Language is a mess. If you’ve ever sat in a meeting and felt that sudden prickle of anxiety because a colleague suggested a "biweekly check-in," you aren't alone. You’re probably wondering: does that mean we’re meeting twice a week, or once every two weeks?

Honestly, it could be both.

The word is a linguistic trap. According to the Merriam-Webster Dictionary, biweekly is defined as occurring every two weeks or occurring twice a week. It is a contronym—a word that can mean its own opposite. This isn't just a fun trivia fact for English majors; it’s a genuine nightmare for payroll departments, project managers, and freelance contractors trying to figure out when their next check is hitting the bank.

The Great Confusion: Every Two Weeks vs. Twice a Week

The prefix "bi-" is the culprit here. In some contexts, like "bilingual," it clearly means two. But when applied to time, the English language loses its mind. If you look at the word "biennial," it exclusively means every two years. Yet, "biweekly" refuses to pick a lane.

Usually, in a business and payroll context, biweekly means every two weeks. This is the standard for about 43% of private businesses in the U.S., based on data from the Bureau of Labor Statistics (BLS). If you get paid biweekly, you receive 26 paychecks a year.

But wait.

If you’re talking about a magazine or a newsletter, biweekly often shifts toward the "twice a week" definition. It’s chaotic. Most style guides, including the Associated Press (AP) Stylebook, suggest avoiding the word entirely because it's so prone to misinterpretation. They recommend just saying "every two weeks" or "twice a week" to keep everyone's sanity intact. It’s better to be wordy than wrong.

How Biweekly Payroll Actually Functions

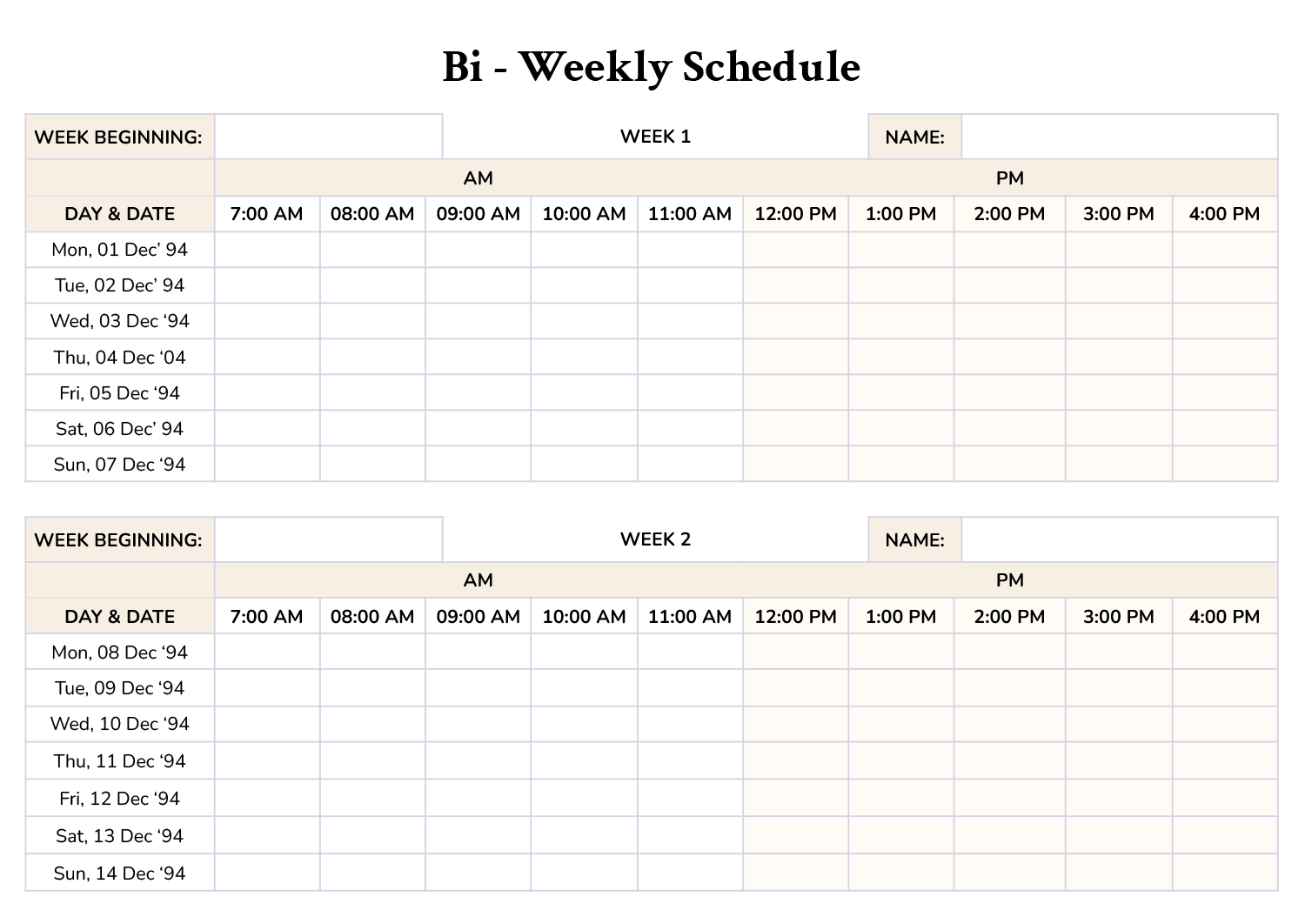

Money changes everything. When a company tells you they operate on a biweekly schedule, they are almost certainly talking about a 14-day cycle.

Why do they do it? It’s predictable. You get paid on the same day, every other week—usually a Friday. This is fundamentally different from a semi-monthly schedule. In a semi-monthly setup, you get paid twice a month, usually on the 1st and the 15th.

The math is where it gets interesting for your budget.

There are 52 weeks in a year. Divide that by two, and you get 26 pay periods. Because most months are slightly longer than four weeks, you’ll eventually hit two months in the year where you receive three paychecks instead of two. People in HR often call these "magic paychecks." Since most of us budget our bills—rent, car payments, insurance—around two checks a month, that third check feels like found money. It’s a great time to shove cash into a high-yield savings account or pay down that credit card balance that's been lingering.

The Employer's Perspective

From a business standpoint, running payroll 26 times a year is slightly more expensive than running it 24 times (semi-monthly). You’re paying processing fees more often. However, it’s often easier for accounting because the pay period always covers exactly 80 hours of work for full-time employees. No prorating for 31-day months or the February weirdness.

Biweekly vs. Semi-monthly: The Subtle War

Don't confuse the two. It happens all the time.

💡 You might also like: TJ Maxx Hourly Pay: What Most People Get Wrong

Semi-monthly means exactly twice a month. 24 checks.

Biweekly means every two weeks. 26 checks.

If you are an hourly employee, biweekly is usually your best friend. It makes calculating overtime a breeze. Overtime is generally calculated on a 40-hour work week. On a biweekly schedule, your pay period aligns perfectly with two work weeks. If you’re on a semi-monthly schedule, pay periods often end in the middle of a week, which makes tracking those extra hours a total headache for the payroll software and the employee.

What About "Bimonthly"?

If you thought biweekly was bad, welcome to the second circle of hell: bimonthly.

Just like its cousin, bimonthly can mean every two months or twice a month. However, in most professional circles, bimonthly has moved toward meaning "every two months." If you have a bimonthly subscription, you’re getting a box six times a year.

If you mean twice a month, the more accurate (and less confusing) term is semi-monthly. But let's be real—nobody uses that word at a dinner party. We just say "every two weeks" and hope for the best.

Why This Ambiguity Exists

It boils down to how prefixes evolved in Latin and Old English. The "bi-" prefix indicates the number two, but it doesn't specify if it's multiplying the frequency or dividing the interval.

Think about it like this:

- Multiplier: Two times per week (Twice a week).

- Interval: Once every two-week block.

Both are technically logical. That’s why the dictionary refuses to take a side. It’s also why your gym might bill you "biweekly" and you end up surprised when 26 payments come out of your account instead of the 24 you mentally budgeted for. Always check the contract. Seriously. If a contract says biweekly, look for a clause that specifies "26 installments" or "every 14 days."

The Psychological Impact of the Biweekly Cycle

There is a rhythm to the 14-day cycle. It’s long enough to feel like you’ve earned the money, but short enough that the "broke" period at the end of the cycle doesn't feel permanent.

For freelancers, "biweekly" is often a goal. Many clients try to push for "Net 30" (payment 30 days after the invoice) or "Net 60." Getting a client on a biweekly billing cycle creates a steady cash flow that mimics a traditional job. It reduces the "feast or famine" cycle that kills so many small businesses.

If you're negotiating a contract right now, try to push for biweekly. It keeps the momentum going. It forces the client to stay on top of their accounts payable, which means you aren't chasing a massive invoice three months down the line.

Actionable Steps to Handle "Biweekly" Situations

Since the word is a mess, you have to be the clear communicator in the room. Don't let the ambiguity mess up your schedule or your bank account.

1. Clarify immediately

The second someone says "biweekly," ask for the specific cadence. "Just to be clear, do you mean twice a week, or every two weeks?" It feels a little pedantic, but it saves hours of missed meetings or late payments later.

2. Map out those "Triple Paycheck" months

If you’re an employee on a biweekly schedule, open your calendar right now. Find the two months this year where you get three Fridays (or whatever your payday is). Mark them. That is your "extra" money. Don't let it just disappear into everyday spending. Plan to use it for a specific goal like a vacation or an IRA contribution.

3. Set your internal clock

If you’re a manager scheduling a "biweekly" meeting, just put it on a recurring calendar invite for every 14 days. If people ask, call it "fortnightly."

The "Fortnightly" Alternative

In the UK, Australia, and many other parts of the English-speaking world, they solved this problem a long time ago. They use the word fortnightly.

A fortnight is fourteen nights—two weeks. It’s elegant. It’s specific. It has zero ambiguity. If you say "fortnightly," everyone knows exactly what you mean. In the United States, however, saying "fortnightly" makes you sound like you’ve spent too much time reading Victorian novels or watching period dramas on PBS.

Still, if you want to be the most precise person in the office, you could try to bring it back. Just don't be surprised if your coworkers look at you funny.

🔗 Read more: Who Moved My Cheese Explained: Why Spencer Johnson’s Simple Parable Still Stings

A Final Note on Avoiding the Trap

Whether you are looking at a payroll schedule, a magazine subscription, or a meeting invite, remember that "biweekly" is a word that requires a follow-up question. In the world of finance and business, it almost always means every 14 days. In the world of casual conversation or publishing, it’s a coin flip.

Don't guess.

If you’re the one writing the memo, ditch the word. Use "twice-weekly" or "every two weeks." Your readers will thank you, and you’ll avoid the inevitable emails from confused employees wondering where their paycheck is.

To manage a biweekly lifestyle effectively, align your largest bills—like your mortgage or rent—with your pay cycle. Some lenders even allow biweekly payments, which can actually help you pay off a 30-year mortgage years earlier because you end up making that extra full payment every year without even noticing it. That’s the power of the 26-check cycle. It’s a subtle shift in math that leads to a massive shift in long-term wealth.

Stop guessing and start counting the 14-day intervals. It's the only way to stay ahead.

Next Steps for You:

Check your 2026 calendar for the "magic" months where your biweekly pay dates land three times. Usually, if your first payday is January 2nd, you'll see those bonuses land in May and October. Use those specific windows to automate a one-time transfer to your savings before you have a chance to spend it.