So, you’ve got a Capital One check in your hand. Maybe it's a refund, a gift from your aunt, or a payment for that couch you sold on Marketplace. Now comes the annoying part: actually turning that piece of paper into spendable cash.

Most people assume they can just walk into any bank and walk out with a stack of twenties. Honestly? It's usually not that simple. If you aren’t a Capital One customer, the process is kinda like trying to get into a club without being on the list—you might get in, but you’re probably going to pay a cover charge.

The good news is that Capital One is one of the few big banks that historically hasn't charged non-customers to cash checks drawn on their own accounts, but that depends heavily on the specific branch and current bank policies in 2026. Let's break down where you can actually go and what it's going to cost you.

Your Best Bet: The Issuing Bank

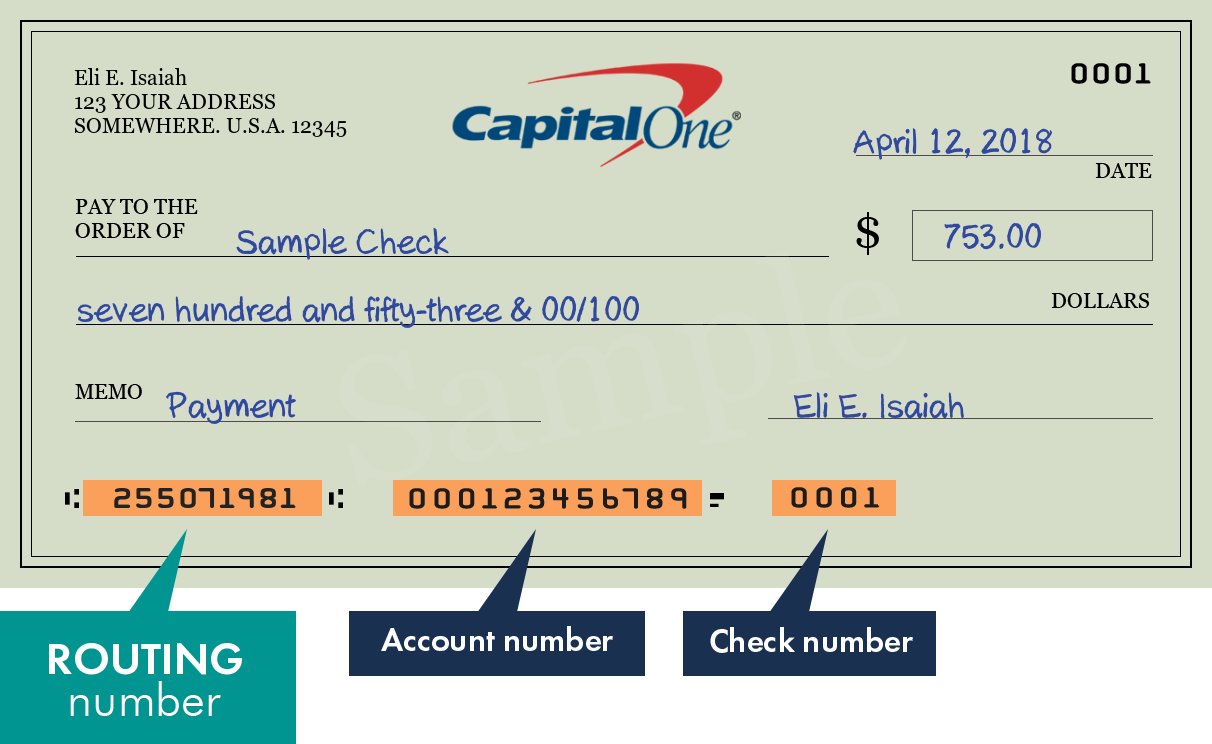

The fastest way to get your money is to go straight to the source. Look at the check. If it says "Capital One" on it, then Capital One is the "issuing bank."

Why does this matter? Because they can see the account the money is coming from. They know instantly if the person who wrote the check actually has the funds.

If you walk into a physical Capital One branch, they will generally cash the check for you even if you don’t have an account there. In the past, they’ve been known for doing this for free, which is rare. Most big banks like Chase or Bank of America will hit you with an $8 or $10 fee just for existing in their lobby without an account.

The Capital One Café Factor

You might have seen those fancy Capital One Cafés that look more like a Starbucks than a bank. Here’s the catch: they aren't full-service branches.

While you can grab a 50% off latte with your Capital One card and use the fee-free ATMs, you usually can't walk up to a "barista" and ask them to cash a personal check. They don’t keep drawers full of cash like a traditional teller. If you need to cash a check at a Café, you’re basically limited to using the ATM—which usually requires you to have your own Capital One account to deposit it first.

Cashing at Retailers and Grocery Stores

If there isn't a branch nearby, or it's 7:00 PM on a Tuesday, your next stop is probably a big-box retailer. This is where things get a bit more "picky."

Walmart is the heavyweight champion here. They will cash most pre-printed checks, including payroll, government, and insurance checks. If your Capital One check is a business check or a tax refund, Walmart is a solid option.

- Fees: They usually charge around $4 for checks up to $1,000 and $8 for anything higher (up to their $5,000 limit).

- The "Personal Check" Wall: Here is the big "no." Walmart and most grocery stores (like Kroger or Publix) generally will not cash a personal check written by an individual. If the check is hand-written by "John Doe" on his personal Capital One account, you’re out of luck at the service desk.

Grocery chains like Kroger, Fred Meyer, and Ralphs often have "Money Services" counters. They follow similar rules to Walmart. They love government and payroll checks; they hate personal checks.

Using Your Own Bank (The Easiest Way)

Got an account at a different bank? Just go there.

Seriously. This is the path of least resistance. When you deposit a Capital One check into your own Wells Fargo, Chase, or local credit union account, they don't charge you a fee.

The downside? The Wait. Banks usually place a "hold" on checks from other institutions. You might get the first $225 immediately, but the rest could take one to two business days to clear. If you need the cash right now to pay rent, this might not work for you. But if you can wait 48 hours, it’s the only way to keep 100% of your money.

High-Fee Alternatives: Check-Cashing Stores

Places like ACE Cash Express or PLS are the "In Case of Emergency" glass you break when nothing else works.

They will cash almost anything, including those personal checks that Walmart won't touch. But you pay for that convenience. We’re talking percentages—sometimes up to 5% or 10% of the check’s value. If you’re cashing a $1,000 check, giving up $50 or $100 just to get it today feels like a gut punch.

Only use these if you have no bank account, no ID issues, and the Capital One branch is three states away.

Digital Options: Cashing via App

It's 2026. You don't necessarily have to leave your couch.

Apps like PayPal, Venmo, and Ingo Money have "Cash a Check" features. You take a photo of the front and back, wait for approval, and the money lands in your digital wallet.

✨ Don't miss: Fox News Stock Market Ticker: What Most People Get Wrong

- The Free Route: If you can wait 10 days, PayPal and Venmo usually let you "cash" it for free.

- The "Now" Route: If you want the money in minutes, they charge a fee—usually 1% for government/payroll checks and 5% for personal checks (with a $5 minimum).

What You Need to Bring (Don't Forget This)

Regardless of where you go, you need two things. No exceptions.

- Valid Photo ID: A driver’s license, passport, or state ID. If it's expired, you’re done. Don't even try.

- The Physical Check: Don't sign the back until you are standing at the counter. If you sign it and then lose it on the way to the bank, anyone who finds it can theoretically try to cash it.

The Reality of Check Cashing in 2026

Banks are getting stingier. Some branches are even going "cashless," meaning they don't even have tellers who handle paper money anymore. Always call the specific Capital One branch before you drive there. Ask two simple questions: "Do you cash checks for non-customers?" and "Is there a fee?"

Summary of Where to Go

- Capital One Branch: Best for non-customers (usually free or low cost).

- Your Own Bank: Best for keeping all your money (if you can wait a day).

- Walmart/Kroger: Best for payroll or government checks (low flat fee).

- PayPal/Venmo: Best for cashing from home (if you aren't in a rush).

- Check-Cashing Store: Absolute last resort (expensive).

If you’re dealing with a large amount—say, over $5,000—none of the retail options will work. You'll almost certainly have to go to a physical bank branch or deposit it into a personal account. Retailers have strict limits to prevent fraud, and they aren't going to hand over five grand to someone without a long-standing account history.

Next Steps for You:

Check the "Locations" tool on the Capital One website to find a "Branch" specifically, not just a "Café." If one is nearby, grab your ID and head there first. If the branch is too far, open your PayPal or Venmo app and see if you’re eligible for their mobile check capture—it might save you a trip in the rain.