You've probably heard the term "solopreneur" thrown around a lot lately on LinkedIn or TikTok. It sounds fancy. It sounds modern. But honestly? It’s just a trendy rebrand of the oldest business structure in existence: the sole proprietorship. If you’re looking for an example of a sole proprietorship, you don't have to look very far. It’s the local freelance graphic designer working from a coffee shop, the person selling handmade ceramics on Etsy, or even the neighborhood handyman who fixes your leaky faucet.

Starting a business is terrifying. I've been there. Most people get bogged down in the "alphabet soup" of legal structures before they even make their first dollar. They worry about LLCs, S-Corps, and C-Corps. But for the vast majority of people testing the waters, the sole proprietorship is the default. It’s the "path of least resistance." In fact, according to the U.S. Small Business Administration (SBA), more than 70% of all American businesses are owned and operated by a single person without any formal incorporation. That's a massive chunk of the economy running on the simplest possible engine.

What an Example of a Sole Proprietorship Looks Like in the Real World

Let's get specific.

Imagine Sarah. Sarah is a freelance writer. She didn't file any fancy paperwork with the Secretary of State. She didn't hire a lawyer. One morning, she decided to start charging people for her blog posts. She got her first check made out to "Sarah Miller." In that exact moment, Sarah became an example of a sole proprietorship. She is the business. The business is her. There is no legal separation between Sarah's personal bank account and her business income, which is both the greatest strength and the scariest weakness of this setup.

The IRS essentially views Sarah and her writing gig as one and the same. When tax season rolls around, Sarah doesn't file a separate corporate tax return. Instead, she fills out a Schedule C (Form 1040) to report her profit or loss. It’s remarkably straightforward.

But it’s not just writers. Think about these real-life scenarios:

A local landscaper who works under his own name. He owns his lawnmower, his truck, and his tools. If he accidentally breaks a window while mowing, he is personally responsible.

A tutor who helps kids with SAT prep on weekends.

A professional photographer who shoots weddings. Even if they use a "Doing Business As" (DBA) name like "Golden Hour Snaps," they are still a sole proprietor unless they formally incorporate.

The common thread here is total control. You don't have a board of directors. You don't have partners to argue with. You make the call, you do the work, and you keep the profit.

✨ Don't miss: Kuwait Money to Dollars: Why It’s the Strongest Exchange in the World

The Messy Reality of Unlimited Liability

We need to talk about the "elephant in the room." Everyone loves the simplicity, but the legal reality is a bit of a tightrope walk.

Because a sole proprietorship isn't a separate legal entity, you have unlimited personal liability. This means if your business gets sued or runs up debt it can't pay, your personal assets—your car, your savings, maybe even your house—are on the line. This is why many people eventually transition to an LLC.

Wait. Don't let that scare you off just yet.

If you're running a low-risk business, like a consultant who gives advice over Zoom, the risk is relatively low. You can often mitigate these risks with a solid professional liability insurance policy. It’s a trade-off. You save money on filing fees and complexity, but you carry the weight of the risk on your own shoulders. It’s raw. It’s personal.

Why People Choose This Path Anyway

Simplicity wins. Most people start this way because it’s free. You don't need $500 for state filing fees. You don't need an accountant to figure out how to pay yourself a "reasonable salary" like you would in an S-Corp. You just... start.

Another huge perk is the tax benefit. Sole proprietors can often take advantage of the Qualified Business Income (QBI) deduction, which allows eligible taxpayers to deduct up to 20% of their business income from their taxes. That’s a significant chunk of change staying in your pocket instead of going to the government. Plus, you don't deal with "double taxation," where a corporation is taxed on its profits and then the owners are taxed again on their dividends.

🔗 Read more: Enbridge Stock Price Today Per Share: What Investors Get Wrong About the 2026 Outlook

Misconceptions About Growing a Solo Business

A lot of people think that being an example of a sole proprietorship means you’re destined to stay small. That’s just not true. You can hire employees! Just because you’re the "sole" owner doesn't mean you have to do all the work yourself. You can have a team of ten people and still technically be a sole proprietorship, though at that point, the legal risks usually make an LLC or Corporation a much smarter move.

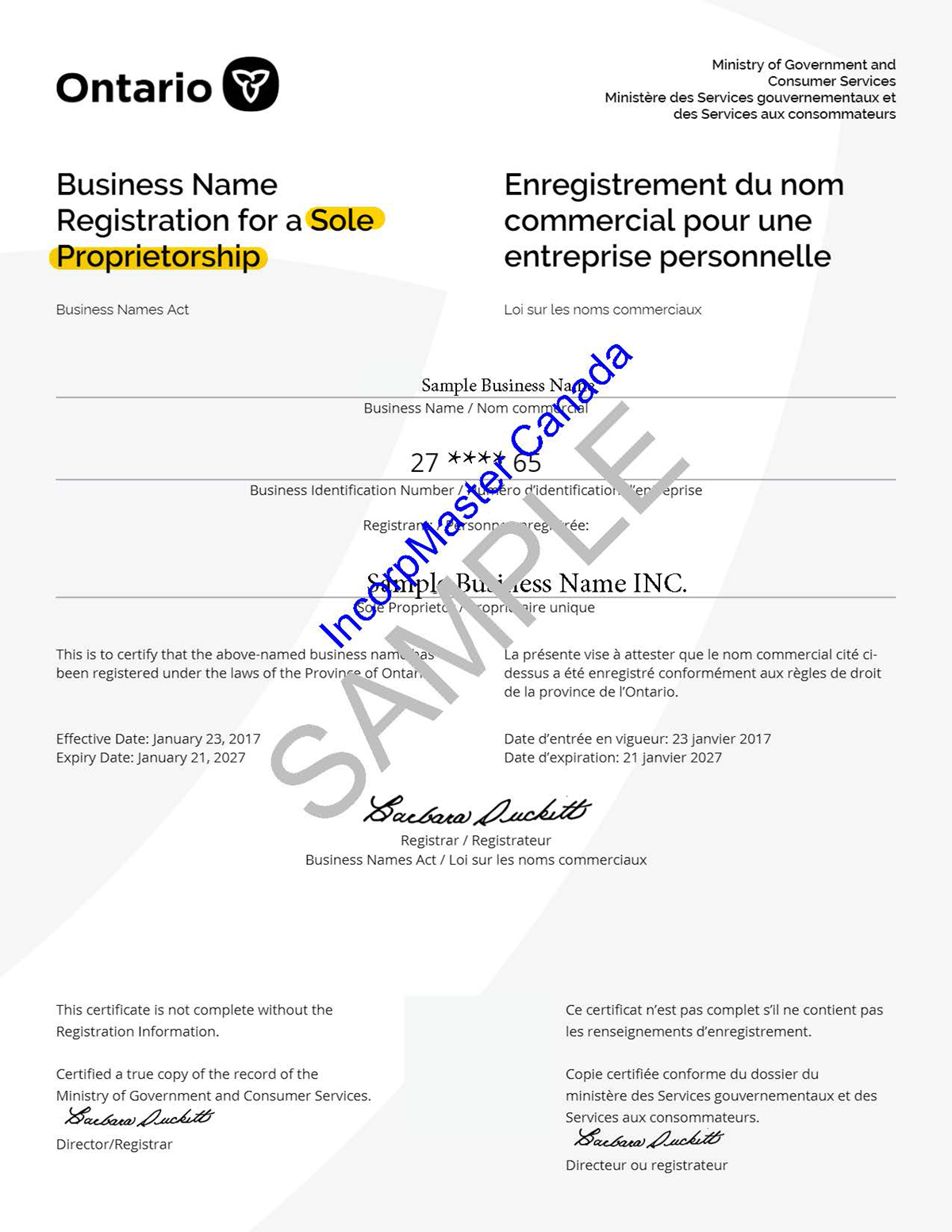

Also, people think you can't have a professional brand. You can absolutely register a DBA. If your name is John Doe but you want to call your business "Elite Tech Support," you can. It just takes a simple filing with your local or state government. It gives you the "look" of a big company while keeping the administrative backend dead simple.

The Paperwork You Actually Need

Even though it’s simple, you aren't totally off the hook. You’ll likely need:

- A Business License: Most cities require one, even if you’re just working from your kitchen table.

- An EIN: While you can use your Social Security Number, getting an Employer Identification Number from the IRS is free and keeps your SSN more private.

- Professional Insurance: Don't skip this. Seriously.

Is This the Right Move for You?

Choosing a structure is a bit like choosing a pair of shoes. You wouldn't wear hiking boots to a ballroom dance, and you wouldn't wear flip-flops to climb Everest.

If you are starting a side hustle with very little overhead and low physical risk, the sole proprietorship is your flip-flop. It’s easy, comfortable, and gets you where you’re going. But if you’re opening a gym where people might trip and hurt themselves, or if you’re taking out a $100,000 loan to buy inventory, you need the "protection" of a more robust structure.

Many successful entrepreneurs, including names you’d recognize from the early days of tech and retail, started exactly this way. They validated their idea first. They made sure people actually wanted to buy what they were selling before they spent thousands of dollars on legal fees.

Actionable Next Steps for Your New Venture

If you've realized that your business idea fits the mold of a sole proprietorship, don't overthink the "launch." Complexity is the enemy of execution.

First, separate your finances. Even if you aren't legally required to have a separate bank account, do it anyway. It makes your life 1,000 times easier when tax season hits. Open a simple business checking account and funnel every penny of business income into it. Use a dedicated credit card for business expenses.

Second, check your local zoning laws. Some neighborhoods have weird rules about running businesses from home, especially if you have clients coming and going. A five-minute search on your city's website can save you a massive headache later.

Third, set aside money for self-employment tax. This is the one that bites people. Since you don't have an employer withholding taxes from your paycheck, you are responsible for both the employer and employee portions of Social Security and Medicare. That’s about 15.3%. Put it in a savings account immediately. Don't touch it.

Finally, get a solid contract. If you're providing a service, a clear agreement protects you more than any legal structure ever could. Use it to define what you will do, what you won't do, and most importantly, when you get paid.

💡 You might also like: BRICS Brazil Russia India China: What Most People Get Wrong About the Global Shift

The beauty of the sole proprietorship is its flexibility. You can start today, and if your business explodes in six months, you can "graduate" to an LLC. It’s not a permanent decision, it’s a starting line. Go ahead and take the first step.