Buying a car in 2026 feels like a chess match where the board keeps moving. You walk onto a lot, fall in love with a sleek SUV, and then comes the "finance office" talk. If you’re like a lot of people, the name Wells Fargo is going to pop up.

But here’s the kicker: You can’t just walk into a Wells Fargo branch and ask for a car loan anymore.

It’s weird, right? Most big banks want your business directly. Wells Fargo, however, has pivoted entirely to an indirect lending model. This means Wells Fargo auto loan rates are strictly managed through their network of roughly 11,000 dealerships across the country. If you want their money, you have to go through the guy in the pleated khakis at the dealership.

The Mystery of the Current Rate

What are the rates actually looking like right now? Well, because Wells Fargo doesn't publish a "sticker price" for their interest rates on their website, it’s a bit of a moving target.

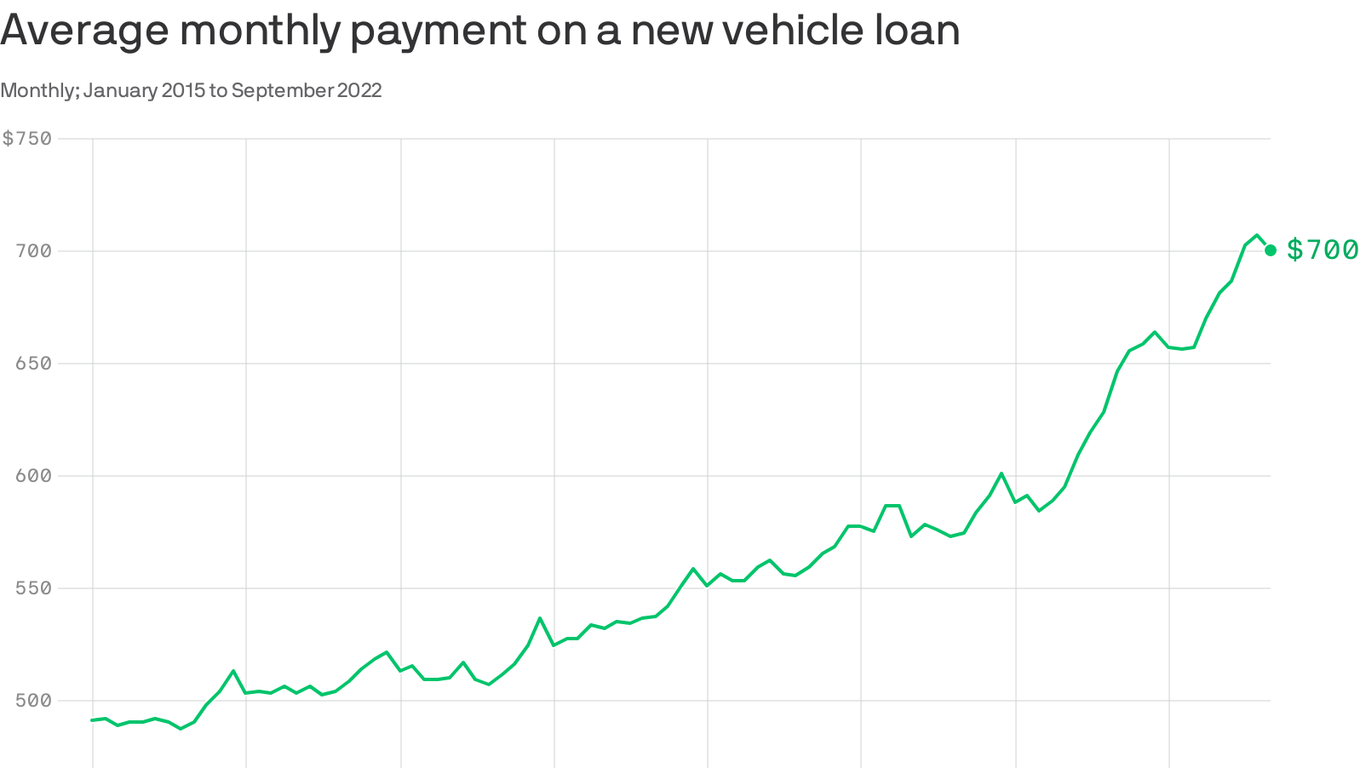

As of January 2026, the broader market has seen a slight stabilization, but "good" rates are still hovering in that 6.5% to 8.5% range for new cars if your credit is stellar. If you’re looking at used vehicles, expect that to jump. Some third-party data suggests Wells Fargo’s floor might start around 7.2% to 7.5% for top-tier borrowers, though dealer markups can easily push that higher.

Wait, dealer markups?

🔗 Read more: Why What is a House Brand Matters More Than the Name on the Label

Yeah. Since you aren't dealing with the bank directly, the dealership acts as the middleman. They might get a "buy rate" from Wells Fargo—say, 7.0%—and then quote you 8.0%. That extra 1% is profit for them. It’s a standard industry practice, but it’s why you’ll never see a flat rate advertised on the Wells Fargo homepage.

Who Actually Gets Approved?

Wells Fargo is notoriously tight-lipped about their minimum credit score. However, they aren't exactly a "subprime" haven.

Generally, if your FICO is under 660, you’re going to have a tough time getting a competitive offer here without a co-signer. They look at the whole picture:

- Debt-to-Income (DTI): If more than 50% of your money goes to bills, they’ll likely pass.

- The Car Itself: They have limits on mileage (usually capped around 125,000) and the age of the vehicle.

- Loan-to-Value (LTV): They don't want to lend $40,000 on a car that’s only worth $30,000.

Honestly, if your credit is in the "Fair" bucket (580–669), you might get an offer, but the APR will probably make you wince. We’re talking potentially 15% or higher. At that point, you have to ask if the car is worth the interest.

Why You Can't Refinance with Them

One of the biggest gripes people have is that Wells Fargo doesn't offer auto refinancing.

If you have a high-interest loan from another bank and you want to move it to Wells Fargo because you already have a checking account there, you're out of luck. They only do purchase-money loans through dealers.

It’s a specific niche. They want to be the engine behind the dealership’s finance office, not a consumer-facing refinance shop. If you’re looking to lower your monthly payment on an existing car, you’ll need to look at Capital One, Chase, or a local credit union instead.

The "Convenience" Trap

If you already bank with Wells, the temptation is real. Seeing your car loan right next to your savings account in the app is super convenient. You can set up Autopay with one click.

But convenience has a cost.

Because you can't get a pre-approval from Wells Fargo before you go to the lot, you have zero leverage. You’re essentially at the mercy of whatever the dealer’s finance manager tells you. Expert tip: Get a pre-approval from a credit union first. Then, when you’re at the dealership, ask them, "Can Wells Fargo beat this 6.8% I already have?"

Often, they can. But they won't unless you ask.

What the Fine Print Doesn't Tell You

There are a few quirks about how Wells Fargo handles these loans that catch people off guard:

- Due Date Changes: You can change your payment due date, but only once during the life of the loan. And you have to have made at least one full payment first.

- The "Grace Period" Myth: Some customers report that while there’s a small window before a late fee hits, Wells Fargo can be aggressive with collections calls if you’re even a few days behind.

- Simple Interest: These are simple interest loans. This is actually a good thing. If you pay extra toward your principal every month, you’ll pay less interest over time. There’s no penalty for paying the car off early.

Real Talk: Is it a Good Deal?

It depends on your leverage. Wells Fargo is a massive, stable institution. Their mobile app is top-tier. If you value having all your finances under one roof and you have the credit score to demand a sub-8% rate, it’s a solid choice.

✨ Don't miss: Tease and Thank You: Why This Forgotten PR Strategy Still Wins Sales

However, if you just take the first rate the dealer offers you without shopping around, you’re probably overpaying. The lack of transparency in their rate structure is a feature, not a bug—it allows for flexibility at the dealership level, which doesn't always favor the buyer.

Practical Next Steps for Your Car Search

If you're heading to a dealership and suspect they'll use Wells Fargo, do these three things first:

- Check your FICO score through the Wells Fargo app (if you're a customer) or a free service. If you're under 700, be prepared for higher rates.

- Secure a "Floor" Rate: Get a written pre-approval from a direct lender or credit union. This is your "shield" against dealer markups.

- Ask for the "Buy Rate": When the dealer says "I can get you 8.5% through Wells," ask them what the actual buy rate from the bank was. They might not tell you, but it lets them know you're savvy.

- Verify the VIN: Ensure the car fits Wells Fargo's criteria (usually under 10 years old and under 125k miles) before you get your heart set on it.

By walking in with your own financing options, you turn the "finance office" from a place where you're sold a product into a place where you're negotiating a business deal.