You’re sitting there, staring at a stack of W-2s or maybe a messy spreadsheet of 1099 income, and the deadline just... passes. It happens. Life gets messy, or maybe you’re just broke and the thought of seeing that "Amount You Owe" line makes you want to crawl under a rock. Most people think the IRS has a giant "arrest" button they hit the second midnight strikes on Tax Day. They don't. But what actually happens if I don't file my taxes is a slow-motion car crash that gets more expensive every single month you let it slide.

Honestly, the IRS isn't looking to throw you in jail immediately. That’s a movie trope. What they really want is your money, and they are incredibly patient about getting it—with interest.

The Failure to File Penalty is a Total Budget Killer

If you owe the government money and you don't send in that return, you're looking at the Failure to File penalty. This is the big one. It’s way worse than the penalty for just not paying. The IRS basically charges you 5% of the unpaid taxes for each month or part of a month that a tax return is late. This keeps stacking up until it hits 25% of your total unpaid tax bill.

Let's say you owe $5,000. If you’re five months late, you’ve just added $1,250 to your bill for absolutely no reason other than paperwork delay. If you're more than 60 days late, the minimum penalty is either $485 (for returns due in 2024-2026) or 100% of the unpaid tax, whichever is less. It's steep. It's meant to hurt.

🔗 Read more: Charlie Kirk Net Worth Breakdown: What Most People Get Wrong

Why the "Failure to Pay" Penalty is Actually Friendlier

There is a huge distinction here that most people miss. If you file your return but don't have the cash to pay, the penalty is only 0.5% per month. Look at those numbers again. 5% for not filing vs 0.5% for filing but not paying. The math says you should always, always file the paperwork even if your bank account is sitting at zero. You are literally paying a 10x premium just for being silent.

The IRS Will Eventually File for You (And Not in a Good Way)

If you stay quiet long enough, the IRS does something called a Substitute for Return (SFR). They aren't doing you a favor. They take the information they have from your employers (W-2s) or clients (1099s) and calculate your tax bill themselves.

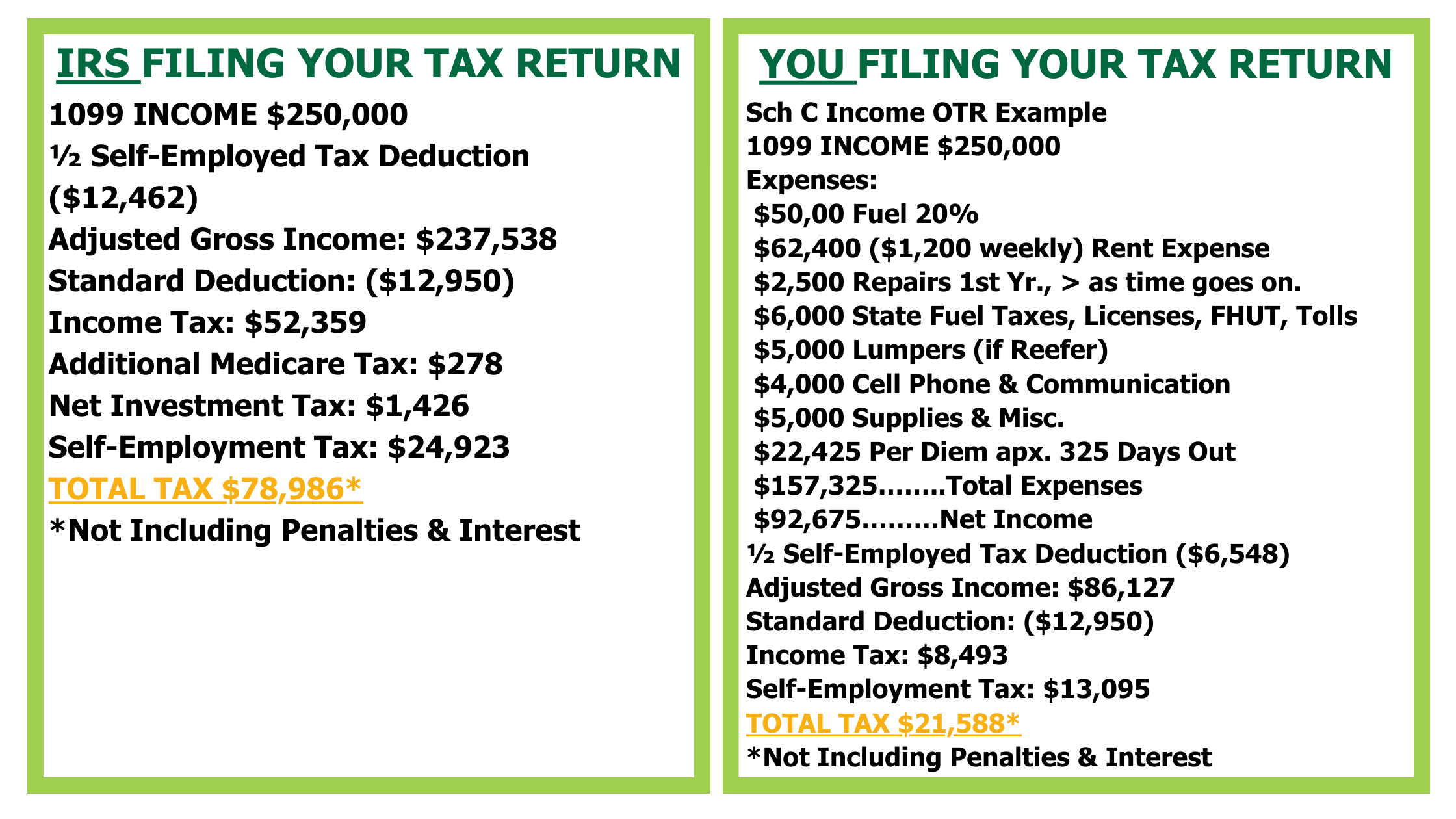

Since they don't know your life, they give you the bare minimum. They won't give you credit for that home office, they won't look for your student loan interest deductions, and they definitely won't figure out your "Head of Household" status if it benefits you. They'll likely file you as "Single" or "Married Filing Separately" with the standard deduction. You end up owing way more than you actually should have. It’s the most expensive tax return you’ll ever "file."

The Myth of the "Missing" Refund

Here is the weird part. If the government actually owes you money—maybe you overpaid through your payroll withholdings—there is no penalty for filing late. The IRS isn't going to punish you for letting them keep your money longer.

But there is a ticking clock. You have a three-year window to claim that refund. According to the IRS, billions of dollars in refunds go unclaimed every year because people simply didn't file. If you haven't filed for 2022, you’ve got until 2025 to grab that cash. After that, the money legally becomes the property of the U.S. Treasury. You're basically giving a voluntary donation to the government. Don't do that.

👉 See also: Dow Jones US Completion Index: Why You Might Be Missing the Rest of the Market

When Does This Become a Legal Nightmare?

We have to talk about the "C" word: Criminal.

For the vast majority of Americans, not filing is a civil matter. You pay fines, you lose your refund, maybe they levy your bank account. But willful failure to file is technically a federal misdemeanor. If the IRS can prove you intentionally evaded taxes—like hiding income in offshore accounts or using fake Social Security numbers—it moves into felony territory.

According to the U.S. Department of Justice Tax Division, they usually reserve criminal prosecution for high-income earners or people engaged in "tax protestor" schemes. If you’re a regular person who just got overwhelmed, you’re likely facing a financial crisis, not a prison cell. But that doesn't mean you should test their patience.

The Loss of "Financial Passport" Status

Not filing your taxes ripples into parts of your life that have nothing to do with the IRS.

- Buying a House: Good luck getting a mortgage. Lenders almost always demand two years of tax transcripts. No return, no house.

- Student Aid: If you’re trying to get FAFSA for college, you need tax info.

- Passports: Under the FAST Act, if you owe "seriously delinquent" tax debt (currently over $62,000 for 2024-2026 inflation-adjusted figures), the IRS can notify the State Department. They can then revoke your passport or deny your application. You are literally grounded.

Real World Scenario: The Freelancer Who Froze

Take a "hypothetical" freelancer—let's call him Mark. Mark made $80,000 in 1099 income but didn't set aside money for taxes. April came, he saw he owed $15,000 in self-employment tax, panicked, and did nothing.

Two years later, Mark wants to buy a car. He realizes he needs his records. He checks his mail and finds a "Notice of Intent to Levy." Because he didn't file, his $15,000 debt has ballooned to nearly $22,000 once you factor in the 25% failure-to-file penalty and the compounded interest. If Mark had just filed the return and set up a payment plan, he would have saved thousands.

How to Fix It (The "Get Out of Jail" Strategy)

If you are currently behind, don't just send a random check. There’s a process.

First, gather your documents. If you lost your W-2s, you can actually request a "Wage and Income Transcript" from the IRS website for free. It shows everything reported under your name.

Second, file the original return. Even if it’s three years late. Use the forms for the specific year you missed—don't use 2025 forms for a 2023 debt.

💡 You might also like: Current price of silver in troy ounces: What most people get wrong about this 2026 rally

Third, ask for "First-Time Penalty Abatement." This is the secret weapon. If you’ve been on top of your taxes for the three years prior to your "miss," you can often get the IRS to waive the failure-to-file and failure-to-pay penalties just by asking. You still owe the tax and the interest, but the penalties vanish.

Payment Plans are Your Best Friend

The IRS is actually a very flexible lender. They offer Installment Agreements. You can often set up a plan online in ten minutes that lets you pay off the debt over six years. As long as you are paying something and communicating, they usually leave your paycheck and your bank account alone.

Moving Forward and Staying Clean

What happens if I don't file my taxes is ultimately a choice between a manageable monthly payment and a looming financial disaster. The IRS has a 10-year statute of limitations to collect tax debt, but that clock doesn't even start ticking until you file the return. If you never file, they can technically come after you forever.

Immediate Next Steps:

- Check your transcript: Go to IRS.gov and create an "ID.me" account to see what the government thinks you owe.

- File "As-Is": Get the return in the mail this week. Stop the 5% monthly penalty clock immediately.

- Consult a CPA or Enrolled Agent: If you owe more than $10,000, don't DIY this. Professionals can often negotiate an "Offer in Compromise" where you pay less than the full amount if you truly can't afford it.

- Adjust your withholding: If you're a W-2 employee, use the IRS Tax Withholding Estimator to make sure you aren't surprised next year.

The fear of filing is almost always worse than the actual filing. The government already knows you made the money; they’re just waiting for you to admit it so they can start charging you interest.