Honestly, if you’re looking at your retirement account or wondering why your mortgage quote looks like a phone number, you’re likely staring at the calendar. Everyone wants to know the same thing right now. When does Federal Reserve next meet?

The short answer: January 27–28, 2026.

But that date isn't just another dry meeting in a marble building. We are currently navigating one of the most chaotic periods in the history of American central banking. Between DOJ subpoenas, a looming leadership change, and a literal government shutdown that messed with the data, this January meeting is basically the Super Bowl of finance.

The 2026 FOMC Schedule: Mark Your Calendars

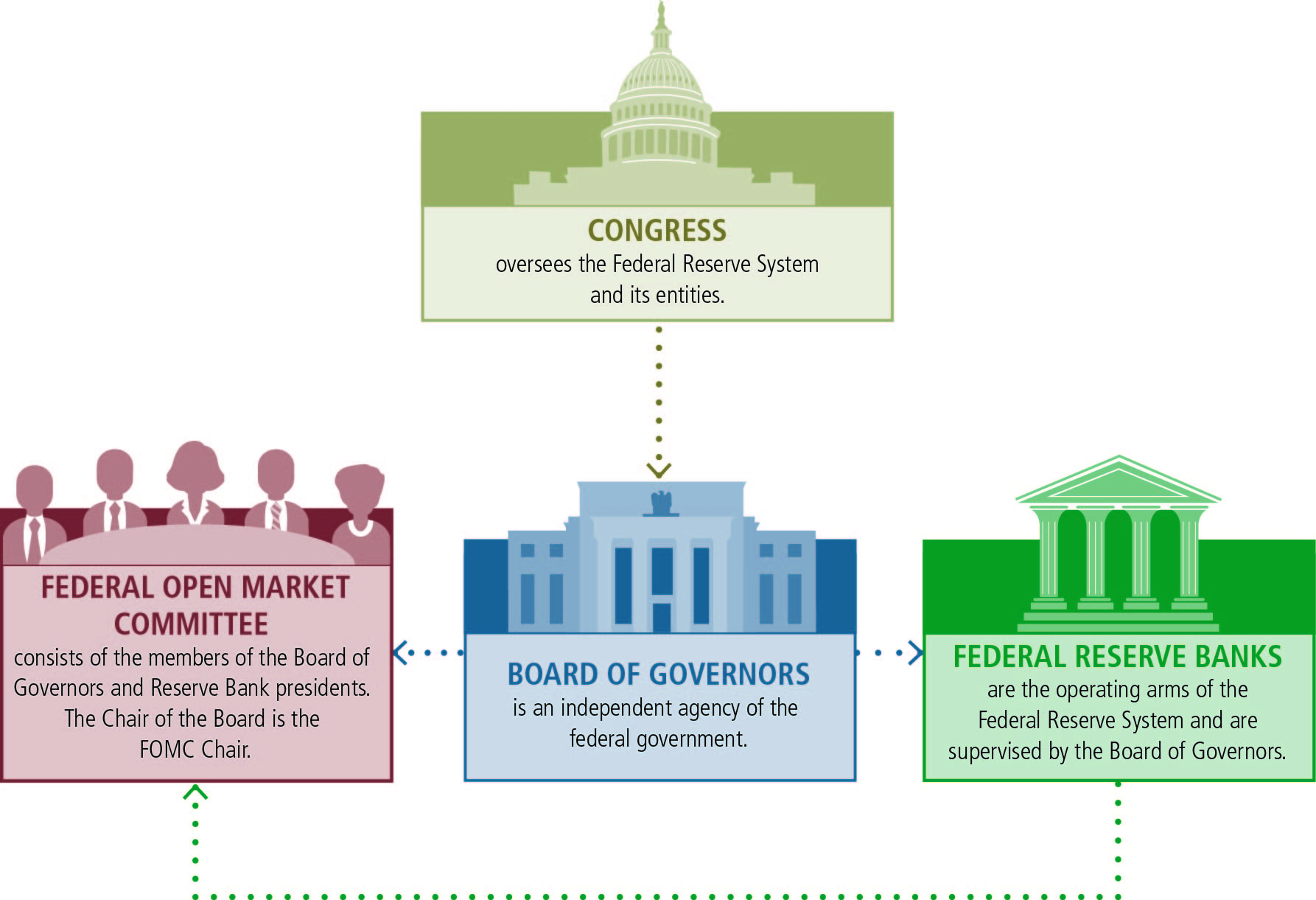

The Federal Open Market Committee (FOMC) usually sticks to a pretty rigid script. They meet eight times a year. They talk. They eat lunch. Then they tell us if we're going to pay more or less to borrow money.

Here is how the rest of 2026 is looking:

- January 27–28 (The big one)

- March 17–18 (Includes economic projections)

- April 28–29

- June 16–17 (Another projection meeting)

- July 28–29

- September 15–16

- October 27–28

- December 8–9

The January 28th decision will drop at exactly 2:00 PM ET. If you’re a nerd for the details, Chair Jerome Powell will start his press conference thirty minutes later. Usually, this is where he tries to sound as boring as possible to keep the markets from freaking out. Lately? That's been a lot harder to do.

Why This Next Meeting is Actually Different

Typically, these meetings are about "basis points" and "inflation targets." This time, it feels like a legal thriller. On January 11, 2026, Jerome Powell did something unheard of. He released a statement revealing that the Department of Justice had served the Fed with subpoenas.

Think about that. The head of the central bank is basically in a public street fight with the administration over "building renovations," though most folks on Wall Street think it’s really about interest rates.

🔗 Read more: Big Name in Nondairy Milk NYT: What’s Actually Happening with Your Favorite Brands

When the Fed meets in late January, they’ll be sitting in a room knowing the President wants rates slashed immediately. Meanwhile, the "hawks" on the committee—the folks who worry about inflation—are pointing at sticky prices. You’ve got a divided group.

The Rotation of Power

Every January, the voting members change. It’s like a roster shuffle in sports. This year, we’re seeing new faces from the Cleveland, Philadelphia, Dallas, and Minneapolis Fed banks move into voting slots.

Specifically, watch Beth Hammack from the Cleveland Fed. She’s already hinted that she’s fine with holding rates steady until at least the spring. If she and the other new voters dig their heels in, that "imminent" rate cut everyone is praying for might just evaporate.

What the "Smart Money" is Betting On

If you look at prediction markets like Polymarket or Kalshi, the vibe is surprisingly calm. Despite the drama, traders are putting a 95% probability on the Fed doing... absolutely nothing.

A "hold" is the consensus. The current federal funds rate is sitting in the 3.50%–3.75% range after a series of cuts in late 2025.

Why wouldn't they cut again?

- The Shutdown Blur: A recent government shutdown made economic data "noisy." The Fed hates making moves when the data is blurry.

- The Trump Factor: Powell’s term ends in May. If he cuts now, it looks like he’s caving to political pressure. If he doesn't, he's accused of "sabotage." It's a lose-lose.

- Core Inflation: It’s still hovering around 2.8%. That’s not the 2% "Goldilocks" zone the Fed dreams about.

Actionable Steps for Your Wallet

Waiting for the Fed is a spectator sport, but your money doesn't have to sit on the sidelines.

Watch the 10-Year Treasury Yield. This is the number that actually dictates mortgage rates. If the Fed sounds grumpy on January 28th, these yields will spike, and that house you wanted just got more expensive.

Check your high-yield savings. If you're sitting on cash, these 4% or 5% APYs won't last forever. If the Fed even hints at a March cut, banks will start lowering those rates before the ink is dry on the Fed's statement.

👉 See also: 3800 INR to USD Explained: What Most People Get Wrong

Lock in debt if you can. If you're looking at a personal loan or a refinance, don't play the "I'll wait for one more meeting" game. The drama between Powell and the White House is creating "volatility," which is just a fancy word for "rates might jump for no reason."

Keep an eye on the January 28th statement. It's the first real look at how the 2026 version of the Fed plans to handle a very loud and very complicated year.