If you walked into a room of 100 people representing the entire country and tried to divvy up a giant pile of cash based on how things actually look right now, it would get awkward fast. One person—just one—would be sitting on nearly a third of the entire pile. Meanwhile, the fifty people on the other side of the room would be huddled together, trying to figure out how to split a tiny 2.5% sliver of the loot.

It sounds like a exaggeration. Honestly, I wish it were. But the latest data from the Federal Reserve shows that wealth distribution in the United States has reached a point where the top 1% of households hold about $45 trillion in assets. That’s more than the bottom 90% combined.

We talk about the "wealth gap" so often that the phrase has basically lost its punch. It’s become background noise. But when you look at the numbers for 2025 and 2026, the shift is pretty startling. We aren't just looking at a "rich getting richer" story anymore; we're looking at a fundamental change in how Americans build—or lose—their net worth.

Why the Wealth Gap is Morphing

For decades, the "American Dream" was built on an earnings-based model. You work a job, you save some money, you buy a house, and you retire. Simple, right?

Not anymore.

Basically, we've shifted to an investment-based model. Today, the real money isn't in what you earn at your 9-to-5; it's in what you own. If you owned a home or a portfolio of stocks before the massive price surges of the early 2020s, you’re likely doing okay. If you didn't? You're chasing a target that's moving at 100 miles per hour.

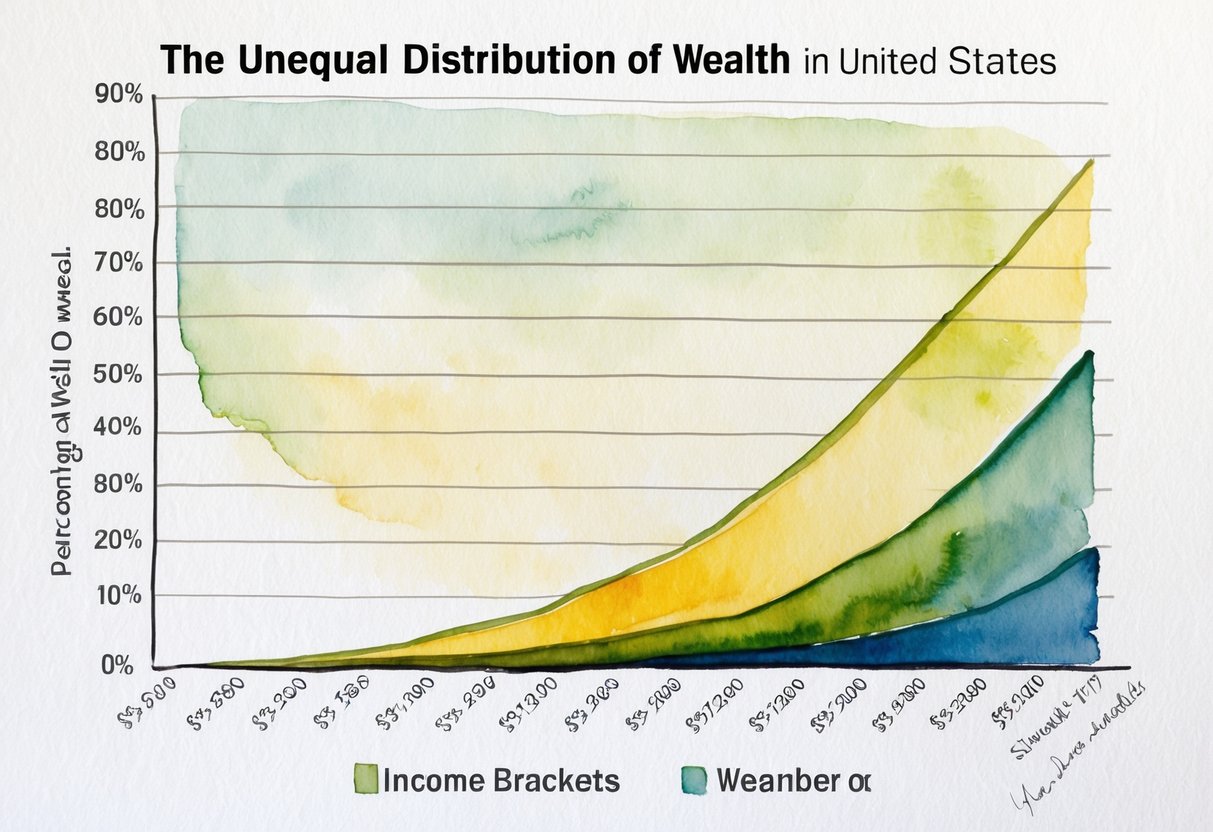

Recent reports from the St. Louis Fed highlight that as of late 2024, the top 10% of households held about 67% of total household wealth. The bottom 50%? They’re hovering around 2.5%. That's a massive disconnect. And while the median household net worth did see a bump recently—reaching about $192,700 in some datasets—that average is heavily skewed by the astronomical gains at the very top.

The Age Factor: A Generational Tug-of-War

You’ve probably heard the jokes about Boomers and their houses. Well, the data backs it up. Wealth is heavily concentrated in the hands of older Americans. Households over the age of 60 now hold about 65% of all wealth in the U.S.

- Baby Boomers: They hold a massive 51.1% share of total wealth ($85.4 trillion).

- Gen X: Sitting at about 26.1%.

- Millennials & Gen Z: Despite being the largest chunk of the workforce, they only hold about 10.7%.

It’s not just that older people have had more time to save. It’s that they were able to buy into the market when the "buy-in" price was a fraction of what it is today. A house that cost $150,000 in the 90s might be worth $600,000 today. That's "unearned" wealth created by market forces, and it's a huge driver of the current disparity.

What Most People Get Wrong About "The Rich"

There’s a common myth that the wealthy are all Wall Street bankers or heirs to massive oil fortunes. Honestly, that's rarely the case.

According to research from the Cato Institute and other analysts, many of the wealthy in the top 1% or 5% are actually small to medium-sized business owners, doctors, and lawyers. However, the ultra-wealthy—the top 0.1%—are a different breed. For this tiny group (about 134,000 households), their wealth is mostly in equities and private businesses. They own about $11 trillion in stocks alone.

Compare that to the bottom 50%. For them, wealth isn't a stock portfolio; it’s a house. And while a house is a great asset, it’s not liquid. You can't easily sell a bedroom to pay for a medical emergency. This is why the bottom half of the country is so much more vulnerable to economic shocks. They have "house-rich, cash-poor" syndrome.

The Education Divide

Education used to be the great equalizer. It still helps, but the "wealth premium" for a college degree has become skewed.

🔗 Read more: 5 Penn Plz New York NY 10001: The Real Story Behind Midtown's Massive Pivot

A report from the St. Louis Fed shows that households headed by a four-year college graduate have vastly more wealth than those without. In fact, a household with just "some college" holds only about 30 cents for every dollar held by a college-grad household. But here’s the kicker: even with a degree, if you’re starting with massive student debt, your "net worth" can be negative for decades.

The Racial Wealth Gap is Actually Growing

Despite a lot of talk about progress, the gap between White families and families of color hasn't just stayed the same—it’s widened in many areas.

In 2022, the average White family had about $1.4 million in wealth. For Black families, that number was $211,596. For Hispanic families, $227,544. This isn't just about current income; it's about the "intergenerational transmission chain." Basically, it’s easier to get rich when your parents can help with a down payment or leave you an inheritance.

Duke University researchers Fenaba Addo and her colleagues have pointed out that even when you compare families with the same education and income levels, White families still tend to have significantly more wealth. Why? Because they are more likely to receive "unearned" transfers like gifts or inheritances that act as a financial safety net.

2025 and 2026: The New Economic Reality

So, where are we now?

Net worth for U.S. households actually hit a record high of $167.3 trillion in mid-2025. On paper, America is richer than it’s ever been. But that "wealth" is mostly sitting in the stock market and real estate. If you don’t own a piece of those two pies, you aren't feeling the record-highs. You're feeling the 10% increase in your grocery bill.

The "wealth multitasker" is a new term coming out of research by firms like Empower. It describes people—mostly Millennials—who are working a main job, running a side hustle, and aggressively investing in an attempt to catch up. They are saving at higher rates than previous generations did at their age, but they're starting from a much deeper hole.

Actionable Insights: How to Navigate the Gap

If you’re not in that top 1% (and let’s be real, most of us aren't), the landscape feels daunting. But understanding the wealth distribution in the United States can actually help you make better moves.

1. Prioritize "Owning" Over "Earning"

Since we are in an investment-based economy, focus on acquiring assets that appreciate. This doesn't mean you have to buy a $500,000 house tomorrow. It means utilizing 401(k) matches, looking into fractional real estate, or even just consistent low-cost index fund investing. The goal is to get your money into the "ownership" side of the ledger.

2. Watch the "House-Rich" Trap

If 90% of your net worth is in your primary residence, you're at risk. Real estate markets can be volatile. Diversifying into liquid assets (like a Roth IRA or even a high-yield savings account) gives you the flexibility that the bottom 50% often lacks.

3. Leverage Education Wisely

A degree still correlates with higher wealth, but the cost of the degree is the variable you can control. Trade schools and community colleges often lead to high-earning careers without the $100k debt burden that kills net worth.

🔗 Read more: Missouri Gold Buyers and Jewelry: What Most People Get Wrong

4. Understand the Tax Code

The wealthy stay wealthy partly because they understand that capital gains (money made from investments) are often taxed at a lower rate than income (money made from working). Moving as much of your long-term savings into tax-advantaged accounts as possible is one of the few ways a regular person can use the system to their advantage.

Wealth in America isn't just a number; it's a reflection of who has access to the engines of growth. Right now, those engines are mostly running on stocks and property. By shifting your focus from just "getting a raise" to "owning a piece of the market," you're at least playing the same game as the folks at the top of the pile.

The reality of 2026 is that the gap is wide, but it's not invisible. Knowing where the money is parked is the first step in figuring out how to get a vehicle of your own into the lot.

Key Takeaways for Your Financial Strategy

- Asset Allocation: Move toward ownership (stocks, real estate, business) rather than just cash savings.

- Debt Management: High-interest debt is a "wealth killer" that keeps you in the bottom 50% regardless of your income.

- Intergenerational Planning: If you have the means, helping the next generation with "entry-level" wealth (like a college fund or a first home) is the most effective way to break the cycle of disparity.

Sources and References

- Federal Reserve Distributional Financial Accounts (2025 Release)

- St. Louis Fed "State of U.S. Household Wealth"

- U.S. Census Bureau 2024 Income and Poverty Report

- Congressional Budget Office (CBO) Trends in Family Wealth

- Duke University "Setting the Record Straight on Racial Wealth Inequality" (2024)