If you ask ten different economists to name the world's wealthiest nation, you'll probably get three different answers. It's frustrating. You'd think "wealth" would be a simple number to track, like a bank balance, but once you start digging into the data from the IMF and the World Bank for 2026, things get messy. Are we talking about the country with the most cash in total? Or the one where the average person is basically a millionaire?

Honestly, most people point to the United States because of its massive $32.1 trillion economy. It’s huge. It’s the undisputed heavyweight in terms of total power. But if you're asking which is richest country based on how much wealth is actually available to each citizen, the U.S. doesn't even make the podium. That honor usually goes to a tiny European nation that most people could barely find on a map without a GPS.

The Luxembourg Anomaly: Small Land, Massive Wallets

Luxembourg is basically the size of a large city, yet it consistently sits at the very top of the rankings. By 2026, its GDP per capita is projected to hover around $141,080. That is a staggering amount of money. But there is a catch—and it's a big one that most "top 10" lists ignore.

📖 Related: Why Benefits of Video Conferencing Actually Matter When Zoom Fatigue is Real

About half of the people who work in Luxembourg don't actually live there. They commute from France, Belgium, and Germany. When the IMF calculates wealth, they count all the money these commuters produce (the numerator) but they don't count the commuters as part of the population (the denominator). This inflates the numbers. It makes Luxembourg look like a fairy-tale kingdom where everyone is swimming in gold, even though the cost of living there is high enough to make your eyes water.

Even with that statistical quirk, Luxembourg is genuinely rich. It’s not just a tax haven. It has shifted from a steel-dependent economy to a global financial hub. They’ve even started investing in space mining—yes, literally mining asteroids—to diversify their future income.

Why Ireland’s Wealth Is Kinda Complicated

Then there’s Ireland. If you look at the 2026 projections, Ireland often ranks as the second or third richest nation, with a GDP per capita exceeding $135,000. On paper, the Irish are wealthier than almost anyone on Earth. But if you talk to a local in Dublin, they might tell you a different story.

Ireland is the European headquarters for giants like Google, Apple, and Pfizer. These companies funnel billions of dollars through their Irish subsidiaries. This makes the Gross Domestic Product (GDP) look incredible. However, a lot of that money doesn't stay in Irish pockets; it flows back to shareholders in the U.S. and elsewhere.

Economists prefer to look at Gross National Income (GNI) to get the real picture. When you strip away the corporate accounting "magic," Ireland is still very wealthy, but it’s more comparable to places like Denmark or the Netherlands rather than being miles ahead of the world.

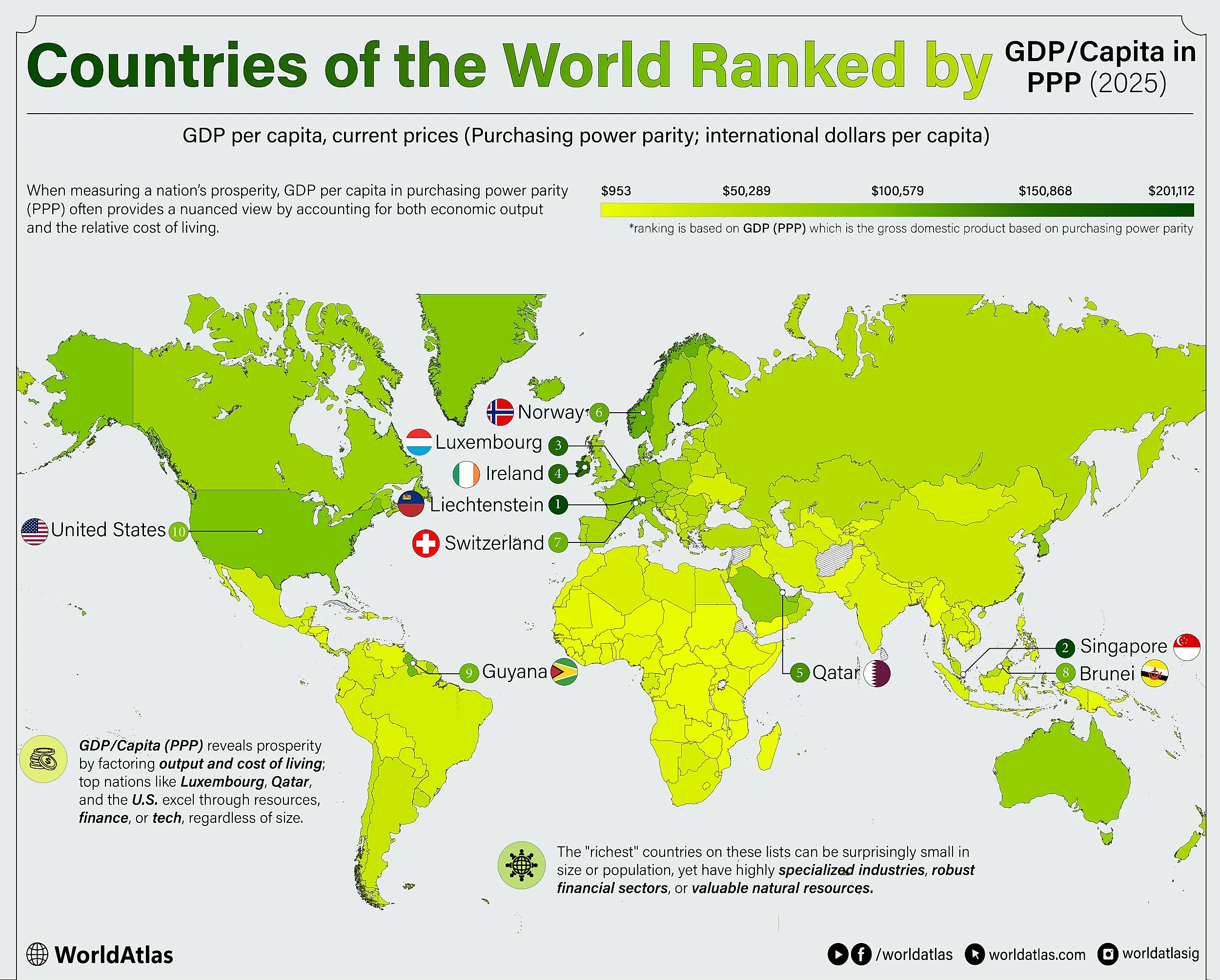

The Power of Purchasing Power Parity (PPP)

Comparing a dollar in New York to a dollar in Singapore is like comparing apples to space rocks. They aren't the same. That’s why the smartest way to answer which is richest country is to use Purchasing Power Parity (PPP). This metric adjusts for the cost of living and inflation.

- Singapore: This tiny island nation is a powerhouse. With a PPP-adjusted wealth of nearly $157,000 per person, it’s arguably the most efficient economy on the planet.

- Qatar: Resource wealth is the name of the game here. Thanks to massive natural gas reserves and a relatively small population, Qatar remains a fixture at the top of the charts.

- The United States: In PPP terms, the U.S. sits around $89,000. It’s the only large-population nation that manages to keep its per-capita wealth so high while being so big.

The Total Wealth vs. Per Capita Debate

If we change the definition of "richest" to mean "most total assets," the United States is the runaway winner. Total national wealth in the U.S.—including real estate, stocks, and private businesses—is over $140 trillion. China is a distant second.

China is a fascinating case because it actually has the highest GDP when measured by PPP (about $35 trillion), but because there are 1.4 billion people living there, the wealth per person is only about **$14,000**. You can see the dilemma. Is a country "rich" if it has the biggest pile of money, or only if its citizens have the biggest individual slices?

📖 Related: Software Payroll Free Download: What Most People Get Wrong About No-Cost Tools

Misconceptions About "Oil Rich" Nations

We often assume the Middle East is where all the world's wealth is concentrated. While Qatar and the UAE are incredibly wealthy, their fortunes are heavily tied to the price of a barrel of oil.

Norway is a better example of how to handle resource wealth. They have a sovereign wealth fund worth over $1.6 trillion. They don't just spend their oil money; they invest it for future generations. This is why Norway consistently ranks high not just in wealth, but in quality of life. In 2026, Norway’s GDP per capita sits comfortably around $96,000, and unlike some other nations, that wealth is spread much more evenly across the population.

Practical Insights for the Global Citizen

Understanding which is richest country isn't just for trivia nights. If you're looking at global trends, here’s what actually matters:

💡 You might also like: Regeneron Stock Price Today: Why the Market is Acting So Weird

- Look past GDP: If you're considering moving or investing, look at GNI per capita and the Human Development Index (HDI). These tell you more about the actual standard of living.

- Watch the Hubs: Countries that act as "middlemen" for global trade (Singapore, Luxembourg, Hong Kong) will always have inflated wealth stats because money is constantly passing through them.

- Cost of Living Matters: A $100,000 salary in Luxembourg might buy you a lifestyle that a $60,000 salary would buy in a lower-cost, high-wealth country like the United States or parts of Germany.

The real answer to the question depends on your lens. If you want the most powerful economy, it’s the United States. If you want the most individual wealth on paper, it’s Luxembourg. But if you want a balance of high income and high purchasing power, Singapore is likely the true winner in 2026.

To get a clearer picture of your own financial standing in the global context, you should compare your local purchasing power against these national averages using a PPP converter tool. This will show you how far your current income would actually go in the world's "richest" nations.