Paper checks feel like a relic. Honestly, in a world of instant Venmo transfers and Apple Pay, pulling out a checkbook feels a bit like using a rotary phone. But here is the thing: businesses, landlords, and government agencies like the IRS still live and breathe by these paper slips. If you mess one up, it’s not just an inconvenience. It’s a bounced payment fee, a late rent penalty, or a giant headache with your bank’s fraud department.

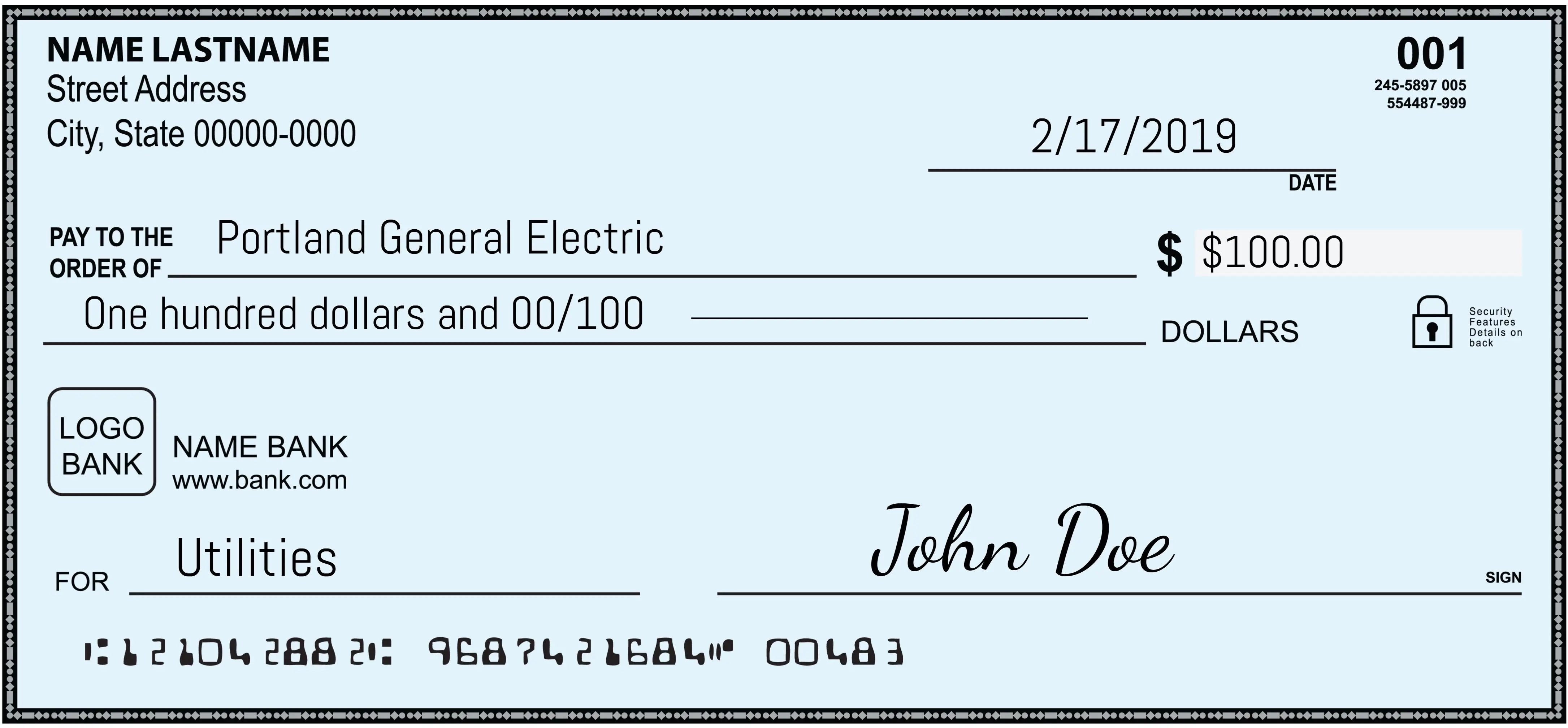

Most people think they know how to do it. Then they get to the "Decimal Point of Doom" or forget to line through the empty space, and suddenly that $100 check looks like a $1,000 invitation for a scammer. Looking at a sample check filled out correctly isn't just for teenagers opening their first account; it’s a necessary refresher for anyone who doesn't want their money hanging in limbo because of a messy "7" or a missing "00/100."

The Anatomy of a Perfect Check

Let's look at what actually happens when you put pen to paper. A check is basically a formal instruction to your bank. You’re telling them, "Hey, take this specific amount from my pile and give it to this person." If the instructions are blurry, the bank stops the bus.

First, the date. Use today’s date. Some people try to "post-date" checks, hoping the landlord won't cash it until Friday. Banks usually don't care. They often process them the moment they hit the scanner, so post-dating is a risky gamble that usually fails. Write it out clearly: January 17, 2026. Or 01/17/26. Just make it readable.

The "Pay to the Order of" line is where things get real. You need the legal name. Not "The Landlord Guy." Not "The Pizza Place." If you’re paying a utility company like Duke Energy or PG&E, write the full name. If it’s an individual, make sure the spelling matches their ID. Why? Because if they try to mobile-deposit a check made out to "Jon Doe" but their bank account says "Jonathan Doe," the AI might flag it.

The Number Box vs. The Written Line

This is where the most frequent errors happen. You have two places to write the amount. The small box on the right is for numbers. The long line below the recipient's name is for words.

💡 You might also like: Ray Dalio on Tariffs: Why the Billionaire Thinks We Are Heading for a 1930s Style Reset

Here is the golden rule: The words legally override the numbers.

If you write "$150.00" in the box but write "One hundred dollars" on the line, the bank is legally obligated to process it as $100. It’s part of the Uniform Commercial Code (UCC) in the United States. To avoid confusion, always write the cents as a fraction. If it’s an even amount, write "no/100" or "00/100." It closes the loop. It says, "I am done writing numbers, and nobody can add an extra zero here."

Why Your "Sample Check Filled Out" Needs a Security Line

You’ve probably seen people draw a long, squiggly line after the written amount. It looks like a doodle. It isn't. It’s a security feature.

Imagine you write a check for "Fifty dollars." You leave a big gap between the word "dollars" and the end of the line. A dishonest person gets a hold of that check. They have the same color pen. Suddenly, your "Fifty dollars" becomes "Fifty dollars and nine hundred cents" or some other clever manipulation. By drawing a line from the end of your written words all the way to the pre-printed "Dollars," you're "locking" the check.

It's a simple, old-school habit that stops check washing and alteration cold.

The Mystery of the Memo Line

The memo line is technically optional. The bank doesn't really look at it. However, your future self will thank you for using it.

If you're paying rent, write "January Rent 2026." If you're paying a medical bill, put the account number there. This is especially vital when paying the IRS or state tax authorities. They process millions of checks. If your check gets separated from your tax return, that memo line—specifically your Social Security Number and the tax year—is the only thing that keeps your payment from being lost in a digital void.

The Signature: The Only Part That Really Matters

You can have a perfectly filled-out check, but without your signature, it's just a piece of scrap paper. Your signature should match the one the bank has on file. Most of us have signatures that have devolved into a messy scribble over the years. That’s usually fine, as long as it’s your scribble.

📖 Related: European Union and Trade: Why It’s Way More Complicated Than Just Lowering Tariffs

Never, ever sign a check before you fill out the other fields. A signed blank check is essentially a "take whatever you want" coupon for whoever finds it.

The Routing and Account Numbers: The DNA of the Check

At the very bottom of any sample check filled out, you’ll see a string of weird-looking numbers printed in a blocky font. This is MICR (Magnetic Ink Character Recognition) ink.

- The Routing Number: This is a nine-digit code that identifies your bank. It’s like an address for the financial institution.

- The Account Number: This is your specific "drawer" at that bank.

- The Check Number: This matches the number in the top right corner.

When you use a check to set up Direct Deposit or an ACH transfer, you aren't actually "giving them a check." You’re giving them these numbers so they can pull or push money electronically. This is why you often see "VOID" written across a sample check. Writing "VOID" in large letters across the front disables the check for manual use but leaves the routing and account numbers legible for the payroll department to copy.

Common Mistakes That Kill Your Cash Flow

We see people mess this up all the time.

Using a pencil is a big no-no. It can be erased. Always use blue or black ink. Some experts suggest using "gel" pens because the ink seeps deeper into the paper fibers, making it nearly impossible to "wash" the check with chemicals.

Another big one? Not keeping a register. We get so used to checking our banking apps that we forget checks take time to clear. If you write a check on Tuesday, but the person doesn't deposit it until next month, that money is technically "gone" but still shows up in your balance. If you don't track it, you might spend that money twice and end up with an overdraft fee that costs more than the pizza you bought.

Real-World Examples of Check Errors

I once knew a guy who wrote a check for a car down payment. He wrote "$5,000" in the box. On the line, he wrote "Five thousand" but his handwriting was so cramped it looked like "Fine thousand." The bank teller flagged it as a potential alteration. The dealership couldn't process it. He lost the car to another buyer while he was busy sitting on hold with his bank’s fraud department trying to prove he wasn't a criminal.

Legibility isn't just about being neat; it's about clarity of intent.

How to Handle a Mistake

If you're halfway through writing and you realize you spelled the name wrong, don't just scribble over it. Most banks will reject a check with heavy alterations or "White-Out" on it.

The best move? Write "VOID" in big letters across it, tear it up (or shred it), and start over with a fresh one. It’s better to waste a ten-cent piece of paper than to risk a $35 returned check fee.

Modern Check Security in 2026

Even though we are talking about paper, the backend is all digital. When you hand a check to a cashier at a big store, they often run it through a machine and hand it right back to you. They are converting your paper check into an Electronic Funds Transfer (EFT).

This means the money leaves your account fast. The "float"—that magical 2-3 day window where the money stayed in your account while the check traveled through the mail—is basically dead. Treat a check like a debit card transaction. Assume the money is gone the second you hand it over.

Actionable Steps for Your Next Payment

If you have a checkbook sitting in a drawer gathering dust, here is how you should handle your next transaction to ensure zero issues:

📖 Related: Target CEO Brian Cornell: What Most People Get Wrong About His Exit

- Use a Gel Pen: Specifically, a black ink gel pen. It’s the most secure against "check washing" scams where thieves use chemicals to remove your ink and write in their own names and amounts.

- Write the Cents Clearly: Always use the fraction format (e.g., 45/100). If there are no cents, write "00/100" rather than leaving it blank.

- Fill the Space: Do not leave large gaps between words or numbers. If you have extra space on the written line, draw a bold line through it.

- Double-Check the Date: Ensure the year is correct. In the first few weeks of January, it is incredibly common to accidentally write the previous year, which can lead to "stale-dated" check rejections.

- Record It Immediately: Don't wait. Write the check number, the date, the recipient, and the amount in your check register or your budgeting app the moment you tear it out of the book.

- Verify the Recipient: If you are paying a business, ask them exactly what name should be on the "Pay to the Order of" line. Some businesses have a "Doing Business As" (DBA) name that is different from their storefront name.

Filling out a check correctly is a small bit of financial hygiene. It keeps the gears of your life turning without the friction of bank holds or late fees. Keep a sample check filled out in your mind—or your phone—as a reference, and you'll never have to worry about a "Return to Sender" stamp on your payments.