Money is getting weird. If you’ve looked at your savings account or considered a mortgage lately, you’ve probably noticed the vibe shifted. Hard.

As of right now, January 17, 2026, the federal fund rate is sitting at a target range of 3.50% to 3.75%. The effective rate—the one banks actually use to lend to each other overnight—is hovering right around 3.64%.

It’s a bit of a "goldilocks" spot, or at least that’s what the Fed wants you to think. Not too hot, not too cold. But honestly? The ground is shifting under Jerome Powell's feet.

The Federal Fund Rate Today: A Reality Check

We’re in a strange holding pattern. Just a few weeks ago, in December 2025, the Federal Open Market Committee (FOMC) wrapped up the year with a 25-basis-point cut. That was the third cut in a row. It felt like we were sliding down a gentle hill toward cheaper money.

Then January hit.

💡 You might also like: 2024 tax brackets married jointly calculator: How to Figure Out Your Real Bill

The labor market, which everyone thought was cooling off, suddenly found its second wind. Unemployment ticked down to 4.4%. Inflation? It’s still being stubborn at around 2.7% to 3%, which is definitely north of that 2% target the Fed obsesses over.

Because of that, the Fed is basically in "wait and see" mode. We are currently in the official blackout period that started today, January 17. This means you won’t hear a peep from Fed officials until after their next meeting on January 28. No speeches. No hints. Just silence while they look at the same messy data we are.

What’s actually happening behind the scenes?

There's a lot of drama. Jerome Powell is in the final stretch of his term, which ends in May 2026. You’ve probably seen the headlines—the Trump administration isn't exactly sending him Christmas cards. There's heavy pressure from the White House to slash rates down toward 1% to "juice" the housing market and lower the interest on our massive national debt.

But the Fed is stubborn about its independence.

Most big banks, like J.P. Morgan, have actually changed their tune. Their chief economist, Michael Feroli, recently came out saying they expect the Fed to hold steady at 3.5%–3.75% for the rest of 2026. That’s a massive pivot from the "rate cut party" everyone was expecting six months ago.

Why This Number Actually Matters for Your Wallet

The federal fund rate isn't just a number for guys in suits on CNBC. It’s the "prime mover" of the entire economy. When this rate moves, everything else follows like a line of rowdy toddlers.

- Mortgage Rates: Even though the Fed doesn't set mortgage rates, they usually dance to the same beat. Right now, 30-year fixed mortgages are hanging out around 6.1% to 6.3%. If the Fed holds steady as expected, don't look for 4% mortgages anytime soon.

- Savings & HYSAs: The good news? Your High-Yield Savings Account is still actually paying you something. With the rate at 3.5%+, you can still find accounts hovering near 4%.

- Credit Cards: This is the sting. Most credit card APRs are tied to the "Prime Rate," which is usually the Fed funds rate plus about 3%. If the Fed doesn't cut, your debt stays expensive.

It’s a balancing act. The Fed wants to keep the economy from crashing (recession) without letting prices spiral out of control (inflation).

The "Neutral Rate" Mystery

Economists are currently arguing about something called r-star or the "neutral rate." Basically, it’s the interest rate that neither speeds up nor slows down the economy.

For years, we thought it was really low, like 2%. Now? Some experts think the neutral rate has moved up because of AI investments and government spending. If the neutral rate is actually 3.5%, then the federal fund rate today isn't actually "restrictive" anymore. It’s just normal.

👉 See also: Joby Aviation Stock Price Today: Why This $15 Level is a Massive Crossroads

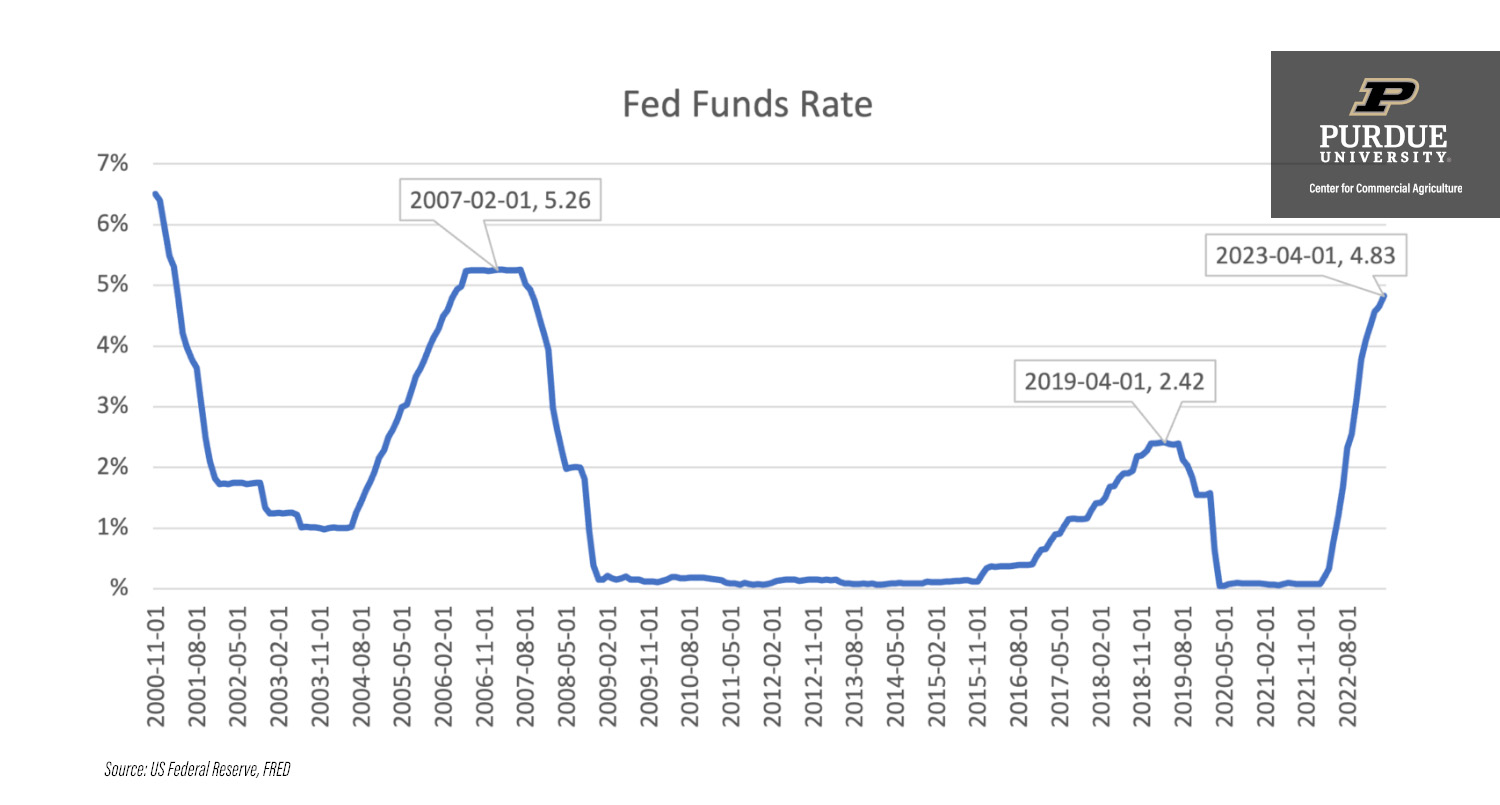

That would mean the days of "free money" and 0% interest rates are dead and buried.

What Happens Next?

The next big date is January 28, 2026.

The CME FedWatch Tool, which tracks what traders are actually betting their money on, shows a 95% chance that the Fed holds rates exactly where they are. Only about 5% of people think we’ll see a cut this month.

After that, all eyes are on May. When Powell leaves, a new Chair—potentially someone like Kevin Hassett or Stephen Miran—might take the reins. Miran has already been vocal about wanting deeper cuts, maybe as much as 1.5% throughout the year.

But for today? Expect the status quo.

Actionable Insights for the Current Rate Environment

Since the federal fund rate today is likely at its "plateau" for a while, here is how to handle your money:

- Lock in yields now. If you have extra cash, consider a 1-year or 2-year CD. If J.P. Morgan is right and rates stay flat or even rise in 2027, you’ll be happy you grabbed a 4% yield while you could.

- Don't wait for a 3% mortgage. If you’re house hunting, the "wait for lower rates" strategy is looking risky. The consensus is that mortgage rates will likely stay in the 6% range through the end of the year.

- Pay down variable debt. Credit card interest isn't going to drop significantly this year. If you're carrying a balance, a balance transfer to a 0% APR card is a smarter move than waiting for the Fed to save you.

- Watch the May transition. The transition to a new Fed Chair in May 2026 will be the biggest volatility event of the year. Be prepared for market swings as the new leadership clarifies its stance on inflation versus growth.