You've probably looked at your paycheck and seen those four letters: FICA. It’s a bit of a sting, isn't it? One minute you’re calculating your weekend plans, and the next, a chunk of your hard-earned cash has vanished into the federal ether. If you’re like most people, you’ve asked the big question: where does social security money come from, and is it actually going to be there when I’m the one holding the retirement cake?

Honestly, there’s a lot of noise out there. Some folks think it’s a giant vault in Baltimore stuffed with cash. Others are convinced it’s a Ponzi scheme running on fumes. The truth is a mix of boring accounting, massive tax collections, and a "pay-as-you-go" system that is currently feeling the squeeze of a massive generation hitting retirement all at once.

The Three Faucets: How the Money Actually Flows

Social Security isn't funded by magic or even the general income tax you pay in April. It has its own dedicated streams. In 2026, the mechanics of this are more transparent than ever, but the numbers are getting bigger.

1. The Payroll Tax (The Big One)

This is the heavy lifter. Basically, about 90% of the money flowing into the system comes directly from workers' pockets and their employers' bank accounts. Under the Federal Insurance Contributions Act (FICA), you pay a specific percentage of your earnings, and your boss matches it.

- The Split: You pay 6.2%, and your employer pays 6.2%.

- Self-Employed? You’re the boss and the worker, so you pay the full 12.4%. It hurts, but that’s the deal.

- The 2026 Cap: You don't pay this tax on every single cent if you're a high earner. For 2026, the taxable maximum has climbed to $184,500. Anything you earn above that is "Social Security tax-free."

2. Taxation of Benefits

It sounds a bit like double-dipping, right? But it’s a huge revenue source. If you’re retired and your total income (including half of your Social Security) exceeds certain levels—$25,000 for individuals or $32,000 for couples—you pay income tax on those benefits. That money doesn't just go into the government's general "pot." It gets funneled right back into the Social Security trust funds.

3. Interest on the Trust Funds

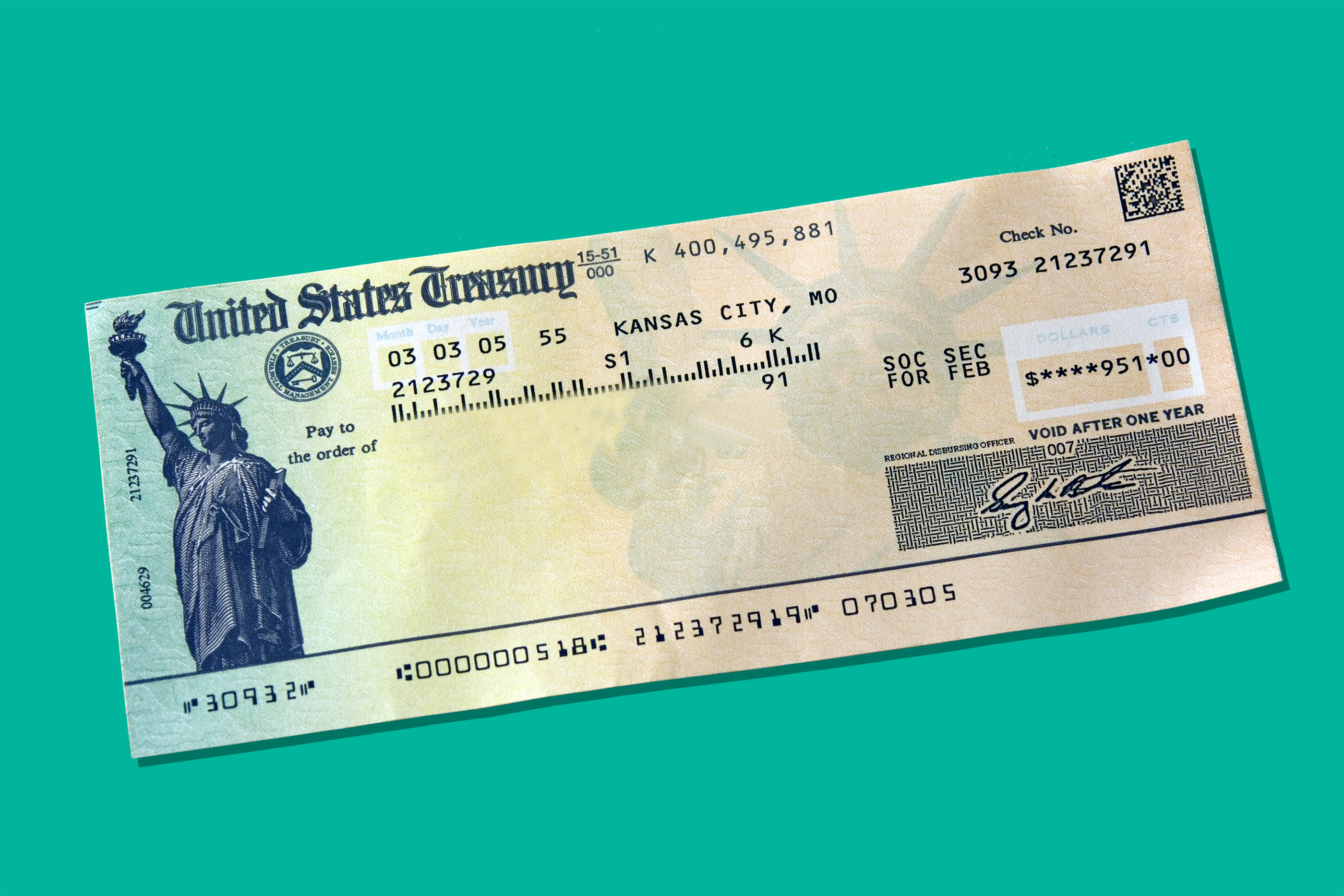

The Social Security Administration (SSA) doesn't just let the surplus sit under a mattress. When the system takes in more than it pays out, the extra cash is invested in special-issue U.S. Treasury bonds. These aren't the ones you buy at the bank; they are "non-marketable" securities backed by the full faith and credit of the United States. They earn interest, which added billions to the coffers over the last few decades.

👉 See also: Chase Bank Share Price: What Most People Get Wrong About JPM

Where Does Social Security Money Come From for People Who Don't Work?

There is a common mix-up between "Social Security" (the stuff you earned via taxes) and Supplemental Security Income (SSI). If you’re looking for the answer to where the SSI money comes from, it’s a totally different story.

SSI is for people with very limited income and assets who are 65+, blind, or have a disability. This money does not come from the Social Security trust funds or your payroll taxes. Instead, it comes from general tax revenues—the same pool of money that pays for the military, national parks, and roads. In 2026, the maximum federal SSI payment for an individual is $994 per month, and that’s strictly a taxpayer-funded safety net, not an insurance payout.

The "Vault" is a Filing Cabinet in West Virginia

People often joke that the government "stole" the Social Security money. Kinda true, kinda not. When the system has a surplus, the Treasury "borrows" that cash to pay for other government spending and gives the Social Security Trust Fund a "promissory note" (an IOU).

These notes are physically kept in a nondescript white filing cabinet in Parkersburg, West Virginia. It sounds like something out of a low-budget spy movie, but those pieces of paper represent the legal obligation of the U.S. government to pay that money back with interest.

Is the Money Running Out?

You’ve heard the headlines. "Social Security is going broke!"

Let’s be real: The Trust Fund reserves are indeed being drawn down. For years, we had more workers than retirees. Now, with the "Silver Tsunami" (Baby Boomers retiring), the system is paying out more than it's taking in. Current projections from the Social Security Trustees suggest the combined trust funds could be depleted by the mid-2030s.

But "depleted" doesn't mean "zero." Even if the trust fund reserves hit $0, the payroll taxes from people working in 2034, 2035, and 2036 will still be flowing in. Experts like those at the Pew Research Center and the SSA's own actuaries point out that even in a "worst-case" scenario, the system would still collect enough to pay roughly 77% to 80% of scheduled benefits. It’s a massive problem, sure, but the "checks will stop entirely" narrative is factually wrong.

What Most People Get Wrong About the 2026 Changes

Every year, the system tweaks itself to keep up with the world. For 2026, there are a few specific shifts you should know about if you're trying to track where the money is going:

- The 2.8% COLA: Because things got more expensive last year, benefits are going up by 2.8% starting in January 2026. That’s an extra $56 a month for the average retired worker.

- The Earnings Test: If you're working while collecting benefits before your full retirement age, you can now earn up to $24,480 before the SSA starts clawing back some of your benefit money.

- Administrative Efficiency: Commissioner Frank J. Bisignano has been pushing for a bigger administrative budget—about $14.8 billion for FY2026—to fix the backlogs. Interestingly, administrative costs are actually less than 1% of the total benefits paid out. It’s a remarkably lean operation for its size.

Actionable Steps for Your Future

Knowing where does social security money come from helps you realize that it’s essentially an intergenerational handshake. You pay for your grandparents; your kids pay for you. Since the system is under pressure, you shouldn't rely on it as your only source of income.

💡 You might also like: 4 million pesos: What Most People Get Wrong About This Amount

What you can do right now:

- Check your statement: Head to ssa.gov and create a "my Social Security" account. Look at your estimated benefits. Is that number enough to live on? Probably not.

- Verify your earnings: Sometimes employers misreport. If your earnings history is wrong, your future check will be smaller. Fix it now while you have the old W-2s.

- Plan for the 80% scenario: When using retirement calculators, assume you'll only get 80% of your promised Social Security. If your plan works with that "haircut," you’re in great shape.

- Watch the "Full Retirement Age" (FRA): If you were born in 1960 or later, your FRA is 67. Claiming at 62 means a permanent 30% cut in your monthly check. If you can wait, the "interest" you get by delaying is better than almost any market investment.

Social Security isn't a mysterious black hole. It’s a massive, transparent insurance program funded by the person staring back at you in the mirror every morning. Understanding that the money comes from your work—not a government gift—is the first step in taking control of your financial finish line.

Next Steps for You: Start by downloading your official Social Security Statement from the SSA website to see exactly how much you have contributed to the system so far. Use this number to update your retirement 401(k) or IRA contributions to bridge any projected gaps in your future monthly income.