You've probably seen the signs while walking past a branch or noticed the tab in your mobile app. A Wells Fargo certificate of deposit feels like the "safe" bet. It’s familiar. It’s a stagecoach icon we’ve known for decades. But honestly, if you’re just looking for a place to park your cash and forget about it, you might be leaving a significant amount of money on the table.

Banking is weird right now.

Interest rates have been on a roller coaster, and while online banks are shouting about 5.00% APY from the rooftops, the big traditional players like Wells Fargo tend to play a different game. They rely on "relationship" rates. This basically means if you already have a Way2Save or a Prime Checking account, they might give you a slightly better deal. If not? You're often looking at "Standard" rates that are, frankly, a bit of a letdown.

The Reality of a Wells Fargo Certificate of Deposit Today

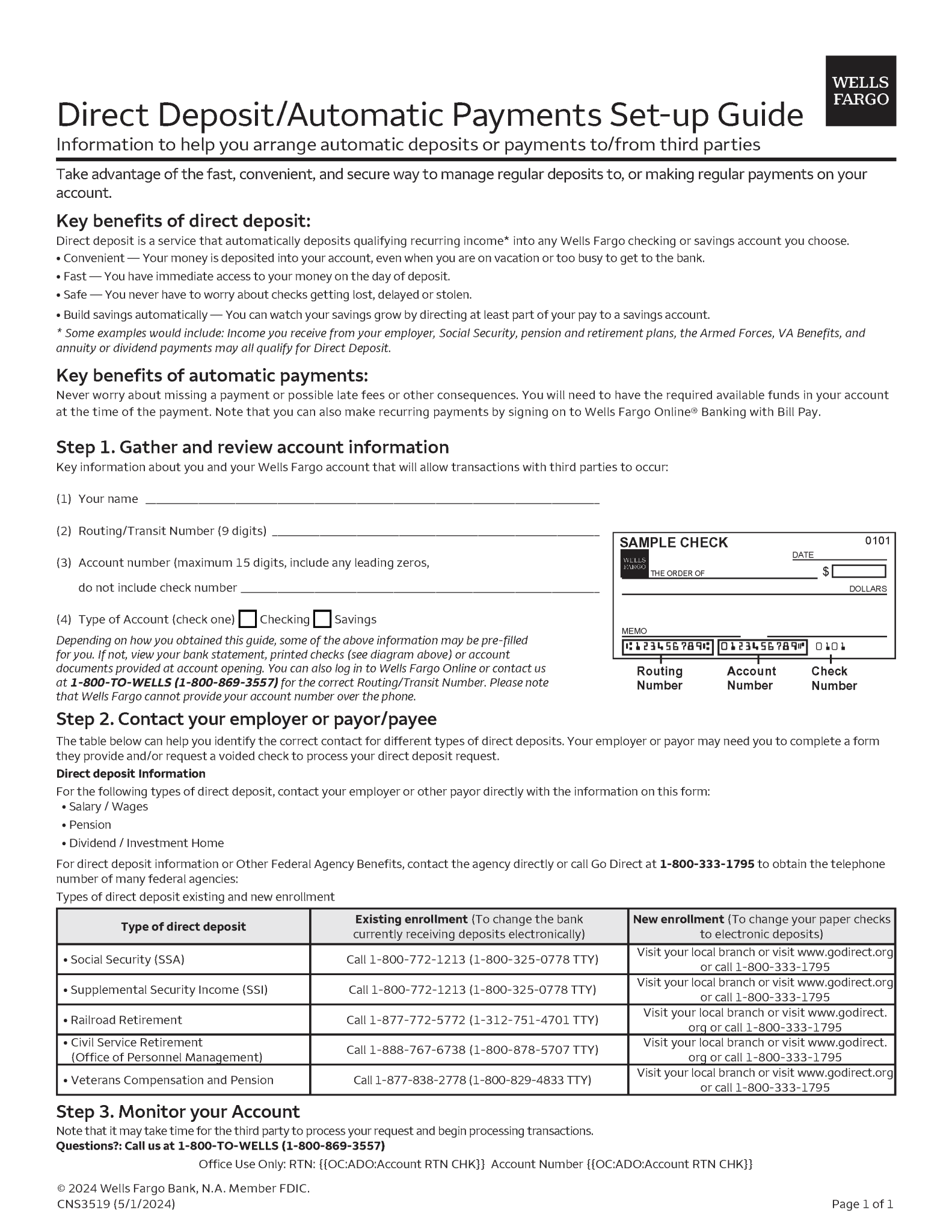

When you open a Wells Fargo certificate of deposit, you’re making a trade. You give them your money for a fixed term—maybe 4 months, maybe 5 years—and they promise not to change your interest rate. It’s a locked-in deal. If the economy tanks and rates drop elsewhere, you’re sitting pretty. But if you need that money early? That’s where they get you.

Wells Fargo typically breaks their CDs into two main camps: Standard and Special Fixed Rate.

✨ Don't miss: Gallons to Barrels Oil: Why the Number 42 Still Rules the Market

The Specials are where the actual action is. Usually, these have odd-numbered terms, like 4, 7, or 11 months. They do this because it’s easier for their internal math, but for you, it means a significantly higher yield than the "Standard" 1-year CD. For example, a Standard 12-month CD at a big bank often pays a fraction of a percent. It's almost insulting. However, their Special Fixed Rate CDs can sometimes compete with the middle-of-the-pack online banks, especially if you have $5,000 or more to deposit.

What’s the Catch with the Minimums?

Most Wells Fargo CDs require a $2,500 minimum opening deposit.

That’s a hurdle.

If you’re a college student or just starting an emergency fund, that $2,500 barrier is annoying. Contrast that with digital-first banks like Ally or Capital One, where you can often start with $0. Wells Fargo is clearly aiming for a specific demographic here—people who already have a chunk of change sitting in a low-interest savings account and just want to "upgrade" it without the hassle of moving money to a new institution.

Understanding the "Relationship" Bump

Here is how the bank keeps you locked into their ecosystem. They offer something called a "Relationship Interest Rate." To get this, you usually need to link your CD to a qualifying Wells Fargo checking account.

Is it worth it?

Sometimes. The bump is usually small—maybe 0.05% or 0.10%. It’s not going to buy you a yacht. But over a $50,000 deposit on a 24-month term, that extra fraction of a percent adds up to a nice dinner or two. If you already bank there, it’s a no-brainer to ask for the relationship rate. If you don't? Don't open a checking account just for the CD bump. The monthly maintenance fees on the checking account will likely eat your interest gains alive.

The Penalty Trap

We have to talk about the early withdrawal penalties because they are brutal. If you put money into a Wells Fargo certificate of deposit and suddenly your car’s transmission explodes three months later, you’re going to pay.

For terms less than 90 days (which are rare), the penalty is one month's interest. For terms between 90 days and 12 months, you lose 3 months of interest. If you go long-term—over 24 months—you could lose a full 12 months of interest. The scary part is that if you haven't even earned that much interest yet, the bank takes it out of your principal. You could actually end up with less money than you started with.

That’s why you never, ever put your "true" emergency fund in a CD. Keep that in a liquid savings account.

Step-Downs and Renewals: The Silent Profit Killers

This is the part that most people miss in the fine print.

When your CD matures, Wells Fargo gives you a "grace period." Usually, it’s about 7 days. During this week, you can pull your money out or add more. If you do nothing? The bank automatically renews your CD.

📖 Related: The Customer Service Trends Nobody Talks About

But here’s the kicker: it doesn't always renew at that sexy "Special" rate you signed up for. If you had an 11-month Special CD, it might renew into a standard 12-month CD with a much lower rate. I’ve seen people lose half their earning power overnight because they forgot to check their mail or login to their portal during that 7-day window.

- Mark your calendar. Set a phone alert for 10 days before maturity.

- Check the new rate. Don't assume it stays the same.

- Compare. Look at what Marcus or SoFi are offering that same week.

Comparison: Big Bank vs. The Internet

Let's look at the landscape. If you go to a site like Bankrate or NerdWallet, you'll see "High-Yield" CDs. These are almost always from online banks.

Why does Wells Fargo stay lower? Because they have branches. Thousands of them. They have to pay for the lights, the tellers, and the armored trucks. Online banks don't. So, when you buy a Wells Fargo certificate of deposit, you are essentially paying a "convenience tax." You're paying for the ability to walk into a building and talk to a human named Gary if something goes wrong.

For some people, Gary is worth 1%. For others, Gary is an expensive luxury they don't need.

The Laddering Strategy

If you're dead set on staying with Wells, consider "laddering." Instead of putting $10,000 into a 5-year CD, you could do:

- $2,500 in a 6-month CD.

- $2,500 in a 12-month CD.

- $2,500 in an 18-month CD.

- $2,500 in a 24-month CD.

Every six months, one of your CDs matures. This gives you cash flow and protects you from being locked into a low rate if interest rates suddenly spike across the country. It’s a hedge. It’s smart.

Is Wells Fargo FDIC Insured?

Yes. Completely. This is the one area where there is zero stress. Your deposits are insured up to $250,000 per depositor, for each account ownership category. If the bank literally vanished tomorrow, the federal government has your back. This makes a Wells Fargo certificate of deposit infinitely safer than "investing" in your cousin's crypto startup or even buying certain corporate bonds. It’s boring, and in the world of finance, boring is often a good thing for your sleep quality.

The Impact of Inflation

We have to be real here. If a CD is paying 4% and inflation is running at 4%, you aren't actually making money. You're just treadmilling. You're maintaining your "purchasing power."

That’s the limitation of any fixed-income product. CDs are not wealth-builders; they are wealth-protectors. If you have a goal three years away—like a house down payment—a CD is great. If you’re saving for retirement thirty years away? A CD is a terrible choice compared to a diversified stock portfolio, even with the market volatility.

How to Open One Without Getting Scammed

It sounds weird to say "scammed" by a major bank, but I'm talking about the "upsell." When you go into a branch to open a Wells Fargo certificate of deposit, the banker is often incentivized to pivot you toward other products.

They might suggest an annuity or a managed investment account.

🔗 Read more: Converting 1 KWD to EGP: Why the Numbers on Your Screen Might Be Lying to You

Stay focused.

If you want a CD, get the CD. Read the Truth in Savings disclosure. Look specifically for the "Annual Percentage Yield" (APY), not just the "Interest Rate." The APY accounts for compounding, which, at Wells Fargo, is usually done daily and credited monthly.

Actionable Steps for Your Cash

If you're sitting on a pile of cash and Wells Fargo is your primary bank, don't just click "open" on the first offer you see.

First, log into your online banking and look for "Special" offers. These are frequently hidden or require a specific link. If you don't see anything above 4%, call your local branch and ask if there are "in-branch only" specials. Banks sometimes give local managers a little leeway to retain customers who are threatening to move their money to a competitor.

Second, compare the 7-month vs. the 12-month. Often, the shorter term pays significantly more. It's counter-intuitive, but it's how big banks manage their short-term liquidity needs.

Third, decide on your "exit strategy." If you think you might need the money, look into a "No-Penalty CD." Wells Fargo occasionally offers these, though they are less common than at banks like CIT or Ally. A no-penalty CD lets you break the term after a short waiting period (usually 6 days) without losing your interest.

Finally, set a hard exit date. If you are using a Special Rate CD, the moment it matures, the "honeymoon" rate is over. Be prepared to wire that money out to a high-yield savings account or a different bank's CD special the day your term ends. Staying loyal to a matured CD is the fastest way to let the bank win and your wallet lose.

Move your money with intention. Wells Fargo is a tool—make sure you're the one using it, rather than the other way around.