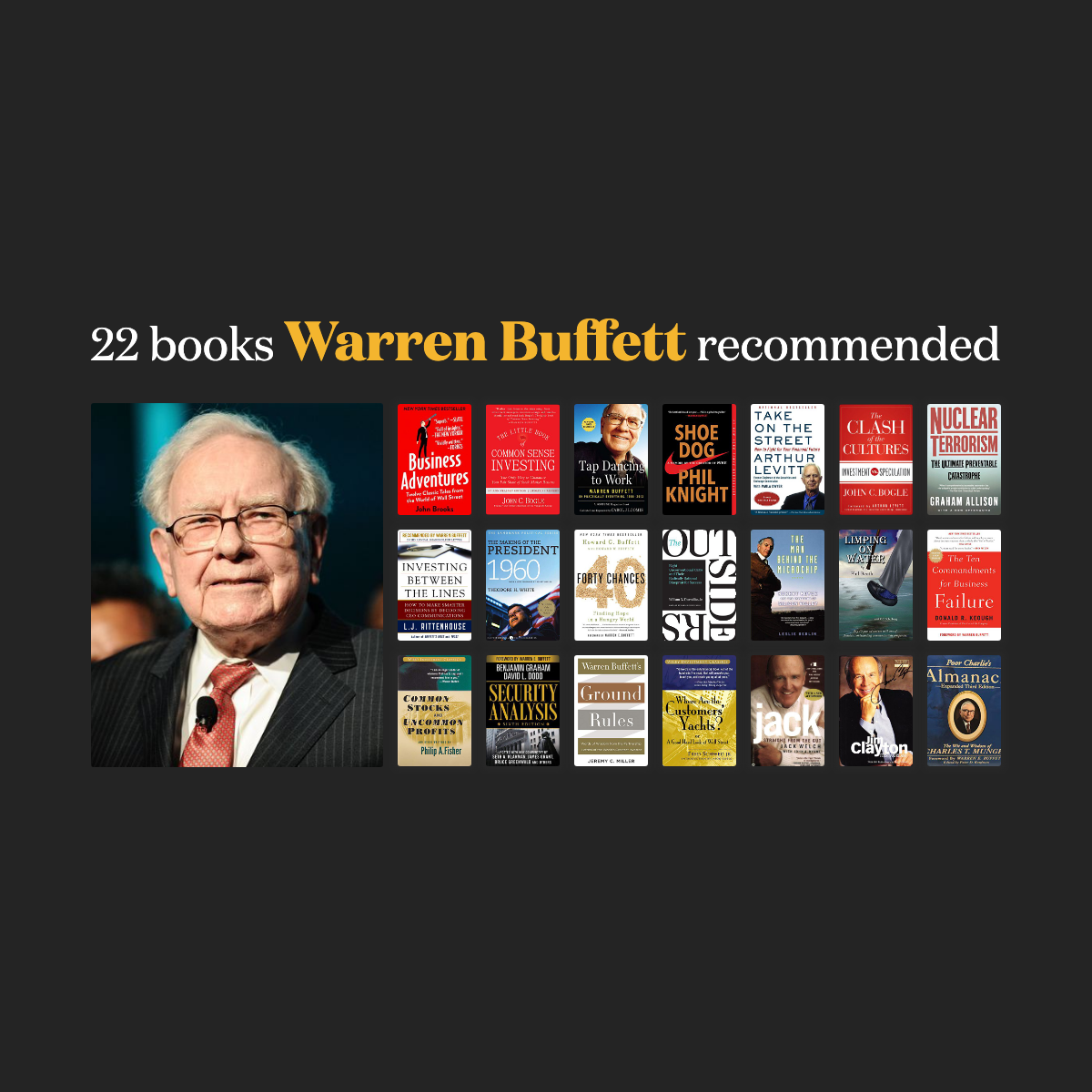

Buffett is a voracious reader. He famously spends about 80% of his day reading. While he doesn't write many books, he recommends them constantly. If you’ve exhausted the few warren buffett authored books, these are the ones he considers his "manuals":

- The Intelligent Investor by Benjamin Graham. Buffett says Chapter 8 and Chapter 20 are the foundation of his entire life.

- Security Analysis by Graham and Dodd. This is the "Bible" of value investing. It’s dense. It’s dry. It’s basically a textbook.

- Poor Charlie’s Almanack. This is by his late partner, Charlie Munger. It is, quite simply, one of the best books on logic and "mental models" ever printed.

How to Read Buffett Without Getting Bored

Look, the annual letters can be dry if you don't know what to look for.

If you’re picking up a collection of warren buffett authored books, don't start at page one and try to power through. It won't work. You’ll get bogged down in the accounting of a textile mill in 1968.

📖 Related: Merck & Co Stock Symbol: Why MRK Still Matters in 2026

Instead, look for the "Owner's Manual" section. It's usually at the beginning of the Essays book. It lays out how he treats shareholders as partners. It’s the moral foundation of his business.

Then, skip to the sections on Moats. This is where he talks about why brands like See’s Candies or Coca-Cola are so hard to beat. He uses the analogy of a castle with a moat full of sharks. It’s vivid, and it teaches you more about business than a four-year degree.

The Actionable Insight: Where to Start Today

If you want to actually "read" Buffett today, you don't even have to buy a book.

Go to the Berkshire Hathaway website. It looks like it was designed in 1995. That’s on purpose. Click on "News Releases" or "Annual & Interim Reports." Every single letter he has written since the mid-70s is there for free.

However, if you want a physical copy for your library, here is the move:

🔗 Read more: PayPal Founder Elon Musk: What Really Happened During the 2000 Palace Coup

- Buy The Essays of Warren Buffett (the latest edition by Lawrence Cunningham). It’s the most organized version of his thoughts.

- Pick up The Warren Buffett Partnership Letters. These cover the years before Berkshire, from 1957 to 1970. This is "Young Buffett"—the guy who was compounding money at 30% a year with a much smaller pile of cash. The strategies here are actually more applicable to the average investor than what he does now with billions.

Stop looking for a ghostwritten autobiography. It doesn't exist. Buffett has already given us everything we need in his annual reports; you just have to be willing to do the reading.

Start by reading the 1984 letter. It’s a masterclass in how to think about market fluctuations. Once you finish that, you'll realize why everyone else's books about him are just noise.