Honestly, trying to pin down a single date for when the tariffs on China start is like trying to catch a greased pig. It’s messy. It’s chaotic. If you’re looking for one simple "go-live" date, I’ve got bad news: there isn't one. Instead, we’re living through a rolling wave of trade barriers that have been stacking up for years, with new ones hitting the docks almost every few months.

Right now, in early 2026, we are standing in the middle of a massive shift in how the U.S. does business with the PRC. You've probably heard the headlines about "60% tariffs" or "reciprocal trade," but the reality on the ground is way more nuanced than a soundbite. The short answer? Some started years ago. Some started last week. And some are sitting in a "pause" mode that could expire at any moment.

The 2024 Legacy: When the "New" Wave Began

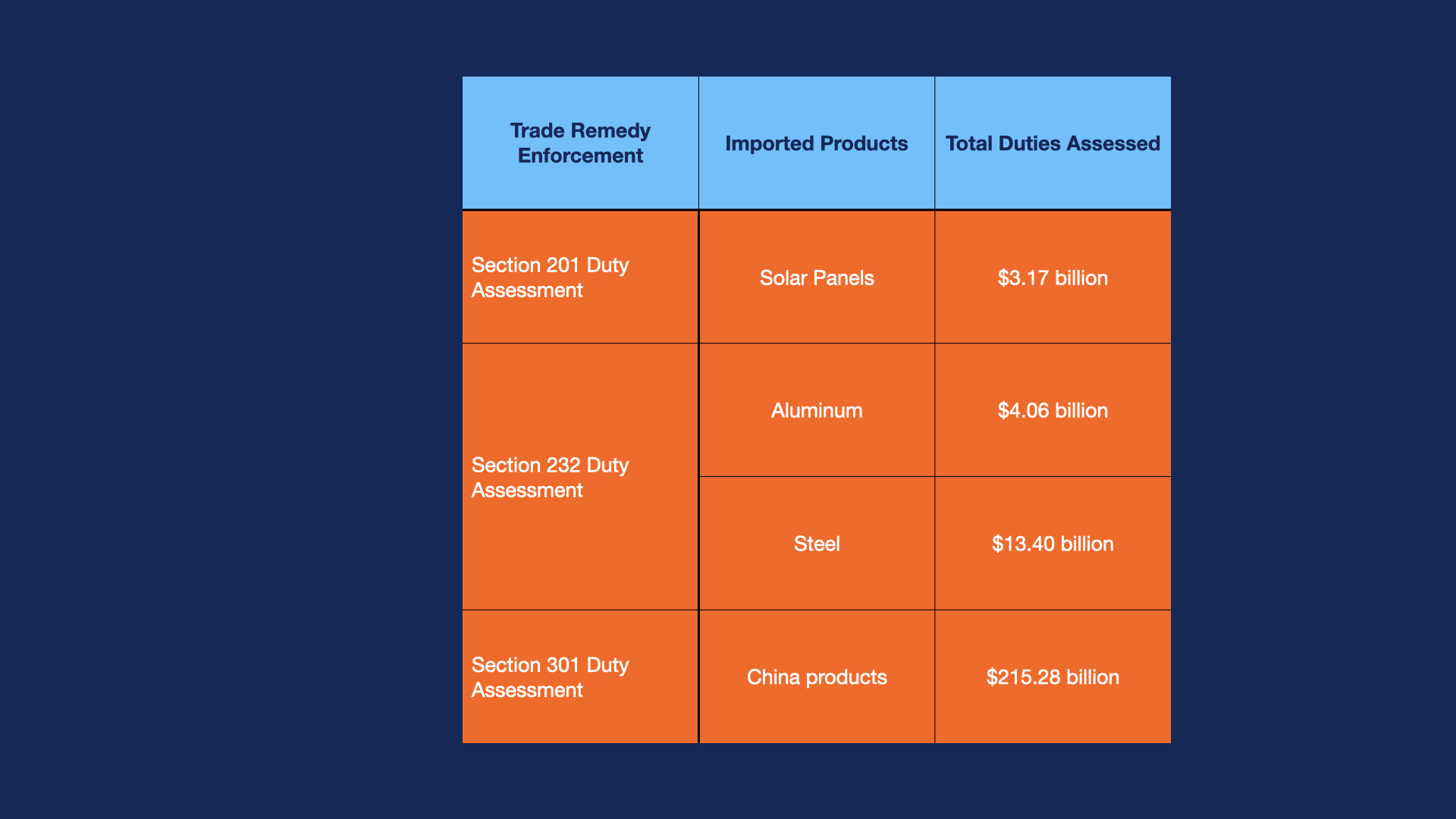

Wait, 2024? Yeah, we have to look back to move forward. While everyone is talking about the 2025/2026 escalations, the Biden-era hikes actually set the current floor. On September 27, 2024, a massive tranche of Section 301 tariffs kicked in. This wasn't just a slap on the wrist; it was a targeted strike at "strategic sectors."

✨ Don't miss: Petrol price in pak: What Most People Get Wrong

Think about electric vehicles. The tariff rate jumped to a staggering 100% that day. Solar cells? 50%. Steel and aluminum? 25%. If you were trying to import a Chinese-made EV in late 2024, that’s exactly when the math stopped making sense for most dealers.

But it didn't stop there. The government likes to "phase in" the pain. For instance, if you’re looking at lithium-ion non-EV batteries or natural graphite, your start date was actually January 1, 2026. Medical gloves? Those have been stepping up from 50% in 2025 to 100% right now in 2026. It’s a slow-motion car crash for supply chain managers who didn't diversify their sourcing two years ago.

The Trump 2.0 Escalation: February 2025 and Beyond

Then came the return of Donald Trump in early 2025, and the pace went from "gradual" to "lightning strike." On February 4, 2025, barely two weeks after the inauguration, a new 10% across-the-board tariff on all Chinese imports went into effect.

This was a different beast. Unlike the targeted "Section 301" tariffs, this was a "fentanyl-related" emergency action under the International Emergency Economic Powers Act (IEEPA). It basically hit everything.

Key Dates of the 2025-2026 Surge:

- February 4, 2025: The 10% "fentanyl" tariff officially started at 12:01 a.m. ET.

- April 5, 2025: This is when the "reciprocal" tariffs began. The U.S. basically said, "If you tax our stuff at 30%, we tax yours at 30%."

- April 9, 2025: The baseline reciprocal rate for China specifically jumped to 34% for most goods.

- November 10, 2025: A massive "truce" deal was struck. The U.S. agreed to lower some fentanyl-related tariffs by 10 percentage points and paused a threatened 125% mega-tariff.

So, when do the tariffs on China start if you're ordering today? Most Chinese goods are currently facing a "stacked" rate. You've got the old Section 301 duties (often 25%), plus the 10% baseline from the early 2025 orders.

The "De Minimis" Loophole is Effectively Dead

You know how you used to buy $20 t-shirts from Shein or Temu and they arrived duty-free? That’s over. The start date for the "end of de minimis" was technically August 29, 2025.

Before that date, shipments under $800 could slide into the U.S. without paying a dime in tariffs. Now, almost everything coming from China—even a $5 phone case—is subject to the 10% to 25% duty rates. It’s a huge reason why your cheap online shopping hauls suddenly feel a lot more expensive. If you’re wondering why your package is stuck in customs or has a surprise fee, that August 2025 rule change is the culprit.

🔗 Read more: How to File Unemployment Massachusetts: What Most People Get Wrong

What’s Coming in 2026 and 2027?

We aren't done. The trade war is a living document. The U.S. Trade Representative (USTR) is currently wrapping up a "Phase One Compliance" investigation that started in October 2025.

What does that mean for you? It means that even though we have a "truce" right now until November 10, 2026, it’s a fragile peace. If the USTR decides China hasn't bought enough American soybeans or corn, those "paused" 125% tariffs could be triggered with very little notice.

Also, keep an eye on June 2027. That is the proposed date for a whole new round of hikes on Chinese semiconductors. The government is trying to give American companies time to build their own chips, but they've already signaled that the tax man is coming for Chinese silicon in about 18 months.

How to Handle the Current Tariff Landscape

It’s easy to feel overwhelmed by the dates and percentages. Honestly, most small business owners I talk to are just trying to keep their heads above water. But you can't just ignore it.

First, check your HTS codes. The "Harmonized Tariff Schedule" is the master list that determines your rate. A "smart watch" might be taxed differently than a "heart rate monitor," even if they look identical. Misclassifying your goods is a one-way ticket to a massive fine from Customs and Border Protection (CBP).

Second, look at the "truce" expiration. The current suspension of the most aggressive tariffs is set to expire on November 10, 2026. If you are planning a massive inventory pull for the 2026 holiday season, you might want to get your goods into the country before that November deadline. If negotiations sour, that 10% could turn into 60% or 100% overnight.

Third, explore "Drawback." This is a program where you can get your tariff money back if you import a part from China, assemble it in the U.S., and then export the finished product to another country. It’s a paperwork nightmare, but it’s one of the few ways to legally avoid the "China tax."

Actionable Next Steps:

💡 You might also like: How Much Is a Won in Dollars: What Most People Get Wrong

- Audit your 2026 shipping schedule: Ensure all major Chinese imports land before the November 10, 2026 truce expiration to avoid "cliff" pricing.

- Verify HTS Classifications: Work with a licensed customs broker to see if your products fall under the "strategic" 2024-2026 hike lists (like batteries or magnets).

- Evaluate Country of Origin: Explore moving final assembly to "friendly" nations like Vietnam or Mexico, but beware of "transshipment" penalties—the U.S. is now aggressively taxing goods that are just "passed through" a third country to hide their Chinese origin.

The era of "free trade" with China is officially in the rearview mirror. Whether you're a consumer or a CEO, the cost of doing business across the Pacific has changed permanently. Keep your eyes on that November 2026 date; that's the next big fork in the road.