Trade wars used to feel like something out of a history book. Not anymore. If you’ve been watching the news lately, you’ve probably seen the headlines about "reciprocal" taxes and "border enforcement" and wondered how it actually hits your wallet or your business. Honestly, the situation with what are Canada’s tariffs on US goods has become a bit of a moving target over the last year. It’s a mess of retaliatory strikes, exemptions, and tense negotiations as we head into the 2026 CUSMA review.

Basically, Canada and the U.S. are in a high-stakes staring contest. While the two countries are technically part of a free-trade agreement, that hasn't stopped a flurry of surtaxes from flying across the 49th parallel.

The Current State of Canada's Tariffs on US Goods

Right now, if you are importing something from the States, you aren't necessarily paying a tariff. Most trade—about 85% of it—still moves across the border duty-free thanks to the CUSMA (USMCA) agreement. But for that other 15%, things have gotten expensive.

As of January 2026, Canada maintains a 25% surtax on a specific list of U.S. goods. This wasn't an unprovoked move. It’s a direct response to the U.S. slapping 50% tariffs on Canadian steel and aluminum and a 35% tariff on most non-energy exports. Canada’s strategy has been "measured and reciprocal." They aren't trying to start a full-scale trade war, but they aren't rolling over either.

What exactly is being taxed?

The Canadian government has been very surgical about this. They don't want to hurt Canadian manufacturers who need U.S. parts, so they’ve avoided taxing "intermediate" goods where possible. However, the heavy hitters are still on the list:

- Steel and Aluminum: This is the big one. If it’s U.S.-origin steel—think pipes, tubes, or flat-rolled sheets—there’s almost certainly a 25% tax on it.

- Vehicles: There is a 25% tariff on U.S.-made cars and trucks that don't meet strict CUSMA "rules of origin" requirements.

- Specific Consumer Goods: While many were lifted in late 2025, several categories still face scrutiny depending on the latest "Customs Notices" from the CBSA.

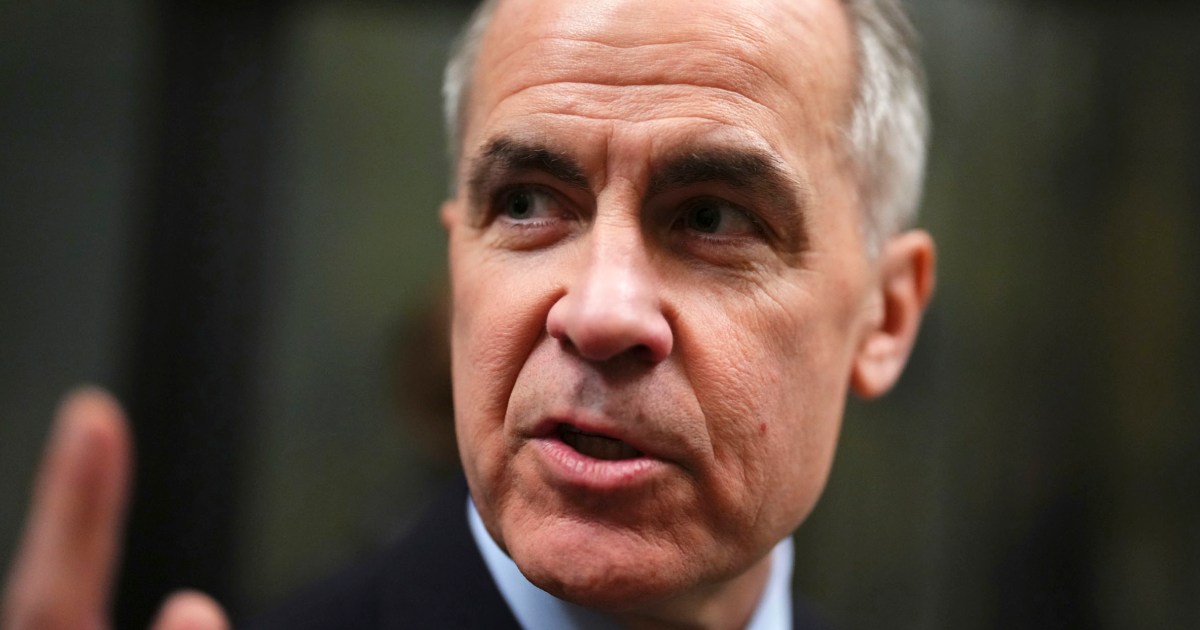

It’s worth noting that Prime Minister Mark Carney’s government actually lowered some of the heat in September 2025. They dropped tariffs on about $44 billion worth of U.S. goods to show "good faith." But because the U.S. didn't budge on steel or autos, Canada kept those specific taxes firmly in place.

✨ Don't miss: 260 USD to INR: Why the Exchange Rate You See Isn't What You Get

The CUSMA Loophole: Why Origin Matters

Here is where it gets kind of tricky. People often think "imported from the US" means "made in the US." It doesn't.

If you buy a piece of equipment from a warehouse in New York, but that equipment was actually manufactured in Germany or Japan, Canada’s retaliatory tariffs usually don't apply. The tax is based on the Country of Origin, not the shipping point. This is why the Canada Border Services Agency (CBSA) has been so aggressive lately with their 2026 "verification priorities." They are checking the paperwork to make sure importers aren't just slapping a U.S. label on something to try and dodge (or accidentally pay) the wrong tax.

Interestingly, even for U.S.-made goods, if they are "CUSMA-compliant"—meaning they meet the very specific regional content rules of the trade deal—they are often exempt. The trade war is mostly targeting the stuff that falls outside those lines.

Why This Matters for 2026

We are currently in a "lame duck" period for trade certainty. The CUSMA agreement is scheduled for a mandatory joint review in July 2026. President Trump has already called the deal "irrelevant," which has sent shockwaves through Ottawa.

The Canadian government is currently setting aside billions in contingency funds (Alberta alone has a $2 billion "tariff fund") just in case things get worse. If the 2026 review goes south, we could see Canada expand its list of taxed U.S. goods to include things like:

- Dairy and Poultry: Always a massive flashpoint.

- Digital Services: Taxes on U.S. tech giants like Netflix and Google.

- Lumber and Paper: A classic "tit-for-tat" sector.

The "De Minimis" Headache

One thing that has changed for the average person is how much you can buy online without getting hit by fees. The U.S. effectively killed their "de minimis" treatment for many low-value shipments. Canada hasn't fully matched the U.S. move yet, but the CBSA is much stricter about collecting duties on anything over $20 (or $40 for most shipping methods) coming from the States. If you're ordering from a U.S. site, you've probably noticed that "shipping and handling" fee has jumped. A lot of that is actually the courier pre-paying these trade-war-related duties.

Navigating the Costs

So, if you’re a business owner or a frequent cross-border shopper, what do you do? Honestly, the best move right now is to double-check the "Harmonized System" (HS) codes for whatever you're bringing in.

You should also look into the Duties Relief Program. If you import U.S. steel, pay the 25% tariff, use it to build a machine in Canada, and then export that machine to Europe, you can actually get that 25% back. It’s a lot of paperwork, but in a world where margins are thin, it’s basically mandatory for survival.

✨ Don't miss: Converting 6000 HKD in USD: Why the Peg Makes This Math Different

Actionable Steps for Importers:

- Verify Origin Documents: Don't just take a supplier's word for it. Get a formal Certificate of Origin to ensure you aren't paying surtaxes on goods that should be exempt.

- Monitor CBSA Customs Notices: These updates happen fast. A product that was tariff-free in December could be on the list by February.

- Audit Your Supply Chain: If you're paying a 25% premium for U.S. aluminum, it might be time to look at domestic Canadian suppliers or partners in Mexico.

- Prepare for July 2026: Treat the upcoming CUSMA review as a volatility event. Lock in prices or diversify your sourcing before the negotiations reach a fever pitch this summer.

Ultimately, Canada's tariffs on U.S. goods are a tool of diplomacy, not just a tax. They are designed to be painful enough to force a deal, but not so painful that they break the Canadian economy. Whether that balance holds through the rest of 2026 is the multi-billion dollar question.