You’re staring at a screen. Red and green candles flicker like a neon sign in a rainstorm. Most people think looking at a us index live chart is just about watching numbers go up or down, but it’s actually a psychological battlefield. If you've ever felt your heart rate spike because the S&P 500 dropped 0.2% in three minutes, you know exactly what I mean.

It’s easy to get lost.

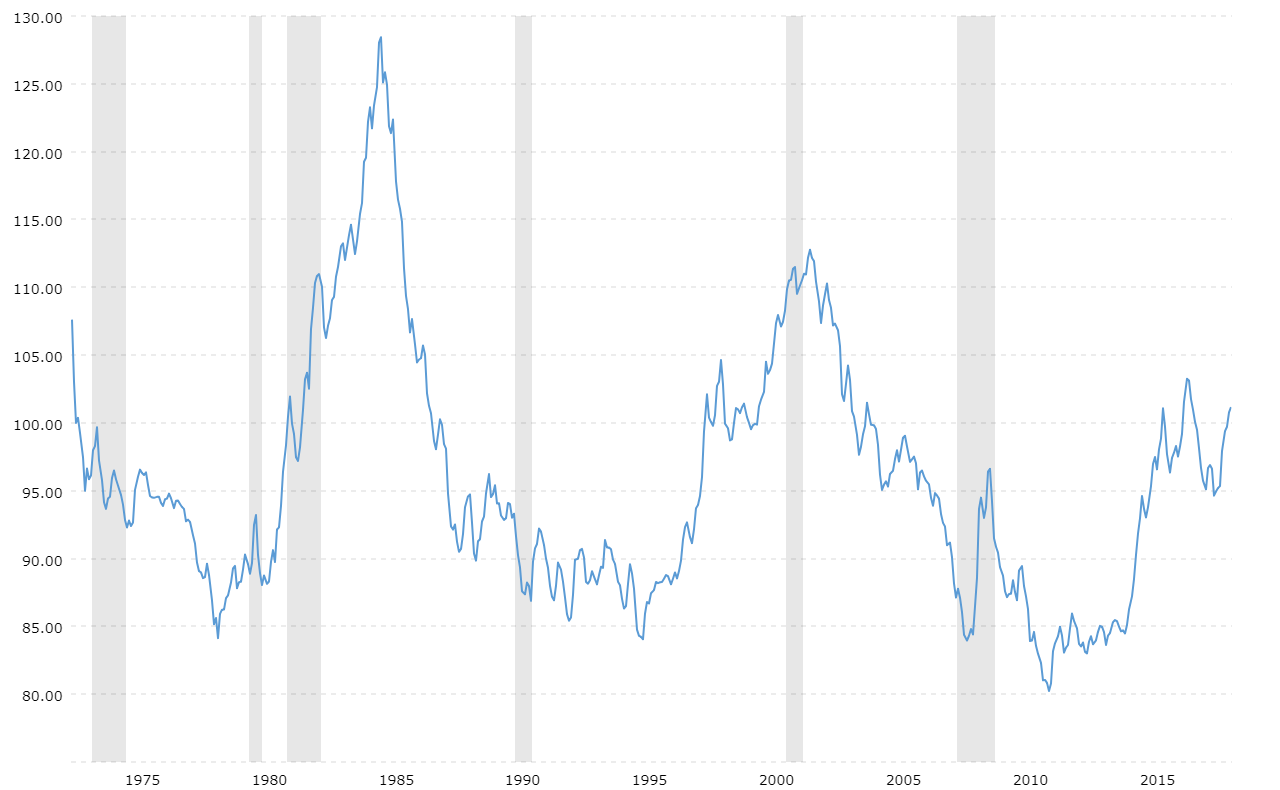

Markets move fast. One second, everyone is talking about a "soft landing" and the next, a single jobs report sends the Nasdaq into a tailspin. But here is the thing: the chart isn't just a line. It’s a visualization of every single fear, hope, and greedy impulse of millions of traders globally. Honestly, if you aren't careful, the live feed will lie to you. It makes the "now" feel much more important than the "next."

Why the US Index Live Chart is More Than Just Lines

When we talk about a US index, we’re usually referring to the "Big Three": the S&P 500 (SPX), the Dow Jones Industrial Average (DJI), and the Nasdaq Composite (IXIC). Each represents a different flavor of the American economy. The Dow is your grandfather’s economy—blue-chip giants like Goldman Sachs and Boeing. The Nasdaq is the tech-heavy future, driven by Nvidia, Apple, and the latest AI hype. The S&P 500? That’s the real pulse. It covers about 80% of the available market capitalization in the US.

Following a us index live chart in real-time gives you a front-row seat to macroeconomics. When the Federal Reserve Chair Jerome Powell clears his throat during a press conference, these charts react before he even finishes his sentence. It’s wild.

The data comes from exchanges like the NYSE and Nasdaq. However, what you see on a free site like Yahoo Finance or Google might be delayed by 15 minutes unless you’re paying for a Pro feed or using a brokerage platform like Charles Schwab or Interactive Brokers. Those 15 minutes are an eternity in finance. If you’re trying to trade the news, a delayed chart is basically a history book, not a live tool.

The Noise vs. The Signal

Most of what you see on a 1-minute or 5-minute live chart is pure noise. It’s static.

High-frequency trading (HFT) algorithms dominate the micro-movements. These bots trade in milliseconds, sniffing out liquidity and "stop losses." If you’re a human trying to compete with a bot on a live chart, you’ve already lost. Expert investors like Howard Marks often talk about the "pendulum" of market sentiment. On a live chart, that pendulum swings fast.

📖 Related: Top Class Action Settlement Claims You Might Actually Be Owed Money For Right Now

One common mistake? Over-indexing on the "VWAP" or Volume Weighted Average Price. While it’s a great tool for seeing where the big money is playing, it can make a stagnant market look like it’s about to explode. You have to step back. Look at the daily or weekly trend before you obsess over the 60-second candles.

The Metrics That Actually Matter

If you’re staring at the chart, don’t just look at the price. Look at the Relative Strength Index (RSI) and the VIX.

The VIX is often called the "fear gauge." When the US index live chart starts heading south and the VIX shoots up above 20 or 30, you aren't just looking at a price correction; you're looking at panic. Conversely, if the index is climbing but volume is thin, that move might be "hollow." It’s like a house built on sand. It looks good until a light breeze—or a slightly higher-than-expected CPI print—knocks it over.

- Breadth is key. Is the S&P 500 rising because all 500 stocks are doing well, or is it just being dragged up by "The Magnificent Seven"?

- Support and Resistance. These aren't magic lines. They are psychological barriers where buyers previously stepped in or sellers gave up.

- The Yield Curve. Keep an eye on the 10-year Treasury. Often, the index chart will move in the opposite direction of bond yields. When yields spike, tech stocks (Nasdaq) usually feel the pain first because their future earnings become less valuable in today's dollars.

Misconceptions About "Live" Data

People think "live" means "predictive." It doesn't.

A us index live chart tells you where the market is, not where it is going. A common trap is the "Gambler’s Fallacy"—thinking that because the Dow has been green for six days straight, it must be red today. The market doesn't have a memory. It doesn't "owe" you a reversal.

Another weird thing is the "Pre-market" and "After-hours" sessions. You’ll see the index moving at 4:00 AM EST. While this can provide a hint of what's coming, the volume is so low that a single large trade can skew the entire chart. Don't bet your mortgage on a pre-market move that hasn't been confirmed by the opening bell at 9:30 AM.

How to Actually Use This Information

If you want to use a us index live chart effectively, you need a system. Stop chasing the green bars.

First, identify the regime. Are we in a "risk-on" environment where people are buying everything, or is the market "defensive," moving into staples and utilities? You can see this by comparing the S&P 500 to the Equal Weight S&P 500 (RSP). If the standard index is beating the equal-weight version, the rally is top-heavy and potentially fragile.

Second, check the economic calendar. Know when the "Big Data" drops. Non-Farm Payrolls, FOMC meetings, and Inflation data (CPI/PCE) are the gravity that holds the charts down. If you’re watching a live chart during these releases, expect "slippage." That’s when the price moves so fast your order gets filled way further away than you intended.

Honestly, for most people, the best way to watch a live chart is... not to watch it constantly. Check the close. Check the major levels. The "intra-day" wiggles are designed to shake you out of good positions.

Actionable Steps for Navigating Live Charts

- Switch your view. Stop looking at line charts. Use Candlestick charts. They show you the "open," "high," "low," and "close" for every time period. It tells a much better story of the battle between buyers and sellers.

- Set alerts. Instead of staring at the screen for eight hours, set price alerts at key levels (like the 200-day moving average). Let the market come to you.

- Watch the 'Tick' index. If you have access to it, the $TICK shows how many stocks are ticking up versus down at that exact second. It’s the ultimate "vibe check" for the trading floor.

- Correlate with Currency. If the US Dollar (DXY) is ripping higher, it usually puts a lid on how high the US indices can go. Strong dollar = harder for multinationals to report big profits.

- Use Multiple Timeframes. Always have a 4-hour or Daily chart open next to your live feed. It keeps you grounded so you don't mistake a tiny bump for a mountain.

The reality of the us index live chart is that it's a tool, not a crystal ball. It requires discipline to look at a plunging red line and realize it might just be a healthy retracement in a long-term bull market. Or, conversely, to see a massive spike and realize it’s a "bull trap" before a larger sell-off. Context is everything. Without it, you're just watching numbers change on a screen.

Keep your eyes on the macro, but keep your emotions on a leash. The chart will always be there tomorrow.

Next Steps for Mastery

Start by identifying the current "Price Action" relative to the 50-day moving average on your preferred index. If the live price is significantly above this line, the market is extended; if it's below, it's struggling. Cross-reference this with the "Put/Call Ratio" to see if retail traders are getting too bearish or too bullish. Finally, clean up your screen. Remove any indicators you don't actually understand. A cluttered chart leads to a cluttered mind, and in the live markets, clarity is the only thing that pays.