It was a weird time. People were literally panicking in the streets of high-tax states like New Jersey and New York, trying to prepay their property taxes before the ball dropped on New Year's Eve. Why? Because the Tax Cuts and Jobs Act (TCJA) had just passed, and everyone knew the world of the IRS was about to flip upside down. But here is the thing that trips people up even now: those massive changes largely didn’t apply to the taxes due in 2018.

When you sat down in April 2018 to file, you were actually looking backward. You were reporting on the 2017 calendar year. That is a distinction that still confuses folks who are digging through old records or dealing with a long-delayed audit. For the 2017 tax year (the returns you filed in 2018), the old rules—the ones we lived with for decades—were still very much in play. We are talking about the era of personal exemptions, the full SALT deduction, and those tiered tax brackets that peaked at 39.6%.

The Last Stand of the Old Tax Code

Most people think of 2018 as the year of the "Trump Tax Cuts," and while that’s true for the laws being enacted, the actual filing season was a ghost of the past. If you were filing taxes due in 2018, you still got to claim a personal exemption of $4,050 for yourself, your spouse, and each of your dependents. That disappeared later. It’s gone now. But back then, it was the primary way families lowered their taxable income.

The standard deduction was also a fraction of what it is today. For a single filer, it was just $6,350. Compare that to the massive jump we saw immediately after, and it’s easy to see why so many people were still itemizing their deductions back then. You didn’t need a mountain of receipts to beat a $6,000 hurdle.

Honestly, the 2018 filing season was the last time the tax code felt "traditional." You had the domestic production activities deduction. You had unreimbursed employee expenses. If you were a salesman who bought your own laptop or a teacher who spent too much on classroom supplies, you could actually subtract those costs from your income if you itemized. After this year, the IRS basically slammed the door on those write-offs for W-2 employees.

Why Everyone Was Obsessed With April 17

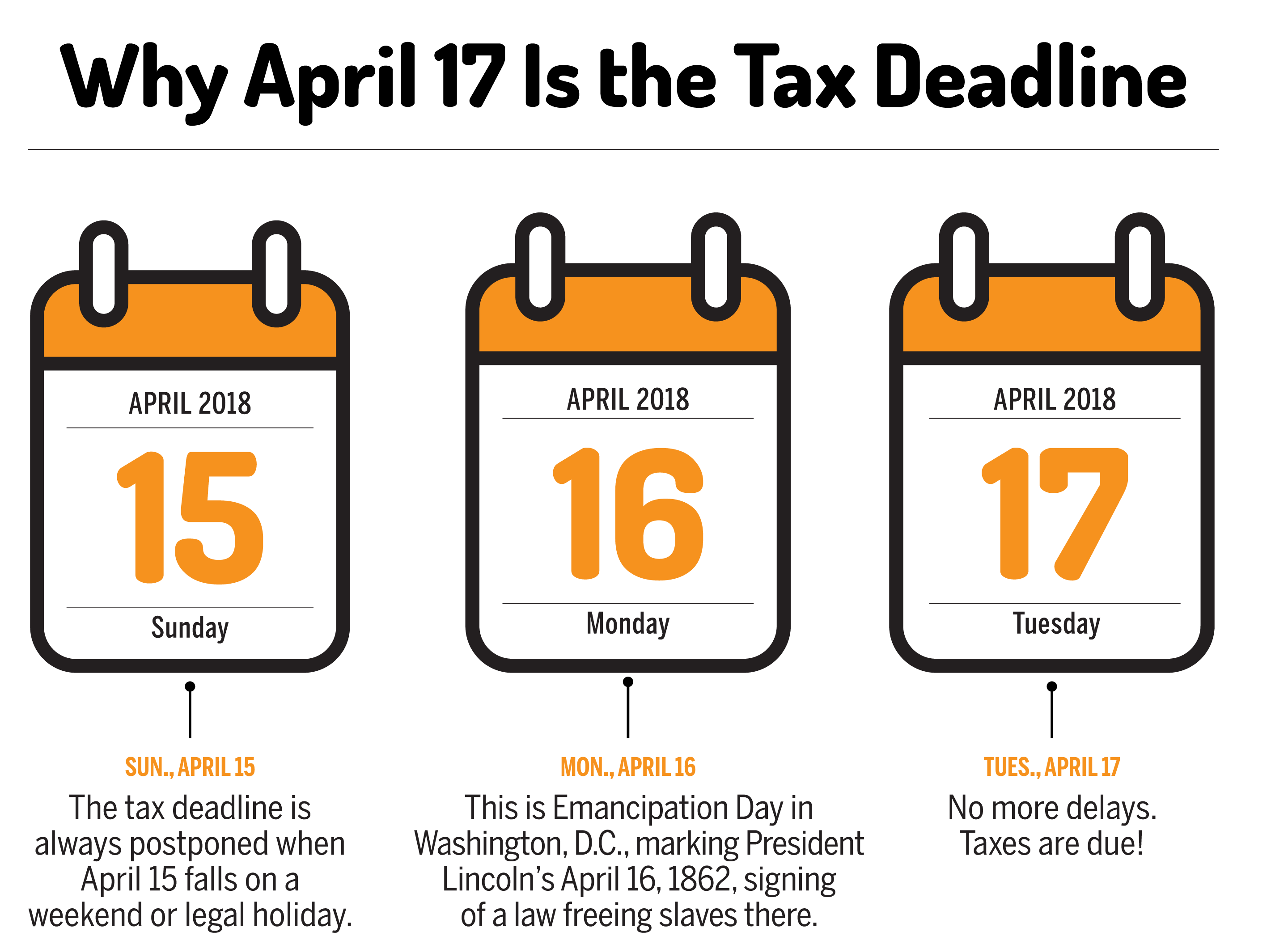

You might remember that the deadline wasn't the usual April 15. It was April 17, 2018.

Why the delay?

A combination of Emancipation Day (a holiday in Washington D.C.) and the fact that the 15th fell on a Sunday. It gave everyone a 48-hour breathing room, which was lucky because the IRS computer systems actually crashed on the final day. It was a mess. Acting IRS Commissioner David Kautter had to come out and give everyone an extra day because the "Direct Pay" system went dark. If you were trying to pay your taxes due in 2018 at the last minute, you probably remember the frantic refreshing of the browser window.

The Real Numbers from the 2017 Tax Year

- The Top Bracket: 39.6% for income over $418,400 (single).

- Medical Expenses: A rare win happened here. The threshold to deduct medical expenses was temporarily lowered to 7.5% of your Adjusted Gross Income (AGI) instead of the usual 10%.

- The Individual Mandate: This is a big one. In 2018, the Affordable Care Act's "Shared Responsibility Payment" was still in full effect. If you didn't have health insurance in 2017, you paid a penalty on that return. It was either $695 per adult or 2.5% of your household income, whichever was higher.

The SALT Fever Dream

State and Local Tax (SALT) deductions were the hottest topic of the year. Before the TCJA kicked in for the 2018 tax year (filed in 2019), there was no $10,000 cap. If you paid $30,000 in property taxes and state income taxes, you deducted the whole thing.

This created a frantic rush. People were calling their town halls asking to pay 2018 taxes in December 2017 just to get it under the wire of the old rules. The IRS eventually had to issue a notice (Notice 2017-77) saying, "Whoa, slow down." They ruled that you could only deduct a prepaid property tax if it had been officially assessed by the local government. You couldn't just guess what you’d owe and write a check to get a deduction.

Misconceptions That Still Haunt Audits

A lot of small business owners get confused when looking back at this period. They hear "2018 taxes" and think of the 20% Qualified Business Income (QBI) deduction. But that didn't exist for the returns filed in early 2018. If you were a freelancer or an S-Corp owner filing your taxes due in 2018, you were paying the old rates without that 20% buffer.

It was also the last year you could do a "recharacterization" of a Roth IRA conversion. If you converted a Traditional IRA to a Roth in 2017 and the value of the stocks plummeted, you could actually undo it before the October extension deadline in 2018. This was a massive safety net for investors that the new law completely abolished. Once you convert to a Roth now, you are stuck with it. No take-backs.

The Paperwork Nightmare

The 1040 form itself was still the "Long Form." It was two full pages of dense lines before you even got to the schedules. The "postcard" sized 1040 didn't arrive until the following year.

Because the rules were changing so fast, tax software companies like TurboTax and H&R Block were in a frenzy. They had to support the old laws for the 2017 filings while simultaneously preparing users for the massive shifts coming in 2018. It created a weird environment where your tax software was telling you, "Hey, you get this deduction this year, but kiss it goodbye for next year."

Actionable Steps for Dealing with 2018 Records

If you are looking at these records now—perhaps because of a look-back audit or mortgage application—keep these things in mind:

1. Check the Version of the Form 1040.

Ensure you aren't looking at the 2018 Tax Year form (filed in 2019) if you are trying to verify 2017 data. The 2017 form (filed in 2018) is the one with the personal exemptions listed right on the first page.

2. Verify Health Insurance Coverage.

If you're amending a return from that period, remember that the ACA penalty was active. You need Form 1095-A, B, or C to prove you had "minimum essential coverage."

💡 You might also like: Converting 10 000 ksh to usd: Why the Mid-Market Rate Is Lying to You

3. Review Your Itemized Deductions.

Since the standard deduction was so low ($12,700 for married filing jointly), go back and see if you missed out on deducting things like job-related move expenses or alimony. Both were still deductible for taxes due in 2018, provided the alimony agreement was in place before the end of 2018.

4. Statute of Limitations.

Generally, the IRS has three years to audit a return. However, if there is a "substantial understatement of income" (usually meaning you left off 25% or more of your gross income), that window stretches to six years. Since we are now several years past 2018, most standard returns are "closed," but high-value errors can still be flagged.

5. Keep Your Records.

Even though the 2018 filing season feels like a lifetime ago, keep those PDFs. The transition between the old tax code and the TCJA is one of the most complex periods in American fiscal history. Having the "before" and "after" snapshots of your finances is vital for long-term tax planning.