If you’ve walked into a store lately and wondered why a basic toaster suddenly costs twenty bucks more than it did last year, you’ve likely felt the invisible hand of trade policy. Most people think of trade wars as abstract arguments between politicians in suits. Honestly, it's way more personal than that. A tariff is basically just a tax, but instead of coming out of your paycheck, it’s tacked onto a product the moment it crosses the border.

But the real question is: why now? When are tariffs imposed in the real world, and what triggers a government to pull that lever?

It’s never just one thing. Sometimes it’s a grudge. Sometimes it’s a strategy to save a dying factory in Ohio. And lately, in 2025 and 2026, it’s been used as a massive "emergency" tool to fix everything from immigration to drug flows.

✨ Don't miss: Why 250 Vesey St NY Is More Than Just a Waterfront Office Tower

The big triggers: Why the taxman shows up at the border

Governments don't just wake up and decide to make things more expensive for fun. There's usually a "justification," even if economists argue about whether it actually works.

Protecting "Infant" or dying industries

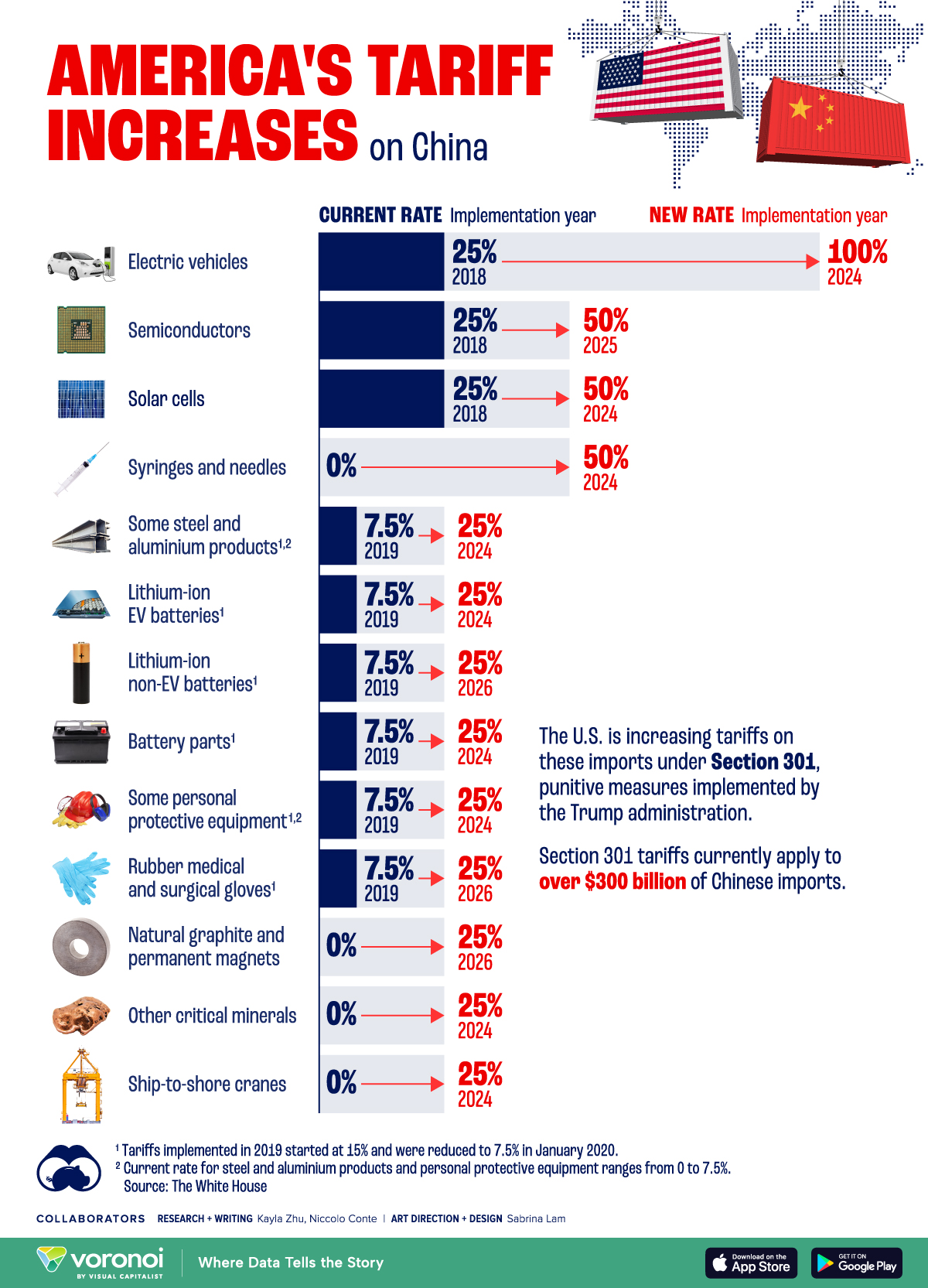

This is the classic move. If a country wants to start making its own microchips or electric vehicles, but China is already pumping them out for half the price, the government steps in. They slap a tariff on the imports to "level the playing field." You’ve probably seen this with the 2025 tariffs on Chinese EVs. The idea is to give local companies a chance to grow without being crushed by cheap foreign competition.

National security (The "Section 232" move)

Under U.S. law, specifically Section 232 of the Trade Expansion Act of 1962, the President can bypass Congress if they decide an import threatens national security. We saw this big time with steel and aluminum. The logic? If we can't make our own steel, we can't build our own tanks or bridges in a war. By 2026, this has expanded into copper and critical minerals used in AI data centers.

Retaliation and "Tit-for-Tat"

Trade is kinda like a playground. If Country A puts a tax on Country B’s wine, Country B is almost certainly going to put a tax on Country A’s soybeans. This is how "trade wars" start. You saw it in early 2025 when China retaliated against U.S. hikes with 34% tariffs on American goods, eventually spiraling into the 100%+ rates we’ve seen recently.

✨ Don't miss: South Africa Currency to US Dollar: Why the Rand is Suddenly Surprising Everyone

The 2025 "Liberation Day" shock

Things got weird on April 2, 2025. President Trump dubbed it “Liberation Day” and launched some of the most aggressive tariffs since the 1930s. We’re talking 25% across-the-board hits on Mexico and Canada.

Why? It wasn't just about trade balances. The administration used tariffs as a bargaining chip for non-trade issues:

- Fentanyl trafficking: Tariffs were threatened to force Mexico and Canada to tighten border controls.

- Immigration: The tax was a "penalty" for what the White House called a failure to stop border crossings.

- Currency manipulation: If a country keeps its currency weak to make its exports cheaper, the U.S. hits back with a "reciprocal" tariff to cancel out that advantage.

Who actually pays the bill?

Here is the part most people get wrong. Governments do not pay tariffs. The foreign country being "punished" does not write a check to the U.S. Treasury.

Basically, the company importing the goods (like Walmart, Target, or a local bike shop) pays the tax to U.S. Customs when the ship docks.

What happens next? Usually one of three things:

- The consumer pays: The store raises the price of the toaster. You pay the tariff.

- The company eats it: The importer takes a hit to their profit margins. This is what Ford reported in 2025, noting nearly $1 billion in tariff-related costs.

- The supplier folds: The foreign factory drops their price to stay competitive, effectively paying the tax themselves. (Spoiler: This rarely happens with essential goods).

The 2026 landscape: Where we are now

As we move through 2026, the "effective" tariff rate—that's the average tax actually paid across all imports—has climbed to over 11%. That's the highest it's been since the 1940s.

It’s not just "big" items either. Small businesses are feeling it the most. Coffee shops are seeing higher prices for beans because of shipping and packaging tariffs. Small tech startups are struggling to source specialized components that only come from a specific region in Asia now covered by 50% duties.

The "Loophole" Game

Because the taxes are so high, companies are getting creative. This is what economists call "tariff evasion" or "rerouting." A product made in China might be shipped to Vietnam, have a single screw turned, and then get labeled as "Made in Vietnam" to avoid the 100% China tax. By 2026, the U.S. government has started cracking down on this "infinite shell game," leading to even more uncertainty for businesses trying to plan their supply chains.

Real-world impact by the numbers

According to data from The Budget Lab at Yale, roughly 60% to 80% of these new 2025 tariffs were passed directly to you, the consumer.

| Product Category | 2024 Price Trend | 2026 Price Impact (Est.) |

|---|---|---|

| Consumer Electronics | Falling | +15% to 20% Increase |

| Steel-heavy Appliances | Stable | +12% Increase |

| Apparel/Clothing | Flat | +5% to 8% Increase |

| Fresh Vegetables | Seasonal | High Volatility (Tariff sensitive) |

Honestly, it's a mess. While some sectors like U.S. steel manufacturing saw a small bump in jobs, it was often offset by losses in "downstream" industries—like construction or auto manufacturing—where the cost of materials just became too high to keep everyone on the payroll.

Actionable steps for businesses and consumers

If you're trying to navigate this era of high tariffs, you can't just sit back and hope prices go down. They probably won't.

- For Businesses: Audit your supply chain. You need to know exactly where every sub-component comes from. If your "Mexican" parts are actually 80% Chinese, you’re at risk for a surprise 25% tax hike. Look for "drawback" programs—these are ways to get tariff refunds if you import a part, build something, and then export it back out.

- For Consumers: Front-load major purchases. If you know a new round of auto or electronics tariffs is scheduled for next quarter, buy now. Retailers usually have a 3-month "buffer" of old inventory before the new, taxed stock hits the shelves.

- Apply for Exclusions: If you’re a manufacturer using a material that literally isn't made in the U.S., you can petition the USTR (U.S. Trade Representative) for an exclusion. It’s a bureaucratic nightmare, but it can save a company from bankruptcy.

Tariffs are essentially a blunt instrument used for surgical problems. Whether they "work" depends entirely on who you ask—the factory worker in Pennsylvania or the parent buying school supplies in California. But one thing is certain: as of 2026, they are the new normal in global business.

To get a better handle on your specific situation, you should check the current Harmonized Tariff Schedule (HTS) for your specific product codes, as these rates are shifting almost monthly in the current political climate.