You’re standing at the counter, pen in hand, feeling that weird pressure of a line forming behind you. It’s just a piece of paper, right? But if you mess up what a check should look like, you’re looking at a bounced payment, a frustrated landlord, or worse, a fraud vulnerability that leaves your bank account gasping for air. Even in 2026, where we tap our phones for everything from lattes to Teslas, the physical check refuses to die. High-value transactions, contractor payments, and even some government agencies still demand that familiar rectangular slip.

Honestly, most of us haven't written one in months. It's easy to forget the anatomy.

A legitimate check from a major institution like Chase, Wells Fargo, or a local credit union has a very specific "face." If it looks off, it probably is. Banks use standard layouts governed by the American National Standards Institute (ANSI), specifically the X9 committee. This ensures that the machines—those high-speed sorters that whir in the back of processing centers—can actually read your handwriting. If your check doesn't meet these unspoken visual rules, it might as well be a napkin.

👉 See also: New York State Taxes Due: Why April 15 Isn't the Only Date You Need to Know

The Basic Anatomy of a Valid Check

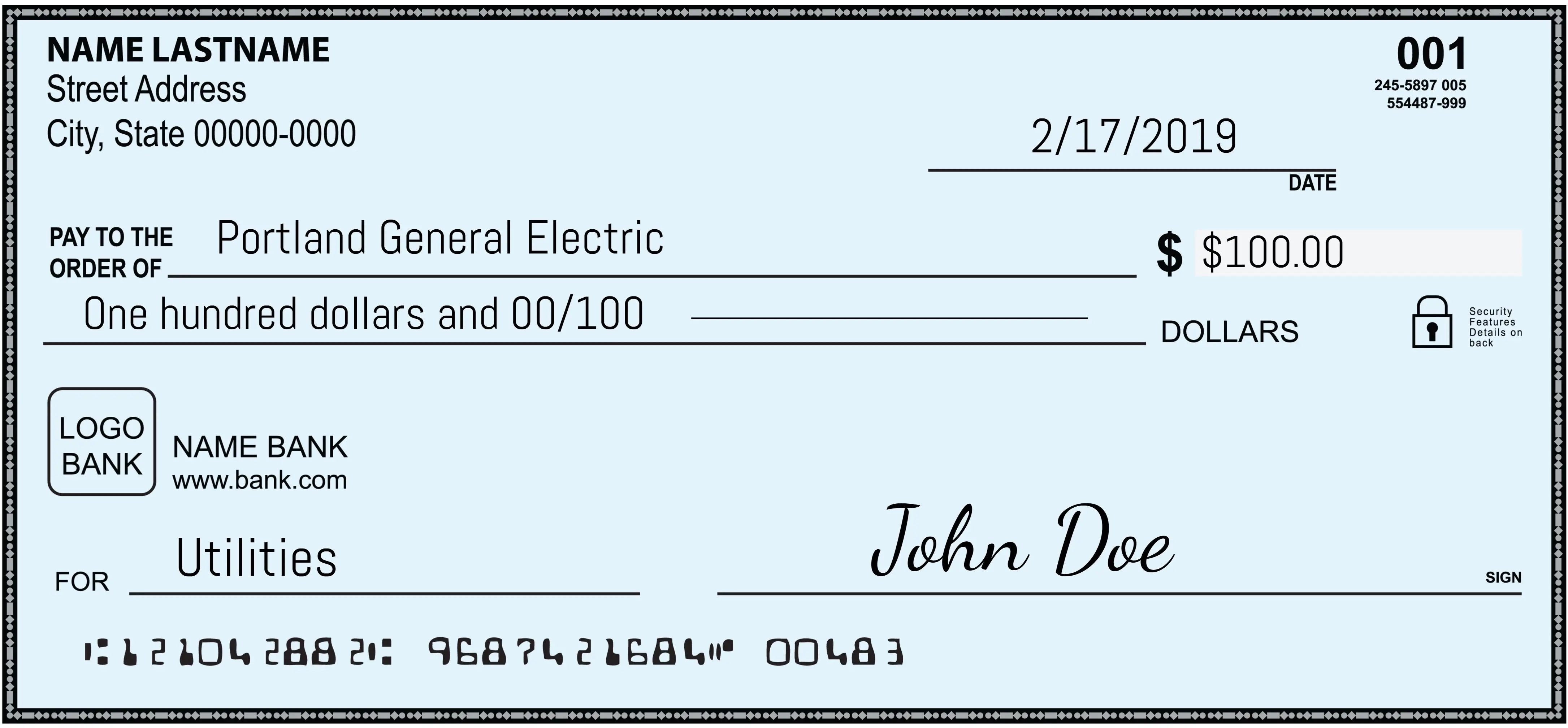

Let's start with the top left. This is your "Personal Information" zone. It’s got to have your name and address. Some people include their phone number, but honestly, that's just giving identity thieves an extra data point they don't need. If you're using a business account, this is where the registered business name and the professional address live.

Look at the top right. That’s where the check number sits. It’s usually a three or four-digit number. It helps you track your spending, sure, but it also helps the bank identify if you’re trying to deposit the same check twice. If that number is missing or looks like it was printed with a dying inkjet printer, red flags should be flying.

Then there’s the date line. It’s simple.

But people mess it up.

In the U.S., we use Month/Day/Year. If you’re sending money abroad or using an international bank, they might expect Day/Month/Year. Always write it clearly. If you post-date a check—meaning you put a future date on it because you don't have the funds today—be careful. Most banks can legally cash it the moment they see it, regardless of the date you scribbled on there.

The Money Lines: Where Most People Trip Up

There are two places to write the amount. This is redundant for a reason.

First, there’s the small box on the right side. This is for the numerical amount. You’ve got to be precise here. Use a decimal point. If it’s for a flat hundred dollars, write "100.00." Don't leave a gap between the dollar sign and the numbers. Why? Because someone with a steady hand and a black pen can easily turn " 100.00" into "9100.00."

Next is the line below the "Pay to the Order of" section. This is the legal line.

Technically, if the number in the box and the words on the line don't match, the bank is supposed to go by the words. If you write "One Hundred Dollars" but put "1,000" in the box, the recipient is only getting a hundred bucks. Use the word "and" only before the cents. For example: "One Hundred Twenty-Five and 50/100." Then, draw a thick line through the remaining empty space all the way to the word "Dollars" printed on the edge. This prevents anyone from adding extra words like "and nine thousand." It sounds paranoid until it happens to you.

Understanding the MICR Line at the Bottom

What a check should look like at the very bottom is the most critical part for bank security. This is called the MICR line (Magnetic Ink Character Recognition). If you run your finger over it on a real check, you might feel a slight texture. That ink contains iron oxide. It’s magnetic.

The MICR line consists of three distinct sets of numbers:

- The Routing Number: This is a nine-digit code that identifies your bank. The first two digits usually indicate which Federal Reserve district the bank is in.

- The Account Number: This is your specific ID. It varies in length depending on the bank.

- The Check Number: This should match the number in the top right corner.

If these numbers look like a standard Arial font, the check is fake. They use a very specific, blocky typeface (usually E-13B or CMC-7) that machines can read even if you’ve spilled coffee on the paper.

Why the Memo Line is a Trap (and a Tool)

The memo line in the bottom left is basically the only part of the check that the bank doesn't care about. You could write "For the best pizza ever" or "Alimony for my ex," and the bank will still process it. However, for your own records—and for the IRS—it’s gold.

If you're paying a utility bill, put your account number there. If you’re paying a contractor, specify the project, like "Kitchen Tile - Final Payment." This creates a legal paper trail. If the contractor later claims you didn't pay for the grout, you have a canceled check image with that memo line as evidence.

Security Features You Should See

Modern checks aren't just paper. They are high-tech documents. If you hold a check up to a bright light, you should see a watermark. This is an image pressed into the paper fibers during manufacturing. You can't just print a watermark with a home printer.

Look for a "Microprint" line. Often, the line where you sign your name isn't actually a solid line. If you look at it under a magnifying glass, it’s actually a string of tiny words, usually "Authorized Signature" or the name of the bank, repeated over and over. Photocopiers can't replicate that level of detail; they just turn it into a blurry solid line.

Chemical sensitivity is another big one. High-quality checks are treated so that if someone tries to use bleach or ink eradicator to change the name or amount, the paper will actually change color or "void" marks will appear. It’s like a silent alarm system built into the pulp.

What a Voided Check Should Look Like

Sometimes an employer or a gym asks for a "voided check" to set up direct deposit or auto-pay. You don't just hand them a blank check. That’s dangerous.

To do it right, write "VOID" in large, bold letters across the front. Write it big enough that it covers the amount box, the signature line, and the legal amount line. Do not cover the MICR line at the bottom! The whole point of the voided check is so the company can scan those routing and account numbers. If you black those out, the check is useless for its intended purpose.

The Back of the Check: The Endorsement Zone

Turning the check over, you’ll see a section at the top that says "Endorse Here." This is where the recipient signs. But if you are the one writing the check, you leave this blank.

If you are receiving a check and want to be safe, don't just sign your name. If you sign it and then drop it on the sidewalk, anyone who finds it can technically cash it. Instead, write "For Deposit Only" followed by your account number and then your signature. This is called a "Restrictive Endorsement." It tells the bank that this money has only one place to go: your account.

Practical Steps for Handling Checks Today

If you’re about to write a check, take a breath. Don't rush it. Use a gel pen with "fraud-resistant" ink if you can; Uniball 207 is a classic recommendation among security experts because the ink contains pigments that trap themselves in the paper fibers, making it nearly impossible to "wash" the check.

- Double-check the recipient's name. Make sure it's exactly how it appears on their ID or business license. "Jon Smith" vs "John Smith" can cause a week of headaches.

- Keep a ledger. Whether it’s the physical book in your checkbook or a digital spreadsheet, record the check number and the amount immediately.

- Store them securely. A blank check is a signed permission slip to your life savings if it falls into the wrong hands. Don't leave your checkbook in your car or a common area at work.

- Monitor your "Pending" transactions. Most banks now show you a digital image of the check once it’s been cashed. Check it against your records once a week. If the signature looks like a chicken scrawled it and you didn't, call the bank's fraud department immediately.

The reality is that checks are slower and riskier than digital transfers, but they remain a staple of the financial world. Knowing exactly what a check should look like—from the microprinting to the MICR line—is your first line of defense against being a victim of fraud. Take the extra ten seconds to fill it out correctly. It’s much cheaper than a $35 overdraft fee or a drained account.