You’ve probably seen the headlines. One week, a report says everyone is getting a massive raise. The next week, another article claims the "middle class" is basically disappearing. It’s enough to give you whiplash. Honestly, figuring out what is average salary in us in 2026 isn't just about looking at a single number. It's a mess of variables—where you live, what you do, and even who you are.

The Bureau of Labor Statistics (BLS) just dropped their latest numbers for the start of 2026, and the "average" is a bit of a moving target. If you look at the mean annual wage across the board, we’re looking at roughly $65,470. But wait. Before you compare that to your last W-2 and feel great (or terrible), we need to talk about the "median."

The median—the actual middle point where half of Americans earn more and half earn less—is sitting closer to $63,795. That’s about $1,214 a week for full-time workers.

📖 Related: Investing in VOO: Why Most People Make It Harder Than It Needs to Be

Why does that $2,000 difference matter? Because the "average" is easily skewed by the guy in the corner office making $5 million a year. The median tells the story of the person standing in line behind you at the grocery store.

The Geography of Your Paycheck

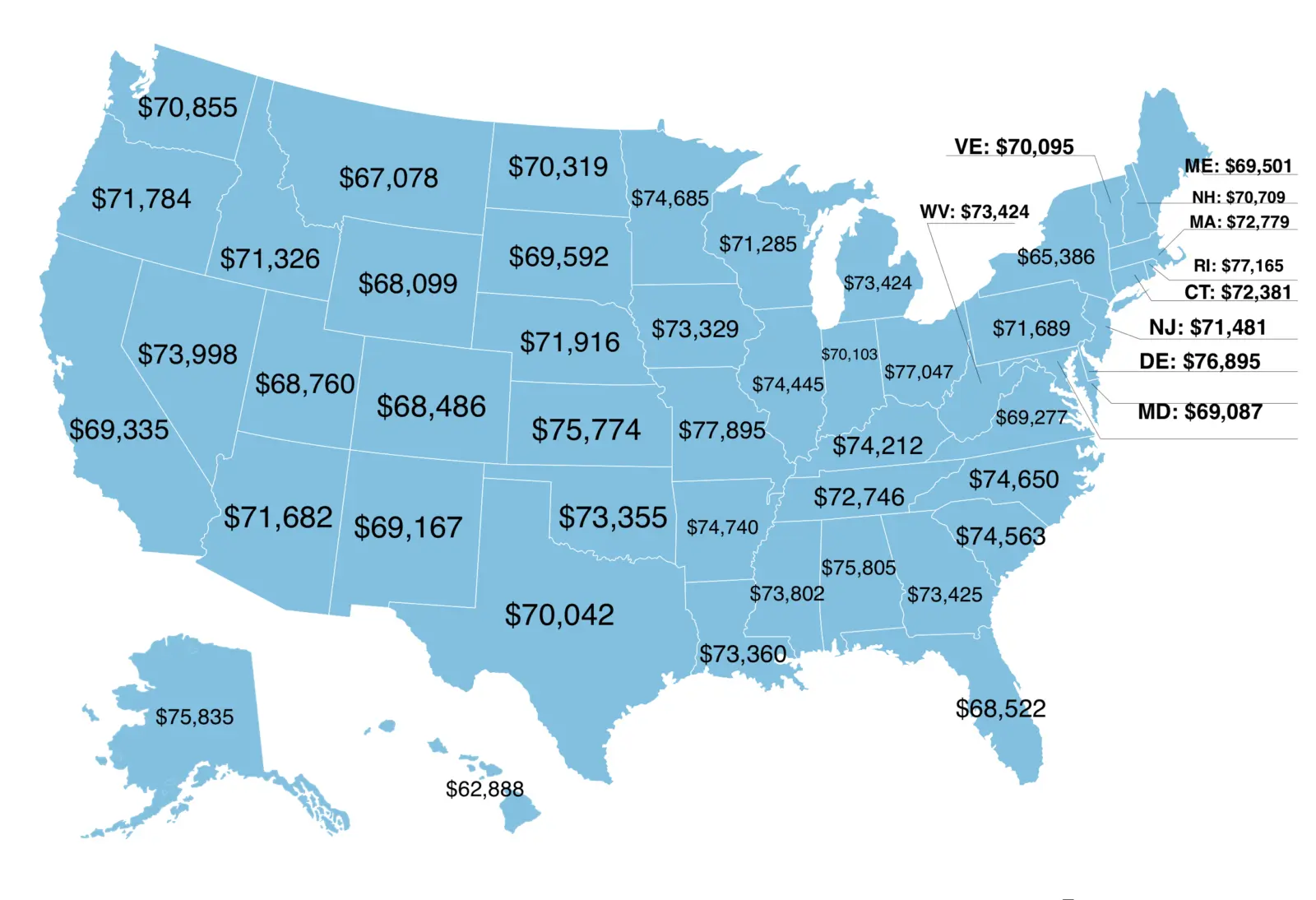

Where you park your car at night has a massive impact on what hits your bank account every two weeks. You can't compare a salary in Jackson, Mississippi, to one in Seattle. It just doesn't work.

In Washington state, the average weekly wage is hovering around $1,489. Meanwhile, in Mississippi, it’s closer to $993. That’s a 50% gap.

Massachusetts remains the heavy hitter for 2026. If you’re working there, the average salary is pushing $80,330. It makes sense when you think about the concentration of biotech, tech, and high-end finance in Boston. But here’s the kicker: New York and California aren't far behind, with averages of $78,620 and $76,960 respectively.

States with the highest average salaries right now:

- Massachusetts: $80,330

- New York: $78,620

- Washington: $78,130

- California: $76,960

- New Jersey: $73,980

Contrast those with places like West Virginia ($52,200) or Arkansas ($51,250). The numbers look lower on paper, but if your rent is $800 instead of $3,500, who is actually "richer"?

What You Do Still Matters Most

Industry is the great divider. If you’re in "Management, Professional, and Related Occupations," the median weekly earnings are hitting $1,912 for men and $1,466 for women. That’s a huge jump from service occupations, where the median for men is $897 and $747 for women.

Information technology and finance are still the gold mines. Data from late 2025 into early 2026 shows workers in the Information sector pulling in an average of $1,996 per week. On the flip side, if you're in leisure and hospitality, you're looking at about $592 per week.

It’s a brutal reality.

💡 You might also like: Why the All Time High Dow Closing Matters More Than Your 401k Balance

Specific roles have seen some interesting shifts lately. Pharmacists are averaging $112,800, while Software Engineers are around $89,200—though that "average" for engineers is notoriously tricky because of how much of their pay comes in stock options rather than base salary.

The Age and Experience Factor

Kinda obvious, but you don't start at the top.

Young workers (16 to 24) are bringing home a median of about $771 a week. By the time people hit the 35 to 44 age bracket, that jumps to $1,385. This is the "peak earning years" window. Interestingly, earnings start to plateau or even slightly dip once you pass age 54.

Education is still the most reliable lever for these numbers.

A bachelor’s degree holder is currently averaging $1,747 a week. Compare that to someone with only a high school diploma at $980. Over a 40-year career, that gap isn't just a number—it's the difference between retiring comfortably and working until you're 80.

The 2026 Reality Check: Inflation vs. Wages

Here is what most people get wrong about the average salary in us. They look at the "nominal" number (the number on the check) and forget the "real" number (what the check actually buys).

For 2026, most employers are keeping salary increases flat—around 3.2% to 3.5% for merit increases. That sounds okay until you realize the Consumer Price Index (CPI) has been rising at nearly the same rate.

Social Security has acknowledged this by bumping the 2026 wage base to $184,500. This is the maximum amount of earnings subject to the 6.2% Social Security tax. The fact that this number keeps rising tells you everything you need to know about where the government thinks "high earners" start.

Actionable Steps for Your Career

Knowing the average is fine, but it doesn't pay your bills. If you're looking to beat the "average salary in us," here is how to actually do it based on current market trends:

- Check the Pay Transparency Laws: If you’re in California or New York, employers are now legally required to give you a "good faith" salary range. Use this. If you’re applying for a job and they won’t give a range, they’re likely trying to lowball you.

- Audit Your Industry: Financial services and high-tech are projecting 3.7% increases this year, while retail and healthcare are lagging at 2.9%. If you're in a low-growth sector, 2026 might be the year to pivot.

- Negotiate Total Compensation: California's new SB 642 law now defines "wages" to include bonuses, stock options, and even travel expenses. When you negotiate, don't just look at the base salary number. Look at the whole pie.

- Location Arbitrage: With remote work still a reality for many, look for jobs based in Massachusetts or Washington while living in a lower-cost state like Ohio or Texas. This is the fastest way to increase your personal "real" wage.

- Skill Up for AI: While AI hasn't gutted salaries yet, Mercer's 2026 data shows that 34% of employers are prioritizing "skill and talent development." They want people who know how to use the tools, even if they aren't hiring "AI specialists" specifically.

The "average" is just a benchmark. Your goal shouldn't be to hit the average—it should be to understand the market forces so you can stay ahead of it.