Finding your first credit card feels a bit like trying to pick a lane in heavy traffic. Everyone has an opinion, and most of them are kind of loud. Your parents might tell you to "just get what the bank offers," while your friends are probably bragging about travel points they haven’t actually earned yet.

Honestly? Most people overthink it. They hunt for the "best" card when they should be looking for the "easiest to get without getting ripped off" card.

The truth is that what is a good first time credit card depends entirely on your starting line. Are you a student with zero history? A working professional who just moved to the U.S.? Or maybe someone who accidentally trashed their score years ago and needs a hard reset?

🔗 Read more: State of California Money Owed: Why You Probably Have a Check Waiting

The Reality of the "First Card" Wall

If you have no credit history, most big-name banks won't even look at you. It’s the classic catch-22: you need credit to get credit. But in 2026, the walls are a little lower than they used to be.

Banks have started realizing that "no credit" isn't the same thing as "bad credit." This shift gave birth to the Chase Freedom Rise®. If you can park $250 in a Chase checking account, your odds of approval for this card skyrocket. It’s basically a handshake deal. They see you have some cash, and they give you a real, unsecured card with 1.5% cash back. No deposit is required—just a relationship.

Why Secured Cards Are the "Safety Net"

If the "relationship" route doesn't work, you go secured.

A secured card is basically a credit card with training wheels. You give the bank a deposit—say, $200—and that becomes your credit limit. You aren't "spending" your $200; you're using the bank's money and paying it back, while they hold your $200 in a vault just in case you disappear.

The Discover it® Secured Credit Card is the gold standard here. Why? Because unlike most secured cards that feel like a punishment, this one actually gives you 2% cash back at gas stations and restaurants. Plus, Discover is famous for their "Cashback Match," where they double everything you earned at the end of the first year.

It’s one of the few cards that treats you like a real customer even when you're technically in the "risky" category.

What Is a Good First Time Credit Card for Students?

If you are currently enrolled in school, you have a massive advantage. You have access to "student" versions of top-tier cards. These are generally easier to get and don't require the same income levels as standard cards.

The Capital One Savor Student Cash Rewards is currently a powerhouse for anyone who spends money on food and fun. You get 3% back on dining, grocery stores, and streaming services.

Think about that.

If you're spending $300 a month on groceries and eating out, that’s $9 back every month for doing absolutely nothing. It’s not "get rich" money, but it pays for a few coffees. More importantly, it builds your file with Capital One, a bank that is very happy to increase your limit as you get older.

The "Alternative" Data Revolution

Some companies don't care about your FICO score. They look at your bank account instead.

Cards like the Petal® 2 "Cash Back, No Fees" Visa® use something called "Cash Score." They look at your income and spending habits via your linked bank account. If you’ve been paying your rent on time and keeping a steady balance, they might give you an unsecured card even with a "thin" credit file.

The Petal 2 is particularly great because it has literally zero fees. No late fees, no international fees, no annual fees. It’s designed for people who are afraid of making a mistake.

Features That Actually Matter (And Those That Don't)

When you’re looking at what is a good first time credit card, you’ll see a lot of fine print. Don't get distracted by the shiny stuff.

- The Annual Fee: For your first card, this should be $0. Period. There is no reason to pay a fee to build credit in 2026.

- Credit Bureau Reporting: This is non-negotiable. If the card doesn't report to Experian, Equifax, and TransUnion, it’s a glorified debit card. It won't help your score.

- The Upgrade Path: You want a card that can "grow up" with you. You don't want to have to close your first account in two years because the card sucks. You want a card you can keep open for decades to anchor your credit age.

A Note on the Interest Rate (APR)

Here’s the thing: your first credit card will probably have a terrifying APR. We’re talking 25% to 30%.

It doesn't matter. If you pay your balance in full every single month, the interest rate is 0%. You should treat a credit card like a debit card that has a 30-day delay. If you don't have the money in your bank account today, don't put it on the card. The moment you start carrying a balance, the "rewards" you earned become completely irrelevant because the interest will eat them alive.

The Strategy: How to Actually Get Approved

Don't just go out and apply for five cards at once. That’s a "hard inquiry" spree that makes you look desperate to lenders.

- Check for Pre-approval: Use the tools on the Capital One or Discover websites. They do a "soft pull" that doesn't hurt your score but tells you if you're likely to get the card.

- The $250 Rule: If you want the Chase Freedom Rise®, get that checking account open first. Let the money sit for a month. It proves you aren't living paycheck to paycheck.

- The Authorized User Hack: If your parents have great credit and a card they’ve had for ten years, ask them to add you as an "authorized user." You don't even need to use the card. Their decade of perfect history will often show up on your report, giving you a head start.

Common Pitfalls to Avoid

I've seen so many people get their first card and immediately max it out on a new iPhone. Don't do that.

Your "Credit Utilization" is a huge part of your score. If your limit is $500 and you spend $450, your score will actually drop because it looks like you're struggling. Try to keep your "reported" balance under 10%.

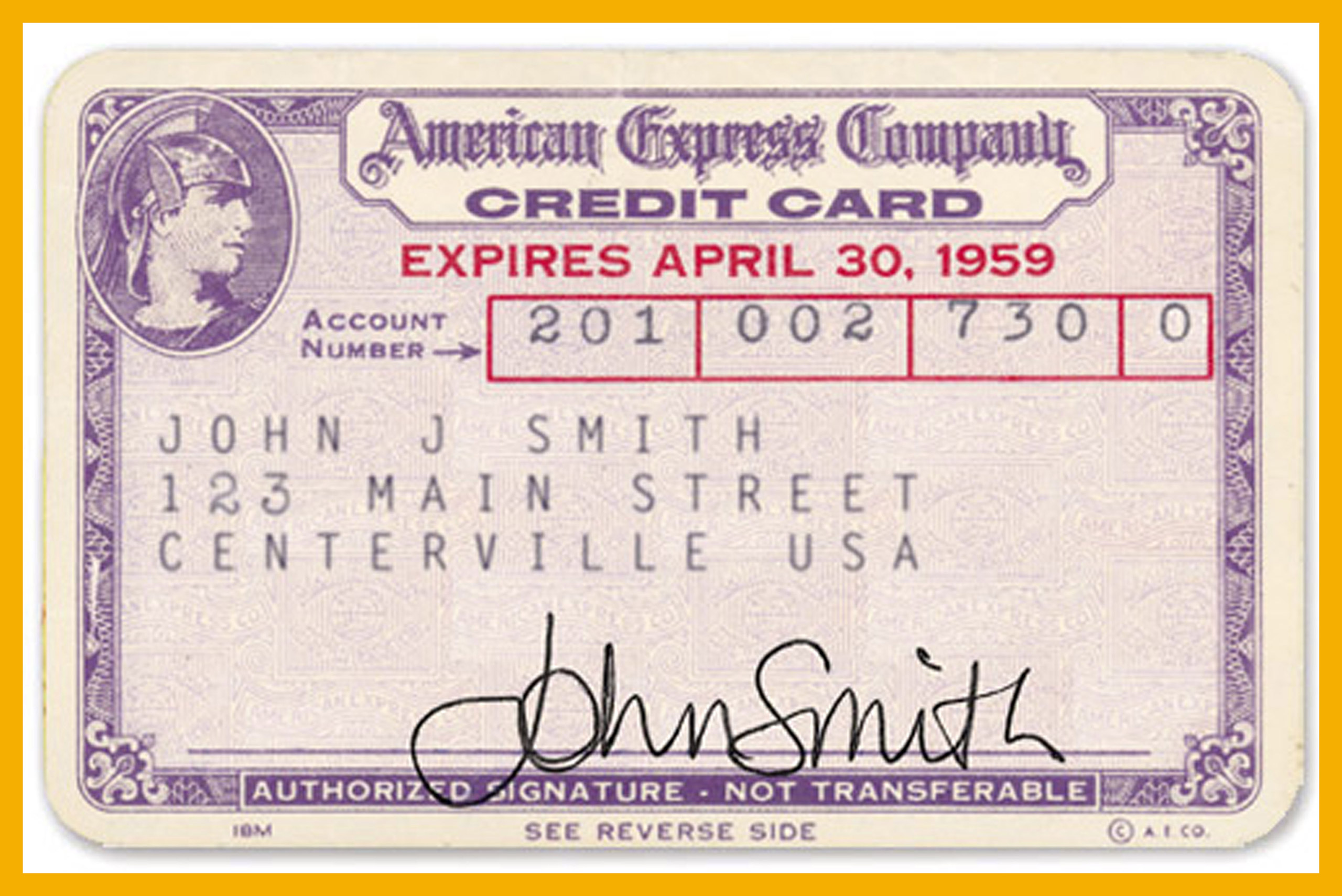

Also, watch out for "Predatory" cards. If you see a card that charges a "monthly maintenance fee" or a "program fee" just to open the account, run away. These are designed to trap people with bad credit. Stick to the big names like Discover, Capital One, Chase, or American Express.

Actionable Steps for Your First Move

If you're ready to jump in, here is the most logical path for most people:

- First Choice: Check for the Capital One Savor Student or Quicksilver Student if you're in college.

- Second Choice: If you have a few hundred dollars in savings, go for the Chase Freedom Rise® (after opening a Chase account).

- The Backup Plan: Apply for the Discover it® Secured. It is almost a guaranteed "yes" if you have the deposit, and it graduates to a "real" card faster than almost any other secured card on the market.

Once you get the card, put one small subscription on it—like Spotify or Netflix—set up Auto-Pay for the full statement balance, and then put the card in a drawer. In six months, you’ll have a credit score that actually opens doors. Building credit is a marathon, not a sprint, and your first card is just the starting gun.