You're staring at a Metatrader screen. The numbers are flickering like a neon sign in a rainstorm, and suddenly, you see someone on a forum bragging about bagging "50 pips" on a GBP/USD scalp. If you're new to the world of currencies, you might feel like you've walked into a room where everyone is speaking a dialect you haven't mastered yet. Honestly, it’s just jargon. But it’s jargon that determines whether you’re buying a steak dinner or eating ramen for a week.

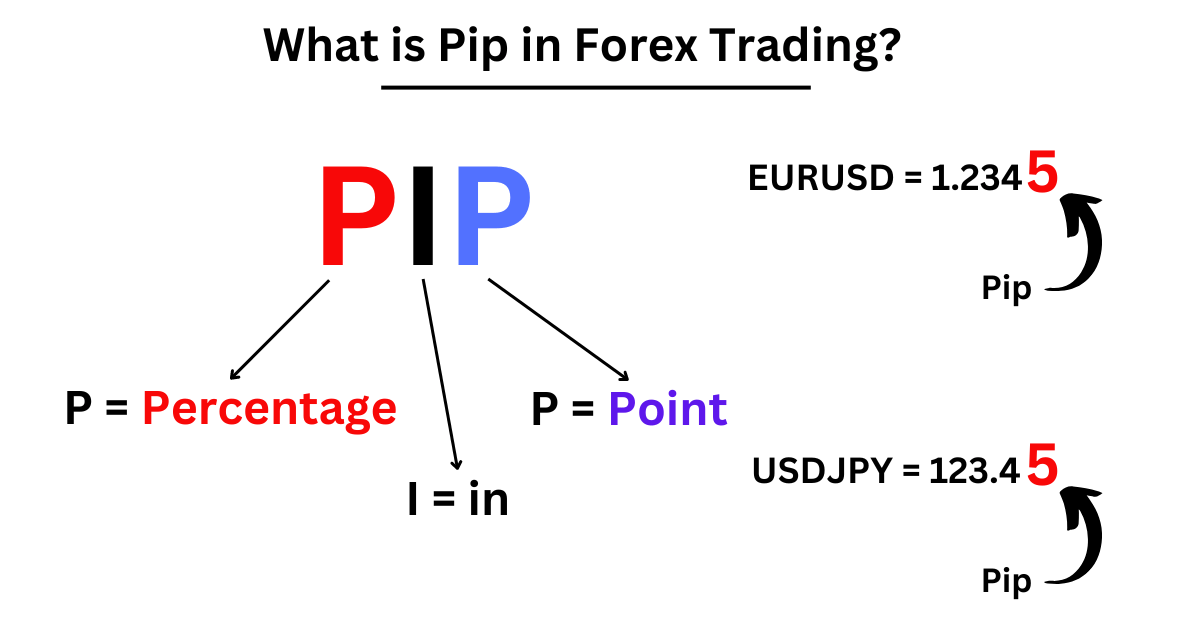

What does pip mean in the simplest possible terms? It’s the smallest price move that a given exchange rate makes based on market convention. Most people think of money in two decimal places—dollars and cents. In the forex world, we go deeper. We’re looking at the fourth decimal place. That tiny, microscopic increment is your pip.

The Math Behind the Micro-Movements

A pip stands for "percentage in point" or "price interest point." If the EUR/USD moves from 1.0850 to 1.0851, that 0.0001 rise is one pip. It sounds like nothing. It feels like nothing. But when you’re trading a standard lot of 100,000 units, that single digit change is worth ten bucks.

The vast majority of currency pairs are priced to four decimal places. However, there's always an outlier. The Japanese Yen (JPY) is the black sheep of the family. Because the Yen’s value is so much lower relative to the Dollar or Euro, pips are calculated at the second decimal place. So, if the USD/JPY climbs from 148.20 to 148.21, that’s your pip move right there.

👉 See also: Blue Cross Blue Shield Net Worth: What Most People Get Wrong

Fractional Pips: The "Pipettes"

Brokers love precision. Nowadays, most platforms don't stop at four decimal places; they add a fifth. This is called a pipette. Think of it like a "deci-pip." If you see a tiny superscript number at the end of a price quote, like 1.1052[3], that "3" is the pipette. It allows for tighter spreads and more competitive pricing, though most traders just round it off in their heads to keep from going crazy.

Why the Value of a Pip Changes Everything

Here is where it gets slightly complicated, but stick with me. The value of a pip isn't a fixed number across the board. It depends on two main things: the currency pair you're trading and the size of your position.

If your account is in USD and the "base" currency (the second one in the pair) is also USD—like in the EUR/USD—the pip value is usually fixed at $10 for a standard lot. But if you’re trading the USD/CHF, the pip value fluctuates based on the current exchange rate of the Swiss Franc. You have to do some mental gymnastics or, more realistically, use a calculator.

- Standard Lots: 100,000 units of currency. One pip usually equals $10.

- Mini Lots: 10,000 units. One pip equals $1.

- Micro Lots: 1,000 units. One pip equals $0.10.

If you’re just starting, please, for the love of your bank account, start with micro lots. Seeing a 20-pip loss take away $200 in three minutes is a psychological gut-punch that most beginners can't handle. Seeing it take away $2? That's just the cost of an education.

The Spread: The Toll Booth of Forex

You can't talk about pips without talking about the spread. This is how brokers get paid. When you look at a quote, you’ll see the "Bid" and the "Ask." The difference between them is the spread, measured in pips.

If the Bid is 1.2000 and the Ask is 1.2002, the spread is 2 pips. The moment you click "buy," you are technically down 2 pips. You need the market to move in your favor just to break even. High-liquidity pairs like the "Fiber" (EUR/USD) usually have razor-thin spreads, sometimes less than one pip. Exotic pairs, like the USD/TRY (Turkish Lira), can have spreads so wide you could drive a truck through them. Be careful there.

Risk Management and Stop Losses

Experienced traders don’t think in dollars; they think in pips and percentages. When someone says they have a "20-pip stop loss," they mean that if the market moves 20 pips against them, the trade automatically closes. This is the only way to survive in this game.

Imagine you have a $5,000 account. You decide you only want to risk 1% per trade ($50). If your trade setup requires a 50-pip stop loss to give the price room to breathe, you calculate your lot size so that those 50 pips equal exactly $50. This is how the pros do it. They don't gamble; they manage math.

Common Misconceptions About Pips

A lot of people think more pips equals more profit. Not necessarily. A "scalper" might aim for 5 to 10 pips per trade, but they use massive position sizes. A "swing trader" might hold a trade for a week aiming for 200 pips but with a much smaller position size.

✨ Don't miss: Why the 2 inch three ring binder is still the king of office organization

At the end of the day, the profit might be the same. The difference is the strategy and the time spent staring at candles.

Also, don't get confused by "points." In some platforms, especially those dealing with indices like the S&P 500 or Gold, they use "points" instead of pips. While the concept is similar—measuring the smallest price move—the valuation is totally different. Always check your broker's contract specifications before you hit that "Place Order" button.

How to Actually Use This Information

Knowing the definition is step one. Step two is application. When you're looking at a chart, identify the "Average Daily Range" (ADR). This tells you how many pips a pair usually moves in a 24-hour period.

If the GBP/JPY has an ADR of 150 pips and it has already moved 140 pips today, the odds of it moving another 50 pips in that same direction are statistically low. It’s "exhausted." Understanding pips helps you realize when you're late to the party.

- Download a Pip Calculator: Don't try to do the math in your head, especially with JPY pairs or crosses like EUR/GBP. Use a free tool from sites like Myfxbook or BabyPips.

- Check the Spread at News Time: During major events like the Non-Farm Payrolls (NFP), spreads can balloon from 1 pip to 20 pips in a heartbeat.

- Focus on the Fourth Digit: Forget the fifth digit (the pipette) for now. Focus on the fourth. That's your "unit" of measurement for success or failure.

Taking the Next Steps

To turn this knowledge into actual profit, you need to see it in action. Open a demo account with a reputable broker. Look at how the "Profit/Loss" column changes as the price ticks up and down.

- Observe the difference between the EUR/USD and the USD/JPY pip movements.

- Practice setting a stop loss exactly 15 pips away from your entry.

- Calculate your "Cost of Trade" by multiplying the spread in pips by your lot size.

Trading is 10% execution and 90% risk management. If you master the pip, you master the math of the market. Without that math, you aren't trading—you're just clicking buttons and hoping for the best, which is a very expensive way to spend an afternoon.