Waiting for that notification to pop up on your phone can feel like watching paint dry. You know your employer sent the money. You’ve got bills due. But when you check the Chase mobile app, the balance hasn't budged. Honestly, it’s frustrating. Most people assume that because we live in a digital world, money should move instantly. It doesn't.

If you're wondering when does direct deposit hit for chase, the short answer is usually between 3:00 AM and 5:00 AM Eastern Time on the day your employer or the government agency scheduled the payment. But there is a lot of nuance behind that window. Banks don't just flip a switch the second a file arrives. There’s a whole dance between the Federal Reserve, the ACH (Automated Clearing House) network, and Chase’s internal processing systems.

Sometimes it’s earlier. Sometimes, if there’s a holiday or a weekend, it feels like it takes forever. Let's break down exactly what happens behind the scenes so you aren't left refreshing your app at 2:00 AM for no reason.

The Chase Direct Deposit Timeline

Chase typically processes incoming ACH transfers in batches. Unlike some fintech startups that try to "front" you the money the second they see a pending notification, Chase generally waits until they have the actual funds or a guaranteed settlement from the Federal Reserve.

For the vast majority of Chase customers, funds become available on the scheduled payday. If your boss says Friday is payday, Chase is going to make sure that money is in your account by the time you wake up on Friday morning. Specifically, the "posting" happens overnight. If you are on the West Coast, you might actually see the money hit your account late Thursday night—around midnight or 1:00 AM—because Chase operates on Eastern Time for many of its core processing functions.

It’s not just about the clock, though.

The timing depends heavily on when your employer sends the payroll file. If your HR department is lazy and sends the file late Thursday afternoon for a Friday payday, there is a chance the ACH network won't clear it in time for that early morning window. In that scenario, you might see the deposit hit later in the business day, though that’s pretty rare for large companies.

Does Chase Do Early Direct Deposit?

This is the big question everyone asks now. You’ve seen the commercials for Chime or Capital One promising paychecks "up to two days early."

For a long time, Chase stayed out of that game. They were the "old guard." But things changed. Chase now offers a feature called Chase Overdraft Assist and, more importantly, they have started rolling out early direct deposit for specific account types.

If you have a Chase Secure Banking account, you might actually get your money up to two days early. It’s a bit of a strategic move by JPMorgan Chase to compete with neobanks. However, if you have a standard Total Checking or Sapphire Checking account, you are likely still on the traditional "day-of" schedule. It’s kinda weird that the "premium" accounts don't always get the early access while the basic, low-fee accounts do, but that’s the current landscape of banking incentives.

Wait. There’s a catch.

Even if you have the right account, "two days early" is not a guarantee. It’s a "maybe." Chase has to receive the payment instruction from your employer ahead of time. If the payroll provider doesn't send the data until the last minute, Chase can't give you money they don't know is coming.

Weekends, Holidays, and the "Monday Blues"

The banking system is surprisingly old-fashioned. It sleeps when you sleep, and it definitely sleeps when the government tells it to.

The ACH network doesn't move money on Saturdays, Sundays, or federal holidays. This is where people get tripped up. If your payday falls on a Monday but that Monday is Labor Day, you aren't getting paid on Monday. You’ll likely see the money on Tuesday. Or, if your employer is cool, they’ll trigger it for the preceding Friday.

Here is a quick reality check for holiday timing:

- New Year’s Day: Delay.

- Juneteenth: Delay.

- Bank Holidays: If the Fed is closed, the money stays still.

If you are expecting a tax refund or a Social Security payment, these follow the same rules. The IRS might say they "sent" your refund on a Wednesday, but Chase won't show it until the following morning.

🔗 Read more: Is the Stock Exchange Open? What Most People Get Wrong About Market Hours

Why is My Direct Deposit Late?

If it’s 9:00 AM on payday and you’re still seeing a zero balance, don’t panic yet. There are three common reasons for a delay.

First, check the calendar. Was there a bank holiday in the last 48 hours? Even a holiday on a Monday can screw up a Wednesday payday because it pushes the entire processing chain back by 24 hours.

Second, talk to your payroll department. Ask them for the "trace number." Every ACH transfer has one. If they can’t give you a trace number, they haven't actually sent the file yet. Most "late" deposits are actually just "unsent" deposits.

Third, is this a new job? The first direct deposit usually takes one or two pay cycles to sync up. Chase has to verify the routing and account numbers match perfectly. Sometimes, that first check comes as a physical piece of paper in the mail. It's annoying, I know.

How to Speed Things Up

You can’t really "force" Chase to work faster. They are a massive institution with rigid protocols. But you can set yourself up for success.

Make sure your "Alerts" are turned on in the Chase app. Specifically, toggle the "Large Deposit" alert. You can set it to notify you for any deposit over $1. This way, you aren't manually logging in and out fifty times a morning. Your phone will just buzz the second the credit hits your ledger.

Also, double-check your account type. If you really need that money early, switching to a Chase Secure Banking account might be worth the small monthly fee, especially if you find yourself cutting it close with bills every two weeks.

The Technical Side: What Happens at 3 AM?

When we talk about when does direct deposit hit for chase, we are really talking about the settlement of "memo posts."

Throughout the night, Chase receives massive batches of data. They check the account number on the incoming file against their database. If it matches, they create a "memo post." This means the bank acknowledges the money is coming. During the early morning hours, usually between 2:00 AM and 4:00 AM, the system runs a final reconciliation. This converts that memo into "available funds."

Once it’s available, you can spend it, withdraw it at an ATM, or use it to cover pending debits. It’s worth noting that Chase processes credits (deposits) before debits (withdrawals) in many cases, which is a consumer-friendly practice that helps you avoid overdraft fees.

Actionable Steps for Managing Your Deposit

Stop stressing and start tracking. If you want to master your Chase direct deposit timing, do these three things right now:

- Verify your account type: Log into the Chase app, click on your checking account, and look at the "Account Details." If it doesn't say "Secure Banking," you are likely on the standard schedule.

- Set a "Deposit Alert": Go to the 'Profile & Settings' menu, find 'Alerts,' and turn on push notifications for deposits. Set the threshold to $0.01 so nothing slips through.

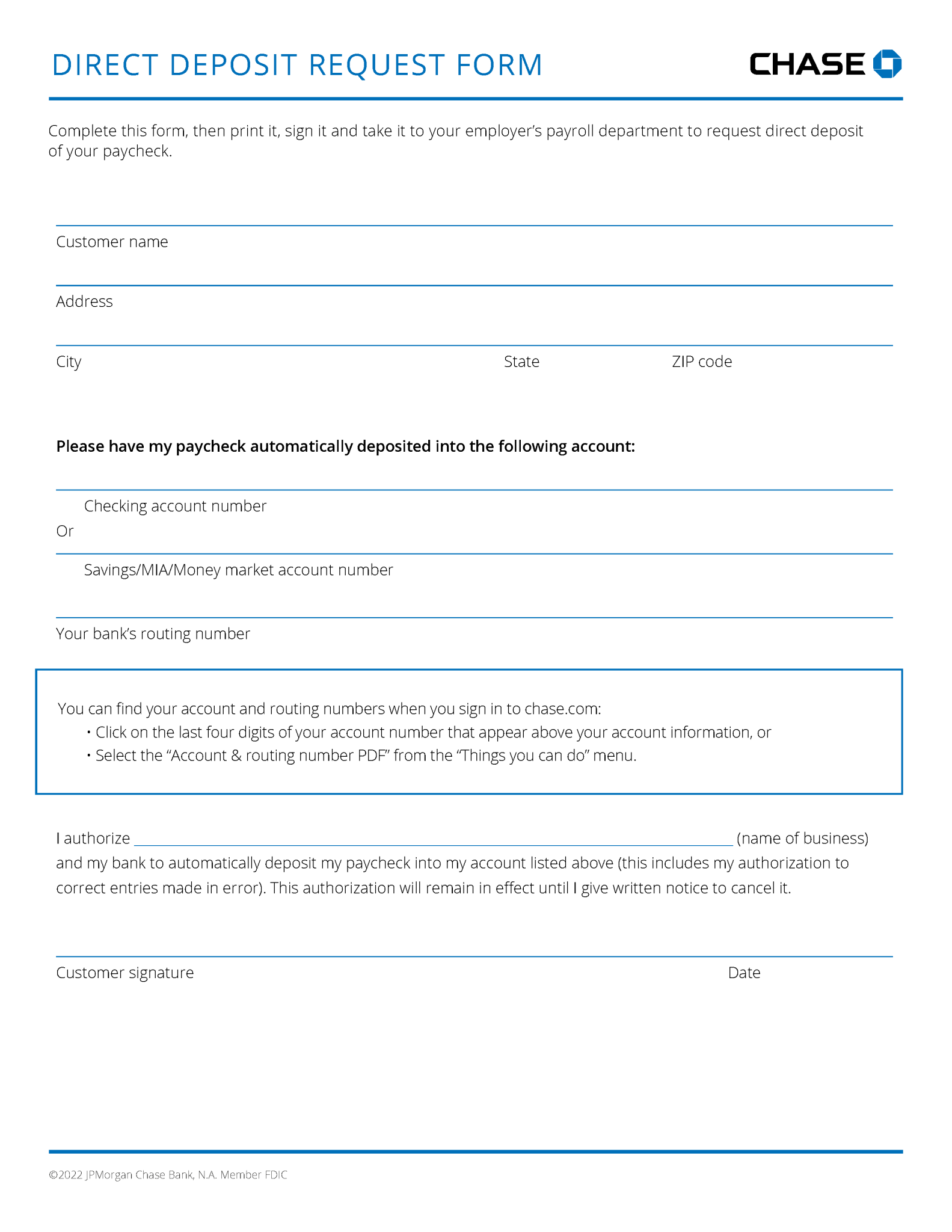

- Check the Payroll Schedule: Ask your HR department for a formal list of "File Transmission Dates." This is different from "Paydays." Knowing when they send the file tells you exactly when Chase receives the info.

If you’ve done all that and your money still isn't there by 6:00 AM on your scheduled payday, that is the time to call Chase customer service. Have your account number and the expected amount ready. Usually, they can see a "pending" item that hasn't cleared the final hurdle yet, giving you some much-needed peace of mind.

Most of the time, it’s just a waiting game. The ACH system is old, but it’s reliable. Your money is coming; the clock just needs to catch up.