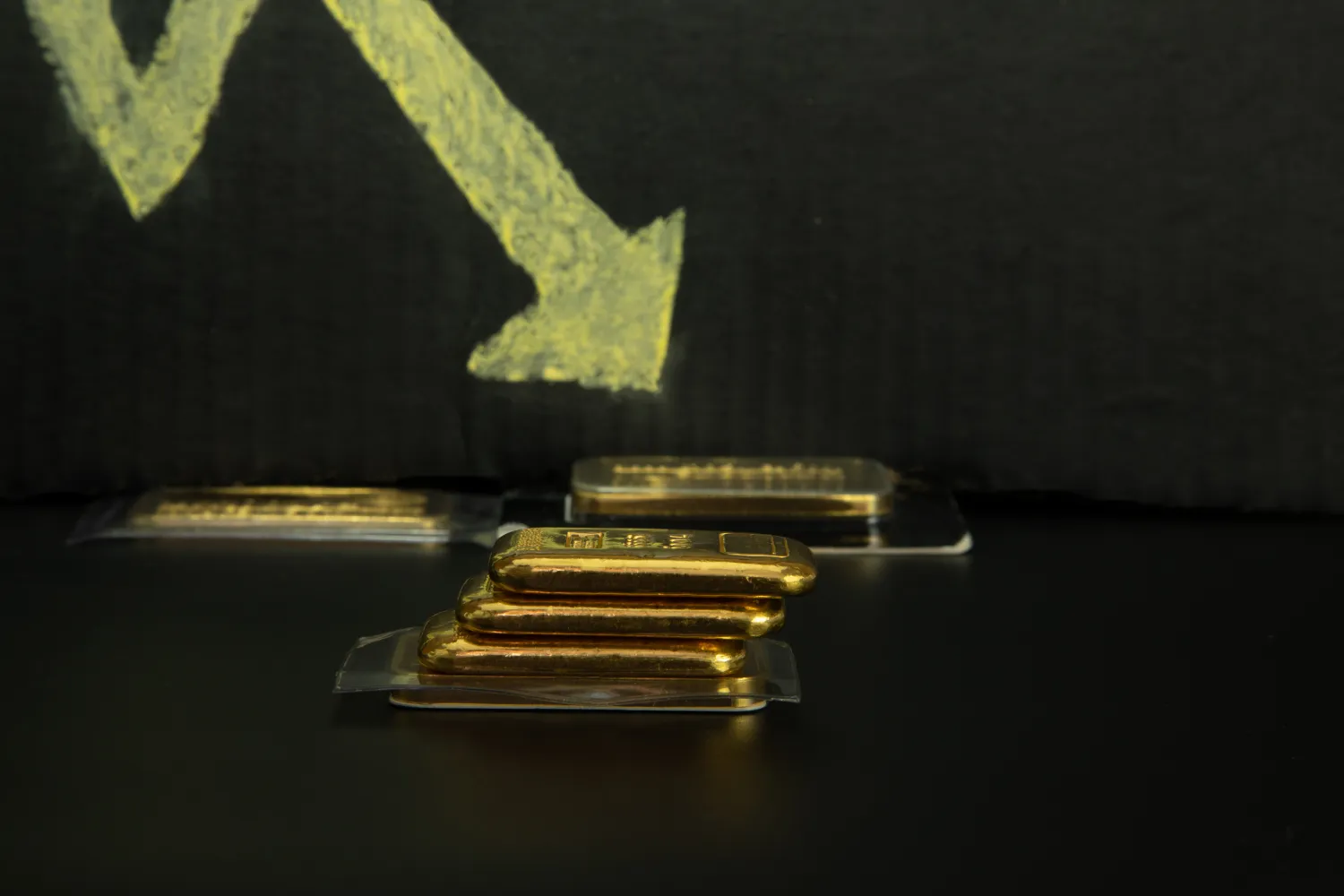

If you woke up and saw red across your precious metals dashboard, you aren't alone. Honestly, it’s a bit of a gut punch after the spectacular run we've seen lately. Gold has been the undisputed king of 2026 so far, shattering records like they were glass. But today, the "yellow metal" finally hit a wall.

So, why did gold drop today? Basically, it's a classic case of the market catching its breath. After hitting a dizzying all-time high of $4,642.72 per ounce earlier this week, spot gold has slipped back down toward the $4,590-$4,600 range. It feels like a crash if you just bought in yesterday, but for the seasoned pros, this is just Tuesday. Or, well, Saturday.

The Profit-Taking Wave

Let’s be real: when an asset climbs 6% in two weeks, people are going to sell. It’s not a conspiracy; it’s just human nature and math.

Investors who rode the wave from $4,300 are looking at their screens and seeing massive green numbers. They’re clicking the "sell" button to lock in those gains before the weekend. According to analysts at Marex, we are seeing a "general retreat in the commodity complex." It's not just gold; silver took an even bigger hit today, dropping over 1.6%.

When everyone rushes for the exit at the same time, the price drops. Fast.

The "Trump Effect" and De-escalation

Geopolitics usually acts as the wind beneath gold's wings. If the world feels like it's ending, gold goes up. Lately, we've had a lot of that—protests in Iran, tariff wars, and even weird headlines about the U.S. executive branch eyeing Greenland.

But today, the "fear premium" evaporated a little.

🔗 Read more: Taking It to the Street: Why Real-World Presence Still Trumps Your Digital Strategy

- Iran cooled off: Reports suggest that the intensity of protests in Iran has subsided.

- The Wait-and-See Approach: President Donald Trump has adopted a more tempered stance recently, and mediation efforts from other global leaders have actually started to show results.

- The Taiwan Factor: A fresh trade agreement between the U.S. and Taiwan regarding semiconductor tariffs has calmed some of the jitters involving China.

When people feel slightly safer, they don't feel the need to hide their cash in a gold bar. They move it back into stocks or the dollar.

The Almighty Dollar is Flexing

There is an old rule in finance: when the U.S. Dollar gets strong, gold gets weak. They are like two kids on a see-saw.

The U.S. Dollar Index (DXY) has been hovering near a six-week high, currently sitting around 99.31. Why? Because the U.S. economy is acting like a tank. New data from the Labour Department showed weekly jobless claims fell to 198,000—way lower than the 215,000 everyone expected.

A strong economy means the Federal Reserve is less likely to cut interest rates anytime soon. Since gold doesn't pay you a dividend or interest, it’s hard to compete with a high-yielding dollar. If you can get a solid return on "safe" government bonds, why bother with gold? That's the logic hitting the market today.

Technical Barriers and "The Wall"

If you look at the charts, gold was screaming "overbought."

Technical analysts like Michael Boutros from FOREX.com have been pointing at the $4,603 level as a massive resistance point. Gold tried to punch through it, failed, and now it's retreating to find support. Think of it like a hiker trying to summit a peak—sometimes you have to go back down to base camp to grab more supplies before the final climb.

In this case, the "base camp" looks to be around $4,550 or even $4,380. If it holds there, the bull run might still have legs.

What Most People Get Wrong About This Drop

A lot of folks see a 1% or 2% drop and think the "Gold Supercycle" is over. Honestly, that’s probably a bit dramatic.

Even with today's dip, gold is still on track for a weekly gain. It’s up over 60% from its lows in early 2025. Major banks like J.P. Morgan and HSBC are still calling for $5,000 gold by the middle of 2026. UBS is even crazier, whispering about $5,400 if political risks flare up again.

💡 You might also like: Dollar to CFA Today: Why the Rate Is Shifting and What to Watch

Actionable Insights: What Should You Do?

Don't panic-sell because of one red day. Market corrections are healthy—they flush out the "weak hands" and create entry points for long-term buyers.

Keep an eye on the Fed. The next Federal Reserve meeting is the real North Star. If they signal that rates are staying high for longer, gold might struggle to reclaim $4,600.

Watch the $4,550 level. If gold stays above this, the upward trend is technically still alive. If it breaks below that, we might be looking at a deeper correction toward $4,400.

Diversify your "Safe Havens." Today showed that silver is much more volatile than gold. If you can't stomach a 4% swing in a day, stick to the yellow stuff.

Today's drop in gold isn't a death knell. It's a reminder that even the strongest bull markets don't go up in a straight line. The fundamentals—global debt, central bank buying (especially in Poland and India), and lingering geopolitical "what-ifs"—haven't changed. The price just got ahead of itself.

Key Next Steps for Investors

- Review your stop-losses: If you are trading on leverage, ensure your stops are set around the $4,550 support level to protect against a flash crash.

- Monitor the DXY: If the Dollar Index breaks above 100, expect more downward pressure on gold in the coming week.

- Check Central Bank Activity: Watch for news from the World Gold Council regarding continued accumulation by central banks, which often provides a "floor" for prices during retail sell-offs.