If you’ve ever looked at your paystub and wondered why a chunk of your hard-earned cash is disappearing into a line item labeled "FICA," you're not alone. It feels like a black hole. You send the money away, and you're told it'll be there for you in thirty or forty years. But honestly, most of the myths floating around about where that money actually goes are just plain wrong.

It isn't sitting in a vault with your name on it. There is no "personal account" at the Social Security Administration (SSA) gathering dust until you hit 67.

Basically, the system is a massive, real-time transfer. Your money today is paying for your neighbor's grandmother’s check tomorrow. Understanding where does social security money come from is the first step to figuring out if the system is actually going to be there when you decide to hang it up.

The Three Main Pipes Feeding the System

Most people think it’s just payroll taxes. While that's the biggest piece of the pie, there are actually three distinct sources of revenue that keep the lights on at the SSA. In 2026, these "pipes" are more pressurized than ever as the baby boomer generation continues its massive exit from the workforce.

1. The Heavy Lifter: FICA Payroll Taxes

This is the big one. Roughly 90% of the money flowing into the Social Security trust funds comes directly from workers’ pockets and their employers’ bank accounts.

💡 You might also like: Ugandan Shillings to Dollars Converter: What Most People Get Wrong

For 2026, the Social Security wage base has climbed to $184,500. This means if you earn $200,000, you only pay Social Security taxes on that first $184,500. Anything above that is "free" from this specific tax. The rate itself is pretty straightforward:

- Employees pay 6.2%

- Employers pay 6.2%

- Self-employed folks get hit with the full 12.4%

If you’re self-employed, it kinda hurts. You’re essentially playing both roles. You pay $22,878 if you hit that 2026 cap. That money doesn't wait for you; it is immediately routed to pay the 71 million people currently receiving benefits.

2. The Irony: Taxes on Benefits

This is the part that surprises people the most. Once you start collecting Social Security, you might actually have to pay federal income tax on those benefits. And guess where that tax money goes? Right back into the Social Security trust funds.

It’s a cycle. About 3% to 4% of the program's total income comes from this. If your "combined income" (which is your adjusted gross income + non-taxable interest + half of your Social Security benefits) is over $25,000 as a single filer, you’re likely handing some of it back to the IRS.

3. The Shrinking Engine: Interest Income

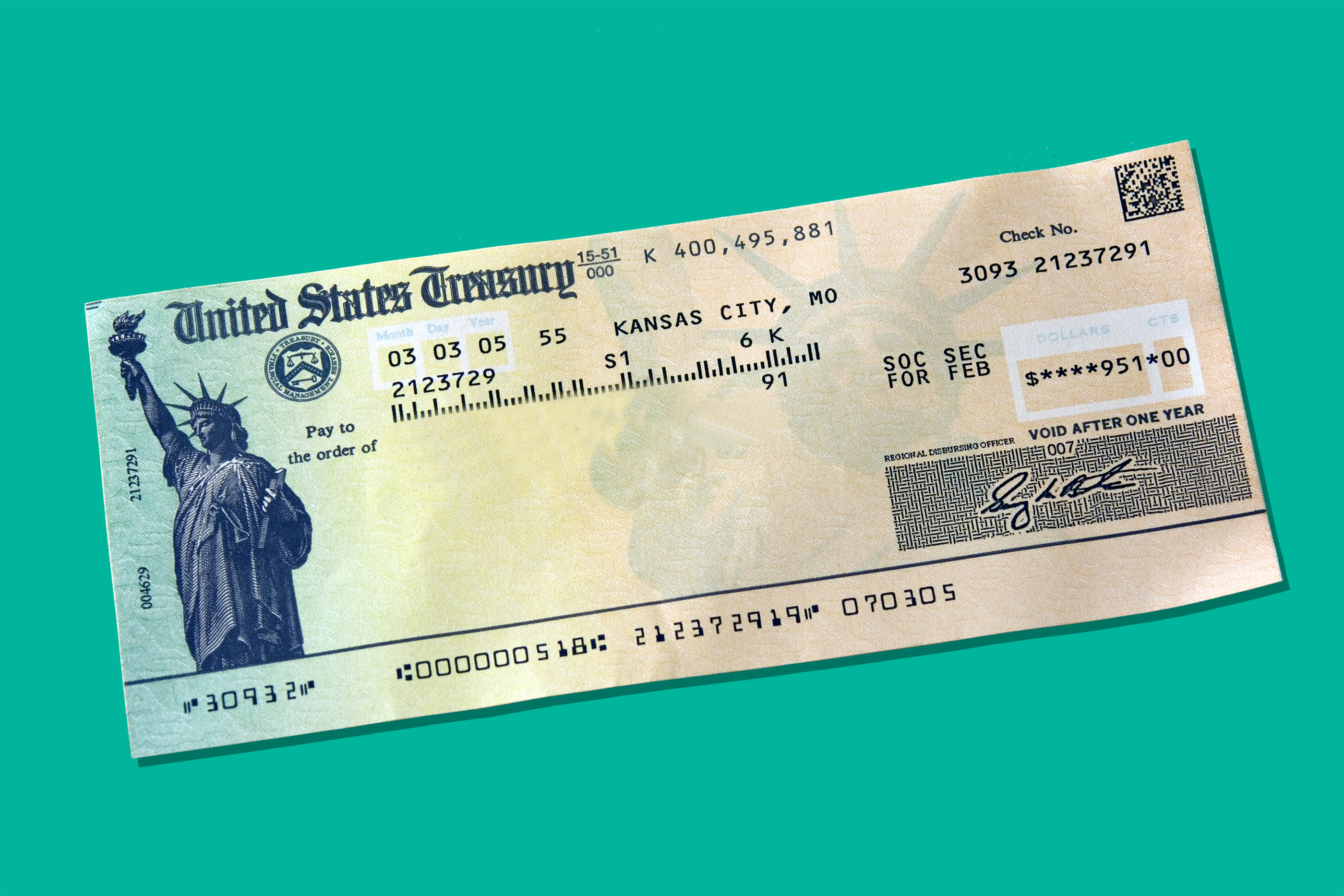

The Social Security Trust Funds—specifically the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) funds—don't just let the surplus cash sit under a mattress. By law, any money not immediately needed to pay benefits must be invested in special-issue U.S. Treasury bonds.

These bonds earn interest. For decades, this interest was a massive revenue stream. But here’s the kicker: as we start dipping into the reserves to cover the shortfall between payroll taxes and benefit payouts, there is less principal to earn interest on. It's a dwindling resource.

What’s Actually Happening in 2026?

Things are getting a bit tight. In 2026, the average Social Security benefit is expected to be around $2,071 per month after a 2.8% Cost-of-Living Adjustment (COLA). That sounds great for the retirees, but it means the "outgo" is rising.

The 2025 Trustees Report, which we’re feeling the effects of right now, was a bit of a wake-up call. It confirmed that the OASI fund (the one for retirees) is on track to be "depleted" by 2033.

Wait. "Depleted" does not mean "bankrupt."

This is the biggest misconception out there. Even if the trust fund hits zero, the payroll taxes from people working in 2033 will still cover about 77% of the scheduled benefits. It’s not a total collapse; it’s a 23% pay cut. That’s still scary, but it’s not a "zeros on the check" scenario.

The Role of the Social Security Fairness Act

You might have heard about the Social Security Fairness Act, which was a huge deal when it passed recently. It basically repealed the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

In plain English: a lot of teachers, police officers, and firefighters who were previously getting "docked" on their Social Security because they had a separate government pension are now getting their full share.

While this is great for those workers, it actually increased the financial pressure on the system. The 2025 Trustees Report noted that this law is one of the reasons the "depletion date" didn't improve. We’re paying out more, which means we need more coming in from those three pipes we talked about earlier.

👉 See also: GE HealthCare Stock Price Today: Why This Healthcare Giant Is Dividing Wall Street

Is the Money Safe?

When people ask "where does social security money come from," they’re usually really asking: "is it going to be there for me?"

The money is backed by the "full faith and credit" of the United States government. Those Treasury bonds in the trust fund are as real as the ones held by foreign countries or private investors. The government has never defaulted on them.

The real issue isn't whether the money "exists"—it's a matter of demographics.

- In 1950, there were 16.5 workers for every one retiree.

- Today, that ratio has dropped to about 2.7 to 1.

- By the time we get deeper into the 2030s, it’ll be even lower.

The "input" pipe (workers) is getting smaller while the "output" pipe (retirees) is getting wider.

Actionable Steps to Protect Your Future

Since you now know the money comes from a "pay-as-you-go" system that's currently facing a long-term deficit, you shouldn't treat Social Security as your only retirement plan. It was designed to replace about 40% of an average worker's income—not 100%.

1. Maximize your contributions elsewhere. If you're a high earner hitting that $184,500 wage base in 2026, you're actually getting a "tax break" on every dollar earned above that. Take that "saved" 6.2% and shovel it into a 401(k) or a Roth IRA.

2. Watch your "Combined Income." If you're nearing retirement, be aware of the tax thresholds ($25k for singles, $32k for couples). Sometimes, taking slightly less from a 401(k) can keep your "combined income" low enough that your Social Security benefits remain tax-free.

👉 See also: Wells Fargo Active Cash Card: Is 2% Back Really the Best You Can Get?

3. Factor in a "Haircut" Scenario. When you’re running your retirement numbers, try a "stress test." See what happens to your lifestyle if your Social Security check is 20% lower than the SSA website predicts. If you can survive that, you're in a great spot.

4. Delay if you can. For every year you wait past your Full Retirement Age (up until age 70), your benefit grows by about 8%. In a world where the trust fund is under pressure, locking in a higher "guaranteed" base rate is one of the smartest moves you can make.

The system isn't going away, but it is changing. By understanding that the money comes from the current workforce—and that you are part of that engine—you can plan for a retirement that doesn't rely on a "vault" that doesn't exist. Keep an eye on the 2026 tax limits and adjust your savings accordingly. Over-preparing is always better than the alternative.