If you're trying to figure out exactly when the next round of China tariffs hits your bottom line, honestly, I don't blame you for being confused. The timeline is a moving target. Just when we think the dust has settled, a new executive order or a "truce" announcement shifts the goalposts.

The short answer? A lot of them have already taken effect, but the "big" wave everyone is bracing for is currently held in a delicate balance.

📖 Related: Ford Country of Origin: Where Your Truck is Actually Born

As of January 2026, we are living through a strange period of staggered implementation. We’ve seen rates on things like steel and semiconductors skyrocket, while other consumer goods are sitting in a "wait and see" mode thanks to a deal struck late last year.

The 2026 Timeline: What's Live and What's Loosening

Right now, the most critical date on the calendar is November 10, 2026. That is the expiration date for the current "tariff truce" between the U.S. and China.

Last November, President Trump and President Xi Jinping reached an agreement that basically hit the pause button on the most aggressive escalations. But "pause" doesn't mean "zero." It means we are maintaining the status quo for about a year.

Here is how the current schedule actually looks:

- January 1, 2026: This was a big one. Tariffs on medical supplies, specifically disposable textile facemasks and rubber medical gloves, jumped significantly. Gloves that were at a 50% rate last year are now facing a staggering 100% tariff.

- January 15, 2026: A new 25% tariff just kicked in on specific advanced computer chips and related hardware. If you're importing these for data centers or high-end tech, you’re feeling it now, though there are some exceptions for research and startups.

- November 10, 2026: This is the "cliff." If negotiations don't progress, the current suspension of "heightened reciprocal tariffs" ends. We could see the 10% base rate jump much higher overnight.

- June 23, 2027: Looking further out, the USTR has already penciled in a rate increase for Chinese semiconductors. It’s currently at 0% for this specific new investigation, but that’s clearly a bargaining chip for next year's talks.

Why the "Fentanyl Tariffs" Changed Everything

You might remember the headlines from early 2025 about "fentanyl-related tariffs." This wasn't just political rhetoric; it had a direct impact on shipping costs. Originally, a 10% across-the-board tariff was slapped on Chinese goods specifically to pressure Beijing on precursor chemicals.

Kinda interestingly, that rate was actually lowered by 10 percentage points on November 10, 2025, as part of the new trade deal. So, if you were paying that specific "fentanyl surcharge," it’s currently suspended—but only until November 2026.

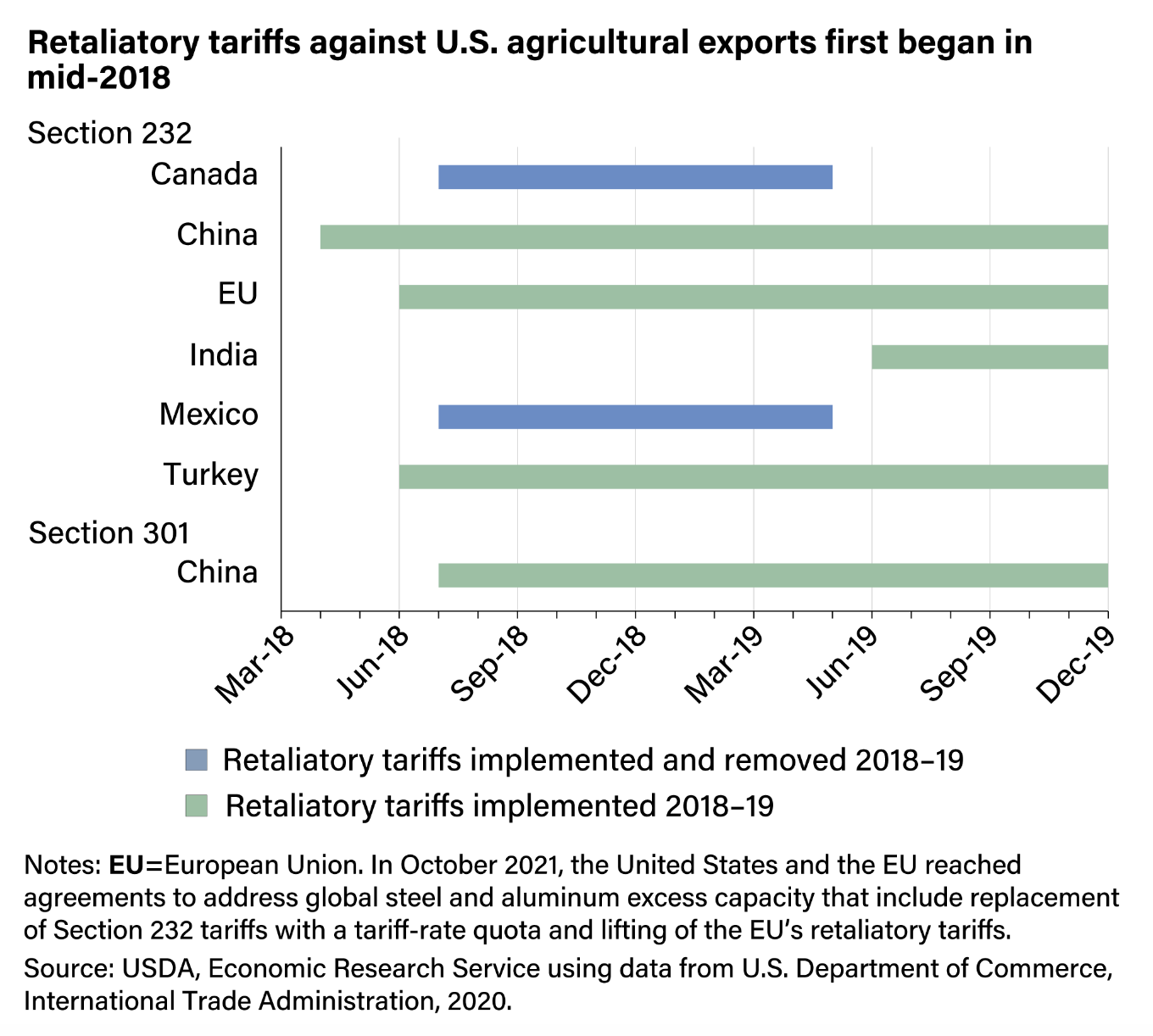

The Stealth Increase: Section 232 vs. Section 301

People often use the word "tariff" like it’s one single thing. It isn't. You have to watch which "legal bucket" your goods fall into.

Section 232 (National Security)

These are the heavy hitters. In mid-2025, we saw steel and aluminum tariffs double from 25% to 50%. These didn't wait for a "truce"—they went live on June 4, 2025. If you’re in construction or manufacturing, you’ve been paying these for months. Even household appliances like refrigerators and dishwashers got swept up in this back in June 2025.

Section 301 (Trade Practices)

This is where the November 2026 deadline mostly lives. It covers the 178 specific product exclusions that were set to expire but got a "pardon" until late 2026. This includes things like solar manufacturing equipment and specific industrial components.

Expert Tip: Don't just look at the date. Look at the De Minimis rules. As of July 2025, the $800 duty-free exemption is basically gone for most Chinese imports. Even if the "tariff" hasn't increased, you're now paying duties on small packages that used to be free.

Real-World Impact: The $1,500 "Tax"

The Tax Foundation and Wharton Budget Model have been crunching the numbers on these 2026 dates. Because so many of these tariffs take effect or stay in effect this year, the average U.S. household is looking at an extra $1,500 in costs for 2026.

👉 See also: Getting Your TD Bank ABA Number PA Right the First Time

It’s not just "China pays it." The importer of record (likely your company or your supplier) pays the bill when the ship hits the port. That cost eventually trickles down to the price tag at big-box retailers. We've already seen this with upholstered furniture and kitchen cabinets, which saw duty updates on January 2, 2026.

What You Should Do Right Now

Waiting until November 2026 to react is a recipe for a supply chain heart attack. Most smart players are already doing "front-loading"—trying to get as much inventory into U.S. warehouses as possible before the next potential hike.

1. Audit your HTS codes immediately. The difference between a "semiconductor" (25% tariff as of Jan 15) and a "derivative electronic product" (potentially 0% or lower) is a tiny line in a massive federal register. If your broker is using the wrong code, you’re lighting money on fire.

2. Watch the "Shipping and Logistics" investigation.

The USTR completed a probe into China's maritime dominance recently. While the port fees and tariffs were suspended in late 2025, they are part of the November 2026 negotiation package. If talks sour, your per-container cost could jump by thousands of dollars in port fees alone.

3. Diversify, but be careful.

Many companies are moving production to Vietnam or Mexico. Just keep in mind that the current administration has already signaled that "trans-shipment" (moving Chinese goods through a third country to avoid tariffs) is the next big target for enforcement.

4. Check your exclusions.

If you are using one of the 178 "Technology Transfer" exclusions, mark November 10, 2026 in red on your calendar. There is no guarantee they will be extended a second time.

The reality is that "when" the China tariff takes effect is a rolling series of deadlines. We’re in a period of relative calm right now, but that's only because the "big" decisions have been punted to the end of 2026. Use this window of stability to lock in your pricing and diversify your sources before the next storm hits.

To stay ahead of these changes, you should regularly monitor the Federal Register and the USTR's "Notice of Actions" page, as many of these "effective dates" are announced with only a few days of lead time.