You’ve finished the walk across the stage. You’ve got the degree. Now, the ticking clock begins. Most people assume there's a standard, universal date when the bills start hitting the mailbox, but that’s not really how it works. Honestly, the timing of when does repayment start for student loans depends almost entirely on the specific "flavor" of debt you’re carrying and whether you’re still technically considered a student in the eyes of the government.

It's a countdown.

For the vast majority of federal loan borrowers, you’re looking at a six-month window. This is the "grace period." It’s designed to give you a breather to find a job, move into a shoebox apartment, and figure out how to afford groceries before the Department of Education comes knocking. But don't get too comfortable. That six-month timer is fragile. If you drop below half-time enrollment or take a "gap year" that lasts a little too long, the clock starts and doesn't always reset just because you went back to class.

The Six-Month Myth and Federal Realities

The federal government is the biggest lender in the game. If you have Direct Subsidized or Unsubsidized loans, your grace period is exactly six months. That’s the standard.

But wait.

If you have Perkins Loans (which are rarer these days since the program ended in 2017), you might actually have nine months. On the flip side, if you’re a parent who took out a Parent PLUS loan, there is technically no grace period unless you specifically requested one during the application process. Otherwise, you’re expected to start paying as soon as the loan is fully disbursed. That’s a massive trap for parents who thought they had a few years of lead time while their kid was still in dorms.

The date your repayment starts is usually triggered by one of three things: graduation, leaving school entirely, or dropping below half-time status. "Half-time" is a legal definition set by your specific college. If you're taking one less credit than the registrar requires for half-time status, you’ve officially entered your grace period. You might still be sitting in a lecture hall, but the clock is ticking.

Why Private Loans Are a Different Beast

Private lenders like SoFi, Sallie Mae, or Earnest don’t play by federal rules. They make their own. When you ask when does repayment start for student loans in the private sector, the answer is often "it depends on what you signed."

Some private lenders offer a six-month grace period that mirrors the federal system. Others require "interest-only" payments while you are still in school. This means you aren't paying down the balance, but you're keeping the interest from snowballing. Some even require full principal and interest payments the moment the loan is issued. If you didn't read the fine print on page 42 of your loan agreement, you might be in for a shock.

Private loans also rarely offer the same protections if you go back to grad school. While federal loans usually go back into "in-school deferment" automatically, a private lender might tell you that your repayment must continue regardless of your enrollment status. It's brutal.

Interest Doesn't Take a Vacation

This is the part that kills people.

💡 You might also like: 1290 6th Ave New York NY 10104: Why This Massive Midtown Slab Actually Matters

Even if you aren't required to make a payment during your grace period, interest is often still accruing. If you have Unsubsidized Federal loans, the interest is growing every single day you're in school and every day of that six-month grace period. When that period ends, the accrued interest "capitalizes."

Capitalization is a fancy word for "adding the interest to your principal."

Let's say you owe $30,000 and you’ve racked up $2,000 in interest by the time your grace period ends. Your new balance is $32,000. Now, you’re paying interest on the interest. It’s a mathematical nightmare. Subsidized loans are the only ones where the government pays that interest for you while you’re in school, but even then, that perk ends the moment your grace period expires.

What Happens if You Leave School Early?

Life happens. Maybe you realized college wasn't for you, or a family emergency pulled you away. The Department of Education doesn't really care about the "why." If you stop attending, your grace period begins the day after your last date of attendance.

🔗 Read more: Maui Land & Pineapple Company: What Most People Get Wrong

Many students make the mistake of thinking that because they didn't "graduate," they don't have to pay yet. Wrong. Your school's financial aid office is required to report your status to the National Student Loan Data System (NSLDS). Once that "withdrawn" status hits the system, the six-month fuse is lit. If you re-enroll later, you can usually get back into deferment, but if you used up your six months during your break, you might not get a second grace period when you eventually graduate. You’ll go straight into repayment.

Consolidation and the "Grace Period Killer"

If you decide to consolidate your federal loans into a Federal Direct Consolidation Loan to simplify your life, be careful with your timing.

When you consolidate, you are essentially taking out a brand new loan to pay off the old ones. This new loan does not have a grace period. If you consolidate two months after graduation, you've just forfeited the remaining four months of your grace period. Your first payment on the new consolidated loan will typically be due within 60 days.

If you need those six months to save up cash, wait until the very end of your grace period to submit your consolidation paperwork.

The Logistics: Servicers and Sign-ups

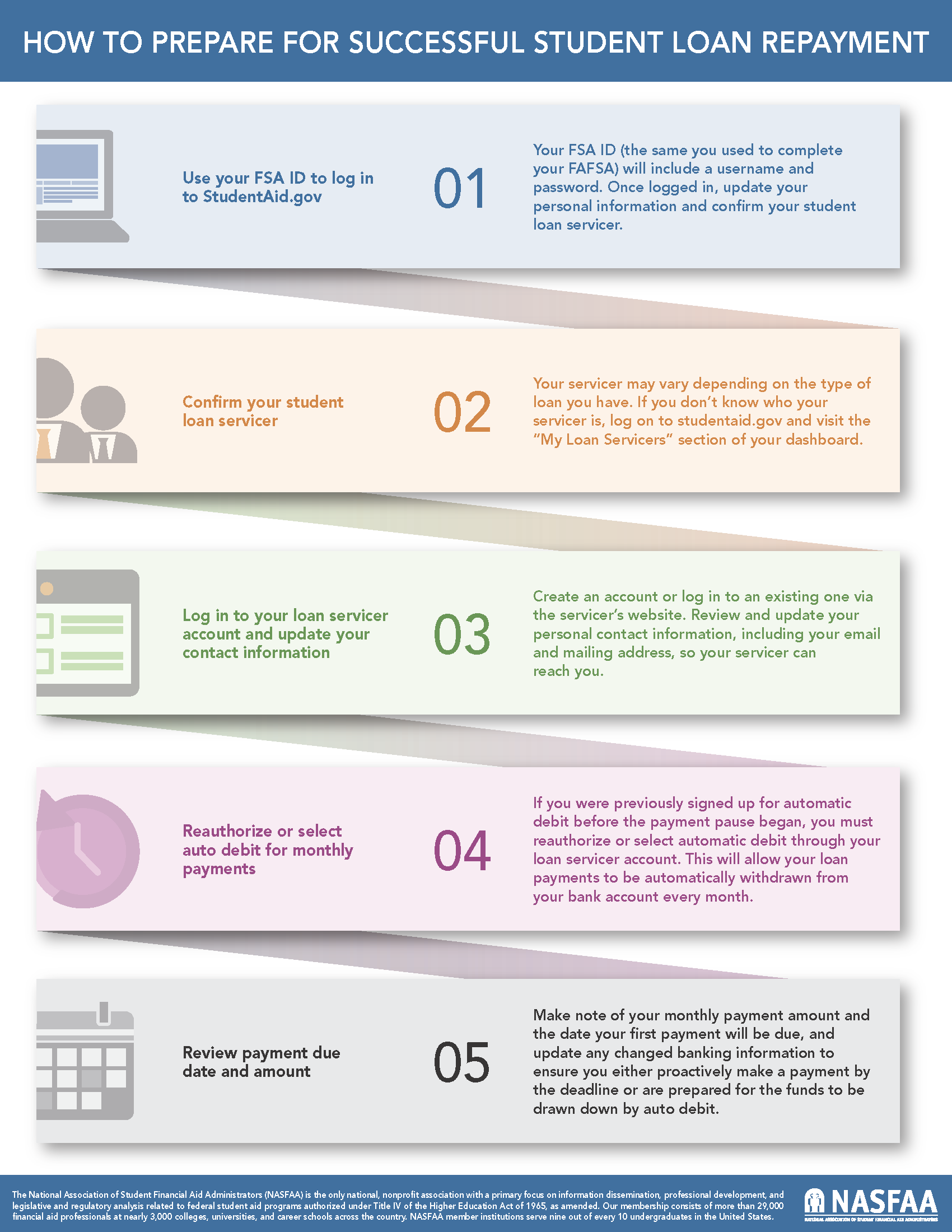

You don't pay "the government" directly. You pay a servicer—companies like Nelnet, Mohela, or EdFinancial. About halfway through your grace period, they should start blowing up your email.

If you haven't heard from them, that's a red flag.

You need to log into StudentAid.gov to see who actually owns your debt. If they have an old mailing address or an old "edu" email that you can't access anymore, you won't get your billing statement. Not getting a bill is not a legal excuse for not paying. The "I didn't know" defense doesn't work with student loans. You’ll just end up with a wrecked credit score before you’ve even turned 23.

Strategies for the Transition

So, when does repayment start for student loans? Technically, it's 180 days after your status changes. But the smart move is to act at day 120.

- Audit your loans: Go to the Federal Student Aid website and download your "My Student Data" file. It lists every single loan, the interest rate, and the servicer.

- Pick a plan early: You’ll be put on the Standard 10-year plan by default. If your entry-level salary can't handle that, you need to apply for an Income-Driven Repayment (IDR) plan like SAVE or IBR while you're still in the grace period.

- Set up Autopay: Most servicers give you a 0.25% interest rate deduction if you use autopay. It’s not much, but over 10 years, it’s a couple of hundred bucks for doing nothing.

- Kill the interest: If you have any spare cash during the grace period, pay off the accrued interest before it capitalizes. This prevents your balance from growing before you've even made your first "real" payment.

Understanding the timeline is half the battle. The other half is realizing that the "start date" isn't a suggestion—it's a hard deadline. Whether you’re looking at a federal six-month window or a private lender’s immediate requirement, being proactive is the only way to keep your head above water. Check your dashboard, verify your servicer, and don't let the end of that grace period catch you by surprise.

Actionable Steps to Take Now

- Verify your exit date: Contact your school’s registrar to confirm the exact "last date of attendance" they reported. This is the date your grace period actually started.

- Identify your servicer: Log in to the StudentAid.gov dashboard. If you have private loans, pull a credit report from AnnualCreditReport.com to see every lender listed under your name.

- Update contact info: Ensure your servicer has your current physical address and a permanent personal email address (not your school email).

- Calculate the "Capitalization Hit": Look at your current "accrued interest" balance. That amount will be added to your principal the day repayment starts. If you can pay even a fraction of that now, you'll save significantly on interest over the life of the loan.