If you’re refreshing your browser waiting for Elon Musk to drop the latest numbers, you’ve probably realized that Tesla doesn’t exactly play by the same rules as your local bank. Tracking the exact moment when does tesla report can feel like trying to predict a SpaceX landing—exciting, slightly chaotic, and prone to last-minute shifts.

Here is the deal. Tesla has officially confirmed that it will release its fourth quarter 2025 financial results on Wednesday, January 28, 2026.

The routine is pretty much set in stone now. They’ll post a brief update on their Investor Relations website immediately after the U.S. markets close, which is usually right around 4:00 p.m. ET. Then, at 5:30 p.m. ET (4:30 p.m. CT), the real show starts with the live question-and-answer webcast.

Honestly, that’s when the stock price usually starts doing backflips.

Why the January 28 Date Actually Matters

For the Q4 2025 report, analysts are currently staring at a consensus earnings per share (EPS) forecast of about $0.32 to $0.44. That’s a pretty wide gap, and it shows just how much "guesswork" goes into these valuations even when we have the delivery numbers.

👉 See also: 10000 zar to usd: Why This Specific Amount is Smarter to Trade Now

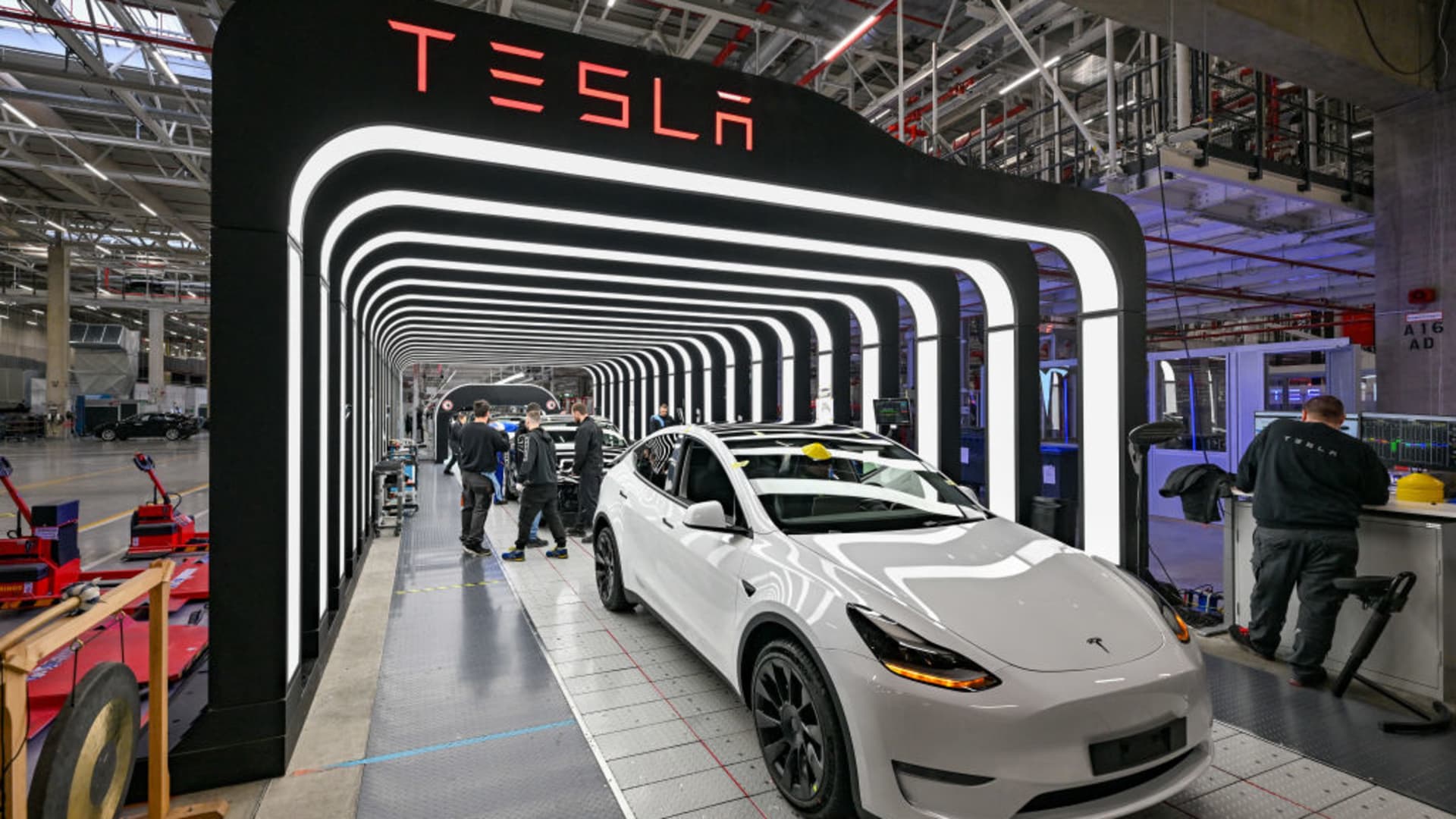

Remember, we already know the production stats. Tesla reported earlier this month that they produced over 434,000 vehicles and delivered roughly 418,000 in the final quarter of 2025. They also smashed a record in energy storage, deploying 14.2 GWh.

But delivery numbers aren't profit. The market is currently obsessed with margins. Investors want to know if those 418,000 cars actually made money or if price cuts chewed through the bottom line.

The 2026 Earnings Calendar: Mark These In Pencil

While the January date is "confirmed," the rest of the 2026 calendar is what we call "inferred." Tesla is a creature of habit. They almost always report on a Tuesday or Wednesday in the third or fourth week of the month following a quarter's end.

Based on historical data from the last five years, here is where the smart money is looking for the rest of 2026:

- Q1 2026 Report: Expected around April 21 or 22, 2026.

- Q2 2026 Report: Likely landing on July 21 or 22, 2026.

- Q3 2026 Report: Targeted for October 20 or 21, 2026.

- Q4 2026 Report: Looking ahead to late January 2027.

If you're planning trades around these, just know that Tesla usually confirms the exact date only two to three weeks before it happens via a press release.

The "After Hours" Volatility Trap

Most people think the news happens when the PDF drops. It doesn't.

The initial "Update Letter" is basically a data dump of balance sheets and colorful charts. The real movement happens during the Q&A. You’ve probably noticed that if Elon is on the call, the tone changes. If he talks about Optimus or Robotaxis instead of car margins, the stock might jump—or tank—regardless of the actual revenue numbers.

For instance, back in July 2025, the stock dropped over 8% the day after the report. Why? Not because they didn't sell cars, but because the "narrative" didn't match the math.

How to Find the Report First

Don't wait for CNBC or Twitter to tell you the numbers. By the time it's on a news ticker, the algorithms have already traded it.

Go straight to the source. The Tesla Investor Relations page (ir.tesla.com) is the ground zero. They usually have a "Events & Presentations" section where the webcast link lives. You don't need to be a hedge fund manager to listen in; it’s open to anyone with an internet connection.

Another pro tip: check the "Production & Deliveries" press release that always comes out a few days after a quarter ends (usually around the 2nd of January, April, July, and October). That release almost always contains the "save the date" for the actual financial earnings call.

What Most People Get Wrong

A common mistake is assuming that "beating" the earnings estimate means the stock will go up. With Tesla, it's rarely that simple.

You also have to look at the "whisper number"—what traders actually expect vs. what analysts officially put on paper. If the consensus is $0.40 but everyone is secretly hoping for $0.45, a "beat" of $0.41 can still feel like a disappointment.

💡 You might also like: 80 29th Street Brooklyn NY 11232: The Real Story Behind Liberty View Industrial Plaza

Also, pay attention to the "Regulatory Credits." Sometimes Tesla’s profit looks amazing, but then you realize a huge chunk of it came from selling carbon credits to other automakers who can't build EVs fast enough. Pure-play investors usually strip those out to see if the actual business of making cars is healthy.

Actionable Steps for the January 28 Report

If you're following this closely, here is what you should do:

- Check the PDF at 4:05 PM ET: Look specifically at the "Gross Margin" (excluding credits). This is the number that tells you if they are becoming more efficient.

- Monitor the Energy Segment: 14.2 GWh of storage is a massive jump. If the margins on Megapacks are higher than cars, the "Tesla is just a car company" argument starts to die.

- Watch the "Outlook" Section: Tesla often includes a line about "volume growth" or "next-generation platforms." Any change in the wording there is a massive signal for the rest of 2026.

- Ignore the First 15 Minutes of the Call: The first part is usually a scripted read-through of the letter you just finished reading. The real gold is in the unscripted answers to analyst questions toward the end.

Tesla's reporting cycle is a high-stakes rhythm that dictates much of the EV market's pulse. While the dates move slightly, the impact of that 5:30 p.m. ET call on January 28 will likely ripple through your portfolio for weeks.