If you haven’t looked at a ticker lately, prepare for some serious sticker shock. Gold isn't just "up"—it's basically in another stratosphere. Right now, as we move through January 2026, gold is going for roughly $4,590 per ounce.

Just think about that for a second.

💡 You might also like: Federal Reserve Chairman Term: Why 14 Years Is Rarely What It Seems

A few years ago, we were debating if it would ever stay above $2,000. Now, hitting a record high of **$4,626.30** on January 14th has become the new normal. It’s wild. Honestly, the market feels like it’s in a state of "price discovery," which is just a fancy way for Wall Street guys to say they have no idea where the ceiling actually is.

The Current Price of Gold and Why It’s Moving

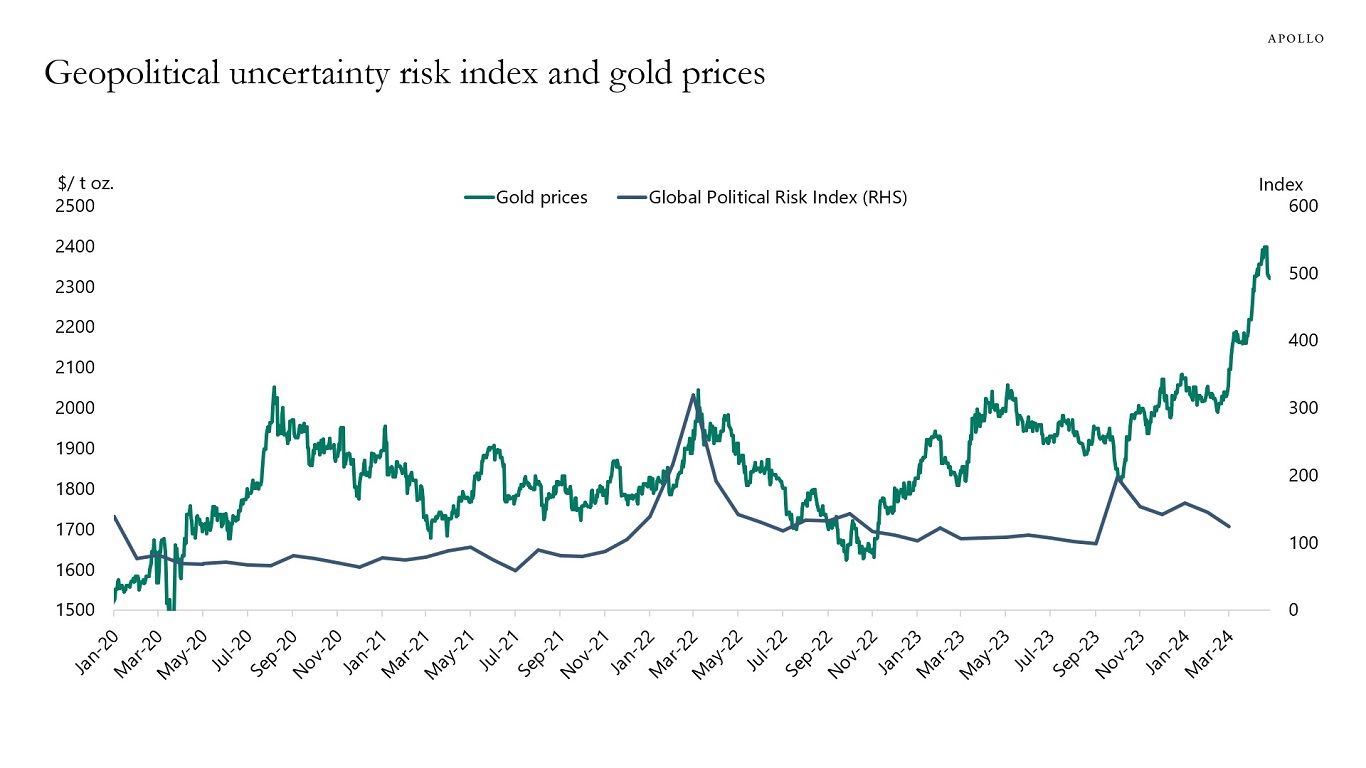

You've probably noticed that everything feels a bit shaky globally. That's the fuel. Specifically, we're seeing gold prices hover between $4,580 and $4,600 on the spot market. Why? Well, it’s a "perfect storm" situation. You have central banks—especially in emerging markets like Poland, China, and India—buying up bullion like there’s no tomorrow. They aren't just dabbling; they are dumping U.S. dollars to shore up their own reserves.

Then there’s the chaos.

Recent protests in Iran and whispers of an "independence crisis" at the Federal Reserve have sent investors sprinting toward safety. When people get scared that the dollar or the banking system is wobbling, they buy yellow bars. Simple as that.

💡 You might also like: Historical Stock Market Crashes: What Most People Get Wrong About Financial Ruin

What the Big Banks Are Predicting for 2026

Don't expect a massive crash back to 2024 levels anytime soon. Most of the heavy hitters in finance have spent the last month frantically revising their targets upward. Here is the gist of what the "smart money" is saying:

- J.P. Morgan: They’re calling for an average of $5,055 by the end of the year.

- Goldman Sachs: Their analysts are eyeing $4,900, citing relentless demand from ETFs.

- Bank of America: They see a potential spike to $5,000, mostly because of "unorthodox" U.S. fiscal policy. That's code for "the government is spending too much money."

It’s not all sunshine, though. Some experts, like those at the World Gold Council, are starting to use words like "overbought." They aren't saying it’s a bubble, but they’re definitely waving a yellow flag. If the price hits $4,770, they expect a "technical correction." Basically, a lot of people will sell to lock in their profits, and the price might take a breather.

The Silver Shadow

Interestingly, silver is actually outperforming gold in terms of percentage gains. While gold is up about 67% from this time last year, silver has exploded by over 150%, recently crossing $80 per ounce. If you're looking at what gold is going for right now and thinking it's too expensive to jump in, you aren't alone. A lot of retail investors are pivoting to silver or platinum because the "gold-to-silver ratio" is doing some very weird things.

Is the "De-Dollarization" Trend Real?

Yes. Sorta.

💡 You might also like: Xcel Energy Stock Price: Why Most People Get It Wrong Right Now

It’s easy to dismiss "de-dollarization" as a conspiracy theory, but the data from the IMF and various central banks tells a different story. In 2025, central banks bought over 1,000 tons of gold for the third year in a row. They are worried about sanctions and the "weaponization" of the dollar. When a country like Kenya or Madagascar starts publicly stating they want to diversify into gold, you know the vibe has shifted.

What This Means for Your Wallet

So, what do you actually do with this information?

If you’re holding old jewelry or coins, right now is one of the best times in history to sell. Most local coin shops are paying out record amounts. However, if you're looking to buy, you're essentially buying at the top of a massive rally.

Wait for the dip. Market analysts generally agree that there’s a strong "support floor" around $4,350. If the price pulls back to that level, it’s usually seen as a buying opportunity rather than a sign of a crash.

Actionable Next Steps:

- Check your inventory: Dig out those old 14k gold chains. At $4,600 an ounce, even a small broken necklace could be worth hundreds of dollars.

- Monitor the $4,770 mark: This is the "danger zone" according to technical analysts. If gold blasts through this, we might see $5,000 by Easter. If it bounces off it, expect a 10% drop.

- Look at the mining stocks: Often, when gold prices are this high, the companies that actually dig the stuff out of the ground (like Newmont or Barrick) see their profit margins explode. They might offer better "leverage" than buying the physical metal.

- Diversify your "Safe Haven": Don't put everything into gold. With silver and platinum also hitting records, a mix is usually safer than betting the house on one shiny rock.

Gold has transitioned from a boring "boomer investment" to a high-velocity asset. Whether it hits $5,000 or $6,000 this year depends on how messy the geopolitical landscape stays. Given the current headlines, "messy" seems like a safe bet.