Honestly, trying to track what the Federal Reserve is doing feels like watching a high-stakes poker game where the players keep changing the rules mid-hand. If you're looking for the quick answer, what is fed funds rate today is currently a target range of 3.50% to 3.75%.

But that number doesn't tell the whole story.

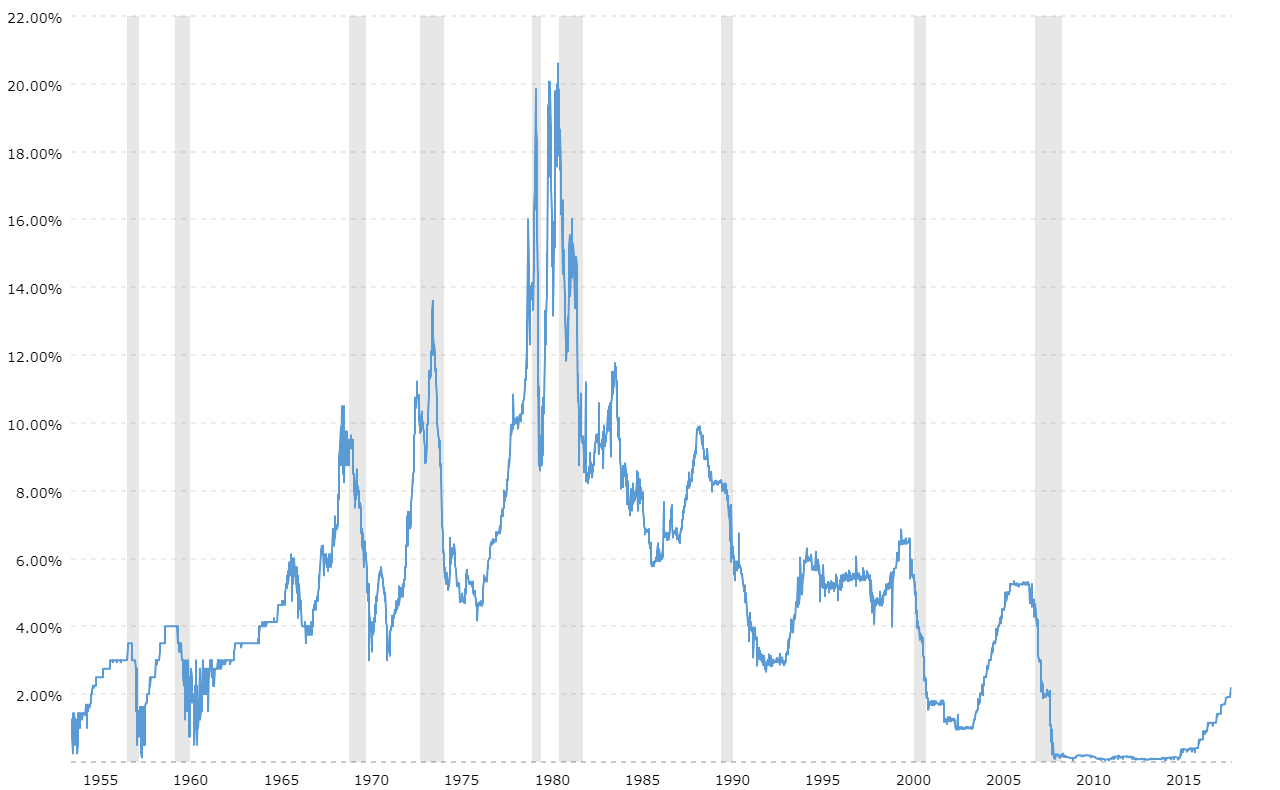

We are sitting in mid-January 2026, and the financial world is basically holding its breath. Why? Because the Fed has been on a bit of a cutting spree lately. They slashed rates three times in late 2025, dropping the benchmark by a total of 75 basis points. It was a wild ride that brought us down from the 4.25%-4.50% range we saw at the start of last year.

Right now, the "effective" rate—which is the actual volume-weighted median of overnight trades—is hovering right around 3.64%.

What is Fed Funds Rate Today and Why the Confusion?

People often think "the rate" is one single number set in stone. It isn't. It’s a target. Think of it like a speed limit that the Fed tries to enforce by buying and selling government securities.

The Federal Open Market Committee (FOMC) hasn't met yet for their first scheduled sit-down of 2026. That happens January 27–28. Until then, we’re essentially living in the shadow of the December 2025 decision.

In that meeting, things got spicy.

Usually, these guys try to look like a united front. Not this time. We saw three different dissents. That hasn't happened in years. You had Stephen Miran, a relatively new Governor, pushing for a massive 50-basis-point cut because he was worried about the job market. On the other side, hawks like Jeffrey Schmid and Austan Goolsbee wanted to stay put.

When the "experts" can't agree, you know the economy is in a weird spot.

The 2026 Outlook: Don't Expect a Waterfall

If you're waiting for rates to plummet back to the "free money" era of 0%, I have some bad news. It’s probably not happening. Most of the heavy hitters on Wall Street—we’re talking J.P. Morgan and Goldman Sachs—are predicting a very slow crawl from here.

- The Consensus: Most analysts expect maybe one or two more tiny cuts this year.

- The Goal: The Fed wants to reach a "neutral" rate—a magic number where the economy neither grows too fast nor stalls out. Most people think that's around 3.00% to 3.25%.

- The Prediction Markets: Interestingly, platforms like Polymarket and Kalshi are currently showing a 95% chance that the Fed stays exactly where it is during the January meeting.

Traders have put over $360 million on the line betting that the Fed does... absolutely nothing this month.

How This Actually Hits Your Wallet

You might wonder why you should care about a rate used for overnight loans between banks. You aren't a bank.

But this rate is the "north star" for everything else. When the fed funds rate sits at 3.50%-3.75%, your local bank isn't going to give you a mortgage for 3%. They’d lose money.

The Bank Prime Loan Rate is currently sitting at 6.75%. This is the base rate for most credit cards and small business loans. If the Fed doesn't cut in January, those high interest charges on your credit card balance aren't going anywhere.

💡 You might also like: Converting 650 INR to USD: What Most People Get Wrong About Small Currency Swaps

Mortgage rates are a different beast. They don't follow the Fed perfectly. They actually track the 10-year Treasury yield, which is currently around 4.17%. Even if the Fed holds steady, mortgage rates can wiggle up or down based on how the market feels about future inflation.

The "Trump Factor" and Fed Independence

We can't talk about interest rates in 2026 without mentioning the political elephant in the room. Jerome Powell’s term as Chair ends this May. President Trump has been very vocal about wanting lower rates to "juice" the economy.

There's a massive debate right now about whether the Fed can actually stay independent. If the market starts to think the Fed is just doing what the White House says, investors might get spooked. They’ll demand higher yields on bonds to compensate for the risk of runaway inflation.

It’s a bit of a paradox: the more the President demands lower rates, the more the market might actually push long-term rates higher.

Real Numbers You Should Know

To give you some perspective on where we are, let's look at the "Selected Interest Rates" released by the Federal Reserve Board on January 16, 2026:

The 4-week Treasury bill is yielding about 3.60%. Meanwhile, the 30-year Treasury bond—what long-term investors look at—is way up at 4.79%.

This is what's called a "normal" yield curve. Usually, you get paid more to lock your money up for 30 years than for one month. For a long time recently, the curve was "inverted," which is a classic recession warning. The fact that it’s normal again suggests the economy might actually be finding its footing.

Actionable Steps for Your Money

Since the what is fed funds rate today is likely staying put for at least the next few weeks, here is how you should handle your cash:

First, if you have a high-yield savings account (HYSA), check your rate. Most are still offering between 3.50% and 4.25%. Since the Fed is expected to cut at least once or twice later this year, these rates will drop. If you have extra cash sitting around, consider locking in a 1-year CD now while rates are still above 4%.

Second, if you're looking to buy a home, don't wait for a "January Fed Cut" that probably isn't coming. Watch the 10-year Treasury yield instead. If it dips below 4%, that’s your signal that mortgage rates might be hitting a temporary floor.

Lastly, pay off that variable-rate debt. With the prime rate at 6.75%, your credit card APR is likely north of 20%. The Fed isn't going to rescue you with a massive rate drop anytime soon. Taking care of that high-interest debt is a guaranteed "return" on your money that no bank can beat.

Keep an eye on the January 28 announcement. Even if they don't change the numbers, the "tone" of the meeting will tell us if a March cut is on the table or if we’re stuck at 3.75% for the long haul.